Blank Transfer-on-Death Deed Document for Washington

Misconceptions

- Misconception 1: The Transfer-on-Death Deed is only for wealthy individuals.

- Misconception 2: A Transfer-on-Death Deed requires the beneficiary to pay taxes immediately.

- Misconception 3: Once a Transfer-on-Death Deed is signed, it cannot be changed.

- Misconception 4: The Transfer-on-Death Deed automatically transfers all property upon death.

- Misconception 5: The Transfer-on-Death Deed eliminates the need for a will.

This is not true. The Transfer-on-Death Deed can benefit anyone who wishes to pass property to a beneficiary without going through probate. It is a useful estate planning tool for individuals of all income levels.

This misconception arises from confusion about property transfer and tax implications. Generally, the beneficiary does not owe taxes upon receiving the property through a Transfer-on-Death Deed until they sell it or it generates income.

In reality, the property owner retains the right to revoke or change the deed at any time before their death. This flexibility allows individuals to adapt their estate plans as circumstances change.

This is misleading. The deed only transfers the specific property that has been designated. If other properties are owned, they will not be affected unless separate deeds are executed for each one.

While a Transfer-on-Death Deed can simplify the transfer of certain properties, it does not replace the need for a will. A will is essential for addressing other assets and ensuring that all wishes regarding the estate are fulfilled.

Form Properties

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | In Washington, the Transfer-on-Death Deed is governed by RCW 64.38, which outlines the rules and requirements for creating and executing the deed. |

| Eligibility | Any individual who owns real property in Washington can create a Transfer-on-Death Deed, provided they are of legal age and mentally competent. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries. If multiple beneficiaries are named, the property will be divided according to the owner's instructions. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner, ensuring flexibility in estate planning. |

| Execution Requirements | The deed must be signed by the property owner and notarized. It must also be recorded with the county auditor to be effective. |

| Tax Implications | Transferring property via a Transfer-on-Death Deed does not trigger gift taxes during the owner's lifetime, but the beneficiaries may face inheritance taxes. |

| Advantages | This deed simplifies the transfer process, avoids probate, and allows the owner to retain full control of the property during their lifetime. |

Key takeaways

Filling out and using the Washington Transfer-on-Death Deed form can be a straightforward process if you keep a few key points in mind. Here are some essential takeaways:

- Eligibility: Only individuals can create a Transfer-on-Death Deed. Ensure that you meet the requirements to avoid complications.

- Property Types: This deed can only be used for real property, such as land or buildings. Personal property is not covered.

- Form Completion: Fill out the form completely and accurately. Incomplete forms can lead to legal challenges later.

- Signature Requirement: The deed must be signed by the property owner. If there are multiple owners, all must sign.

- Notarization: The deed must be notarized to be valid. A notary public can help ensure that the signing process meets legal standards.

- Filing: After completing the deed, file it with the county auditor where the property is located. This step is crucial for the deed to take effect.

- Revocation: You can revoke the deed at any time before your death. Ensure you follow the proper procedure for revocation to avoid confusion.

By keeping these points in mind, you can effectively use the Washington Transfer-on-Death Deed to manage your property and ensure a smooth transition for your heirs.

Dos and Don'ts

When filling out the Washington Transfer-on-Death Deed form, it's essential to navigate the process carefully. Here are some dos and don'ts to keep in mind:

- Do ensure that the form is completed in full and accurately.

- Do include the legal description of the property, not just the address.

- Do sign the form in the presence of a notary public.

- Do file the completed deed with the county auditor's office.

- Don't forget to check that the property title is clear before filing.

- Don't use vague language when describing the property.

- Don't leave any sections of the form blank; this can lead to delays.

- Don't assume that verbal agreements about the deed are sufficient; everything must be in writing.

By following these guidelines, you can help ensure that your Transfer-on-Death Deed is processed smoothly and effectively. Taking the time to get it right can save you and your loved ones from potential complications in the future.

Common mistakes

-

Incorrect Property Description: Many individuals fail to provide a complete and accurate description of the property. This includes not specifying the correct address or omitting important details like parcel numbers. A vague description can lead to confusion and potential disputes later on.

-

Not Naming Beneficiaries Clearly: Some people make the mistake of not clearly naming the beneficiaries. It’s crucial to specify full names and relationships to avoid ambiguity. If the names are unclear, it may result in challenges to the deed's validity.

