Blank Operating Agreement Document for Tennessee

Misconceptions

Misconceptions about the Tennessee Operating Agreement form can lead to misunderstandings regarding its purpose and functionality. Here are six common misconceptions:

-

It is not necessary for all LLCs.

Some believe that an operating agreement is optional for all Limited Liability Companies (LLCs). However, while it is not legally required in Tennessee, having one is highly recommended to outline the management structure and operating procedures.

-

It must be filed with the state.

Many assume that the operating agreement needs to be submitted to the state government. In reality, this document is kept internal and does not require filing with any state agency.

-

It only benefits multi-member LLCs.

Some individuals think that operating agreements are only useful for LLCs with multiple members. In truth, single-member LLCs can also benefit from having a clear operating agreement to define their business operations and protect their limited liability status.

-

It cannot be amended.

There is a misconception that once an operating agreement is created, it cannot be changed. However, amendments can be made to the agreement as long as all members consent to the changes, allowing for flexibility as the business evolves.

-

It is only a formal requirement.

Some view the operating agreement merely as a formality. In reality, it serves as a vital tool for conflict resolution, outlining procedures for decision-making, profit distribution, and member responsibilities.

-

It is the same as the Articles of Organization.

Many confuse the operating agreement with the Articles of Organization. While both documents are essential for forming an LLC, the Articles of Organization are filed with the state to legally establish the LLC, whereas the operating agreement governs internal operations.

Form Properties

| Fact Name | Description |

|---|---|

| Purpose | The Tennessee Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC). |

| Governing Law | This agreement is governed by the Tennessee Limited Liability Company Act, found in Title 48, Chapter 249 of the Tennessee Code. |

| Member Rights | The agreement defines the rights and responsibilities of members, including profit sharing and decision-making processes. |

| Customization | Members can customize the agreement to fit their specific needs, allowing flexibility in terms of management and financial arrangements. |

| Filing Requirements | While the Operating Agreement is not required to be filed with the state, it is crucial for internal governance and legal protection. |

Key takeaways

When filling out and using the Tennessee Operating Agreement form, consider the following key takeaways:

- Understand the Purpose: The Operating Agreement outlines the management structure and operating procedures for your LLC.

- Identify Members: Clearly list all members of the LLC, including their roles and responsibilities.

- Capital Contributions: Specify the initial capital contributions made by each member to avoid future disputes.

- Profit Distribution: Outline how profits and losses will be shared among members.

- Decision-Making Process: Establish how decisions will be made, including voting rights and procedures.

- Management Structure: Decide whether the LLC will be member-managed or manager-managed and detail the responsibilities of each.

- Amendment Procedures: Include a process for making changes to the Operating Agreement as needed.

- Dispute Resolution: Provide a method for resolving disputes among members, such as mediation or arbitration.

- Compliance with State Laws: Ensure the agreement complies with Tennessee laws governing LLCs.

- Keep It Updated: Regularly review and update the Operating Agreement to reflect any changes in membership or business operations.

By following these takeaways, you can create a comprehensive Operating Agreement that protects the interests of all members and ensures smooth operations for your LLC.

Dos and Don'ts

When filling out the Tennessee Operating Agreement form, it’s important to be thorough and accurate. Here are some key dos and don’ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate information about all members of the LLC.

- Do include details about the management structure of the LLC.

- Do specify the purpose of the business clearly.

- Don't leave any required fields blank.

- Don't use vague language that could lead to misunderstandings.

- Don't forget to review the document for spelling and grammatical errors.

By following these guidelines, you can help ensure that your Operating Agreement is completed correctly and meets the necessary legal standards.

Common mistakes

-

Neglecting to include all members: One common mistake is failing to list all members of the LLC. Every member should be clearly identified to avoid disputes in the future.

-

Inaccurate information: Providing incorrect details, such as names, addresses, or ownership percentages, can lead to complications down the line. Ensure all information is accurate and up-to-date.

-

Omitting the purpose of the LLC: Some people forget to state the purpose of the LLC. Clearly defining the business purpose helps clarify the entity's goals and objectives.

-

Not specifying management structure: Failing to outline how the LLC will be managed can create confusion. It's important to specify whether the LLC will be member-managed or manager-managed.

-

Ignoring voting rights: Many overlook the importance of detailing voting rights and procedures. Clearly outlining how decisions will be made can prevent misunderstandings among members.

