Blank Articles of Incorporation Document for Tennessee

Misconceptions

When it comes to the Tennessee Articles of Incorporation, several misconceptions often arise. These misunderstandings can lead to confusion for those looking to start a business. Here are seven common misconceptions:

- All businesses must file Articles of Incorporation. Many people believe that every type of business entity must file Articles of Incorporation. In reality, only corporations need to file this document. Sole proprietorships and partnerships do not require it.

- Filing Articles of Incorporation guarantees business success. Some assume that simply filing the Articles of Incorporation will ensure their business thrives. However, success depends on various factors, including market demand, management, and business strategy.

- Once filed, Articles of Incorporation cannot be changed. There is a belief that the Articles of Incorporation are set in stone once submitted. In fact, amendments can be made to the Articles if changes are necessary, such as altering the business name or changing the number of authorized shares.

- Articles of Incorporation are the same as a business license. A common misconception is that filing Articles of Incorporation is equivalent to obtaining a business license. These are distinct processes; the Articles establish the corporation, while a business license is often required to operate legally within a specific locality.

- There are no fees associated with filing Articles of Incorporation. Some individuals believe that filing is free. In Tennessee, a fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation being formed.

- All information in the Articles of Incorporation is confidential. Many think that the details included in the Articles are private. However, these documents are public records, meaning anyone can access them to review the information.

- Only attorneys can file Articles of Incorporation. There is a misconception that only licensed attorneys can submit the Articles of Incorporation. In reality, individuals can file the documents themselves, provided they understand the requirements and process involved.

Understanding these misconceptions can help individuals navigate the incorporation process more effectively and set a solid foundation for their business ventures in Tennessee.

Form Properties

| Fact Name | Description |

|---|---|

| Governing Law | The Tennessee Articles of Incorporation are governed by the Tennessee Business Corporation Act. |

| Purpose | The form is used to officially establish a corporation in the state of Tennessee. |

| Required Information | Key details such as the corporation's name, principal office address, and registered agent must be included. |

| Filing Fee | A filing fee is required upon submission of the Articles of Incorporation, which varies based on the type of corporation. |

| Submission Method | The form can be submitted online or by mail to the Tennessee Secretary of State. |

| Approval Timeframe | Typically, processing takes about 5 to 10 business days, depending on the volume of applications. |

| Amendments | Changes to the Articles of Incorporation can be made by filing an amendment form with the Secretary of State. |

Key takeaways

When filling out and using the Tennessee Articles of Incorporation form, there are several important points to keep in mind. Here are some key takeaways to help guide you through the process:

- Choose a Unique Name: The name of your corporation must be distinct and not already in use by another entity in Tennessee. It’s advisable to conduct a name search through the Secretary of State’s website to ensure availability.

- Designate a Registered Agent: Every corporation in Tennessee must have a registered agent. This person or business will receive legal documents on behalf of the corporation. The agent must have a physical address in Tennessee.

- Include Purpose Statement: Clearly state the purpose of your corporation. This can be a general business purpose or a specific one, but it should reflect the nature of your business activities.

- Specify the Duration: Indicate whether your corporation will exist indefinitely or for a specific period. Most corporations choose to exist indefinitely, but it’s essential to state this clearly.

- File with the Secretary of State: After completing the form, submit it to the Tennessee Secretary of State along with the required filing fee. This can often be done online, by mail, or in person.

- Obtain an EIN: Once your Articles of Incorporation are approved, apply for an Employer Identification Number (EIN) through the IRS. This number is necessary for tax purposes and to open a business bank account.

By keeping these points in mind, you can ensure a smoother process when forming your corporation in Tennessee.

Dos and Don'ts

When filling out the Tennessee Articles of Incorporation form, it is important to follow specific guidelines to ensure a smooth process. Below is a list of things you should and shouldn't do.

- Do provide accurate and complete information about your business.

- Do include the name of your corporation, ensuring it complies with Tennessee naming requirements.

- Do designate a registered agent who will receive legal documents on behalf of the corporation.

- Do specify the purpose of your corporation clearly and concisely.

- Don't use a name that is too similar to an existing corporation in Tennessee.

- Don't forget to include the names and addresses of the initial directors.

