Blank Promissory Note Document for Virginia

Misconceptions

Understanding the Virginia Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are nine common misconceptions:

- It is a legally binding document. Many believe that a promissory note is automatically enforceable. While it can be legally binding, specific conditions must be met for it to be enforceable in court.

- Only banks can issue promissory notes. This is not true. Individuals and businesses can create and issue promissory notes as well.

- Promissory notes must be notarized. Notarization is not a requirement for all promissory notes in Virginia, although it can add an extra layer of validity.

- They are only for large loans. Promissory notes can be used for loans of any size, not just significant amounts.

- All promissory notes are the same. Different types of promissory notes exist, including secured and unsecured notes, each serving different purposes.

- Interest rates must be included. While many promissory notes include interest rates, it is not a legal requirement. A note can specify a zero-interest loan.

- They can’t be transferred. Promissory notes can be assigned or transferred to another party unless stated otherwise in the document.

- They are only for personal loans. Businesses also frequently use promissory notes for various financial transactions.

- Once signed, they cannot be changed. Amendments can be made to a promissory note if all parties agree and sign the changes.

Clarifying these misconceptions can help individuals navigate the lending process more effectively and make informed decisions regarding promissory notes in Virginia.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Virginia Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a future date. |

| Governing Law | The Virginia Promissory Note is governed by the Virginia Uniform Commercial Code (UCC), specifically Article 3, which deals with negotiable instruments. |

| Parties Involved | The note typically involves two parties: the borrower (also known as the maker) and the lender (the payee). |

| Interest Rate | Interest rates on promissory notes can be fixed or variable, depending on the agreement between the parties. |

| Payment Terms | The payment terms, including the due date and payment schedule, should be clearly outlined in the note. |

| Collateral | Some promissory notes may be secured by collateral, which provides the lender with additional protection in case of default. |

| Default Provisions | The note should specify what constitutes a default and the consequences that follow, such as late fees or acceleration of the payment due. |

| Transferability | Promissory notes can often be transferred or assigned to another party, allowing the new holder to enforce the terms of the note. |

| Legal Requirements | For a promissory note to be enforceable, it must be signed by the borrower and include essential elements such as the amount, interest rate, and payment terms. |

| State-Specific Considerations | Virginia law may have specific requirements regarding the format and content of promissory notes, so it is important to ensure compliance with local regulations. |

Key takeaways

When dealing with a Virginia Promissory Note, it's essential to understand the key components to ensure everything is filled out correctly and serves its purpose. Here are some important takeaways:

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This establishes who is involved in the agreement.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed. This should be an exact figure to avoid any confusion later.

- Detail the Repayment Terms: Outline how and when the borrower will repay the loan. This includes the payment schedule, interest rate, and any late fees.

- Include Signatures: Both parties should sign and date the document. This signifies agreement to the terms laid out in the note.

- Keep Copies: After signing, make sure to keep copies of the note for both the lender and the borrower. This ensures that both parties have access to the terms of the agreement.

By following these guidelines, you can create a clear and effective promissory note that protects both parties involved.

Dos and Don'ts

When filling out the Virginia Promissory Note form, it is essential to follow certain guidelines to ensure the document is accurate and legally binding. Below is a list of things you should and shouldn't do.

- Do ensure that all parties involved are clearly identified, including full names and addresses.

- Do specify the exact amount of money being borrowed.

- Do include the interest rate, if applicable, and clarify whether it is fixed or variable.

- Do state the repayment schedule, including due dates and payment amounts.

- Do sign and date the document in the presence of a witness, if required.

- Don't leave any blanks in the form; fill in all necessary information.

- Don't use ambiguous language; be clear and precise in your wording.

- Don't forget to keep a copy of the signed Promissory Note for your records.

- Don't ignore state laws that may affect the terms of the note.

Common mistakes

-

Inaccurate Borrower Information: One common mistake is providing incorrect or incomplete information about the borrower. Ensure that the name, address, and contact details are accurate to avoid any confusion later.

-

Missing Lender Details: Just as it is crucial to provide correct borrower information, the lender’s details must also be complete. Omitting the lender’s name or address can lead to complications in the future.

