Blank Promissory Note Document for Washington

Misconceptions

Understanding the Washington Promissory Note form can be challenging. Many people hold misconceptions that can lead to confusion or mistakes. Here are eight common misconceptions:

- 1. A Promissory Note is the Same as a Loan Agreement. While both documents relate to borrowing money, a promissory note specifically outlines the borrower's promise to repay the loan, whereas a loan agreement includes more detailed terms and conditions.

- 2. All Promissory Notes Must Be Notarized. Not all promissory notes require notarization. In Washington, a promissory note is valid without a notary, but notarization can provide additional legal protection.

- 3. A Promissory Note Cannot Be Modified. This is false. Parties can agree to modify the terms of a promissory note, but any changes should be documented in writing to avoid future disputes.

- 4. Interest Rates on Promissory Notes Are Always Fixed. Interest rates can be either fixed or variable. The terms of the note will specify how interest is calculated.

- 5. A Promissory Note is Only for Personal Loans. This misconception overlooks the fact that promissory notes are used in business transactions, real estate deals, and other financial agreements as well.

- 6. You Cannot Enforce a Promissory Note in Court. On the contrary, if a borrower defaults, the lender can take legal action to enforce the terms of the note.

- 7. A Promissory Note Does Not Need to Be Written. While oral agreements may be enforceable in some cases, it is always advisable to have a written promissory note to ensure clarity and legal standing.

- 8. Once Signed, a Promissory Note Cannot Be Canceled. A promissory note can be canceled if both parties agree to it. However, proper documentation of the cancellation is essential.

Awareness of these misconceptions can help individuals navigate their financial agreements more effectively and avoid potential pitfalls.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Washington Promissory Note is a written promise to pay a specified amount of money to a designated party at a certain time. |

| Governing Law | The Washington Uniform Commercial Code (UCC) governs promissory notes in Washington State. |

| Form Requirements | The note must include the principal amount, interest rate, payment terms, and signatures of the parties involved. |

| Transferability | Promissory notes in Washington can be transferred to others, allowing the holder to assign rights to receive payment. |

| Enforceability | A properly executed promissory note is legally enforceable in court, provided it meets all necessary legal requirements. |

Key takeaways

When filling out and using the Washington Promissory Note form, it’s essential to understand the key components to ensure the document is both valid and enforceable. Here are some important takeaways:

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This establishes who is involved in the agreement.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed. This figure should be accurate to avoid any confusion later on.

- Outline the Interest Rate: If applicable, specify the interest rate being charged on the loan. Make sure this rate complies with Washington state laws.

- Set the Repayment Terms: Detail how and when the borrower will repay the loan. This includes the payment schedule and any grace periods.

- Include Default Provisions: Define what constitutes a default and the consequences that will follow. This protects the lender's interests.

- Signatures Required: Both parties must sign the document for it to be legally binding. Include the date of signing as well.

- Keep Copies: After the form is completed and signed, each party should retain a copy. This ensures that both parties have access to the agreed terms.

Understanding these elements will help ensure that the Washington Promissory Note serves its purpose effectively and protects the interests of both parties involved.

Dos and Don'ts

When filling out the Washington Promissory Note form, it’s important to follow specific guidelines to ensure everything is correct. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Do provide accurate information, including names and addresses.

- Do specify the loan amount clearly.

- Do include the interest rate, if applicable.

- Don't leave any required fields blank.

- Don't use unclear language or abbreviations.

- Don't forget to sign and date the document.

Following these guidelines will help avoid complications and ensure your Promissory Note is valid and enforceable.

Common mistakes

-

Incorrect Names: Many individuals fail to enter the full legal names of the borrower and lender. Using nicknames or initials can lead to confusion and potential legal issues.

-

Missing Dates: A common oversight is neglecting to include the date when the note is signed. This date is crucial for establishing the timeline of the agreement.

