Blank Transfer-on-Death Deed Document for Tennessee

Misconceptions

- Misconception 1: The Transfer-on-Death Deed is only for wealthy individuals.

- Misconception 2: A Transfer-on-Death Deed requires the consent of all heirs.

- Misconception 3: The Transfer-on-Death Deed is the same as a will.

- Misconception 4: You can only use a Transfer-on-Death Deed for residential properties.

- Misconception 5: A Transfer-on-Death Deed can be revoked only through a formal process.

- Misconception 6: The Transfer-on-Death Deed is not recognized in Tennessee.

This form can benefit anyone who owns property, regardless of their financial status. It provides a straightforward way to transfer real estate without the complexities of probate.

In reality, the property owner can designate beneficiaries without needing approval from other family members or heirs. This allows for more control over the transfer process.

While both documents deal with property transfer, a Transfer-on-Death Deed takes effect immediately upon the owner's death, bypassing probate. A will, on the other hand, must go through probate before assets are distributed.

This deed can be used for various types of real estate, including commercial properties and vacant land, making it a versatile option for property owners.

Property owners can revoke or change their Transfer-on-Death Deed at any time by simply executing a new deed. This flexibility allows for adjustments as life circumstances change.

This deed is indeed recognized in Tennessee and has been a legal option since 2012. It offers a simple way to transfer property and is an effective estate planning tool.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) deed allows property owners in Tennessee to designate a beneficiary to receive their property upon their death, avoiding probate. |

| Governing Law | The Tennessee Transfer-on-Death Deed is governed by Tennessee Code Annotated § 66-4-201 through § 66-4-210. |

| Eligibility | Any individual who owns real property in Tennessee can create a TOD deed, including single owners and joint owners. |

| Beneficiary Designation | Property owners can name one or more beneficiaries in the TOD deed, allowing for flexibility in estate planning. |

| Revocation | A TOD deed can be revoked at any time by the property owner, provided they follow the proper legal procedures. |

| Recording Requirement | To be effective, a TOD deed must be recorded with the county register of deeds before the property owner's death. |

| Tax Implications | Transfer-on-Death deeds do not trigger gift taxes or income taxes during the owner's lifetime, but beneficiaries may face tax obligations upon inheritance. |

| Limitations | Certain types of property, such as life estates or property held in a trust, cannot be transferred using a TOD deed. |

| Effectiveness | The TOD deed becomes effective immediately upon the owner's death, transferring ownership directly to the designated beneficiary. |

| Legal Assistance | While individuals can create a TOD deed without legal help, consulting an attorney is advisable to ensure compliance with state laws and proper execution. |

Key takeaways

Understanding the Tennessee Transfer-on-Death Deed form is essential for effective estate planning. Here are some key takeaways to consider:

- Purpose of the Deed: This form allows property owners to transfer real estate to a beneficiary upon their death without going through probate.

- Eligibility: Any individual who owns real property in Tennessee can use this deed to designate a beneficiary.

- Form Requirements: The deed must be signed by the property owner and notarized to be valid.

- Beneficiary Designation: You can name one or multiple beneficiaries, and they can be individuals or entities, such as trusts.

- Revocation: The property owner can revoke or change the deed at any time during their lifetime, ensuring flexibility in estate planning.

- Filing the Deed: To make the deed effective, it must be recorded with the county register of deeds where the property is located.

- Tax Implications: The transfer does not trigger immediate tax consequences, but beneficiaries may be subject to taxes based on the property's value at the time of transfer.

Dos and Don'ts

When filling out the Tennessee Transfer-on-Death Deed form, it is crucial to follow specific guidelines to ensure the document is valid and effective. Here’s a list of things you should and shouldn’t do:

- Do ensure that the property description is accurate and complete.

- Do include the names of all beneficiaries clearly.

- Do sign the form in the presence of a notary public.

- Do file the deed with the appropriate county register’s office.

- Don’t leave any sections of the form blank; fill in all required information.

- Don’t forget to check for errors before submitting the form.

- Don’t use outdated forms; always use the most current version.

- Don’t assume that verbal agreements about the deed are sufficient; everything must be in writing.

Common mistakes

-

Incorrect Property Description: People often fail to provide a clear and accurate description of the property. This can lead to confusion or disputes later on.

-

Not Using the Correct Form: Some individuals mistakenly use an outdated version of the Transfer-on-Death Deed form. Always ensure you have the most current version.