-

Failure to Specify the Loan Amount: Clearly stating the loan amount is essential. Leaving this blank or writing an unclear amount can create disputes over what is owed.

-

Neglecting to Include Interest Rate: If the loan involves interest, it must be specified in the note. Not including this information can lead to misunderstandings regarding repayment terms.

-

Omitting Payment Terms: The payment schedule should be clearly outlined. Whether payments are due monthly, quarterly, or in a lump sum, clarity is key to ensuring both parties understand their obligations.

-

Not Signing the Document: A promissory note is not valid without the signatures of both the borrower and the lender. Forgetting to sign can render the document unenforceable.

-

Ignoring State-Specific Requirements: Each state may have specific requirements for promissory notes. Failing to comply with Virginia’s regulations could invalidate the note.

What You Should Know About This Form

-

What is a Virginia Promissory Note?

A Virginia Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. This document outlines the terms of the loan, including the principal amount, interest rate, and repayment schedule. It serves as a legal record of the agreement between the borrower and the lender.

-

Who can use a Promissory Note in Virginia?

Any individual or business can use a Promissory Note in Virginia. This includes personal loans between friends or family members, as well as more formal agreements between businesses or financial institutions. The key is that both parties must agree to the terms and sign the document.

-

What information is typically included in a Virginia Promissory Note?

- The names and addresses of the borrower and lender

- The principal amount being borrowed

- The interest rate, if applicable

- The repayment schedule, including due dates

- Any late fees or penalties for missed payments

- Signatures of both parties

This information helps clarify the obligations of both parties and provides a clear reference in case of any disputes.

-

Is a Promissory Note legally binding in Virginia?

Yes, a Promissory Note is legally binding in Virginia as long as it meets certain requirements. Both parties must agree to the terms, and the document must be signed by the borrower. It is advisable to have the note witnessed or notarized to strengthen its enforceability, although this is not always necessary.

-

What happens if the borrower fails to repay the loan?

If the borrower fails to repay the loan as outlined in the Promissory Note, the lender has the right to take legal action to recover the owed amount. This could involve filing a lawsuit or seeking a judgment against the borrower. It is important for both parties to understand their rights and obligations under the agreement to avoid misunderstandings.