-

Inaccurate Loan Amount: People often miswrite the loan amount, either in numbers or words. Both representations must match to avoid disputes.

-

Omitting Payment Terms: Some forget to specify the payment schedule, including the frequency and amount of each payment. Clear terms help prevent misunderstandings.

-

Ignoring Interest Rates: Failing to include an interest rate or leaving it blank can lead to complications. If interest is applicable, it should be clearly stated.

-

Not Including Default Terms: Many overlook the importance of outlining what happens in the event of a default. Including these terms can protect both parties.

-

Signature Issues: Signatures must be clear and legible. Some individuals forget to sign or have someone else sign on their behalf, which can invalidate the note.

-

Failure to Keep Copies: After completing the form, not retaining a copy for personal records is a mistake. Both parties should have a signed copy for reference.

What You Should Know About This Form

-

What is a Washington Promissory Note?

A Washington Promissory Note is a written financial document that outlines a borrower's promise to repay a specific amount of money to a lender under agreed-upon terms. This document serves as a legal record of the loan agreement and includes details such as the loan amount, interest rate, repayment schedule, and any applicable fees.

-

Who can use a Promissory Note in Washington?

Any individual or business can use a Promissory Note in Washington. It is commonly utilized by lenders and borrowers in personal loans, business loans, and real estate transactions. Both parties should ensure that the terms are clear and mutually agreed upon to avoid future disputes.

-

What are the essential elements of a Washington Promissory Note?

A valid Washington Promissory Note should include the following elements:

- The names and addresses of the borrower and lender.

- The principal amount of the loan.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Any penalties for late payments.

- Signatures of both parties.

-

Is it necessary to notarize a Promissory Note in Washington?

Notarization is not required for a Promissory Note to be legally binding in Washington. However, having the document notarized can provide an extra layer of protection and may be beneficial in case of disputes. It serves as proof that the signatures were made willingly and in the presence of a notary.

-

Can a Promissory Note be modified after it has been signed?

Yes, a Promissory Note can be modified after it has been signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement to ensure clarity and enforceability.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults on the Promissory Note, the lender may take legal action to recover the owed amount. This may include filing a lawsuit or seeking a judgment against the borrower. It is crucial for both parties to understand their rights and obligations under the agreement to navigate such situations effectively.

