Blank Gift Deed Document for Virginia

Misconceptions

The Virginia Gift Deed is a legal document used to transfer property as a gift without any exchange of money. However, several misconceptions surround this form, which can lead to confusion among potential donors and recipients. Here are eight common misconceptions:

- Gift Deeds are only for family members. While many people use gift deeds to transfer property to relatives, they can also be used for friends or charitable organizations.

- Gift Deeds are not legally binding. In Virginia, a properly executed gift deed is a legally binding document, provided it meets all necessary requirements.

- There are no tax implications for gift deeds. Although the recipient does not pay taxes on the gift, the donor may be subject to gift tax if the value exceeds certain thresholds set by the IRS.

- A gift deed must be notarized to be valid. While notarization is highly recommended to ensure authenticity, it is not a strict requirement for the deed to be valid in Virginia.

- Gift deeds can be revoked at any time. Once a gift deed is executed and delivered, it generally cannot be revoked without the consent of the recipient.

- Only real estate can be transferred through a gift deed. Gift deeds can be used for various types of property, including personal property, such as vehicles or valuable items.

- All gifts are automatically considered taxable income for the recipient. Gifts are not considered taxable income for the recipient; however, they may affect the recipient’s tax situation in other ways.

- Gift deeds do not require any specific language. While there is no strict language requirement, the deed must clearly express the intent to make a gift and comply with Virginia law.

Understanding these misconceptions can help individuals navigate the process of using a Virginia Gift Deed more effectively. Proper knowledge ensures that both the giver and the recipient are aware of their rights and responsibilities.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Virginia Gift Deed is a legal document used to transfer ownership of property from one individual to another without any exchange of money. |

| Governing Laws | The Virginia Gift Deed is governed by the Code of Virginia, specifically § 55.1-601 through § 55.1-606, which outline the requirements and procedures for property transfers. |

| Requirements | The deed must be in writing, signed by the donor (the person giving the gift), and acknowledged before a notary public. |

| Tax Implications | Gift deeds may have tax implications for both the donor and the recipient. It is advisable to consult a tax professional to understand potential gift tax liabilities. |

| Recording | Once executed, the Gift Deed should be recorded in the local land records office to provide public notice of the transfer and protect the rights of the new owner. |

Key takeaways

Filling out and using the Virginia Gift Deed form can seem daunting, but understanding some key points can simplify the process. Here are essential takeaways to keep in mind:

- Understand the Purpose: A Gift Deed is used to transfer ownership of property without any exchange of money. It is a legal document that formalizes the gift.

- Identify the Parties: Clearly state the names of both the donor (the person giving the gift) and the recipient (the person receiving the gift). Accurate identification is crucial.

- Describe the Property: Provide a detailed description of the property being gifted. This includes the address and any relevant legal descriptions to avoid confusion.

- Signatures Required: Both the donor and the recipient must sign the Gift Deed. Depending on the situation, a witness or notary public may also need to sign to validate the document.

- Record the Deed: After filling out the form, it’s important to record the Gift Deed with the local county clerk's office. This step ensures that the transfer of ownership is officially recognized.

- Tax Implications: Be aware of potential tax consequences. While the recipient typically does not owe taxes on a gift, the donor may need to report the gift if it exceeds a certain value.

By keeping these points in mind, you can navigate the process of completing and using a Virginia Gift Deed with confidence.

Dos and Don'ts

When filling out the Virginia Gift Deed form, it is crucial to follow specific guidelines to ensure the process is smooth and legally compliant. Here are five important do's and don'ts to consider:

- Do provide accurate property descriptions to avoid confusion.

- Do include the full names of both the donor and the recipient.

- Do sign the form in the presence of a notary public for validation.

- Don't leave any sections of the form blank; incomplete forms can lead to delays.

- Don't forget to check local regulations, as they may have specific requirements.

Adhering to these guidelines will help ensure that the Gift Deed is processed without issues.

