Blank Articles of Incorporation Document for Virginia

Misconceptions

The Virginia Articles of Incorporation form is essential for anyone looking to establish a corporation in Virginia. However, several misconceptions often cloud understanding of this important document. Below is a list of seven common misconceptions, along with clarifications for each.

- Misconception 1: The Articles of Incorporation are only necessary for large businesses.

- Misconception 2: Filing the Articles guarantees immediate approval.

- Misconception 3: You can use a generic template without customization.

- Misconception 4: The Articles of Incorporation are a one-time requirement.

- Misconception 5: You can file the Articles of Incorporation without any legal assistance.

- Misconception 6: The Articles of Incorporation are the same as a business license.

- Misconception 7: All corporations must have the same structure outlined in the Articles.

This is incorrect. Any business entity, regardless of size, must file Articles of Incorporation to legally establish itself as a corporation in Virginia.

Approval is not automatic. The state reviews the submission for compliance with legal requirements, which can take time.

While templates exist, each corporation has unique needs. Customizing the form ensures it meets specific business requirements and complies with state laws.

This is misleading. While the initial filing is crucial, corporations must adhere to ongoing compliance requirements, including annual reports and fees.

While it is possible to file independently, consulting with a legal expert can help avoid mistakes that may lead to delays or rejections.

This is not true. The Articles of Incorporation establish the corporation, while a business license is a separate requirement that permits operation within a specific locality.

Different types of corporations can have varying structures. The Articles allow for flexibility in defining management roles, share classes, and other organizational elements.

Understanding these misconceptions can help ensure a smoother incorporation process and pave the way for a successful business venture in Virginia.

Form Properties

| Fact Name | Details |

|---|---|

| Purpose | The Virginia Articles of Incorporation form is used to legally establish a corporation in the state of Virginia. |

| Governing Law | This form is governed by the Virginia Stock Corporation Act, specifically Title 13.1, Chapter 9 of the Code of Virginia. |

| Filing Requirement | Filing the Articles of Incorporation with the Virginia State Corporation Commission is mandatory for corporation formation. |

| Information Required | The form requires details such as the corporation's name, registered agent, and the number of shares authorized for issuance. |

| Filing Fee | A filing fee is required, which varies based on the type of corporation being formed. |

| Processing Time | Typically, the processing time for the Articles of Incorporation is about 5 to 7 business days, depending on the volume of submissions. |

Key takeaways

When filling out and using the Virginia Articles of Incorporation form, it's important to keep a few key points in mind. Here are some essential takeaways:

- Understand the Purpose: The Articles of Incorporation officially establish your corporation in Virginia. This document lays the groundwork for your business structure.

- Provide Accurate Information: Ensure that all details, such as the corporation's name and registered agent, are correct. Mistakes can lead to delays or legal issues.

- Choose the Right Name: The corporation's name must be unique and comply with Virginia's naming rules. It should include a designation like "Corporation" or "Inc."

- Filing Fees: Be prepared to pay the necessary filing fees when submitting your Articles of Incorporation. These fees can vary, so check the latest information.

- Consider Additional Documents: Depending on your business type, you may need to submit other forms or documents along with your Articles of Incorporation.

By keeping these points in mind, you can navigate the process of incorporating your business in Virginia more smoothly.

Dos and Don'ts

When filling out the Virginia Articles of Incorporation form, it's important to follow certain guidelines to ensure a smooth process. Here’s a list of things you should and shouldn’t do:

- Do provide accurate information about your business name.

- Do include the correct registered agent's name and address.

- Do specify the purpose of your corporation clearly.

- Do ensure that the incorporators' names and addresses are complete.

- Do double-check for any typos or errors before submitting.

- Don't use a name that is already taken by another business in Virginia.

- Don't forget to sign and date the form.

- Don't leave any required sections blank; complete all necessary fields.

- Don't submit the form without the required filing fee.

By following these guidelines, you can help ensure that your Articles of Incorporation are processed efficiently. Take your time, and don't hesitate to seek assistance if needed.

Common mistakes

-

Incomplete Information: Failing to provide all required information can lead to delays or rejection. Each section of the form must be filled out completely.

-

Incorrect Business Name: The chosen business name must be unique and not already in use by another entity in Virginia. Double-checking the name's availability is crucial.