-

Failure to Sign: A common oversight is not signing the deed. The document must be signed by the owner to be valid.

-

Improper Witnessing: In Tennessee, the deed must be witnessed. Some people forget to have the required number of witnesses present when signing.

-

Missing Notarization: The deed must be notarized. Skipping this step can invalidate the entire document.

-

Failure to Record the Deed: After completing the deed, it must be recorded with the local county register. Failing to do so means the transfer may not be recognized.

-

Ignoring State Laws: Some individuals do not familiarize themselves with Tennessee's specific laws regarding Transfer-on-Death Deeds, which can lead to mistakes.

-

Not Considering Tax Implications: People often overlook potential tax implications of transferring property upon death, which can lead to unexpected costs.

-

Confusing Beneficiaries: It’s important to clearly name the beneficiaries. Ambiguities can create conflicts among heirs.

What You Should Know About This Form

-

What is a Transfer-on-Death (TOD) Deed in Tennessee?

A Transfer-on-Death Deed is a legal document that allows a property owner in Tennessee to designate one or more beneficiaries to receive their property upon their death. This deed enables the transfer of property without the need for probate, simplifying the process for heirs. The owner retains full control of the property during their lifetime, and they can revoke or change the deed at any time before their death.

-

How do I create a Transfer-on-Death Deed?

To create a TOD Deed in Tennessee, you must complete the appropriate form, which includes details about the property and the designated beneficiaries. It’s crucial to ensure that the deed is signed in front of a notary public and then recorded with the county register of deeds where the property is located. This recording makes the deed legally effective and ensures that the beneficiaries can claim the property upon your passing.

-

Can I change or revoke a Transfer-on-Death Deed after it is created?

Yes, you can change or revoke a TOD Deed at any time while you are alive. To do this, you must create a new deed that explicitly revokes the previous one or amend the existing deed to reflect the changes. It is advisable to record any changes with the county register of deeds to ensure that your intentions are clear and legally recognized.

-

Are there any limitations to using a Transfer-on-Death Deed?

While a TOD Deed offers many benefits, there are some limitations. For instance, it cannot be used for all types of property. Real estate is typically eligible, but other assets like bank accounts or vehicles may require different estate planning tools. Additionally, if the property has outstanding debts or liens, those may need to be settled before the transfer can occur. Consulting with a legal professional can help clarify these limitations based on your specific situation.

-

What happens if I do not name a beneficiary in my Transfer-on-Death Deed?

If you do not name a beneficiary in your TOD Deed, the property will not transfer as intended upon your death. Instead, it will become part of your estate and will be subject to probate. This could lead to delays and additional costs for your heirs. Therefore, it is essential to ensure that beneficiaries are clearly named in the deed to avoid complications later on.

