Blank Promissory Note Document for Tennessee

Misconceptions

Understanding the Tennessee Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions often cloud the understanding of this legal document. Here are eight common misconceptions:

- It is a legally binding contract only if signed in front of a notary. While notarization can add an extra layer of authenticity, a promissory note is legally binding once both parties sign it, regardless of notarization.

- All promissory notes must be written in complex legal language. In reality, a promissory note can be straightforward and clear. Simple language is often more effective in conveying the terms of the agreement.

- A promissory note is the same as a loan agreement. Although they are related, a promissory note is a specific type of loan document that outlines the borrower's promise to repay. A loan agreement usually contains additional terms and conditions.

- You cannot change a promissory note once it is signed. Amendments can be made to a promissory note, provided both parties agree to the changes and sign the amended document.

- Interest rates must be specified in the note. While it is common to include an interest rate, a promissory note can also be structured as an interest-free loan. The terms can be tailored to the needs of both parties.

- Only formal institutions can issue promissory notes. Individuals can also create and use promissory notes. They are not limited to banks or financial institutions.

- A promissory note is not enforceable in court. If properly executed, a promissory note can be enforced in court. It serves as evidence of the debt and the borrower's obligation to repay.

- Once a promissory note is paid, it is no longer needed. It is crucial to keep a copy of the paid promissory note for your records. This document serves as proof that the debt has been settled.

By dispelling these misconceptions, individuals can better navigate the complexities of promissory notes and ensure that their financial agreements are clear and enforceable.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Tennessee Promissory Note is a legal document in which one party promises to pay a specified amount of money to another party at a designated time. |

| Governing Law | This form is governed by Tennessee Code Annotated, Title 47, Chapter 3, which outlines the laws regarding negotiable instruments. |

| Parties Involved | The document typically involves two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be specified in the note and must comply with Tennessee's usury laws, which limit the maximum allowable interest rates. |

| Enforcement | If the borrower fails to repay the loan as agreed, the lender has the right to take legal action to enforce the terms of the note. |

Key takeaways

The Tennessee Promissory Note serves as a written promise to pay a specified amount of money to a lender.

It is essential to include the names and addresses of both the borrower and the lender to ensure clarity and enforceability.

The document should clearly state the principal amount being borrowed, as well as any applicable interest rate.

Repayment terms must be outlined, including the payment schedule, due dates, and any grace periods.

It is advisable to specify the consequences of default, such as late fees or acceleration of the loan.

Signatures from both parties are necessary for the note to be legally binding.

Keep a copy of the signed Promissory Note for personal records, as it may be needed for future reference or legal purposes.

Dos and Don'ts

When filling out the Tennessee Promissory Note form, it’s essential to be careful and thorough. Here are some important dos and don’ts to keep in mind.

- Do ensure that all parties involved are clearly identified. Include full names and addresses to avoid any confusion.

- Do specify the loan amount and interest rate clearly. This information is crucial for the enforceability of the note.

- Do sign and date the document. Without signatures, the note may not be considered valid.

- Do keep a copy for your records. Having a copy can be important for future reference or in case of disputes.

- Don’t leave any sections blank. Every part of the form should be filled out completely to avoid misunderstandings.

- Don’t use vague language. Be specific in your terms to ensure clarity and avoid potential legal issues.

- Don’t forget to review the form for errors. Double-checking can prevent costly mistakes.

- Don’t underestimate the importance of legal advice. Consulting with a professional can help ensure that your document is properly prepared.

Common mistakes

-

Incorrect Borrower Information: Failing to provide accurate details for the borrower can lead to confusion. Always double-check names and addresses.

-

Missing Lender Information: Just as with the borrower, the lender's details must be complete. Omitting this information can invalidate the note.

-

Unclear Loan Amount: Clearly state the amount being borrowed. Ambiguities can cause disputes later on.

-

Improper Interest Rate: If applicable, ensure the interest rate is specified correctly. Misunderstandings about rates can lead to legal issues.

-

Failure to Specify Payment Terms: Clearly outline how and when payments should be made. Vague terms can lead to missed payments and conflicts.

-

Not Including a Due Date: Always include a specific due date for the loan repayment. Without this, it may be unclear when the borrower must pay.

-

Ignoring Signatures: Both parties must sign the document. A missing signature can render the note unenforceable.

-

Not Keeping Copies: Failing to keep copies of the signed note can lead to difficulties if disputes arise. Always retain a copy for your records.

What You Should Know About This Form

-

What is a Tennessee Promissory Note?

A Tennessee Promissory Note is a legal document in which one party, the borrower, promises to pay a specified sum of money to another party, the lender, at a designated time or on demand. This document serves as a written acknowledgment of the debt and outlines the terms of repayment.

-

What are the key components of a Promissory Note?

Key components typically include:

- The names and addresses of the borrower and lender.

- The principal amount being borrowed.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Consequences of default, such as late fees or acceleration clauses.

- Any collateral securing the loan, if relevant.

-

Do I need a lawyer to create a Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, consulting with one can be beneficial. A lawyer can ensure that the document complies with Tennessee laws and adequately protects your interests.

-

Is a Promissory Note enforceable in Tennessee?

Yes, a properly executed Promissory Note is generally enforceable in Tennessee. To be enforceable, the note must meet specific legal requirements, such as being in writing and signed by the borrower.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has several options. These may include demanding immediate repayment of the entire loan amount, charging late fees, or pursuing legal action to recover the owed amount. The specific consequences should be outlined in the Promissory Note.

-

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified, but both parties must agree to the changes. It is advisable to document any modifications in writing to avoid misunderstandings in the future.

-

What is the difference between a secured and an unsecured Promissory Note?