Common mistakes

-

Neglecting to Include All Required Information: When filling out the Virginia Gift Deed form, individuals often overlook essential details such as the full names and addresses of both the donor and the recipient. This omission can lead to complications down the line, as the deed may be deemed incomplete or invalid.

-

Failing to Provide a Clear Description of the Property: A common mistake is not providing a precise and detailed description of the property being gifted. Vague descriptions can create confusion and may result in disputes about what exactly was intended to be transferred.

-

Not Signing the Deed Correctly: The signature of the donor is crucial for the validity of the Gift Deed. Some individuals forget to sign the document, while others may not have their signature notarized as required. This oversight can render the deed unenforceable.

-

Ignoring the Tax Implications: Many people do not consider the tax consequences associated with gifting property. Failing to consult a tax professional can lead to unexpected liabilities for both the donor and the recipient, making it essential to understand the financial implications of the gift.

What You Should Know About This Form

-

What is a Virginia Gift Deed?

A Virginia Gift Deed is a legal document used to transfer property ownership from one person to another without any exchange of money. This type of deed is often used when a property owner wishes to give their property as a gift to a family member or friend.

-

What are the requirements for a valid Gift Deed in Virginia?

For a Gift Deed to be valid in Virginia, it must meet certain criteria. The deed must be in writing, signed by the donor (the person giving the gift), and must clearly describe the property being transferred. Additionally, the deed should include the names of both the donor and the recipient (the person receiving the gift).

-

Is it necessary to have the Gift Deed notarized?

While it is not strictly required to have a Gift Deed notarized in Virginia, it is highly recommended. Notarization adds a layer of authenticity and can help prevent disputes regarding the validity of the deed in the future. Furthermore, some localities may require notarization for recording purposes.

-

Are there any tax implications associated with a Gift Deed?

Yes, there can be tax implications when transferring property through a Gift Deed. The donor may be subject to federal gift tax if the value of the gift exceeds the annual exclusion limit set by the IRS. However, many gifts fall below this threshold and may not incur any tax. It is advisable to consult a tax professional for personalized guidance.

-

How do I record a Gift Deed in Virginia?

To record a Gift Deed in Virginia, the completed and signed deed should be submitted to the local circuit court clerk's office in the county or city where the property is located. There may be a recording fee, and it is important to ensure that the deed is properly executed to avoid any issues during the recording process.

-

Can a Gift Deed be revoked?

Generally, once a Gift Deed has been executed and recorded, it cannot be revoked. The transfer of ownership is considered final. However, if the deed includes specific conditions or if the donor retains certain rights to the property, there may be grounds for revocation. Legal advice should be sought if there are concerns about revoking a Gift Deed.

-

What should I do if I have more questions about Gift Deeds?

If you have additional questions about Gift Deeds or need assistance with the process, consider reaching out to a qualified attorney who specializes in real estate law. They can provide tailored advice and help ensure that all legal requirements are met.