Washington Promissory Note Example

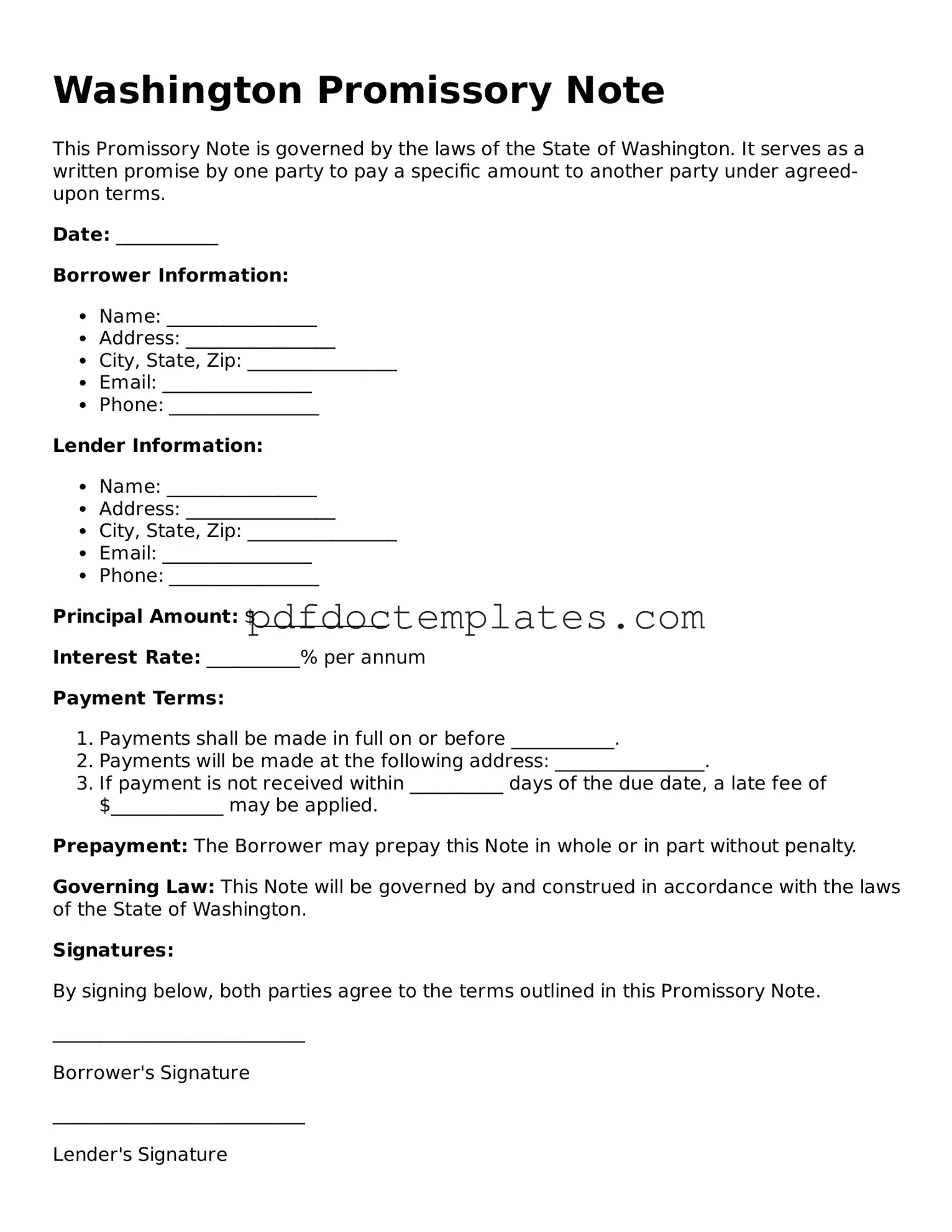

Washington Promissory Note

This Promissory Note is governed by the laws of the State of Washington. It serves as a written promise by one party to pay a specific amount to another party under agreed-upon terms.

Date: ___________

Borrower Information:

- Name: ________________

- Address: ________________

- City, State, Zip: ________________

- Email: ________________

- Phone: ________________

Lender Information:

- Name: ________________

- Address: ________________

- City, State, Zip: ________________

- Email: ________________

- Phone: ________________

Principal Amount: $______________

Interest Rate: __________% per annum

Payment Terms:

- Payments shall be made in full on or before ___________.

- Payments will be made at the following address: ________________.

- If payment is not received within __________ days of the due date, a late fee of $____________ may be applied.

Prepayment: The Borrower may prepay this Note in whole or in part without penalty.

Governing Law: This Note will be governed by and construed in accordance with the laws of the State of Washington.

Signatures:

By signing below, both parties agree to the terms outlined in this Promissory Note.

___________________________

Borrower's Signature

___________________________

Lender's Signature

___________________________

Date

Check out Other Common Promissory Note Templates for US States

Michigan Promissory Note - Regular communication between lender and borrower during the term of the promissory note can prevent misunderstandings.

When entering into a rental relationship in Florida, it's essential to have a thorough understanding of the Florida Residential Lease Agreement form, which serves as a legally binding outline of the terms and conditions between landlords and tenants. This document plays a vital role in establishing clear expectations and protecting the rights of both parties. To access this form and ensure you are prepared for a successful rental process, visit All Florida Forms.

Tennessee Promissory Note - The failure to pay the sum stated in a Promissory Note can impact the borrower's credit rating.

Promissory Note Notarized - This document outlines the terms of a loan between a borrower and a lender.