Printable Vehicle Repayment Agreement Template

Misconceptions

When dealing with a Vehicle Repayment Agreement form, several misconceptions can arise. Understanding these misconceptions is crucial for anyone involved in vehicle financing or repayment. Here are nine common misunderstandings:

- It is a legally binding contract. Many people believe that signing this form automatically creates a legally binding contract. While it is intended to be a formal agreement, its enforceability can depend on various factors, including state laws and the specific terms outlined.

- All terms are negotiable. Some individuals think that every aspect of the agreement can be negotiated. While certain terms may be flexible, lenders often have standard policies that limit negotiation on key elements like interest rates and payment schedules.

- It guarantees loan approval. A common misconception is that completing the Vehicle Repayment Agreement form guarantees loan approval. In reality, approval depends on multiple factors, including creditworthiness and income verification.

- Late payments are not a big deal. Some borrowers believe that missing a payment will not have serious consequences. However, late payments can lead to penalties, increased interest rates, and damage to credit scores.

- It applies to all types of vehicles. Many assume that the Vehicle Repayment Agreement form can be used for any vehicle. However, specific agreements may only apply to certain types of vehicles, such as new or used cars, and not to motorcycles or recreational vehicles.

- It covers all costs associated with the vehicle. Some individuals think that signing the form covers all expenses, including insurance and maintenance. In reality, the agreement typically focuses only on the repayment of the loan itself.

- Once signed, it cannot be changed. A misconception exists that the agreement is final and cannot be altered. In fact, amendments can be made, but they usually require mutual consent from both parties and proper documentation.

- It is only important for the lender. Some borrowers may feel that the agreement primarily serves the lender's interests. In truth, it is equally important for borrowers, as it outlines their rights and responsibilities.

- It is the same as a loan application. Many people confuse the Vehicle Repayment Agreement form with a loan application. While both are related to financing, the agreement is a commitment to repay the loan, while the application is a request for financing.

Understanding these misconceptions can help borrowers navigate the complexities of vehicle financing more effectively. It is always wise to seek clarification on any aspect of the agreement to ensure a clear understanding of one's obligations and rights.

Form Properties

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form is designed to outline the terms under which a borrower will repay a loan for a vehicle. |

| Parties Involved | This agreement typically involves two main parties: the borrower (who receives the loan) and the lender (who provides the loan). |

| Governing Law | The laws of the state where the agreement is signed will govern the terms of the Vehicle Repayment Agreement. For example, in California, the relevant laws include the California Civil Code. |

| Payment Terms | It specifies the payment schedule, including the amount due, frequency of payments, and the total loan amount. |

| Interest Rate | The form will outline the interest rate applicable to the loan, which can affect the total repayment amount. |

| Default Conditions | It includes conditions under which the borrower may default on the loan, leading to potential penalties or repossession of the vehicle. |

| Signatures | Both parties must sign the agreement to make it legally binding, indicating their acceptance of the terms. |

| Amendments | The form may outline how amendments to the agreement can be made, ensuring that both parties can agree on any changes. |

| Dispute Resolution | It may provide a method for resolving disputes, such as mediation or arbitration, to avoid lengthy court proceedings. |

| Confidentiality | The agreement may include clauses that protect the confidentiality of the terms and conditions agreed upon by both parties. |

Key takeaways

When dealing with a Vehicle Repayment Agreement form, it’s essential to understand the key elements involved. Here are seven important takeaways to keep in mind:

- Complete All Sections: Ensure that every section of the form is filled out accurately. Missing information can lead to delays or complications.

- Provide Accurate Vehicle Information: Include the correct make, model, year, and VIN of the vehicle. This information is crucial for identification purposes.

- Understand the Terms: Carefully read and understand the repayment terms outlined in the agreement. This includes payment amounts, due dates, and any interest rates.

- Signatures Required: Both parties must sign the agreement. Without signatures, the document may not be legally binding.

- Keep Copies: After completing the form, make copies for your records. This ensures you have documentation of the agreement.

- Consult a Professional: If you have questions or concerns, consider consulting a legal advisor. They can provide clarity on any complex terms.

