Blank Tractor Bill of Sale Document for Tennessee

Misconceptions

The Tennessee Tractor Bill of Sale form is a crucial document for anyone involved in the buying or selling of tractors in the state. However, several misconceptions surround its use and requirements. Understanding these misconceptions can help individuals navigate the process more effectively. Here are seven common misunderstandings:

- 1. The form is not legally required. Many believe that a bill of sale is optional when buying or selling a tractor. In reality, while not always mandated, having a bill of sale can protect both parties and provide proof of the transaction.

- 2. A verbal agreement suffices. Some people think that a verbal agreement is enough to finalize a sale. However, without written documentation, disputes may arise later, making a bill of sale essential for clarity and security.

- 3. The form is only for new tractors. There is a misconception that the bill of sale is only necessary for new tractor purchases. In fact, it is equally important for used tractors, as it documents the transfer of ownership regardless of the vehicle's age.

- 4. The bill of sale must be notarized. While notarization can add an extra layer of authenticity, it is not a requirement for a bill of sale in Tennessee. The form can be valid without a notary's signature, provided it is signed by both parties.

- 5. All sales are subject to sales tax. Some believe that every tractor sale incurs a sales tax. In Tennessee, certain exemptions may apply, depending on the buyer's status or the tractor's intended use. It’s important to check local regulations.

- 6. The form does not need to be filed with the state. There is a common belief that once a bill of sale is completed, it does not need to be submitted to any governmental body. While the bill itself does not need to be filed, it is advisable to keep it for personal records and potential future reference.

- 7. The form is a one-size-fits-all document. Many assume that a generic bill of sale template will suffice for any tractor transaction. However, each sale may have unique circumstances that should be reflected in the document, such as specific terms of the sale or conditions of the tractor.

By addressing these misconceptions, individuals can approach the buying and selling process with greater confidence and understanding. A well-prepared bill of sale can serve as a valuable tool in ensuring a smooth transaction.

Form Properties

| Fact Name | Description |

|---|---|

| Purpose | The Tennessee Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor in Tennessee. |

| Governing Laws | This form is governed by the Tennessee Uniform Commercial Code (UCC) and relevant state laws pertaining to the sale of personal property. |

| Required Information | Essential details include the buyer's and seller's names, contact information, tractor description, sale price, and date of sale. |

| Signatures | Both the buyer and seller must sign the form to validate the transaction and ensure legal recognition of the sale. |

Key takeaways

When filling out and using the Tennessee Tractor Bill of Sale form, consider the following key takeaways:

- Accurate Information: Ensure all details about the tractor, including make, model, year, and Vehicle Identification Number (VIN), are accurate. This helps avoid future disputes.

- Seller and Buyer Details: Include complete names and addresses for both the seller and buyer. This information is essential for legal documentation.

- Signatures Required: Both parties must sign the bill of sale. Without signatures, the document may not hold up in legal situations.

- Keep Copies: After completing the form, make copies for both the buyer and seller. Retaining a copy provides proof of the transaction.

Dos and Don'ts

When filling out the Tennessee Tractor Bill of Sale form, it is important to follow certain guidelines to ensure accuracy and legality. Here are some dos and don'ts to keep in mind:

- Do provide accurate and complete information about the tractor, including make, model, year, and VIN.

- Do include the names and addresses of both the buyer and the seller.

- Do sign and date the form to validate the transaction.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't leave any fields blank; incomplete forms may lead to issues later.

- Don't use vague descriptions; be specific about the tractor's condition and any included attachments.

- Don't forget to check for any local regulations that may require additional documentation.

- Don't rush through the process; take your time to ensure all information is correct.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to fill out all required fields. Ensure that every section, including the buyer's and seller's information, is completed.

-

Incorrect Vehicle Identification Number (VIN): The VIN must be accurate. Double-check this number against the tractor's title or registration to avoid errors.

-

Omitting the Purchase Price: The bill of sale should clearly state the agreed-upon purchase price. Leaving this blank can lead to confusion or disputes later.

-

Not Including the Date of Sale: Failing to write the date of the transaction can create complications, especially if there are issues with the sale down the line.

-

Ignoring Signatures: Both the buyer and seller must sign the document. Not obtaining both signatures can render the bill of sale invalid.

-

Forgetting to Notarize: While notarization may not be required in all cases, having the document notarized can provide additional legal protection and authenticity.

