Blank Real Estate Purchase Agreement Document for Washington

Misconceptions

Here are nine common misconceptions about the Washington Real Estate Purchase Agreement form, along with clarifications to help you understand the truth.

-

It’s just a standard form with no flexibility.

The Washington Real Estate Purchase Agreement can be customized to meet the specific needs of both the buyer and seller. Parties can negotiate terms and conditions before signing.

-

Only real estate agents can fill it out.

While real estate agents are experienced in using the form, buyers and sellers can also fill it out. It’s important to understand the terms and conditions before signing.

-

It guarantees the sale of the property.

Signing the agreement does not guarantee that the sale will go through. It is a step in the process, but it is subject to contingencies and conditions.

-

Once signed, it cannot be changed.

Changes can be made to the agreement after it is signed, but both parties must agree to any amendments. Communication is key.

-

It only protects the seller.

The agreement is designed to protect the interests of both the buyer and seller. It outlines rights, responsibilities, and remedies for both parties.

-

It’s not legally binding.

The Washington Real Estate Purchase Agreement is a legally binding document once both parties have signed it. It creates enforceable obligations.

-

All contingencies must be met for the agreement to be valid.

While contingencies are important, not all of them must be satisfied for the agreement to be valid. It depends on the specific terms agreed upon by both parties.

-

It’s only for residential properties.

The form can be used for various types of real estate transactions, including commercial properties. It is not limited to residential sales.

-

You don’t need legal advice to use it.

While many people successfully use the form without legal help, consulting an attorney can provide additional peace of mind and ensure all aspects are understood.

Form Properties

| Fact Name | Description |

|---|---|

| Purpose | The Washington Real Estate Purchase Agreement is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Governing Law | This agreement is governed by the laws of the State of Washington, specifically under the Revised Code of Washington (RCW) Title 64. |

| Parties Involved | The form identifies the buyer and seller, ensuring that both parties are clearly defined and legally recognized. |

| Property Description | A detailed description of the property being sold is included, which helps to avoid any ambiguity regarding the transaction. |

| Purchase Price | The agreement specifies the purchase price, including any deposits or earnest money required to secure the agreement. |

| Contingencies | Common contingencies, such as financing, inspections, and appraisals, can be included to protect the buyer's interests. |

| Closing Process | The agreement outlines the closing process, including the timeline and responsibilities of each party leading up to the transfer of ownership. |

Key takeaways

When engaging in real estate transactions in Washington, understanding the Real Estate Purchase Agreement (REPA) is crucial. Here are some key takeaways to keep in mind:

- Understand the Purpose: The REPA serves as a legally binding document that outlines the terms of the sale between the buyer and seller.

- Complete All Sections: Ensure that every section of the form is filled out accurately. Missing information can lead to misunderstandings or disputes later on.

- Include Important Dates: Specify critical dates, such as the closing date and any deadlines for contingencies. This helps keep the transaction on track.

- Contingencies Matter: Clearly outline any contingencies, such as financing or inspection conditions. These clauses protect the buyer and can affect the sale's success.

- Review the Purchase Price: State the agreed-upon purchase price clearly. This figure is central to the agreement and should be double-checked for accuracy.

- Understand Earnest Money: The agreement typically requires an earnest money deposit. Know how much is expected and the implications of this deposit.

- Consider Additional Terms: If there are special agreements or conditions, include them in the additional terms section. This ensures all parties are on the same page.

- Seek Legal Advice: It is wise to consult with a real estate attorney or agent to review the REPA. Their expertise can help clarify any complex terms or conditions.

By keeping these points in mind, individuals can navigate the Washington Real Estate Purchase Agreement more effectively, ensuring a smoother transaction process.

Dos and Don'ts

When filling out the Washington Real Estate Purchase Agreement form, it is important to follow certain guidelines to ensure accuracy and clarity. Here are some recommendations:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information for all parties involved.

- Do consult with a real estate professional if you have questions about any section.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless instructed to do so.

- Don't use abbreviations or shorthand that may cause confusion.

- Don't sign the agreement without reviewing all terms and conditions.

- Don't forget to date the form when signing.

Common mistakes

-

Inaccurate Property Description: Buyers often fail to provide a complete and accurate description of the property. This includes not specifying the correct parcel number or omitting key details like the address.