- Follow Up: After submitting the form, follow up to confirm that it has been received and processed. This helps prevent any misunderstandings.

Dos and Don'ts

When filling out the Vehicle Repayment Agreement form, it is important to approach the task with care to ensure accuracy and compliance. Here are some guidelines to follow:

- Do: Read the entire form carefully before starting to fill it out.

- Do: Provide accurate and complete information in all sections.

- Do: Double-check your entries for any spelling or numerical errors.

- Do: Sign and date the form where required.

- Don't: Rush through the form; take your time to ensure everything is correct.

- Don't: Leave any required fields blank; this may delay processing.

Following these steps can help facilitate a smoother process in the completion of the Vehicle Repayment Agreement form.

Common mistakes

-

Not reading the instructions carefully. It's essential to understand what is required before starting to fill out the form.

-

Failing to provide accurate personal information. Double-check names, addresses, and contact details to avoid delays.

-

Leaving sections blank. Every part of the form must be completed, even if it seems irrelevant.

-

Misunderstanding the payment terms. Ensure you fully grasp the repayment schedule and interest rates.

-

Not signing the form. A signature is often required to validate the agreement.

-

Using incorrect dates. Ensure all dates are accurate and correspond to the relevant events.

-

Failing to keep a copy of the completed form. Always retain a copy for your records.

-

Ignoring deadlines. Submit the form promptly to avoid penalties or complications.

What You Should Know About This Form

-

What is a Vehicle Repayment Agreement?

A Vehicle Repayment Agreement is a legal document that outlines the terms under which a borrower agrees to repay a loan used to purchase a vehicle. This agreement typically includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments.

-

Who needs to sign the Vehicle Repayment Agreement?

Both the borrower and the lender must sign the Vehicle Repayment Agreement. This ensures that both parties understand and agree to the terms outlined in the document. In some cases, a co-signer may also be required, particularly if the borrower has a limited credit history.

-

What happens if I miss a payment?

If a borrower misses a payment, the lender may impose late fees as specified in the agreement. Continued missed payments can lead to more serious consequences, such as repossession of the vehicle. It is important to communicate with the lender if financial difficulties arise.

-

Can I modify the Vehicle Repayment Agreement?

Yes, modifications to the Vehicle Repayment Agreement can be made, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement to avoid misunderstandings.

-

What information is required to complete the agreement?

To complete the Vehicle Repayment Agreement, you will need to provide personal information such as your name, address, and contact details. Additionally, details about the vehicle, loan amount, interest rate, and repayment terms should be included.

-

Is the Vehicle Repayment Agreement legally binding?

Yes, once signed by both parties, the Vehicle Repayment Agreement is legally binding. This means that both the borrower and the lender are obligated to adhere to the terms set forth in the document. Failure to comply can result in legal action.

-

Where can I obtain a Vehicle Repayment Agreement form?

Vehicle Repayment Agreement forms can typically be obtained from financial institutions, online legal document services, or legal offices. It is important to ensure that the form complies with state laws and regulations.