-

Failure to Sign and Date: A common oversight is neglecting to sign and date the form. Without the proper signatures, the deed may not be considered valid. Ensure that all required parties sign the document in the designated areas.

-

Not Following State Requirements: Each state has specific requirements for Transfer-on-Death Deeds. Failing to adhere to Washington’s regulations, such as notarization or witnessing, can invalidate the deed.

-

Ignoring Tax Implications: Some individuals overlook the potential tax consequences associated with the transfer of property. Understanding how a Transfer-on-Death Deed may affect estate taxes is essential for effective estate planning.

-

Not Recording the Deed: After completing the form, it’s vital to record the deed with the county auditor’s office. Many people forget this step, which can lead to complications in transferring ownership when the time comes.

What You Should Know About This Form

-

What is a Transfer-on-Death Deed (TOD Deed)?

A Transfer-on-Death Deed allows you to transfer real estate to a beneficiary upon your death without going through probate. You remain the owner of the property during your lifetime, and you can change or revoke the deed at any time.

-

How do I create a Transfer-on-Death Deed in Washington?

To create a TOD Deed, you need to fill out the appropriate form and sign it in front of a notary public. Make sure to include a legal description of the property and the name of the beneficiary. Once completed, you must record the deed with the county auditor where the property is located.

-

Can I change or revoke my Transfer-on-Death Deed?

Yes, you can change or revoke your TOD Deed at any time while you are alive. To do this, you must complete a new TOD Deed or a revocation form and record it with the county auditor. This ensures that your wishes are updated and legally recognized.

-

Who can be a beneficiary of a Transfer-on-Death Deed?

Any individual or entity can be named as a beneficiary. This can include family members, friends, or even charitable organizations. However, it’s important to consider the implications of your choice, especially if there are multiple beneficiaries.

-

What happens if the beneficiary predeceases me?

If your named beneficiary dies before you, the transfer will not occur. To avoid complications, you may want to name an alternate beneficiary in your TOD Deed. This ensures that your property will still be transferred according to your wishes.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax consequences when you create a TOD Deed. The property does not change ownership until your death, so you continue to pay property taxes. However, it’s wise to consult a tax professional to understand any potential estate tax implications.

-

Can a Transfer-on-Death Deed be contested?

Yes, like any estate planning tool, a TOD Deed can be contested. If someone believes they have a rightful claim to the property, they may challenge the deed in court. Having clear documentation and following legal procedures can help minimize disputes.

-

Is a Transfer-on-Death Deed the right choice for me?

This depends on your personal situation. A TOD Deed can simplify the transfer of property and avoid probate. However, it may not be suitable for everyone. Consider discussing your options with a legal professional to determine what works best for your estate planning needs.