-

Failing to Keep Copies: After completing the bill of sale, both parties should retain copies. This helps ensure that there is a record of the transaction for future reference.

-

Neglecting to Include Tractor Details: Important details about the tractor, such as make, model, year, and condition, should be included to avoid misunderstandings.

-

Not Understanding State Requirements: Each state has its own regulations regarding bills of sale. Familiarizing oneself with Tennessee's specific requirements can prevent issues.

What You Should Know About This Form

-

What is a Tractor Bill of Sale in Tennessee?

A Tractor Bill of Sale is a legal document that serves as proof of the sale and transfer of ownership of a tractor from one party to another in the state of Tennessee. This form outlines essential details about the transaction, including the buyer and seller's information, a description of the tractor, and the sale price.

-

Why is a Bill of Sale important?

The Bill of Sale is important for several reasons. Firstly, it protects both the buyer and the seller by providing a written record of the transaction. This document can be used to resolve disputes that may arise regarding ownership or the terms of the sale. Additionally, it may be required for registration purposes with the state or for obtaining insurance on the tractor.

-

What information is typically included in the Tractor Bill of Sale?

A comprehensive Tractor Bill of Sale generally includes:

- The names and addresses of both the buyer and seller

- A detailed description of the tractor, including make, model, year, and VIN (Vehicle Identification Number)

- The sale price

- The date of the transaction

- Signatures of both parties

-

Is the Bill of Sale required by law in Tennessee?

While a Bill of Sale is not legally required for every sale in Tennessee, it is highly recommended. For certain transactions, especially those involving vehicles, having a Bill of Sale can simplify the registration process and provide legal protection. Always check with local authorities for specific requirements.

-

Can I create my own Tractor Bill of Sale?

Yes, you can create your own Tractor Bill of Sale. As long as it contains the necessary information and is signed by both parties, it can be a valid document. However, using a standard form can help ensure that all required elements are included, reducing the risk of overlooking important details.

-

Do I need to have the Bill of Sale notarized?

Notarization is not typically required for a Tractor Bill of Sale in Tennessee. However, having the document notarized can add an extra layer of authenticity and may be beneficial in case of future disputes. It is wise to check with local authorities or legal counsel for specific recommendations.

-

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should retain a copy for their records. The buyer may need to present the Bill of Sale when registering the tractor with the state or obtaining insurance. It is also advisable to keep any additional documentation related to the sale, such as payment receipts or warranties.

-

What if there are issues after the sale?

If issues arise after the sale, such as disputes over the condition of the tractor or failure to disclose important information, the Bill of Sale can serve as a critical piece of evidence. It is essential to clearly outline any warranties or guarantees in the document to avoid potential misunderstandings.

-

Where can I find a template for a Tractor Bill of Sale?

Templates for a Tractor Bill of Sale can be found online through various legal document websites or state government resources. These templates can provide a useful starting point, ensuring that all necessary information is included. Always ensure that the template is specific to Tennessee to comply with state laws.

