Blank Articles of Incorporation Document for Washington

Misconceptions

When it comes to the Washington Articles of Incorporation form, many people hold misconceptions that can lead to confusion. Understanding the truth behind these myths can make the process of incorporating your business smoother. Here are seven common misconceptions:

-

All businesses must file Articles of Incorporation.

Not every business entity is required to file Articles of Incorporation. For example, sole proprietorships and general partnerships do not need to file this document. Only corporations need to submit Articles of Incorporation to establish their legal status.

-

Filing Articles of Incorporation is the same as obtaining a business license.

While both are essential steps in starting a business, they serve different purposes. Articles of Incorporation establish your corporation's existence, while a business license allows you to operate legally within your jurisdiction.

-

Once filed, Articles of Incorporation cannot be changed.

This is not true. You can amend your Articles of Incorporation if you need to make changes, such as altering your business name or the number of shares authorized. Just follow the proper amendment procedures.

-

Only lawyers can file Articles of Incorporation.

While having legal assistance can be beneficial, it is not mandatory. Many business owners successfully file their own Articles of Incorporation without legal representation, provided they understand the requirements.

-

Filing Articles of Incorporation guarantees business success.

Incorporating your business is an important step, but it does not ensure success. Success depends on various factors, including your business plan, market conditions, and management strategies.

-

All states have the same requirements for Articles of Incorporation.

This is a misconception. Each state has its own specific requirements and forms for Articles of Incorporation. It's crucial to familiarize yourself with Washington's requirements to ensure compliance.

-

Once incorporated, you no longer need to file any paperwork.

Incorporation is just the beginning. Corporations must continue to file annual reports, maintain records, and comply with other ongoing legal obligations to stay in good standing.

By debunking these misconceptions, you can approach the incorporation process with greater confidence and clarity. Always seek reliable information and resources to guide you through your business journey.

Form Properties

| Fact Name | Description |

|---|---|

| Purpose | The Washington Articles of Incorporation form is used to create a corporation in the state of Washington. |

| Governing Law | This form is governed by the Washington Business Corporation Act (RCW 23B). |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for establishing a corporation. |

| Information Needed | Key information includes the corporation's name, registered agent, and address. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation. |

| Processing Time | Typically, processing takes about 5 to 10 business days, depending on the method of submission. |

| Online Filing | Corporations can file the Articles of Incorporation online through the Washington Secretary of State’s website. |

| Amendments | Changes to the Articles of Incorporation can be made by filing an amendment form. |

| Importance of Compliance | Failure to file correctly can lead to penalties or denial of the corporation's legal status. |

Key takeaways

When filling out and using the Washington Articles of Incorporation form, it is essential to understand the following key points:

- Purpose of the Form: This form is necessary for establishing a corporation in Washington State. It legally registers your business and grants it certain rights.

- Filing Fee: There is a fee associated with submitting the Articles of Incorporation. Ensure you check the current fee structure before filing.

- Business Name: The name of your corporation must be unique and not similar to existing businesses in Washington. Conduct a name search to avoid conflicts.

- Registered Agent: You must designate a registered agent who will receive legal documents on behalf of the corporation. This agent must have a physical address in Washington.

- Duration: Indicate how long you intend the corporation to exist. Most corporations are set up to exist perpetually unless stated otherwise.

- Incorporators: At least one incorporator must sign the Articles. This person does not have to be a resident of Washington.

- Business Purpose: Clearly state the purpose of the corporation. This can be broad, but it should align with the business activities you plan to conduct.

- Initial Board of Directors: Include the names and addresses of the initial directors. They will manage the corporation until new directors are elected.

- Filing Process: After completing the form, submit it to the Washington Secretary of State, either online or via mail, along with the required fee.

Understanding these key points can help ensure a smoother incorporation process in Washington State.

Dos and Don'ts

When filling out the Washington Articles of Incorporation form, it is essential to approach the task with care. Here are some important dos and don'ts to keep in mind:

- Do ensure that all required information is accurate and complete. Missing or incorrect details can delay the processing of your application.

- Do include the correct name of your corporation. It must be unique and not similar to any existing business in Washington.

- Do provide the registered agent's information. This person or entity will receive legal documents on behalf of your corporation.

- Do double-check your filing fee. Ensure that you include the correct payment to avoid any processing issues.

- Don't rush through the form. Take your time to read each section carefully to avoid mistakes.

- Don't forget to sign and date the form. An unsigned application will not be processed.

- Don't use abbreviations or informal language. Stick to the official terms and formats required by the state.

- Don't overlook the importance of following up. After submitting your application, check the status to ensure it is being processed.