-

Improper Designation of Registered Agent: A registered agent must be designated to receive legal documents. This person or business must have a physical address in Virginia.

-

Failure to Specify Purpose: Clearly stating the purpose of the corporation is essential. A vague or overly broad purpose may lead to complications.

-

Neglecting to Include Incorporators' Information: The names and addresses of the incorporators must be included. Omitting this information can result in processing issues.

-

Incorrect Filing Fee: The filing fee must be accurate. Submitting an incorrect amount can delay the processing of the Articles of Incorporation.

-

Not Following Submission Guidelines: The form must be submitted according to Virginia's guidelines, whether online or by mail. Ignoring these instructions can cause delays.

-

Overlooking Signature Requirements: The form must be signed by the incorporators. Missing signatures can lead to the rejection of the application.

-

Ignoring State-Specific Regulations: Each state has its own requirements. Not being aware of Virginia's specific regulations can result in errors that need correction.

What You Should Know About This Form

-

What is the Virginia Articles of Incorporation form?

The Virginia Articles of Incorporation form is a legal document that establishes a corporation in the state of Virginia. This form outlines essential details about the corporation, such as its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this document is a crucial step in the process of forming a corporation.

-

Who needs to file the Articles of Incorporation?

Any individual or group wishing to create a corporation in Virginia must file the Articles of Incorporation. This includes businesses, non-profits, and other entities seeking to operate as a corporation. It is important to ensure that the chosen name for the corporation complies with state regulations.

-

What information is required on the form?

The form requires several key pieces of information, including:

- The name of the corporation

- The purpose of the corporation

- The registered agent's name and address

- The number of shares the corporation is authorized to issue

- The name and address of the incorporators

Providing accurate and complete information is essential for the processing of the application.

-

How do I file the Articles of Incorporation?

Filing can be done online or by mail. To file online, visit the Virginia Secretary of the Commonwealth's website and follow the instructions for submitting the Articles of Incorporation electronically. If filing by mail, print the completed form and send it to the appropriate office along with the required filing fee.

-

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Virginia varies based on the type of corporation being formed. Generally, the fee ranges from $25 to $100. It is advisable to check the latest fee schedule on the Virginia Secretary of the Commonwealth's website to ensure accurate payment.

-

How long does it take to process the Articles of Incorporation?

Processing times can vary. Typically, online submissions are processed more quickly, often within a few business days. Mail submissions may take longer, sometimes up to several weeks. It is recommended to plan accordingly and check for any updates on processing times from the Virginia Secretary of the Commonwealth.

-

What happens after I file the Articles of Incorporation?

Once the Articles of Incorporation are filed and approved, the corporation officially exists. You will receive a certificate of incorporation, which serves as proof of the corporation's legal status. Following this, the corporation must comply with ongoing requirements, such as obtaining necessary licenses and permits and filing annual reports.

-

Can I amend the Articles of Incorporation after they are filed?

Yes, amendments can be made to the Articles of Incorporation. If changes are needed, such as altering the corporation's name or purpose, a formal amendment must be filed with the Virginia Secretary of the Commonwealth. This process also requires a fee, and it is essential to follow the proper procedures to ensure compliance with state regulations.