A secured Promissory Note is backed by collateral, such as property or assets, which the lender can claim if the borrower defaults. An unsecured Promissory Note does not have collateral backing it, making it riskier for the lender.

-

How should I store my Promissory Note?

It is important to keep your Promissory Note in a safe and accessible place. Both the borrower and lender should retain copies. Digital storage can also be considered, but ensure that the document is backed up and secure.

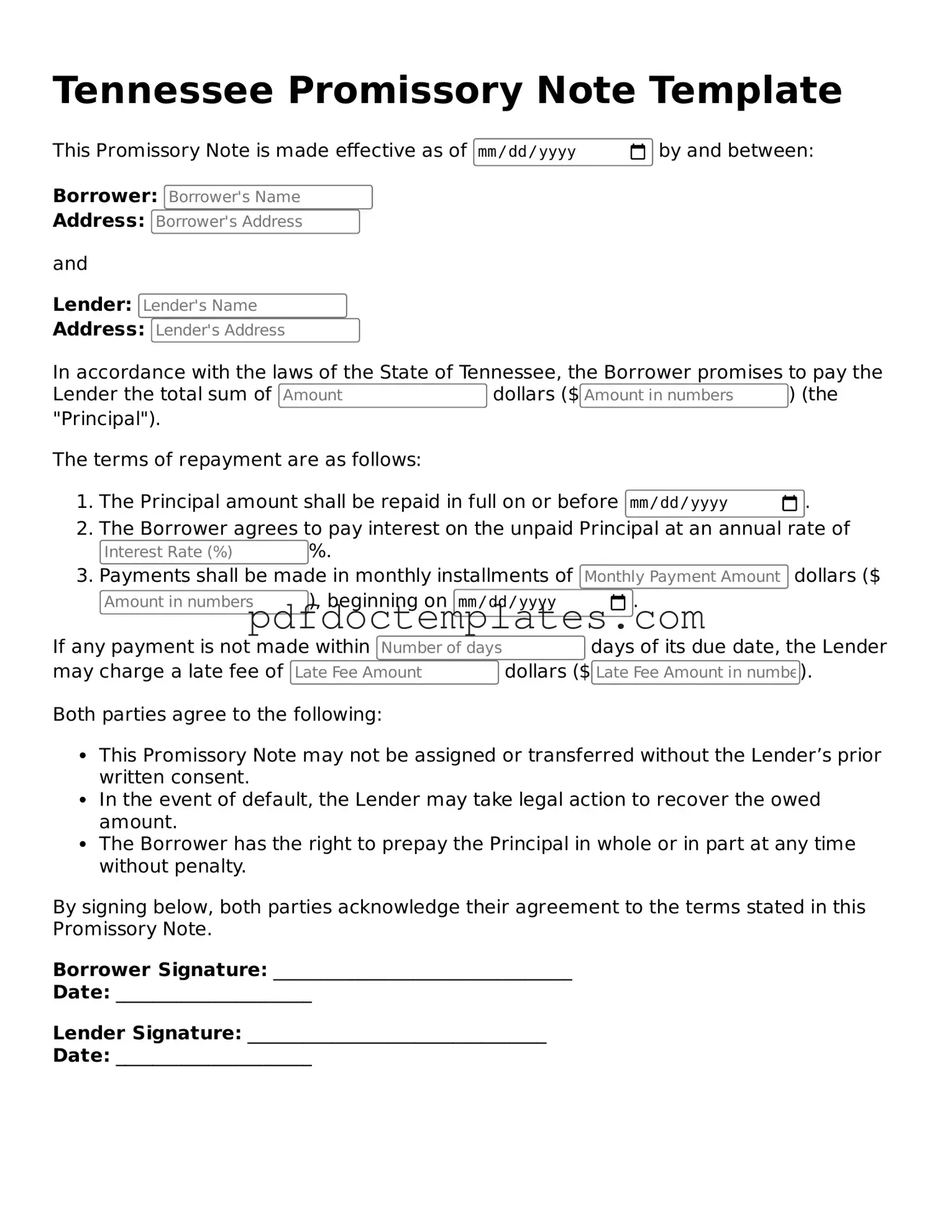

Tennessee Promissory Note Example

Tennessee Promissory Note Template

This Promissory Note is made effective as of by and between:

Borrower:

Address:

and

Lender:

Address:

In accordance with the laws of the State of Tennessee, the Borrower promises to pay the Lender the total sum of dollars ($) (the "Principal").

The terms of repayment are as follows:

- The Principal amount shall be repaid in full on or before .

- The Borrower agrees to pay interest on the unpaid Principal at an annual rate of %.

- Payments shall be made in monthly installments of dollars ($), beginning on .

If any payment is not made within days of its due date, the Lender may charge a late fee of dollars ($).

Both parties agree to the following:

- This Promissory Note may not be assigned or transferred without the Lender’s prior written consent.

- In the event of default, the Lender may take legal action to recover the owed amount.

- The Borrower has the right to prepay the Principal in whole or in part at any time without penalty.

By signing below, both parties acknowledge their agreement to the terms stated in this Promissory Note.

Borrower Signature: ________________________________

Date: _____________________

Lender Signature: ________________________________

Date: _____________________

Check out Other Common Promissory Note Templates for US States

Promissory Note Notarized - It can also stipulate the governing law in case of legal issues.

Understanding the significance of the Florida Notice to Quit form is essential for both landlords and tenants, as it outlines the necessary steps in the eviction process. This form not only communicates the specifics of the lease violation to the tenant but also provides them with a chance to remedy the situation. For further guidance on legal documents like this, you can refer to All Florida Forms.

Create a Promissory Note - The length of a promissory note may vary depending on the terms of the loan.