By adhering to these guidelines, you can help ensure a smooth and efficient filing process for your Articles of Incorporation in Washington.

Common mistakes

-

Incorrect Business Name: One common mistake is failing to ensure that the chosen business name is unique and complies with state requirements. The name must not be deceptively similar to existing entities registered in Washington.

-

Omitting Registered Agent Information: Applicants sometimes forget to include the name and address of a registered agent. This individual or entity is responsible for receiving legal documents on behalf of the corporation.

-

Improper Purpose Statement: The purpose of the corporation should be clearly stated. Vague or overly broad descriptions can lead to confusion and may not meet legal standards.

-

Inaccurate Incorporator Information: The form requires the name and address of the incorporator. Errors in this information can delay processing and lead to complications in establishing the corporation.

-

Failure to Indicate Stock Structure: If the corporation will issue stock, the Articles must specify the number of shares and their par value. Omitting this information can result in the application being rejected.

-

Not Including Required Signatures: Each incorporator must sign the Articles of Incorporation. Neglecting to obtain all necessary signatures can invalidate the document and delay the incorporation process.

What You Should Know About This Form

-

What is the purpose of the Articles of Incorporation?

The Articles of Incorporation serve as a foundational document for a corporation. This document establishes the existence of the corporation in the eyes of the law. It includes essential information such as the corporation's name, its purpose, and the address of its registered office. Filing this document is a crucial step in the process of forming a corporation in Washington State.

-

Who needs to file the Articles of Incorporation?

Any individual or group looking to create a corporation in Washington State must file the Articles of Incorporation. This includes businesses ranging from small startups to larger enterprises. Nonprofit organizations also need to submit this document to be recognized as a legal entity.

-

What information is required in the Articles of Incorporation?

The Articles of Incorporation must include several key pieces of information. This typically includes the name of the corporation, the duration of the corporation (if not perpetual), the purpose of the corporation, the address of the registered office, and the names and addresses of the initial directors. Additionally, the number of shares the corporation is authorized to issue must be specified.

-

How do I file the Articles of Incorporation?

Filing the Articles of Incorporation can be done online or by mail. To file online, visit the Washington Secretary of State's website, where you can complete the form and pay the required filing fee. If you prefer to file by mail, you can download the form, complete it, and send it along with the payment to the appropriate address listed on the Secretary of State's website.

-

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation varies depending on the type of corporation being formed. Generally, the fee ranges from $180 to $200. Additional fees may apply if expedited processing is requested. It is advisable to check the Washington Secretary of State’s website for the most current fee schedule.

-

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary. Typically, if filed online, it may take a few business days. Mail filings may take longer, potentially up to several weeks, depending on the volume of applications being processed. For those needing faster service, expedited processing options are available for an additional fee.

-

Can I amend the Articles of Incorporation after filing?

Yes, amendments to the Articles of Incorporation can be made after the initial filing. To do this, you must file an amendment form with the Washington Secretary of State. This process involves providing the details of the changes being made and paying any associated fees. It's important to keep the corporation's records up to date to ensure compliance with state regulations.

-

What happens if I don’t file the Articles of Incorporation?

If the Articles of Incorporation are not filed, the business cannot legally operate as a corporation. This means that the individuals involved may be personally liable for any debts or obligations incurred by the business. Additionally, without proper incorporation, the business may miss out on potential tax benefits and legal protections that corporations typically enjoy.

-

Do I need a lawyer to file the Articles of Incorporation?

While it is not legally required to have a lawyer to file the Articles of Incorporation, consulting with one can be beneficial. A lawyer can help ensure that the document is completed accurately and that all necessary provisions are included. This can help avoid potential legal issues in the future and provide peace of mind during the incorporation process.

