Printable Transfer-on-Death Deed Template

Transfer-on-Death Deed - Customized for State

Misconceptions

Transfer-on-Death Deeds (TODDs) are often misunderstood. Below are seven common misconceptions about this form, along with explanations to clarify each point.

-

Transfer-on-Death Deeds are only for wealthy individuals.

This is not true. TODDs can be beneficial for anyone who wishes to transfer property outside of probate, regardless of their financial status.

-

A TODD can be revoked only by a court order.

In reality, a property owner can revoke a TODD at any time by filing a revocation form or creating a new TODD that replaces the previous one.

-

All states allow Transfer-on-Death Deeds.

Not all states recognize TODDs. It is essential to check local laws to determine if this option is available.

-

Transfer-on-Death Deeds are the same as wills.

While both serve to transfer property, TODDs take effect immediately upon the owner's death, whereas wills go through probate and may take longer to execute.

-

Using a TODD avoids all taxes.

This misconception is misleading. While TODDs can help avoid probate, they do not eliminate potential estate taxes or capital gains taxes.

-

Once a TODD is filed, the property cannot be sold.

This is incorrect. The property owner retains full control and can sell or mortgage the property at any time before their death.

-

A TODD is only useful for real estate.

This is not accurate. While TODDs are primarily used for real estate, they can also apply to other types of property in some jurisdictions.

Understanding these misconceptions can help individuals make informed decisions about estate planning and property transfer options.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| State-Specific Laws | The use of a TOD Deed is governed by state law. For example, in California, it is governed by California Probate Code Sections 5600-5695. |

| Revocability | Property owners can revoke or change the beneficiaries named in a TOD Deed at any time before their death. |

| Tax Implications | Generally, a TOD Deed does not trigger gift taxes since the transfer occurs after the owner's death. |

| Requirements | To be valid, a TOD Deed must be signed by the property owner and recorded with the appropriate county office before their death. |

Key takeaways

Filling out and using a Transfer-on-Death Deed (TODD) can be a straightforward process, but it’s essential to understand the key aspects. Here are some important takeaways to consider:

- Purpose: A Transfer-on-Death Deed allows property owners to transfer their real estate to beneficiaries upon their death without going through probate.

- Eligibility: This deed can typically be used for residential properties, but check state laws to confirm eligibility.

- Simple Process: Completing the form requires basic information about the property and the beneficiaries.

- Beneficiary Designation: Clearly name the beneficiaries to avoid confusion. You can designate multiple beneficiaries.

- Revocation: You can revoke or change the TODD at any time before your death, provided you follow the proper procedures.

- Recording: To be effective, the TODD must be recorded with the county recorder’s office where the property is located.

- No Immediate Effect: The deed does not transfer ownership during your lifetime; you retain full control of the property.

- Tax Implications: Consult a tax professional regarding any potential tax implications for your beneficiaries.

- State Variations: Laws governing Transfer-on-Death Deeds vary by state, so it’s crucial to understand local regulations.

- Consultation Recommended: While the form is accessible, consulting with a legal professional can ensure that your intentions are clearly documented and legally sound.

Understanding these key points will help you navigate the process of creating and using a Transfer-on-Death Deed effectively.

Dos and Don'ts

When filling out a Transfer-on-Death Deed form, it is crucial to follow certain guidelines to ensure the document is valid and meets your intentions. Here are some dos and don'ts to consider:

- Do ensure you are the legal owner of the property.

- Do provide accurate and complete information about the property.

- Do include the names and contact information of the beneficiaries.

- Do sign the form in the presence of a notary public.

- Do file the deed with the appropriate county office.

- Don't forget to check state-specific laws regarding Transfer-on-Death Deeds.

- Don't leave out important details, such as property descriptions.

- Don't assume verbal agreements with beneficiaries are sufficient.

- Don't delay filing the deed after it has been signed and notarized.

Common mistakes

-

Not Including All Required Information: One common mistake is failing to provide all necessary details about the property and the beneficiaries. It's crucial to accurately describe the property, including the legal description, to avoid any confusion or disputes later on.

-

Incorrectly Identifying Beneficiaries: Sometimes, individuals mistakenly name beneficiaries who are not legally eligible or who may not exist. It is essential to verify that the names and details of the beneficiaries are correct and up-to-date.