- Don't leave any required fields blank; incomplete forms can lead to delays.

- Don't neglect to sign the form; an unsigned document is invalid.

Common mistakes

-

Inaccurate Business Name: One common mistake is failing to choose a unique business name. The name must not only comply with state regulations but also be distinguishable from existing entities. Before submitting, it is essential to conduct a thorough name search.

-

Incorrect Registered Agent Information: Another frequent error involves providing incorrect or incomplete information about the registered agent. The registered agent must have a physical address in Tennessee and be available during business hours. Omitting this information can lead to delays or rejections.

-

Improper Purpose Statement: Some applicants fail to clearly articulate the purpose of the corporation. The purpose statement should be specific enough to inform the public and the state about the nature of the business activities. Vague or overly broad statements can result in complications.

-

Omitting Required Signatures: Lastly, neglecting to obtain the necessary signatures can derail the filing process. All incorporators must sign the Articles of Incorporation. Without these signatures, the document will not be considered valid.

What You Should Know About This Form

-

What are Articles of Incorporation?

Articles of Incorporation are legal documents that establish a corporation in the state of Tennessee. This document outlines essential details about your business, such as its name, purpose, and the structure of its management. Filing these articles is the first step in forming a corporation and provides your business with legal recognition.

-

Why do I need to file Articles of Incorporation?

Filing Articles of Incorporation is crucial for several reasons. It grants your business legal status, allowing you to operate under a corporate structure. This status can protect your personal assets from business liabilities. Additionally, it can enhance your credibility with customers, suppliers, and potential investors.

-

What information is required in the Articles of Incorporation form?

The form typically requires basic information such as:

- The name of the corporation

- The purpose of the corporation

- The duration of the corporation (if not perpetual)

- The address of the corporation's principal office

- The name and address of the registered agent

- The number of shares the corporation is authorized to issue

Make sure all information is accurate and complete to avoid delays in processing.

-

How do I file the Articles of Incorporation in Tennessee?

You can file the Articles of Incorporation online or by mail. If you choose to file online, visit the Tennessee Secretary of State's website. For mail submissions, send the completed form along with the required filing fee to the appropriate address listed on the form. Ensure you keep a copy for your records.

-

What is the filing fee for the Articles of Incorporation?

The filing fee varies depending on the type of corporation you are forming. Generally, the fee ranges from $100 to $300. It’s important to check the latest fee schedule on the Tennessee Secretary of State’s website to ensure you include the correct amount with your submission.

-

How long does it take for the Articles of Incorporation to be processed?

Processing times can vary. Typically, online filings are processed faster, often within a few business days. Mail submissions may take longer, sometimes up to two weeks or more. If you need your documents quickly, consider filing online.

-

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, you will receive a certificate of incorporation. This document serves as official proof that your corporation is legally recognized. You will then need to fulfill additional requirements, such as obtaining an Employer Identification Number (EIN) and setting up corporate bylaws.

