Blank Durable Power of Attorney Document for Tennessee

Misconceptions

Understanding the Tennessee Durable Power of Attorney form is essential for ensuring that your wishes are respected in the event you cannot make decisions for yourself. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings about this important legal document.

- It only applies to financial decisions. Many people believe that a Durable Power of Attorney only allows someone to make financial decisions. In reality, it can also cover health care decisions if specified.

- It becomes invalid if I become incapacitated. This form is specifically designed to remain valid even if you become incapacitated, which is one of its key features.

- Anyone can be my agent. While you can choose almost anyone, it is important to select someone you trust. They should be responsible and capable of handling your affairs.

- It is the same as a regular Power of Attorney. A Durable Power of Attorney remains in effect even if you lose the ability to make decisions, unlike a standard Power of Attorney, which may not.

- Once I sign it, I cannot change it. You can revoke or change your Durable Power of Attorney at any time, as long as you are competent to do so.

- It must be notarized to be valid. While notarization is recommended for clarity, it is not strictly required in Tennessee. Witness signatures may suffice in some cases.

- My agent can do anything they want with my money. Your agent has a fiduciary duty to act in your best interests and must follow your wishes as outlined in the document.

- It will automatically cover all my assets. You need to specify which assets or decisions you want your agent to manage. It does not automatically cover everything.

- I need a lawyer to create one. While consulting a lawyer is advisable, you can create a Durable Power of Attorney on your own using available templates, as long as you follow the state’s requirements.

- It is only for older adults. People of all ages can benefit from having a Durable Power of Attorney. Unexpected events can happen at any time, making this document valuable for anyone.

Clarifying these misconceptions can help you make informed decisions about your Durable Power of Attorney and ensure that your preferences are honored when necessary.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Tennessee Durable Power of Attorney allows an individual to appoint someone else to make decisions on their behalf, even if they become incapacitated. |

| Governing Law | This form is governed by Tennessee Code Annotated, Title 34, Chapter 6. |

| Durability | The "durable" aspect means the authority remains effective even if the principal becomes mentally incompetent. |

| Principal and Agent | The person granting authority is called the principal, while the person receiving authority is the agent or attorney-in-fact. |

| Limitations | While broad, the powers granted can be limited. The principal can specify what the agent can or cannot do. |

| Signing Requirements | The form must be signed by the principal in the presence of a notary public and two witnesses to be valid. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent. |

| Use Cases | This document is often used for financial decisions, healthcare choices, and managing assets when the principal is unable to do so. |

Key takeaways

- Understanding the Purpose: A Durable Power of Attorney (DPOA) allows an individual to designate another person to make decisions on their behalf, particularly in financial or medical matters.

- Durability: The term "durable" indicates that the authority granted remains effective even if the principal becomes incapacitated.

- Choosing an Agent: Selecting a trustworthy agent is crucial, as this person will have significant control over your affairs.

- Specific Powers: The form allows you to specify the powers granted to the agent, which can include managing finances, real estate, and healthcare decisions.

- Legal Requirements: The form must be signed by the principal and witnessed by two individuals or notarized to be valid in Tennessee.

- Revocation: The principal retains the right to revoke the DPOA at any time, provided they are still competent to do so.

- Limitations: Certain limitations may apply, such as restrictions on the agent’s ability to make gifts or change beneficiaries.

- State-Specific Rules: It is important to follow Tennessee's specific laws regarding the execution and use of a DPOA to ensure its validity.

- Healthcare Decisions: A DPOA can be used to designate an agent for healthcare decisions, but a separate Healthcare Power of Attorney may also be advisable.

- Review and Update: Regularly reviewing and updating the DPOA is essential to reflect any changes in personal circumstances or relationships.

Dos and Don'ts

When filling out the Tennessee Durable Power of Attorney form, it’s important to follow certain guidelines to ensure that the document is valid and effective. Here’s a list of things you should and shouldn't do:

- Do clearly identify the principal and the agent by including full names and addresses.

- Do specify the powers granted to the agent, ensuring they align with your wishes.

- Do date and sign the document in the presence of a notary public to validate it.

- Do keep copies of the signed document in a safe place and share them with relevant parties.

- Do review the form periodically to ensure it still reflects your intentions.

- Don't leave any sections blank, as this can lead to confusion or misinterpretation.

- Don't use vague language; be specific about the powers you are granting.

- Don't forget to check the requirements for witnesses, as they may vary.

- Don't assume that verbal agreements will suffice; written documentation is essential.

- Don't neglect to revoke the document if you change your mind about the agent or the powers granted.

Common mistakes

-

Not specifying powers clearly: Individuals often fail to outline the specific powers they wish to grant. This can lead to confusion or disputes later on. It's crucial to detail whether the agent can make financial decisions, manage real estate, or handle healthcare matters.