-

Forgetting to include profit distribution: Not specifying how profits and losses will be distributed among members is a frequent oversight. This should be clearly defined to ensure fairness.

-

Leaving out procedures for adding or removing members: Some agreements do not include how new members can join or how existing members can exit. Establishing these procedures can save time and conflict later.

-

Not addressing dispute resolution: Failing to include a method for resolving disputes can lead to significant problems. Including a clear process for conflict resolution is essential for maintaining harmony.

-

Neglecting to sign the agreement: Lastly, one of the simplest yet most critical mistakes is forgetting to sign the agreement. An unsigned document holds no legal weight, rendering it ineffective.

What You Should Know About This Form

-

What is a Tennessee Operating Agreement?

A Tennessee Operating Agreement is a legal document that outlines the management structure and operational guidelines for a limited liability company (LLC) in Tennessee. It serves as an internal document that governs the rights and responsibilities of the members and managers of the LLC.

-

Is an Operating Agreement required in Tennessee?

While Tennessee law does not require LLCs to have an Operating Agreement, it is highly recommended. Having one can help clarify the roles of members, outline procedures for decision-making, and provide a clear framework for resolving disputes.

-

Who should create the Operating Agreement?

The members of the LLC should collaboratively create the Operating Agreement. It’s essential for all members to participate in the process to ensure that everyone's interests are represented and understood.

-

What should be included in the Operating Agreement?

- Member roles and responsibilities

- Management structure (member-managed or manager-managed)

- Voting rights and procedures

- Profit and loss distribution

- Process for adding or removing members

- Dispute resolution methods

- Amendment procedures

Including these elements can help prevent misunderstandings and provide a roadmap for the operation of the LLC.

-

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. It’s important to outline the process for making amendments within the agreement itself. Typically, amendments require a vote from the members, but the specifics should be clearly defined.

-

How does the Operating Agreement affect liability?

The Operating Agreement helps establish the limited liability status of the LLC. By clearly outlining the operational procedures and member roles, it reinforces the separation between personal and business liabilities, protecting members' personal assets from business debts.

-

Do I need a lawyer to create an Operating Agreement?

While it is not mandatory to hire a lawyer, consulting one can be beneficial. A legal professional can provide valuable insights and ensure that the agreement complies with state laws and meets the specific needs of your LLC.

-

How many copies of the Operating Agreement should be made?

It’s advisable to create several copies of the Operating Agreement. Each member should have their own copy, and a designated copy should be kept with the LLC’s official records. This ensures that everyone has access to the terms and conditions outlined in the agreement.

-

What happens if we don’t have an Operating Agreement?

Without an Operating Agreement, your LLC will be governed by Tennessee's default laws. This may not align with your specific business needs and could lead to misunderstandings among members regarding management and profit distribution.

