Blank Bill of Sale Document for Tennessee

Misconceptions

The Tennessee Bill of Sale form is an important document for recording the sale of personal property. However, several misconceptions surround its use. Here are five common misunderstandings:

-

It is only needed for vehicle sales.

Many people believe the Bill of Sale is only necessary for selling vehicles. In reality, it can be used for any personal property transaction, including boats, furniture, and equipment.

-

It must be notarized to be valid.

While notarization can add an extra layer of authenticity, it is not a legal requirement for a Bill of Sale in Tennessee. The form is valid as long as both parties sign it.

-

It protects against all future claims.

A Bill of Sale provides proof of transfer but does not guarantee that the item is free from liens or other claims. Buyers should conduct due diligence before completing a purchase.

-

It is only necessary for high-value transactions.

Regardless of the item's value, having a Bill of Sale is wise. It serves as a record of the transaction and can help resolve disputes in the future.

-

One form suffices for multiple transactions.

Each sale should have its own Bill of Sale. Using a single form for multiple transactions can lead to confusion and potential legal issues.

Understanding these misconceptions can help ensure that transactions are conducted smoothly and legally in Tennessee.

Form Properties

| Fact Name | Description |

|---|---|

| Purpose | The Tennessee Bill of Sale is used to document the sale of personal property between a buyer and a seller. |

| Governing Law | The form is governed by Tennessee Code Annotated, Title 47, Chapter 2. |

| Types of Property | This form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Notarization | Notarization is not required for the Bill of Sale in Tennessee, but it is recommended for added security. |

| Buyer and Seller Information | Both parties must provide their names and addresses on the form to ensure clarity and accountability. |

| Consideration | The form must state the amount paid for the property, known as consideration, to validate the transaction. |

| As-Is Clause | Including an "as-is" clause can protect the seller from future claims regarding the condition of the property. |

| Record Keeping | Both the buyer and seller should keep a copy of the Bill of Sale for their records, as it serves as proof of the transaction. |

Key takeaways

When dealing with the Tennessee Bill of Sale form, there are several important points to keep in mind. This document serves as proof of the transfer of ownership for various types of property, including vehicles, boats, and personal items. Here are key takeaways to consider:

- Identification of Parties: Clearly identify both the seller and the buyer. Include full names and addresses to avoid any confusion.

- Description of the Item: Provide a detailed description of the item being sold. This should include make, model, year, and any identifying numbers, such as a VIN for vehicles.

- Purchase Price: State the agreed-upon purchase price. This helps establish the terms of the sale and can be important for tax purposes.

- As-Is Clause: Consider including an "as-is" clause. This indicates that the buyer accepts the item in its current condition, reducing the seller's liability for any future issues.

- Signatures: Both parties should sign the document. This signifies agreement to the terms and helps validate the sale.

- Date of Sale: Record the date of the transaction. This is crucial for legal and record-keeping purposes.

- Notarization: While not required, having the Bill of Sale notarized can add an extra layer of authenticity and can be beneficial in disputes.

By keeping these key points in mind, you can ensure that the Tennessee Bill of Sale form serves its purpose effectively and protects the interests of both the buyer and the seller.

Dos and Don'ts

When filling out the Tennessee Bill of Sale form, it’s important to ensure that all information is accurate and complete. Here are some key things to consider:

- Do provide accurate details about the buyer and seller, including full names and addresses.

- Do include a clear description of the item being sold, such as make, model, year, and VIN for vehicles.

- Do specify the sale price clearly to avoid any confusion later on.

- Do sign and date the document in the presence of a witness or notary, if required.

- Don’t leave any blank spaces on the form; fill in all necessary fields.

- Don’t use abbreviations or shorthand that could lead to misunderstandings.

- Don’t forget to keep a copy of the Bill of Sale for your records after it has been completed.

By following these guidelines, you can help ensure that your Bill of Sale is valid and protects both parties involved in the transaction.

Common mistakes

-

Not including all required information: It's crucial to fill out every section of the form. Missing details can lead to complications later.