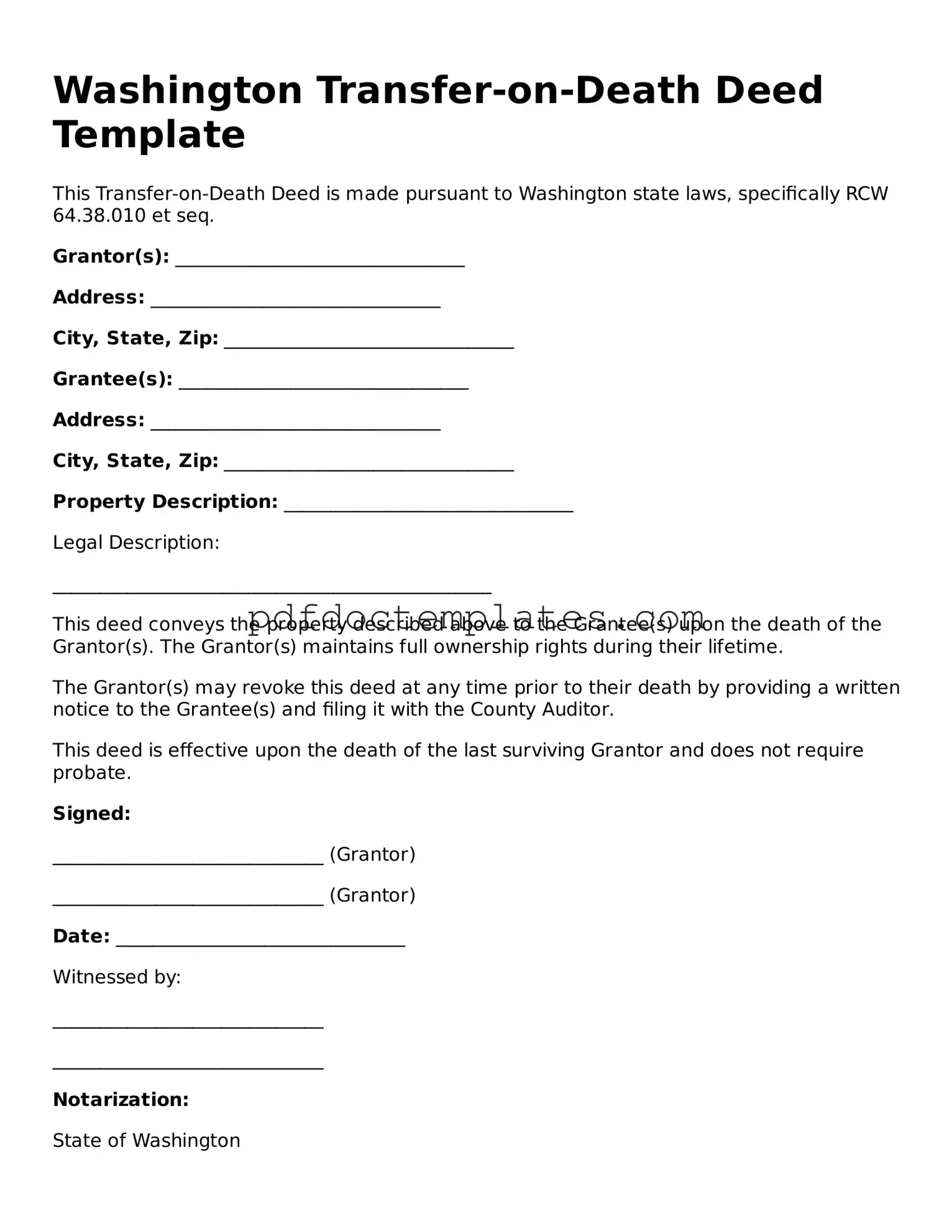

Washington Transfer-on-Death Deed Example

Washington Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to Washington state laws, specifically RCW 64.38.010 et seq.

Grantor(s): _______________________________

Address: _______________________________

City, State, Zip: _______________________________

Grantee(s): _______________________________

Address: _______________________________

City, State, Zip: _______________________________

Property Description: _______________________________

Legal Description:

_______________________________________________

This deed conveys the property described above to the Grantee(s) upon the death of the Grantor(s). The Grantor(s) maintains full ownership rights during their lifetime.

The Grantor(s) may revoke this deed at any time prior to their death by providing a written notice to the Grantee(s) and filing it with the County Auditor.

This deed is effective upon the death of the last surviving Grantor and does not require probate.

Signed:

_____________________________ (Grantor)

_____________________________ (Grantor)

Date: _______________________________

Witnessed by:

_____________________________

_____________________________

Notarization:

State of Washington

County of _________________

On this ____ day of ______________, 20___, before me, a Notary Public, personally appeared _______________________________ and _______________________________, personally known to me (or proved to me on the basis of satisfactory evidence) to be the individuals that executed this instrument and acknowledged it to be their free and voluntary act for the uses and purposes therein mentioned.

_____________________________

Notary Public in and for the State of Washington

My Commission Expires: ________________

Check out Other Common Transfer-on-Death Deed Templates for US States

Transfer on Death Deed New Jersey - Beneficiaries can find assurance in knowing that a Transfer-on-Death Deed can secure their future interests in property.

When completing a transaction for the purchase of a motorcycle in New York, it is vital to utilize a properly formatted New York Motorcycle Bill of Sale to ensure that all legal requirements are met. This document not only serves as proof of purchase but also facilitates the seamless transfer of ownership between the buyer and seller, safeguarding both parties in the process. For those looking for an efficient way to create this important document, you can find a useful template at https://smarttemplates.net/fillable-new-york-motorcycle-bill-of-sale/.

How to Transfer Land Ownership - With a Transfer-on-Death Deed, you maintain full control of your property while you are alive, and the transfer occurs automatically at death.