Virginia Gift Deed Example

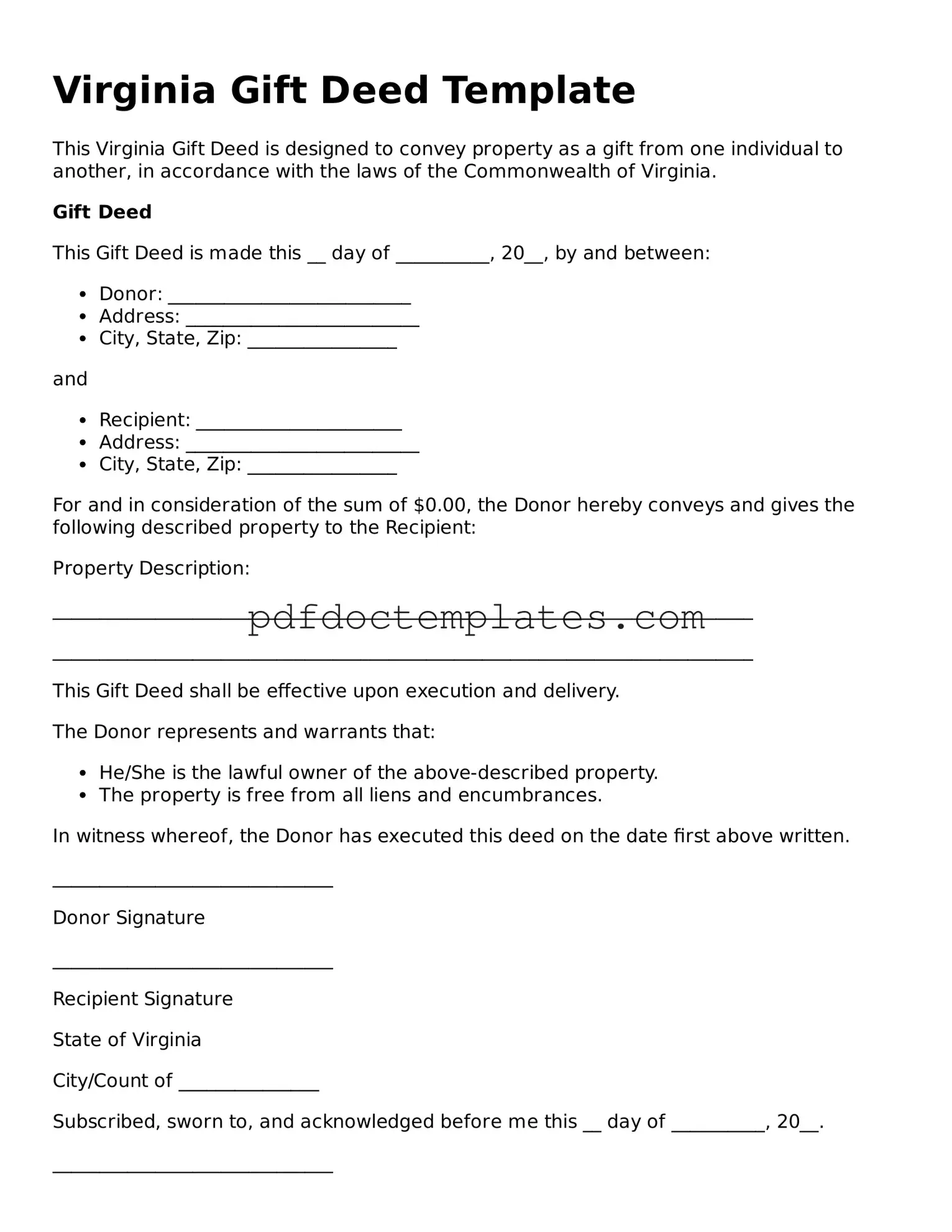

Virginia Gift Deed Template

This Virginia Gift Deed is designed to convey property as a gift from one individual to another, in accordance with the laws of the Commonwealth of Virginia.

Gift Deed

This Gift Deed is made this __ day of __________, 20__, by and between:

- Donor: __________________________

- Address: _________________________

- City, State, Zip: ________________

and

- Recipient: ______________________

- Address: _________________________

- City, State, Zip: ________________

For and in consideration of the sum of $0.00, the Donor hereby conveys and gives the following described property to the Recipient:

Property Description:

___________________________________________________________________________

___________________________________________________________________________

This Gift Deed shall be effective upon execution and delivery.

The Donor represents and warrants that:

- He/She is the lawful owner of the above-described property.

- The property is free from all liens and encumbrances.

In witness whereof, the Donor has executed this deed on the date first above written.

______________________________

Donor Signature

______________________________

Recipient Signature

State of Virginia

City/Count of _______________

Subscribed, sworn to, and acknowledged before me this __ day of __________, 20__.

______________________________

Notary Public

My commission expires: _______________