-

Incorrect Purchase Price: Listing the wrong purchase price can lead to confusion and disputes. Ensure that the amount matches the agreed-upon figure in negotiations.

-

Missing Signatures: All necessary parties must sign the agreement. A common mistake is leaving out a co-buyer or failing to sign the document altogether.

-

Omitting Contingencies: Buyers sometimes neglect to include important contingencies, such as financing or inspection clauses. These protections are crucial for safeguarding your interests.

-

Failure to Specify Closing Date: Not stating a clear closing date can create uncertainty. Both parties should agree on a timeline to avoid delays.

-

Ignoring Local Laws and Regulations: Each jurisdiction may have specific requirements. Failing to adhere to local laws can invalidate the agreement or lead to legal issues down the line.

What You Should Know About This Form

-

What is the Washington Real Estate Purchase Agreement form?

The Washington Real Estate Purchase Agreement is a legal document used in the buying and selling of real estate properties in Washington State. This form outlines the terms and conditions agreed upon by the buyer and seller, including the purchase price, financing details, and contingencies. It serves as a binding contract that protects both parties during the transaction process.

-

What key components are included in the agreement?

The agreement typically includes several important sections, such as:

- Property Description: A detailed description of the property being sold.

- Purchase Price: The agreed-upon price for the property.

- Financing Terms: Information regarding how the buyer will finance the purchase.

- Contingencies: Conditions that must be met for the sale to proceed, such as inspections or financing approval.

- Closing Date: The date when the ownership of the property will officially transfer from the seller to the buyer.

-

How does the agreement protect both parties?

The Real Estate Purchase Agreement protects the interests of both the buyer and seller by clearly outlining the responsibilities and expectations of each party. For instance, it specifies what happens if either party fails to meet their obligations. This clarity helps prevent misunderstandings and disputes, providing a framework for resolving any issues that may arise.

-

Can the agreement be modified after it is signed?

Yes, the agreement can be modified, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the buyer and seller to ensure that the changes are legally binding. It is important to keep a record of any amendments to avoid confusion later on.

-

What happens if the buyer or seller breaches the agreement?

If either party breaches the agreement, the other party may have several options. They can seek damages, which may include financial compensation for losses incurred due to the breach. Alternatively, the non-breaching party may choose to enforce the contract, requiring the breaching party to fulfill their obligations as outlined in the agreement.

-

Is it necessary to have a real estate agent when using this form?

While it is not mandatory to have a real estate agent when completing the Washington Real Estate Purchase Agreement, it is highly recommended. An agent can provide valuable guidance throughout the process, help ensure that all necessary details are included, and assist in negotiations. Their expertise can help navigate potential pitfalls and make the transaction smoother.

-

Where can I obtain a copy of the Washington Real Estate Purchase Agreement form?

A copy of the Washington Real Estate Purchase Agreement form can typically be obtained from various sources. These include real estate agencies, legal offices, and online resources that specialize in real estate documents. It is important to ensure that the form you are using is up-to-date and complies with current Washington State laws.