-

Incorrect buyer or seller names: Ensure that the names of both the buyer and seller are spelled correctly. Errors can create confusion and potential legal issues.

-

Omitting the date of sale: Always include the date when the transaction occurs. This information is important for record-keeping and legal purposes.

-

Failing to describe the item accurately: Provide a clear and detailed description of the item being sold. This includes the make, model, year, and any identifying numbers.

-

Not signing the form: Both parties must sign the Bill of Sale. A missing signature can render the document invalid.

-

Not having a witness or notarization: While not always required, having a witness or notarizing the document can add an extra layer of protection.

-

Using outdated forms: Always use the most current version of the Bill of Sale form. Laws can change, and using an old form may lead to issues.

-

Ignoring state-specific requirements: Tennessee may have specific rules regarding Bill of Sale forms. Familiarize yourself with these to ensure compliance.

What You Should Know About This Form

-

What is a Bill of Sale in Tennessee?

A Bill of Sale is a legal document that serves as proof of a transaction between a buyer and a seller. In Tennessee, this document is particularly important for transferring ownership of personal property, such as vehicles, boats, or other tangible items. It outlines the details of the sale, including the item being sold, the purchase price, and the names of both the buyer and seller.

-

Is a Bill of Sale required in Tennessee?

While a Bill of Sale is not legally required for all transactions in Tennessee, it is highly recommended. For certain items, such as vehicles, a Bill of Sale is necessary for registration and titling purposes. Having a Bill of Sale protects both parties by providing a written record of the transaction, which can be useful in case of disputes or legal issues.

-

What information should be included in a Tennessee Bill of Sale?

A comprehensive Bill of Sale should include the following details:

- The names and addresses of both the buyer and seller

- A description of the item being sold, including any identifying details like VIN for vehicles

- The purchase price

- The date of the transaction

- Any warranties or conditions of the sale, if applicable

Including all of this information helps ensure clarity and can prevent misunderstandings down the road.

-

Do I need to have the Bill of Sale notarized?

In Tennessee, notarization of a Bill of Sale is not mandatory for all transactions. However, having the document notarized can add an extra layer of authenticity and may be required by certain institutions, such as banks or the Department of Motor Vehicles (DMV) for vehicle sales. Notarization can also help in establishing the legitimacy of the transaction if any disputes arise later.

-

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale in Tennessee. There are many templates available online that can guide you in drafting a suitable document. Just ensure that you include all the necessary details and that it is clear and concise. Alternatively, you can also seek assistance from a legal professional to ensure that your Bill of Sale meets all legal requirements.

-

What should I do with the Bill of Sale after the transaction?

After completing the transaction, both the buyer and seller should keep a copy of the Bill of Sale for their records. This document serves as proof of the sale and can be crucial if any issues arise later, such as disputes over ownership or payment. If the transaction involves a vehicle, the buyer may need to present the Bill of Sale when registering the vehicle with the DMV.