Tennessee Operating Agreement Example

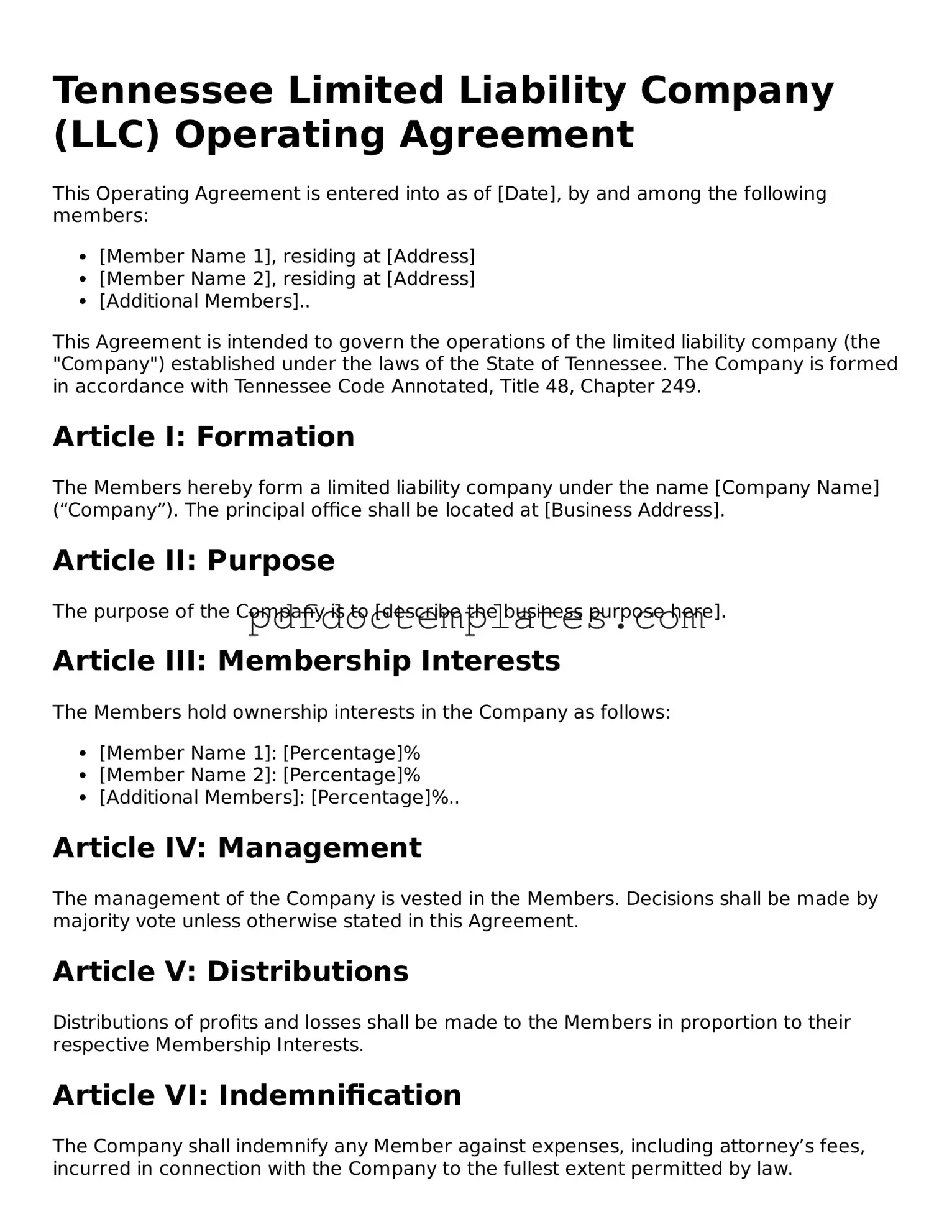

Tennessee Limited Liability Company (LLC) Operating Agreement

This Operating Agreement is entered into as of [Date], by and among the following members:

- [Member Name 1], residing at [Address]

- [Member Name 2], residing at [Address]

- [Additional Members]..

This Agreement is intended to govern the operations of the limited liability company (the "Company") established under the laws of the State of Tennessee. The Company is formed in accordance with Tennessee Code Annotated, Title 48, Chapter 249.

Article I: Formation

The Members hereby form a limited liability company under the name [Company Name] (“Company”). The principal office shall be located at [Business Address].

Article II: Purpose

The purpose of the Company is to [describe the business purpose here].

Article III: Membership Interests

The Members hold ownership interests in the Company as follows:

- [Member Name 1]: [Percentage]%

- [Member Name 2]: [Percentage]%

- [Additional Members]: [Percentage]%..

Article IV: Management

The management of the Company is vested in the Members. Decisions shall be made by majority vote unless otherwise stated in this Agreement.

Article V: Distributions

Distributions of profits and losses shall be made to the Members in proportion to their respective Membership Interests.

Article VI: Indemnification

The Company shall indemnify any Member against expenses, including attorney’s fees, incurred in connection with the Company to the fullest extent permitted by law.

Article VII: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

Article VIII: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Tennessee.

IN WITNESS WHEREOF

The undersigned Members have executed this Operating Agreement as of the date first above written.

[Member Name 1] _______________________ (Signature)

[Member Name 2] _______________________ (Signature)

[Additional Members]..

Check out Other Common Operating Agreement Templates for US States

How to Set Up an Operating Agreement for Llc - The Operating Agreement can provide a sense of security for investors.

The comprehensive California Boat Bill of Sale form is crucial for ensuring the legality of the vessel transfer process, safeguarding both buyer and seller during the transaction.

Operating Agreement Llc Virginia - It can specify the duration of the LLC’s existence.

How to Write an Operating Agreement - An Operating Agreement can specify how disputes are resolved through mediation or arbitration.