Tennessee Tractor Bill of Sale Example

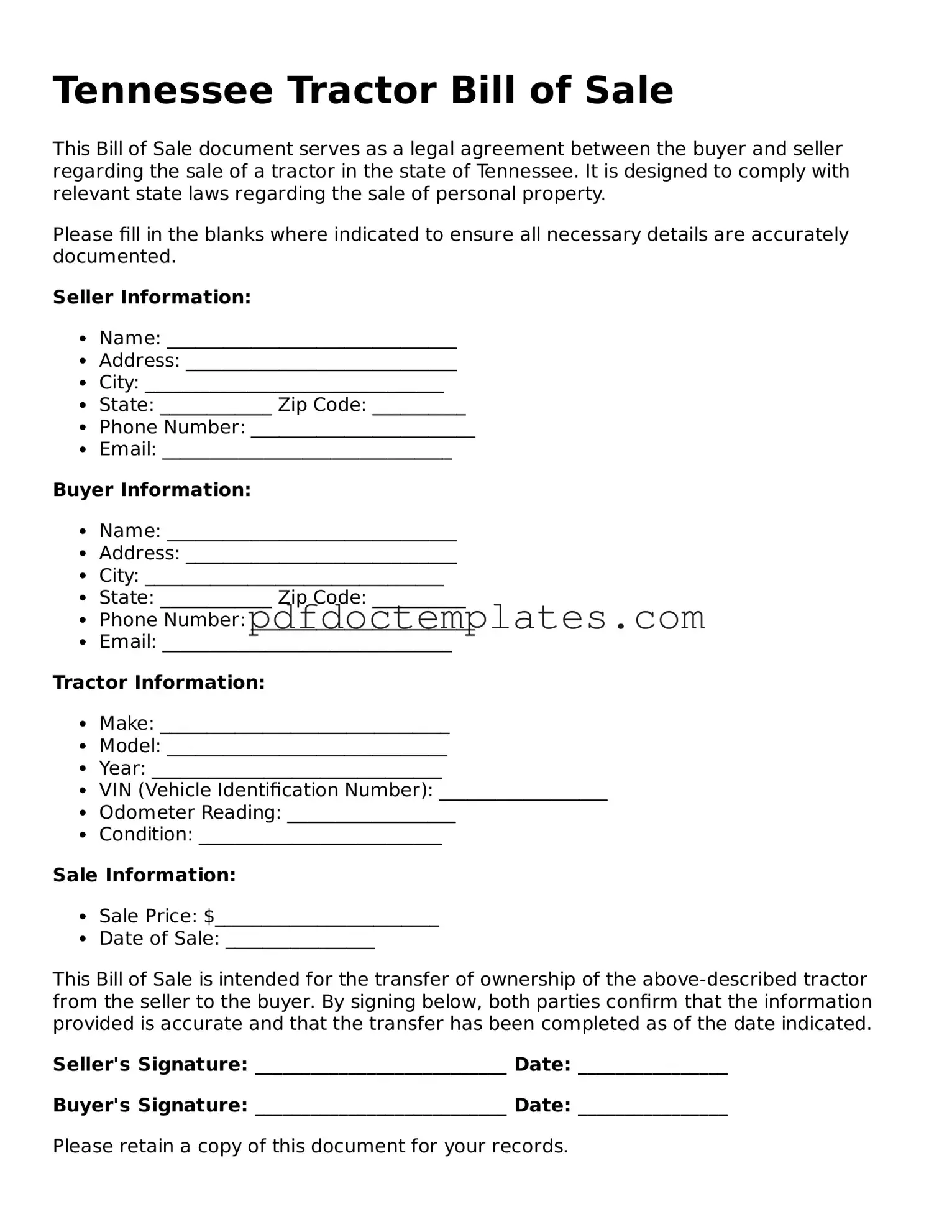

Tennessee Tractor Bill of Sale

This Bill of Sale document serves as a legal agreement between the buyer and seller regarding the sale of a tractor in the state of Tennessee. It is designed to comply with relevant state laws regarding the sale of personal property.

Please fill in the blanks where indicated to ensure all necessary details are accurately documented.

Seller Information:

- Name: _______________________________

- Address: _____________________________

- City: ________________________________

- State: ____________ Zip Code: __________

- Phone Number: ________________________

- Email: _______________________________

Buyer Information:

- Name: _______________________________

- Address: _____________________________

- City: ________________________________

- State: ____________ Zip Code: __________

- Phone Number: ________________________

- Email: _______________________________

Tractor Information:

- Make: _______________________________

- Model: ______________________________

- Year: _______________________________

- VIN (Vehicle Identification Number): __________________

- Odometer Reading: __________________

- Condition: __________________________

Sale Information:

- Sale Price: $________________________

- Date of Sale: ________________

This Bill of Sale is intended for the transfer of ownership of the above-described tractor from the seller to the buyer. By signing below, both parties confirm that the information provided is accurate and that the transfer has been completed as of the date indicated.

Seller's Signature: ___________________________ Date: ________________

Buyer's Signature: ___________________________ Date: ________________

Please retain a copy of this document for your records.

Check out Other Common Tractor Bill of Sale Templates for US States

Tractor Bill of Sale Form - This document often includes the sale price and payment method used.

To ensure that both landlords and tenants fully comprehend their rights and obligations, it is essential to utilize the appropriate documentation, such as the Florida Residential Lease Agreement form. This vital agreement not only lays down the terms of the rental arrangement but also safeguards the interests of both parties. For those looking to access various templates and resources, All Florida Forms can provide invaluable assistance in this process.

Farm Tractor Bill of Sale - This document plays a key role in avoiding legal challenges post-transaction.

Bill of Sale Truck - A straightforward tool for documenting the sale process.