Blank Transfer-on-Death Deed Document for Virginia

Misconceptions

The Virginia Transfer-on-Death Deed (TODD) is a relatively straightforward tool for estate planning, but several misconceptions surround its use. Understanding these misconceptions can help individuals make informed decisions about their property and inheritance. Below are seven common misunderstandings regarding the TODD in Virginia.

- 1. A Transfer-on-Death Deed is the same as a will. Many people believe that a TODD functions like a will. However, a TODD specifically allows for the transfer of real estate directly to beneficiaries upon the owner’s death, bypassing probate, while a will addresses the distribution of all assets, including personal property, and requires probate to validate.

- 2. You cannot change or revoke a TODD. Some individuals think that once a TODD is executed, it is permanent. In reality, a property owner can revoke or modify the deed at any time before their death, as long as the proper procedures are followed.

- 3. A TODD automatically transfers all property upon death. This misconception implies that all assets owned by the deceased are transferred automatically. In truth, a TODD only applies to the specific property listed in the deed and does not extend to other assets owned by the deceased.

- 4. You must be wealthy to use a TODD. Many people assume that TODDs are only for wealthy individuals. However, anyone who owns real estate can benefit from a TODD, regardless of their overall financial situation, as it simplifies the transfer process for any property.

- 5. A TODD avoids all taxes. There is a belief that using a TODD eliminates tax obligations entirely. While it can help avoid probate taxes, it does not exempt the property from estate taxes or any other tax liabilities that may arise upon the owner's death.

- 6. You need an attorney to create a TODD. Some people think that hiring an attorney is mandatory for drafting a TODD. While legal assistance can be beneficial, Virginia law allows individuals to create a TODD without an attorney, provided they follow the correct form and procedures.

- 7. Beneficiaries can access the property before the owner’s death. There is a common belief that a TODD allows beneficiaries to take possession of the property while the owner is still alive. This is incorrect; beneficiaries only gain rights to the property after the owner has passed away.

Understanding these misconceptions can empower property owners to utilize the Transfer-on-Death Deed effectively, ensuring a smoother transition of assets to their intended beneficiaries.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Virginia Transfer-on-Death Deed allows a property owner to transfer real estate to a designated beneficiary upon their death without the need for probate. |

| Governing Law | The Transfer-on-Death Deed is governed by Virginia Code § 64.2-620 through § 64.2-629. |

| Revocability | The deed can be revoked at any time by the property owner, provided they follow the proper procedures for revocation. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries in the deed, allowing for flexibility in estate planning. |

| No Immediate Transfer | The transfer of property does not occur until the death of the owner, which helps retain control during their lifetime. |

| Tax Implications | Generally, the property is not subject to estate tax at the time of transfer; however, beneficiaries may be responsible for property taxes after the owner's death. |

| Filing Requirements | The deed must be recorded in the county or city where the property is located to be effective. |

| Limitations | Transfer-on-Death Deeds cannot be used for all types of property, including certain types of jointly owned property or property subject to a lien. |

Key takeaways

Filling out and using the Virginia Transfer-on-Death Deed form can be a straightforward process, but it is essential to understand the key aspects to ensure everything is done correctly. Here are some important takeaways:

- Purpose: The Transfer-on-Death Deed allows property owners in Virginia to transfer their real estate to designated beneficiaries upon their death, avoiding probate.

- Eligibility: This deed can be used for residential properties, but not for commercial properties or properties held in a trust.

- Form Requirements: The form must be filled out completely, including the names of the current owner(s) and the designated beneficiary(ies).

- Signature: The deed must be signed by the property owner(s) in the presence of a notary public to be legally valid.

- Recording: After signing, the deed should be recorded in the local land records office to ensure it is enforceable and to provide public notice.

- Revocation: Property owners can revoke the deed at any time before their death by completing a revocation form and recording it.

- Tax Implications: Beneficiaries may be subject to capital gains taxes upon selling the property, so consulting a tax professional is advisable.

- Consultation Recommended: It is often beneficial to seek legal advice when preparing a Transfer-on-Death Deed to ensure compliance with all applicable laws.

Understanding these key points can help ensure a smooth process when utilizing the Virginia Transfer-on-Death Deed form. Taking the time to do it right can save time and stress for your loved ones in the future.

Dos and Don'ts

When filling out the Virginia Transfer-on-Death Deed form, it’s essential to follow specific guidelines to ensure accuracy and legality. Here are nine things to keep in mind:

- Do ensure that the property description is complete and accurate.

- Do include the names of all beneficiaries clearly.

- Do sign the form in the presence of a notary public.

- Do keep a copy of the completed deed for your records.