Virginia Articles of Incorporation Example

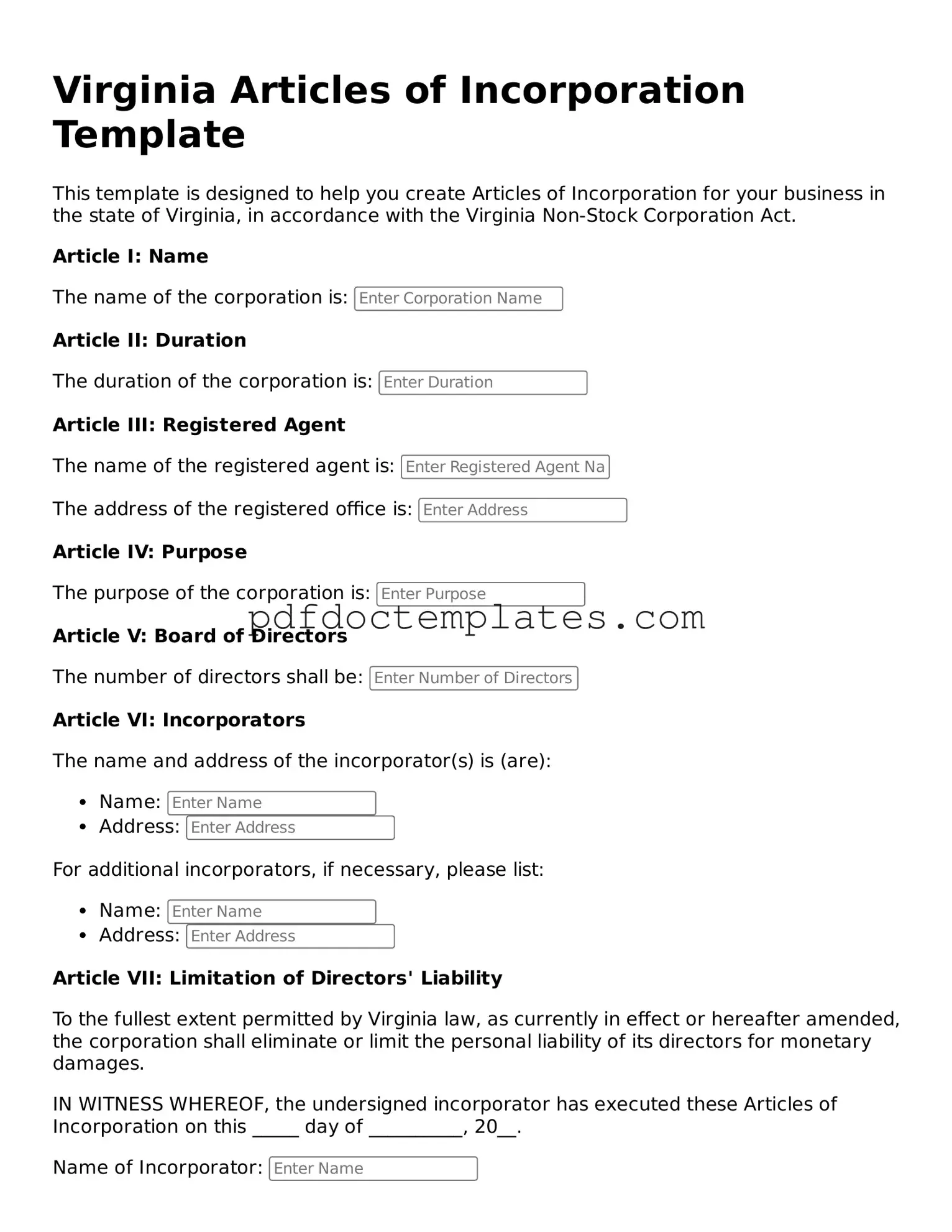

Virginia Articles of Incorporation Template

This template is designed to help you create Articles of Incorporation for your business in the state of Virginia, in accordance with the Virginia Non-Stock Corporation Act.

Article I: Name

The name of the corporation is:

Article II: Duration

The duration of the corporation is:

Article III: Registered Agent

The name of the registered agent is:

The address of the registered office is:

Article IV: Purpose

The purpose of the corporation is:

Article V: Board of Directors

The number of directors shall be:

Article VI: Incorporators

The name and address of the incorporator(s) is (are):

- Name:

- Address:

For additional incorporators, if necessary, please list:

- Name:

- Address:

Article VII: Limitation of Directors' Liability

To the fullest extent permitted by Virginia law, as currently in effect or hereafter amended, the corporation shall eliminate or limit the personal liability of its directors for monetary damages.

IN WITNESS WHEREOF, the undersigned incorporator has executed these Articles of Incorporation on this _____ day of __________, 20__.

Name of Incorporator:

Check out Other Common Articles of Incorporation Templates for US States

Wa Secretary of State Business Search - It identifies the corporation's registered agent for official communications.

A Florida Quitclaim Deed form is a legal document used to transfer interest in real estate with no guarantees about the title. It's commonly employed between family members or close acquaintances when the property is not being sold for its full market value. This form simplifies the process, making it faster and more straightforward to shift ownership. For those looking for more information, you can visit All Florida Forms.

Articles of Incorporation in Michigan - The Articles may include provisions for the management structure of the corporation.