Vehicle Repayment Agreement Example

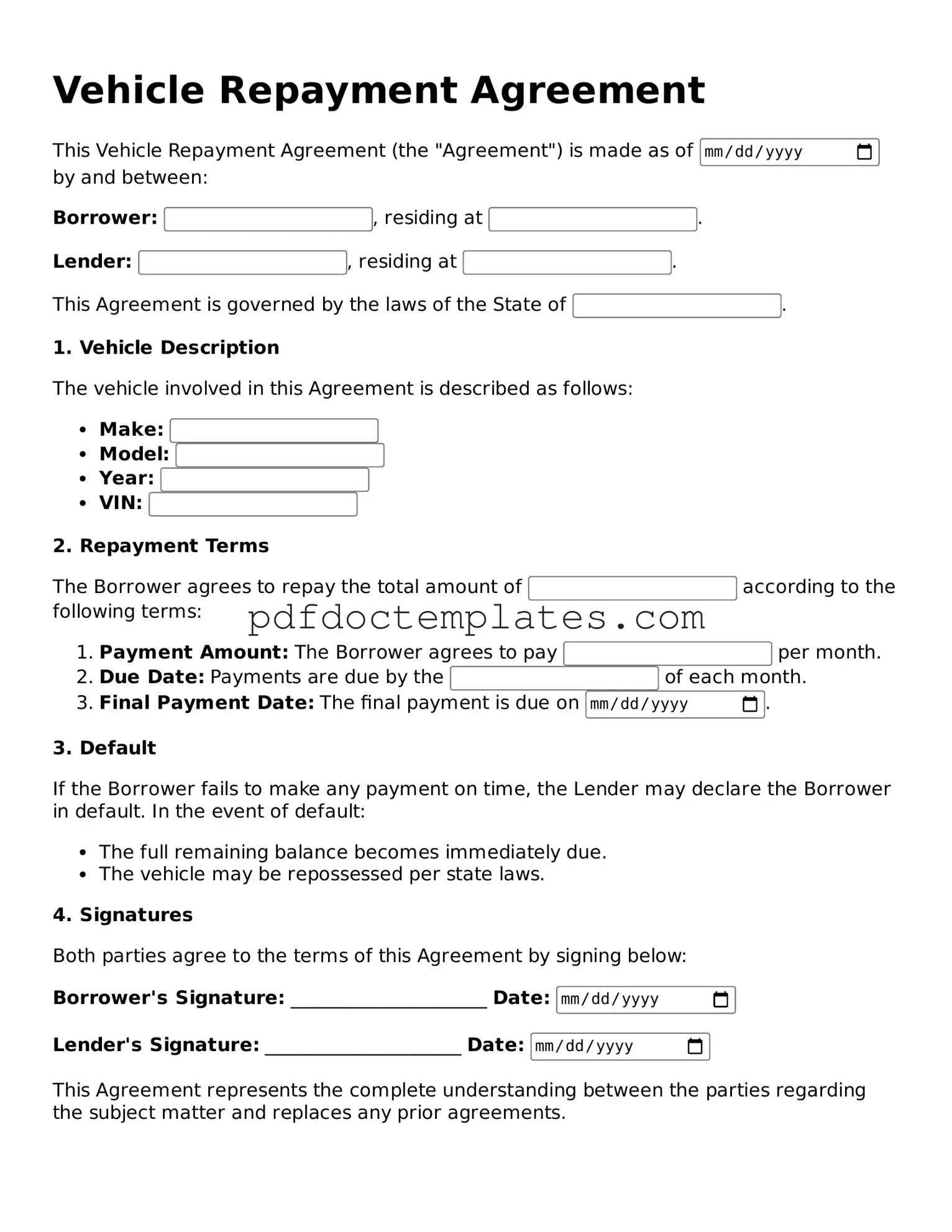

Vehicle Repayment Agreement

This Vehicle Repayment Agreement (the "Agreement") is made as of by and between:

Borrower: , residing at .

Lender: , residing at .

This Agreement is governed by the laws of the State of .

1. Vehicle Description

The vehicle involved in this Agreement is described as follows:

- Make:

- Model:

- Year:

- VIN:

2. Repayment Terms

The Borrower agrees to repay the total amount of according to the following terms:

- Payment Amount: The Borrower agrees to pay per month.

- Due Date: Payments are due by the of each month.

- Final Payment Date: The final payment is due on .

3. Default

If the Borrower fails to make any payment on time, the Lender may declare the Borrower in default. In the event of default:

- The full remaining balance becomes immediately due.

- The vehicle may be repossessed per state laws.

4. Signatures

Both parties agree to the terms of this Agreement by signing below:

Borrower's Signature: _____________________ Date:

Lender's Signature: _____________________ Date:

This Agreement represents the complete understanding between the parties regarding the subject matter and replaces any prior agreements.

Find Other Forms

Gift Deed - The form creates a lasting record of generosity and intention in property gifting.

For those looking to understand the nuances of a general bill of sale, exploring how this form serves as a vital documentation tool for transactions is essential. You can find more information with our extensive guide on the critical aspects of a General Bill of Sale.

Charts in Ms Word - Column 1 Heading: The first section to categorize important facts or figures related to the topic.

Who Owns Geico and Progressive - This form is essential for requesting a supplement for your repairs through GEICO.