- Do file the deed with the local land records office before your death.

- Don't leave out any required information, as this may invalidate the deed.

- Don't forget to check for any local requirements that may apply.

- Don't use unclear language that could lead to confusion about the intent.

- Don't attempt to make changes after the deed has been signed and notarized.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to delays or rejection of the deed. Ensure that names, addresses, and property descriptions are fully filled out.

-

Incorrect Property Description: Using vague or inaccurate descriptions of the property can cause confusion. Always include the full legal description as recorded in public records.

-

Not Signing the Form: The deed must be signed by the owner. Omitting a signature renders the document invalid.

-

Failure to Notarize: A Transfer-on-Death Deed must be notarized to be valid. Skipping this step can lead to issues in transferring ownership.

-

Using Incorrect Names: Ensure that the beneficiaries’ names are spelled correctly. Mistakes in names can complicate the transfer process.

-

Not Including Contingent Beneficiaries: It is wise to name alternative beneficiaries in case the primary ones cannot inherit. Failing to do so may lead to unintended consequences.

-

Improper Filing: After completing the deed, it must be filed with the appropriate local government office. Neglecting this step means the deed is not legally recognized.

-

Ignoring State-Specific Requirements: Each state has unique regulations regarding Transfer-on-Death Deeds. Be sure to review Virginia’s specific requirements to avoid errors.

What You Should Know About This Form

-

What is a Transfer-on-Death Deed in Virginia?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner to designate one or more beneficiaries to receive their real estate upon their death. This deed enables the transfer of property without the need for probate, simplifying the process for the beneficiaries.

-

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Virginia can use a Transfer-on-Death Deed. This includes homeowners, landowners, and individuals holding property in their name. However, it is important to ensure that the property is not subject to any liens or other legal complications that may affect the transfer.

-

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you must complete the appropriate form, which includes details about the property and the designated beneficiaries. The deed must be signed by the property owner in the presence of a notary public. After signing, it must be recorded in the local land records office where the property is located.

-

Is there a specific format for the Transfer-on-Death Deed?

Yes, Virginia law requires the Transfer-on-Death Deed to meet certain formatting and content requirements. The deed must clearly state that it is a Transfer-on-Death Deed, include the names of the beneficiaries, and provide a legal description of the property. Using the proper format ensures the deed is valid and enforceable.

-

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked at any time before the property owner's death. To revoke the deed, the property owner must create a new deed stating the revocation and record it in the same land records office where the original deed was filed. This ensures that all parties are aware of the change.

-

What happens if a beneficiary dies before the property owner?

If a beneficiary named in the Transfer-on-Death Deed passes away before the property owner, the deed does not automatically transfer the property to that beneficiary's heirs. Instead, the property will remain with the original owner unless the deed is updated to include new beneficiaries or the property is transferred through other means.

-

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger any immediate tax consequences for the property owner or the beneficiaries. However, when the property is transferred to the beneficiaries, they may be subject to capital gains taxes based on the property's value at the time of transfer. Consulting with a tax professional is advisable to understand any potential implications.

-

Can I use a Transfer-on-Death Deed for all types of property?

A Transfer-on-Death Deed can be used for most types of real estate, including residential homes, commercial properties, and vacant land. However, it cannot be used for personal property, such as vehicles or bank accounts. It is important to ensure that the property qualifies for this type of transfer.

-

What should I do if I have more questions about the Transfer-on-Death Deed?

If you have additional questions or need assistance with the Transfer-on-Death Deed process, consider reaching out to a qualified attorney or a legal document preparer. They can provide guidance tailored to your specific situation and help ensure that all legal requirements are met.