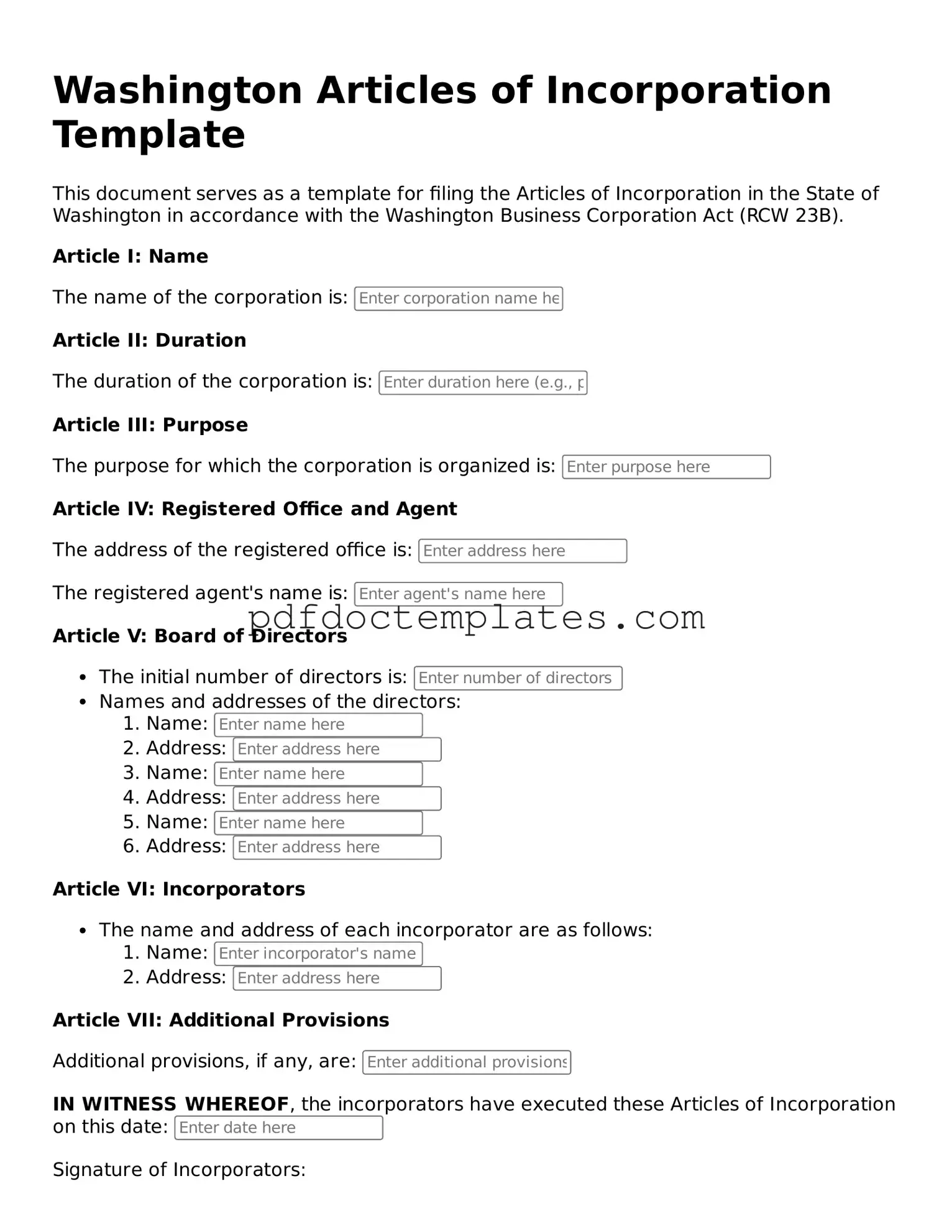

Washington Articles of Incorporation Example

Washington Articles of Incorporation Template

This document serves as a template for filing the Articles of Incorporation in the State of Washington in accordance with the Washington Business Corporation Act (RCW 23B).

Article I: Name

The name of the corporation is:

Article II: Duration

The duration of the corporation is:

Article III: Purpose

The purpose for which the corporation is organized is:

Article IV: Registered Office and Agent

The address of the registered office is:

The registered agent's name is:

Article V: Board of Directors

- The initial number of directors is:

- Names and addresses of the directors:

- Name:

- Address:

- Name:

- Address:

- Name:

- Address:

Article VI: Incorporators

- The name and address of each incorporator are as follows:

- Name:

- Address:

Article VII: Additional Provisions

Additional provisions, if any, are:

IN WITNESS WHEREOF, the incorporators have executed these Articles of Incorporation on this date:

Signature of Incorporators:

- Signature: _____________________ Name:

- Signature: _____________________ Name:

Submit this form to the Washington Secretary of State's office along with any applicable fees. Ensure that all information is accurate and complete to avoid processing delays.

Check out Other Common Articles of Incorporation Templates for US States

Tennessee Articles of Organization - Outlines restrictions on business activities.

Articles of Incorporation in Michigan - The document can set procedures for the issuance of shares.

A Bill of Sale is a legal document that provides evidence of the transfer of ownership from one party to another, usually for goods or personal property. This form outlines the details of the transaction, including the item description, purchase price, and the names of both the buyer and seller. For ease of use, fill out the Bill of Sale form by clicking the button below, or you can find additional resources at PDF Documents Hub.

How Do I Get a Certificate of Good Standing - The filing fee varies by state and must be included with the submission.