-

Choosing the wrong agent: Selecting an agent who lacks the necessary skills or trustworthiness can result in poor decision-making. It’s essential to choose someone who understands the responsibilities and can act in the principal's best interest.

-

Not signing or witnessing properly: A common mistake is neglecting to sign the form or ensure it is properly witnessed. In Tennessee, the signature of the principal must be notarized or witnessed by two individuals. Failing to follow these requirements can invalidate the document.

-

Overlooking updates: Life circumstances change, and many forget to update their Durable Power of Attorney. Regularly reviewing and amending the document ensures it reflects current wishes and relationships.

What You Should Know About This Form

-

What is a Durable Power of Attorney in Tennessee?

A Durable Power of Attorney (DPOA) in Tennessee is a legal document that allows an individual, known as the principal, to designate another person, called the agent or attorney-in-fact, to make decisions on their behalf. This authority remains effective even if the principal becomes incapacitated. The DPOA can cover a wide range of decisions, including financial matters, healthcare, and property management.

-

How does one create a Durable Power of Attorney in Tennessee?

To create a Durable Power of Attorney in Tennessee, the principal must complete a written document that clearly outlines the powers granted to the agent. The document must be signed by the principal in the presence of a notary public. It is advisable for the principal to discuss their wishes with the chosen agent before finalizing the document.

-

What powers can be granted through a Durable Power of Attorney?

The principal can grant a variety of powers through a DPOA. These may include managing bank accounts, paying bills, handling real estate transactions, and making healthcare decisions. It is important for the principal to specify which powers they wish to grant, as the document can be tailored to fit individual needs.

-

Can a Durable Power of Attorney be revoked?

Yes, a Durable Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent. To revoke the DPOA, the principal should create a written revocation document and notify the agent and any institutions or individuals who may have relied on the original DPOA.

-

What happens if the agent cannot serve?

If the designated agent is unable or unwilling to serve, the principal can name an alternate agent in the DPOA document. If no alternate is named, or if both the agent and alternate are unavailable, a court may need to appoint a guardian or conservator to make decisions on behalf of the principal.

-

Is a Durable Power of Attorney effective immediately?

A Durable Power of Attorney can be effective immediately upon signing, or it can be set to become effective only upon a specific event, such as the principal's incapacity. The principal should clearly state their intentions in the document to avoid confusion.

-

Do I need a lawyer to create a Durable Power of Attorney?

While it is not legally required to have a lawyer draft a DPOA, consulting with one can be beneficial. A lawyer can ensure that the document complies with state laws and accurately reflects the principal's wishes. This can help prevent potential disputes or misunderstandings in the future.

-

Can a Durable Power of Attorney be used for healthcare decisions?

A Durable Power of Attorney can include provisions for healthcare decisions, but it is often recommended to use a separate document known as a Healthcare Power of Attorney for this purpose. This document specifically addresses medical decisions and may be subject to different legal requirements.

-

What should I do after creating a Durable Power of Attorney?

After creating a Durable Power of Attorney, it is important to provide copies to the designated agent, relevant family members, and any financial institutions or healthcare providers that may need it. Keeping the original document in a safe but accessible place is also advisable. Regularly reviewing the DPOA to ensure it still meets the principal's needs is a good practice.