Tennessee Transfer-on-Death Deed Example

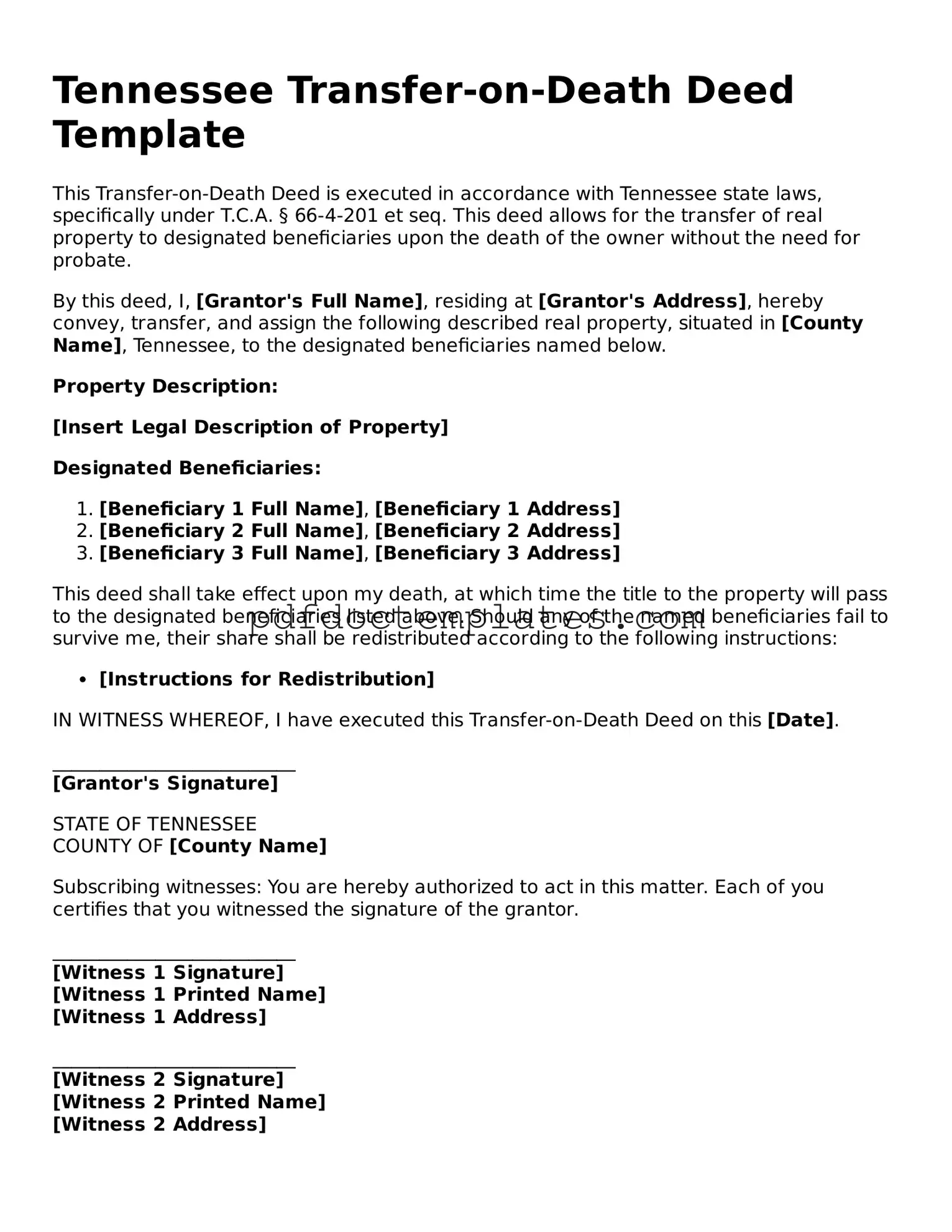

Tennessee Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with Tennessee state laws, specifically under T.C.A. § 66-4-201 et seq. This deed allows for the transfer of real property to designated beneficiaries upon the death of the owner without the need for probate.

By this deed, I, [Grantor's Full Name], residing at [Grantor's Address], hereby convey, transfer, and assign the following described real property, situated in [County Name], Tennessee, to the designated beneficiaries named below.

Property Description:

[Insert Legal Description of Property]

Designated Beneficiaries:

- [Beneficiary 1 Full Name], [Beneficiary 1 Address]

- [Beneficiary 2 Full Name], [Beneficiary 2 Address]

- [Beneficiary 3 Full Name], [Beneficiary 3 Address]

This deed shall take effect upon my death, at which time the title to the property will pass to the designated beneficiaries listed above. Should any of the named beneficiaries fail to survive me, their share shall be redistributed according to the following instructions:

- [Instructions for Redistribution]

IN WITNESS WHEREOF, I have executed this Transfer-on-Death Deed on this [Date].

__________________________

[Grantor's Signature]

STATE OF TENNESSEE

COUNTY OF [County Name]

Subscribing witnesses: You are hereby authorized to act in this matter. Each of you certifies that you witnessed the signature of the grantor.

__________________________

[Witness 1 Signature]

[Witness 1 Printed Name]

[Witness 1 Address]

__________________________

[Witness 2 Signature]

[Witness 2 Printed Name]

[Witness 2 Address]

After filling out the appropriate fields, ensure to file this deed with the county Register of Deeds in the county where the property is located.

Check out Other Common Transfer-on-Death Deed Templates for US States

Transfer on Death Deed California - Careful planning is advised, particularly for those with complex family dynamics.

For those looking to navigate the trailer ownership process, the "step-by-step Arizona Trailer Bill of Sale" can provide clear guidance on transferring ownership and meeting legal requirements effectively. Access the necessary documentation through this link: step-by-step Arizona Trailer Bill of Sale.

Transfer on Death Deed New Jersey - Deciding to create a Transfer-on-Death Deed can signify a forward-thinking approach to managing real estate legacies.