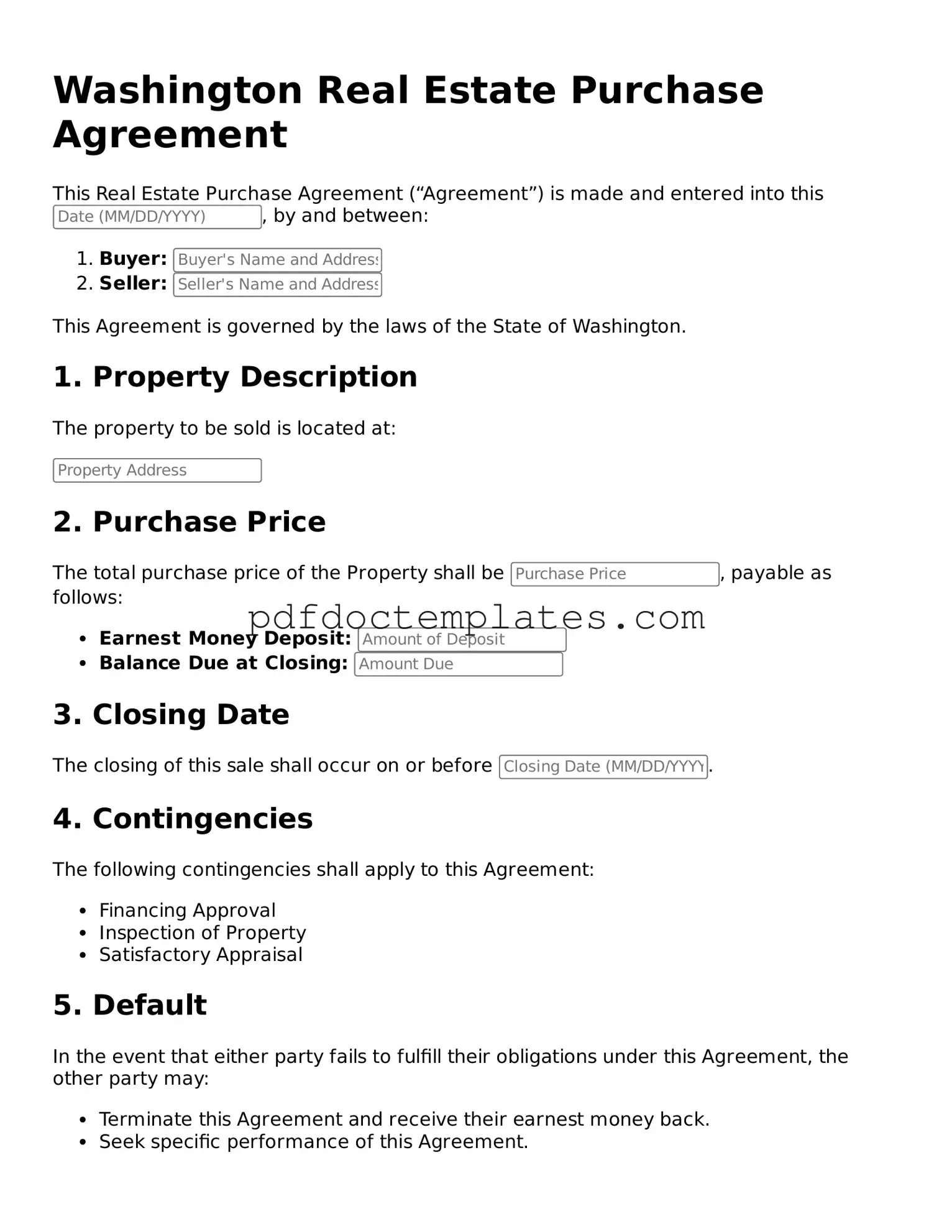

Washington Real Estate Purchase Agreement Example

Washington Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is made and entered into this , by and between:

- Buyer:

- Seller:

This Agreement is governed by the laws of the State of Washington.

1. Property Description

The property to be sold is located at:

2. Purchase Price

The total purchase price of the Property shall be , payable as follows:

- Earnest Money Deposit:

- Balance Due at Closing:

3. Closing Date

The closing of this sale shall occur on or before .

4. Contingencies

The following contingencies shall apply to this Agreement:

- Financing Approval

- Inspection of Property

- Satisfactory Appraisal

5. Default

In the event that either party fails to fulfill their obligations under this Agreement, the other party may:

- Terminate this Agreement and receive their earnest money back.

- Seek specific performance of this Agreement.

6. Signatures

By signing below, both parties acknowledge that they have read and understood this Agreement and agree to its terms:

Buyer Signature: ___________________________ Date: _______________

Seller Signature: __________________________ Date: _______________

Check out Other Common Real Estate Purchase Agreement Templates for US States

Real Estate Contract Nj - Details the requirements for maintaining the property during escrow.

When considering the responsibilities that come with child care, parents may find it beneficial to draft a legal document such as the Florida Power of Attorney for a Child form. This empowers another adult to make crucial decisions for their child(ren) during times when parents are unable to be present. Parents can be reassured that their child's needs will be met in their absence, whether due to travel, illness, or military obligations. For more detailed information about this form, visit All Florida Forms.

Real Estate Purchase Agreement Example - A Real Estate Purchase Agreement should adhere to state-specific regulations and requirements.