Tennessee Articles of Incorporation Example

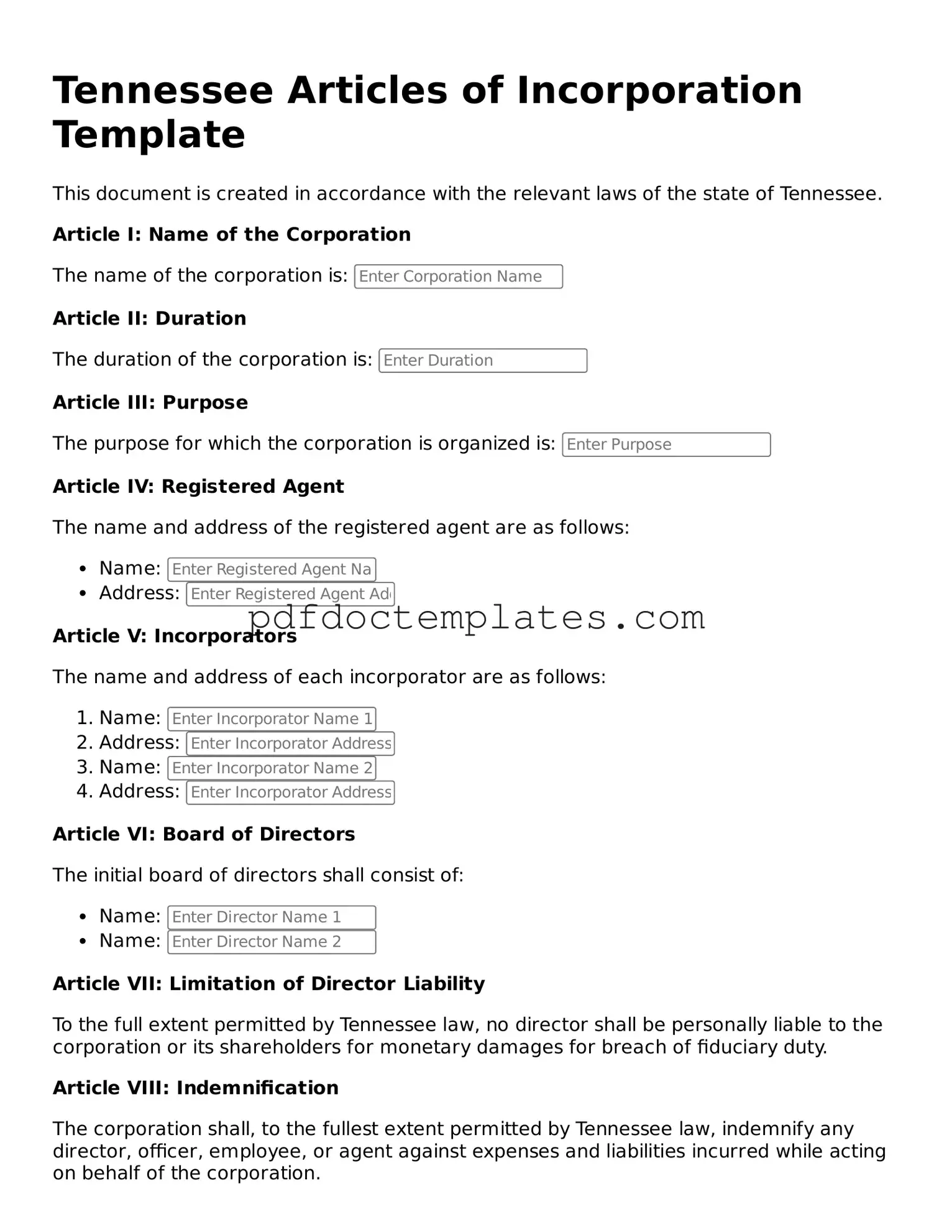

Tennessee Articles of Incorporation Template

This document is created in accordance with the relevant laws of the state of Tennessee.

Article I: Name of the Corporation

The name of the corporation is:

Article II: Duration

The duration of the corporation is:

Article III: Purpose

The purpose for which the corporation is organized is:

Article IV: Registered Agent

The name and address of the registered agent are as follows:

- Name:

- Address:

Article V: Incorporators

The name and address of each incorporator are as follows:

- Name:

- Address:

- Name:

- Address:

Article VI: Board of Directors

The initial board of directors shall consist of:

- Name:

- Name:

Article VII: Limitation of Director Liability

To the full extent permitted by Tennessee law, no director shall be personally liable to the corporation or its shareholders for monetary damages for breach of fiduciary duty.

Article VIII: Indemnification

The corporation shall, to the fullest extent permitted by Tennessee law, indemnify any director, officer, employee, or agent against expenses and liabilities incurred while acting on behalf of the corporation.

Dated this ___ day of ____________, 20__.

______________________________

Signature of Incorporator

- End of Template -

Check out Other Common Articles of Incorporation Templates for US States

Document Retrieval Center - Facilitates easier transfer of ownership through shares.

The boat bill of sale is an important legal document that facilitates the transfer of boat ownership, ensuring that both the buyer and seller are protected during the transaction. For guidance on how to effectively complete this form, refer to a thorough boat bill of sale resource that outlines necessary requirements and best practices.

How Do I Get a Certificate of Good Standing - The document is filed with the state to create a separate legal entity.

How to Incorporate in Nc - Specific provisions can aim to limit liability for directors.

Wa Secretary of State Business Search - Completing this form correctly ensures a smoother incorporation process.