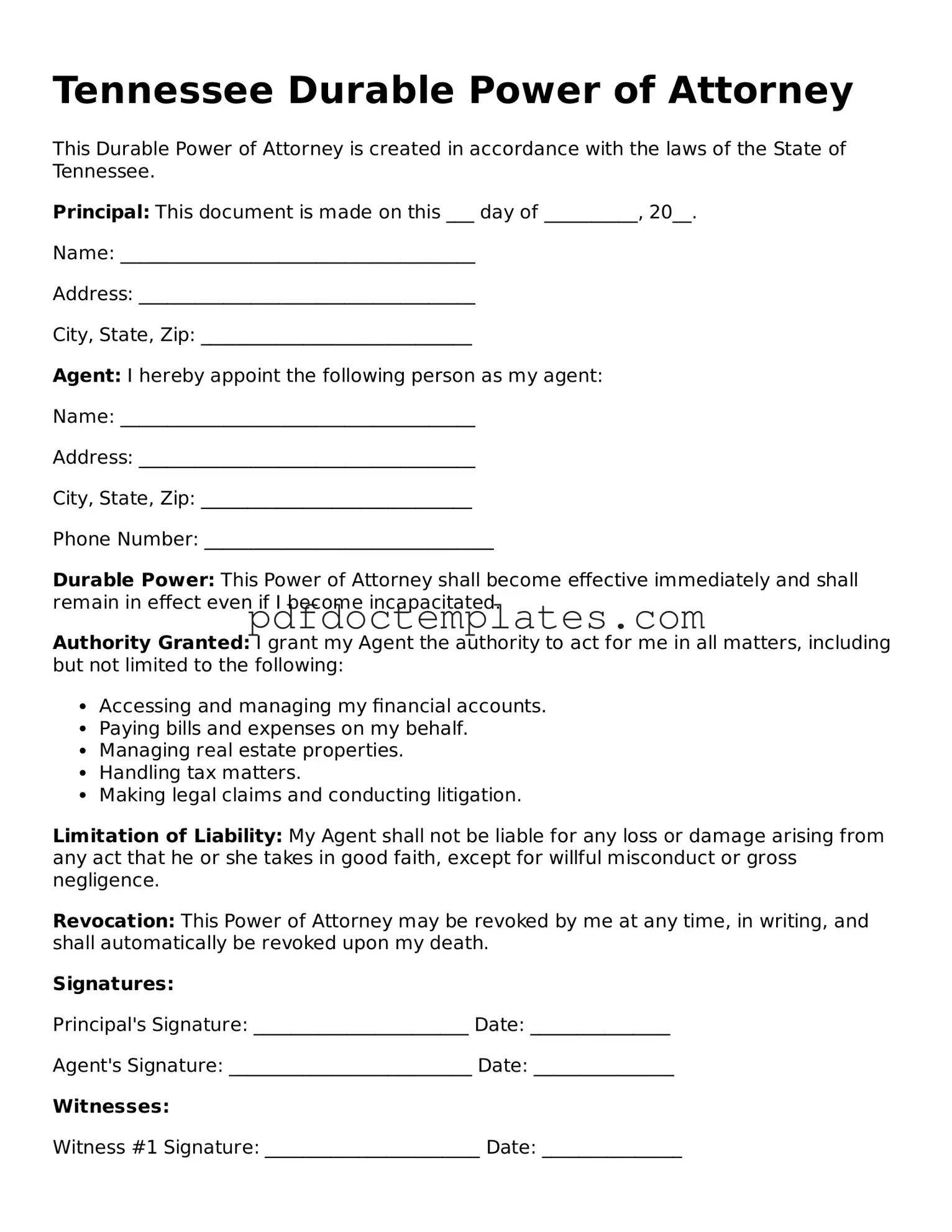

Tennessee Durable Power of Attorney Example

Tennessee Durable Power of Attorney

This Durable Power of Attorney is created in accordance with the laws of the State of Tennessee.

Principal: This document is made on this ___ day of __________, 20__.

Name: ______________________________________

Address: ____________________________________

City, State, Zip: _____________________________

Agent: I hereby appoint the following person as my agent:

Name: ______________________________________

Address: ____________________________________

City, State, Zip: _____________________________

Phone Number: _______________________________

Durable Power: This Power of Attorney shall become effective immediately and shall remain in effect even if I become incapacitated.

Authority Granted: I grant my Agent the authority to act for me in all matters, including but not limited to the following:

- Accessing and managing my financial accounts.

- Paying bills and expenses on my behalf.

- Managing real estate properties.

- Handling tax matters.

- Making legal claims and conducting litigation.

Limitation of Liability: My Agent shall not be liable for any loss or damage arising from any act that he or she takes in good faith, except for willful misconduct or gross negligence.

Revocation: This Power of Attorney may be revoked by me at any time, in writing, and shall automatically be revoked upon my death.

Signatures:

Principal's Signature: _______________________ Date: _______________

Agent's Signature: __________________________ Date: _______________

Witnesses:

Witness #1 Signature: _______________________ Date: _______________

Name: ______________________________________

Address: ____________________________________

Witness #2 Signature: _______________________ Date: _______________

Name: ______________________________________

Address: ____________________________________

Notarization:

State of Tennessee

County of _______________________

On this ___ day of __________, 20__, before me appeared the Principal, who is known to me (or proved to me on the basis of satisfactory evidence) to be the person whose name is subscribed to this Durable Power of Attorney.

Notary Public Signature: ____________________

My Commission Expires: ____________________

Check out Other Common Durable Power of Attorney Templates for US States

Power of Attorney Arizona - This form allows individuals to assert control over their future healthcare and financial decisions.

Understanding the importance of a Hold Harmless Agreement in New York is crucial for anyone engaging in potentially risky activities or agreements. This legal document serves to protect parties from liabilities that may arise during the execution of agreements or events. For those looking to ensure proper legal coverage, utilizing resources like All New York Forms can be immensely beneficial, offering helpful templates and guidance.

North Carolina Durable Power of Attorney - The ability to appoint a trusted individual ensures that your interests and needs are prioritized.