-

Not Signing the Deed: A Transfer-on-Death Deed must be signed by the property owner. Failing to sign the document renders it invalid. Ensure that the signature is legible and matches the name on the property title.

-

Ignoring Witness or Notary Requirements: Depending on the state, the deed may need to be witnessed or notarized. Neglecting this step can lead to the deed being challenged or deemed invalid. Check local laws to confirm what is required.

-

Not Recording the Deed: After completing the form, it is vital to record the Transfer-on-Death Deed with the appropriate local government office. Failing to do so may result in the deed not being recognized upon the owner's death.

-

Overlooking State-Specific Laws: Each state has its own rules regarding Transfer-on-Death Deeds. Ignoring these regulations can lead to complications. It is advisable to consult local laws or a legal expert to ensure compliance.

What You Should Know About This Form

-

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) allows property owners to transfer their real estate to a beneficiary upon their death, without the need for probate. This deed is effective immediately upon signing but only transfers ownership after the owner passes away.

-

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate can use a TOD Deed. This includes homeowners, landowners, and individuals holding property in their name. However, some states may have specific requirements regarding eligibility.

-

How do I create a Transfer-on-Death Deed?

To create a TOD Deed, you must fill out the appropriate form for your state. The form typically requires details about the property, the owner, and the designated beneficiary. After completing the form, it must be signed and notarized, then recorded with the county recorder’s office.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a TOD Deed at any time while you are alive. To do this, you must complete a new deed that either names a different beneficiary or explicitly revokes the previous deed. The new deed must also be signed, notarized, and recorded.

-

What happens if the beneficiary dies before me?

If the designated beneficiary dies before you, the TOD Deed becomes void concerning that beneficiary. You may want to name an alternate beneficiary in the deed to ensure that your property still transfers as intended.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a TOD Deed does not trigger any immediate tax consequences. The property remains part of your estate until your death. However, beneficiaries may be subject to estate taxes or capital gains taxes when they sell the property, depending on the laws in your state.

-

Does a Transfer-on-Death Deed affect my ability to sell the property?

No, you can sell or mortgage the property at any time while you are alive. The TOD Deed does not restrict your ownership rights. Just remember that if you sell the property, the deed will no longer apply.

-

Is a Transfer-on-Death Deed valid in all states?

No, not all states recognize Transfer-on-Death Deeds. Currently, many states do allow them, but the rules can vary. It is crucial to check your state’s laws to determine if a TOD Deed is an option for you.

-

What should I consider before using a Transfer-on-Death Deed?

Consider your overall estate plan, the potential for changes in beneficiaries, and the laws in your state. Consulting with a legal professional can help you understand the implications and ensure that this option aligns with your goals.

-

Can I use a Transfer-on-Death Deed for all types of property?

A TOD Deed typically applies only to real estate, such as residential homes and land. It does not cover personal property like vehicles or bank accounts. Always verify your state’s regulations for specific details.