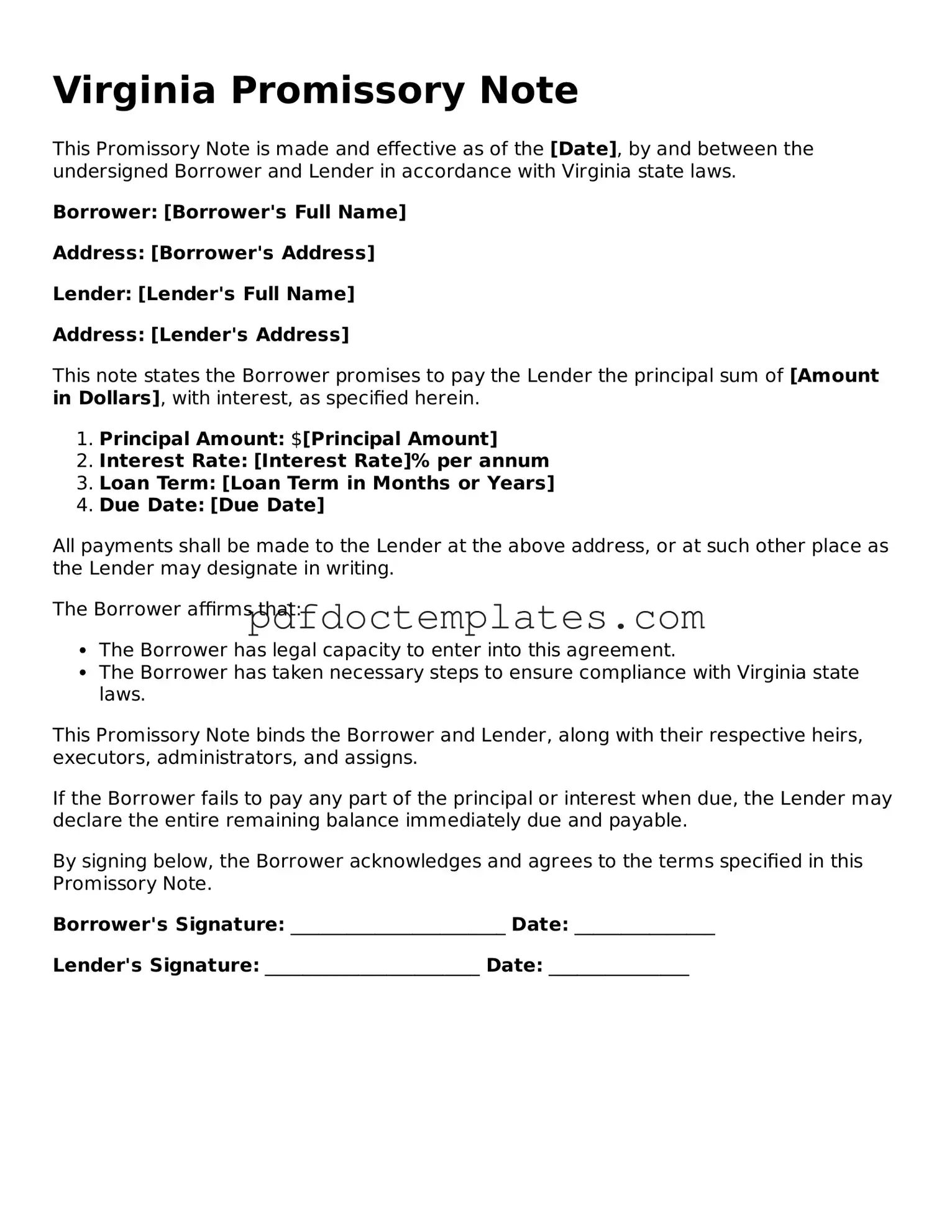

Virginia Promissory Note Example

Virginia Promissory Note

This Promissory Note is made and effective as of the [Date], by and between the undersigned Borrower and Lender in accordance with Virginia state laws.

Borrower: [Borrower's Full Name]

Address: [Borrower's Address]

Lender: [Lender's Full Name]

Address: [Lender's Address]

This note states the Borrower promises to pay the Lender the principal sum of [Amount in Dollars], with interest, as specified herein.

- Principal Amount: $[Principal Amount]

- Interest Rate: [Interest Rate]% per annum

- Loan Term: [Loan Term in Months or Years]

- Due Date: [Due Date]

All payments shall be made to the Lender at the above address, or at such other place as the Lender may designate in writing.

The Borrower affirms that:

- The Borrower has legal capacity to enter into this agreement.

- The Borrower has taken necessary steps to ensure compliance with Virginia state laws.

This Promissory Note binds the Borrower and Lender, along with their respective heirs, executors, administrators, and assigns.

If the Borrower fails to pay any part of the principal or interest when due, the Lender may declare the entire remaining balance immediately due and payable.

By signing below, the Borrower acknowledges and agrees to the terms specified in this Promissory Note.

Borrower's Signature: _______________________ Date: _______________

Lender's Signature: _______________________ Date: _______________

Check out Other Common Promissory Note Templates for US States

Create a Promissory Note - Having clear repayment terms can help avoid confusion later on.

The Florida Power of Attorney for a Child form serves as an essential tool for parents, allowing them to designate another adult to make crucial decisions regarding their child(ren) in their absence. This legal provision is particularly valuable during times of travel, illness, or military deployment, ensuring that children's needs are adequately met. For those needing a template or guidance on this matter, All Florida Forms offers a comprehensive source for the necessary documentation.

Michigan Promissory Note - Some promissory notes may include clauses for prepayment, allowing borrowers to pay off their debt early.

Promissory Note Washington State - The note can be used between individuals, businesses, or financial institutions.

Promissory Note Arizona - It is essential for the lender to keep a copy of the signed promissory note for their records.