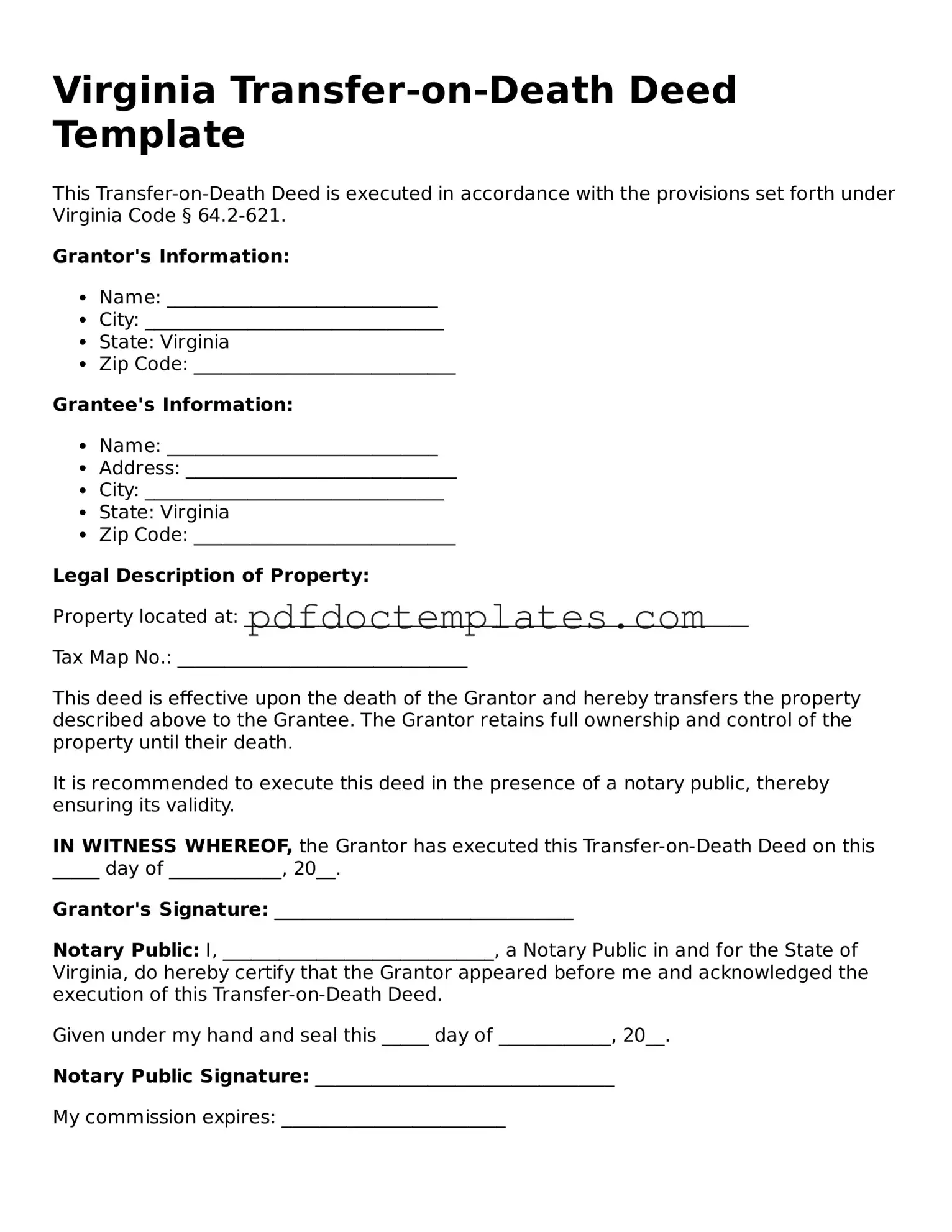

Virginia Transfer-on-Death Deed Example

Virginia Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the provisions set forth under Virginia Code § 64.2-621.

Grantor's Information:

- Name: _____________________________

- City: ________________________________

- State: Virginia

- Zip Code: ____________________________

Grantee's Information:

- Name: _____________________________

- Address: _____________________________

- City: ________________________________

- State: Virginia

- Zip Code: ____________________________

Legal Description of Property:

Property located at: ______________________________________________________

Tax Map No.: _______________________________

This deed is effective upon the death of the Grantor and hereby transfers the property described above to the Grantee. The Grantor retains full ownership and control of the property until their death.

It is recommended to execute this deed in the presence of a notary public, thereby ensuring its validity.

IN WITNESS WHEREOF, the Grantor has executed this Transfer-on-Death Deed on this _____ day of ____________, 20__.

Grantor's Signature: ________________________________

Notary Public: I, _____________________________, a Notary Public in and for the State of Virginia, do hereby certify that the Grantor appeared before me and acknowledged the execution of this Transfer-on-Death Deed.

Given under my hand and seal this _____ day of ____________, 20__.

Notary Public Signature: ________________________________

My commission expires: ________________________

Check out Other Common Transfer-on-Death Deed Templates for US States

Transfer on Death Deed California - This deed can be revoked or modified at any time before the owner's death.

Transfer on Death Deed New Jersey - The form simplifies the transition of property ownership, ensuring quicker access for heirs under specified conditions.

A Florida Quitclaim Deed form is a legal document used to transfer interest in real estate with no guarantees about the title. It's commonly employed between family members or close acquaintances when the property is not being sold for its full market value. This form simplifies the process, making it faster and more straightforward to shift ownership, and can be easily accessed through resources like All Florida Forms.

Transfer on Death Deed Washington State - This deed remains effective even if the property owner moves to a different state before their passing.