Tennessee Bill of Sale Example

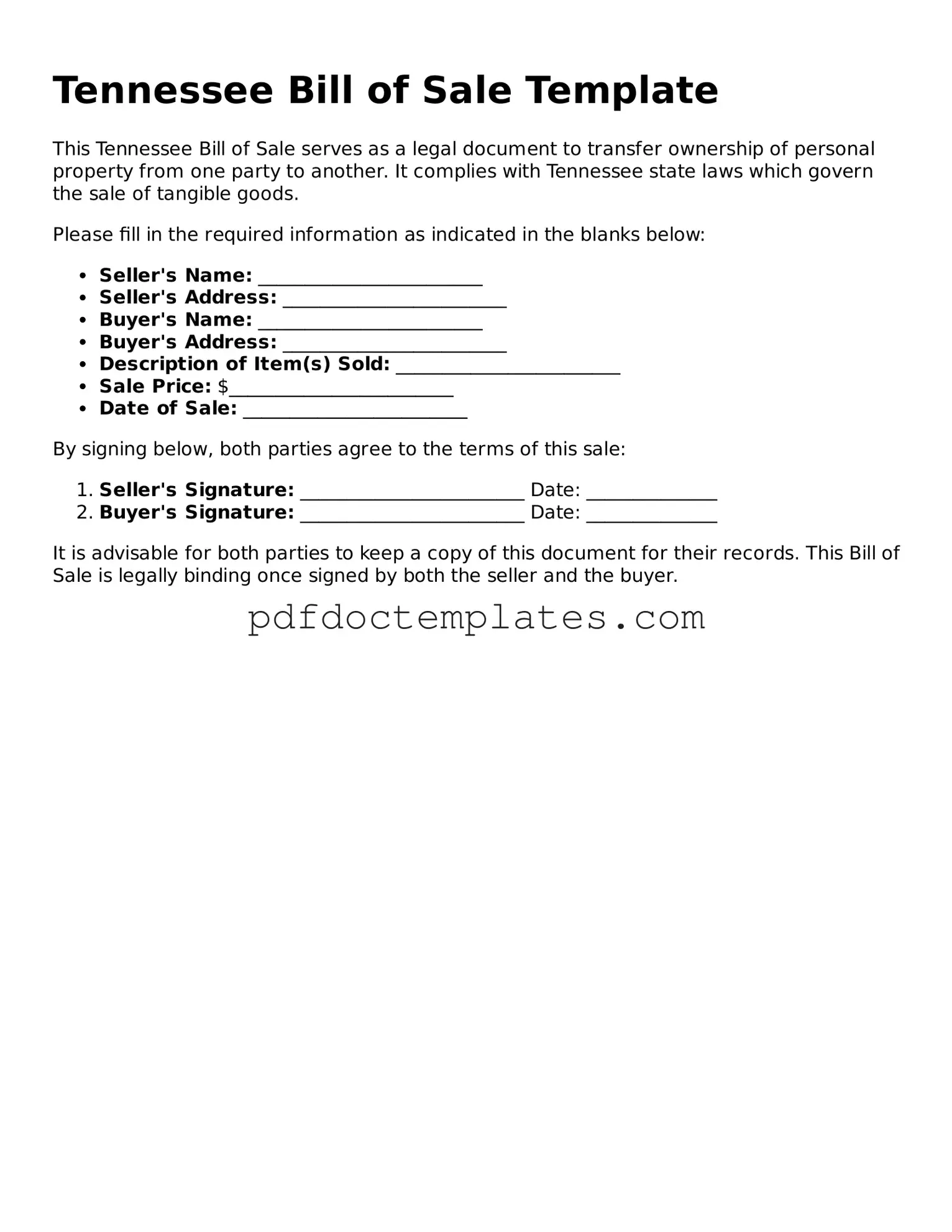

Tennessee Bill of Sale Template

This Tennessee Bill of Sale serves as a legal document to transfer ownership of personal property from one party to another. It complies with Tennessee state laws which govern the sale of tangible goods.

Please fill in the required information as indicated in the blanks below:

- Seller's Name: ________________________

- Seller's Address: ________________________

- Buyer's Name: ________________________

- Buyer's Address: ________________________

- Description of Item(s) Sold: ________________________

- Sale Price: $________________________

- Date of Sale: ________________________

By signing below, both parties agree to the terms of this sale:

- Seller's Signature: ________________________ Date: ______________

- Buyer's Signature: ________________________ Date: ______________

It is advisable for both parties to keep a copy of this document for their records. This Bill of Sale is legally binding once signed by both the seller and the buyer.

Check out Other Common Bill of Sale Templates for US States

Bill of Sale for Car Michigan - The date of the sale is an important part of the Bill of Sale.

The New York Operating Agreement form is essential for limited liability companies (LLCs) in New York State, as it not only outlines the business's financial and functional decisions but also specifies the rules and regulations governing its operations. This document plays a crucial role in defining the business structure, detailing member responsibilities, and protecting personal assets from company liabilities. For those looking to create a solid foundation for their LLC, it is advisable to utilize resources like All New York Forms to ensure all necessary provisions are included for effective governance and conflict resolution.

Is a Bill of Sale Required in Arizona - This form might be a requirement for financing arrangements, validating the transaction to third parties.