Transfer-on-Death Deed Example

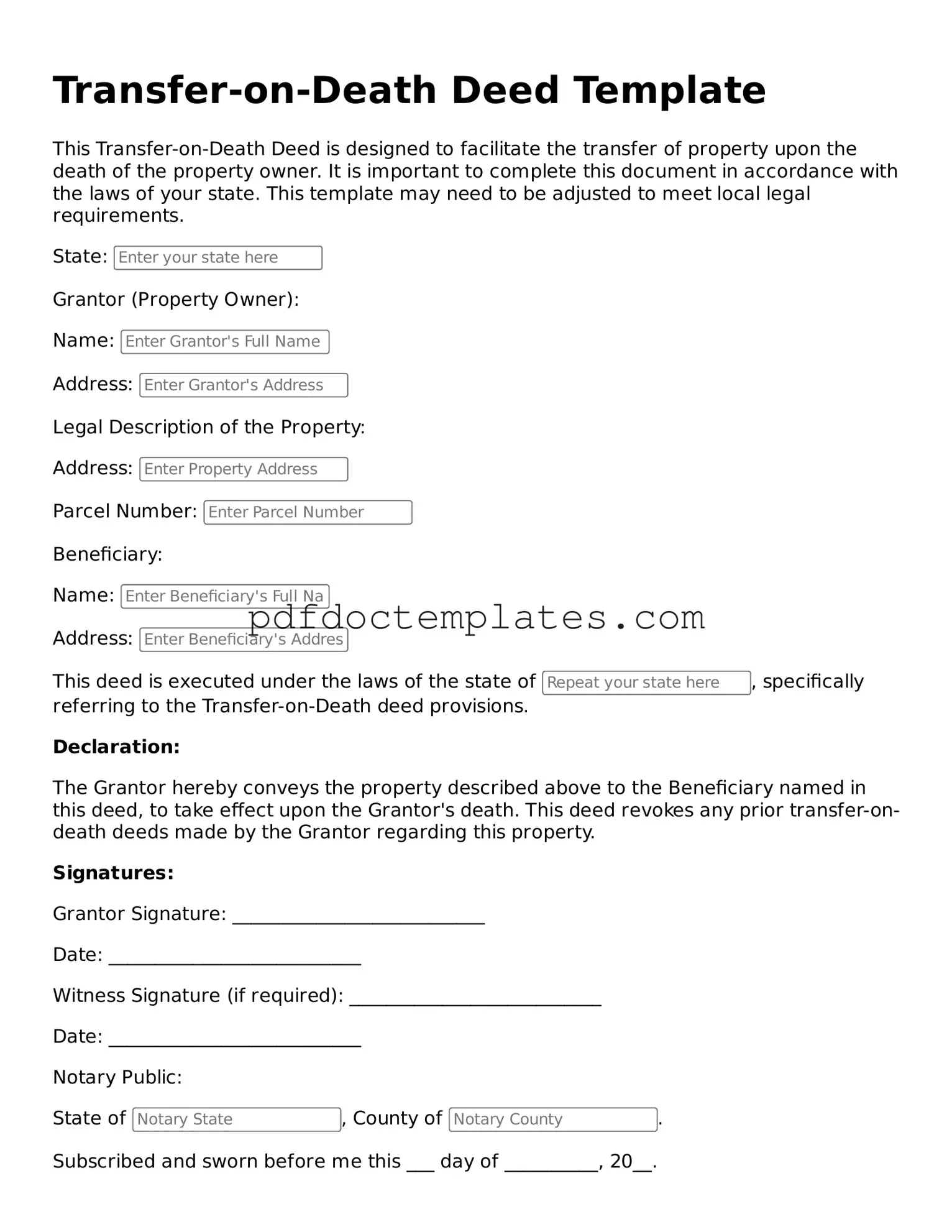

Transfer-on-Death Deed Template

This Transfer-on-Death Deed is designed to facilitate the transfer of property upon the death of the property owner. It is important to complete this document in accordance with the laws of your state. This template may need to be adjusted to meet local legal requirements.

State:

Grantor (Property Owner):

Name:

Address:

Legal Description of the Property:

Address:

Parcel Number:

Beneficiary:

Name:

Address:

This deed is executed under the laws of the state of , specifically referring to the Transfer-on-Death deed provisions.

Declaration:

The Grantor hereby conveys the property described above to the Beneficiary named in this deed, to take effect upon the Grantor's death. This deed revokes any prior transfer-on-death deeds made by the Grantor regarding this property.

Signatures:

Grantor Signature: ___________________________

Date: ___________________________

Witness Signature (if required): ___________________________

Date: ___________________________

Notary Public:

State of , County of .

Subscribed and sworn before me this ___ day of __________, 20__.

Notary Signature: ___________________________

My Commission Expires: ___________________________

**Important Note:** Please consult an attorney or legal expert to ensure this deed is valid for your circumstances and complies with local property laws.

Different Types of Transfer-on-Death Deed Forms:

Ladybug Deed - Property owners can utilize a Lady Bird Deed to secure their family's financial future after they are gone.

The Florida Residential Lease Agreement form is essential for anyone looking to rent property in Florida, ensuring that both landlords and tenants are aware of their rights and responsibilities. For those seeking to further understand the nuances of this important document, resources like All Florida Forms can provide invaluable assistance in navigating the rental landscape.