Download Tax POA dr 835 Template

Misconceptions

Understanding the Tax POA DR 835 form is essential for anyone looking to manage their tax affairs effectively. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

- It is only for businesses. Many people believe that the Tax POA DR 835 form is exclusively for businesses. In reality, both individuals and businesses can use this form to authorize someone to represent them before the tax authorities.

- It allows unlimited access to personal information. Some think that signing this form gives the representative unrestricted access to all personal financial information. However, the authorization is limited to specific tax matters and years as designated on the form.

- It must be filed every year. There is a misconception that the Tax POA DR 835 form needs to be submitted annually. In fact, it remains in effect until revoked or until the specified tax matters are resolved, unless a new form is filed.

- It is only necessary for audits. Many assume that this form is only needed during an audit. However, it is also useful for other interactions with the tax authority, such as inquiries or appeals.

- Any representative can be authorized. Some believe that anyone can be appointed as a representative on this form. While you can choose someone you trust, they must meet specific qualifications set by the IRS or state tax authority.

Clarifying these misconceptions can help you navigate the tax process more effectively. Understanding the limitations and purposes of the Tax POA DR 835 form is crucial for making informed decisions.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Tax Power of Attorney (POA) Form 835 allows individuals to designate someone else to handle their tax matters with the state tax authority. |

| Governing Law | This form is governed by state tax laws, which vary by state. For example, in California, it is governed by the California Revenue and Taxation Code. |

| Eligibility | Any individual or business entity can use this form to authorize a representative to act on their behalf regarding tax issues. |

| Submission Process | The completed form must be submitted to the appropriate state tax authority, either online or via mail, depending on state-specific guidelines. |

Key takeaways

Understanding the Tax Power of Attorney (POA) DR 835 form is crucial for anyone needing to authorize someone else to handle their tax matters. Here are some key takeaways to keep in mind:

- Purpose of the Form: The Tax POA DR 835 form allows you to designate an individual or organization to represent you before the IRS or state tax authorities.

- Who Can Be Authorized: You can appoint anyone you trust, such as a family member, accountant, or tax professional, to act on your behalf.

- Filling Out the Form: Ensure that all required fields are completed accurately. This includes your personal information and the details of the person you are designating.

- Revoking the POA: If you ever need to revoke the authorization, you can do so by submitting a written notice to the tax authorities. This ensures your previous representative can no longer act on your behalf.

By keeping these points in mind, you can navigate the process of filling out and using the Tax POA DR 835 form with confidence.

Dos and Don'ts

When filling out the Tax POA DR 835 form, it’s crucial to follow specific guidelines to ensure the process goes smoothly. Here are nine important do's and don'ts to keep in mind:

- Do read the instructions carefully before starting.

- Do provide accurate information to avoid delays.

- Do sign and date the form where required.

- Do keep a copy of the completed form for your records.

- Do submit the form to the correct tax authority.

- Don't leave any required fields blank.

- Don't use pencil; always use blue or black ink.

- Don't forget to check for any additional documentation needed.

- Don't submit the form late; adhere to deadlines.

Common mistakes

-

Incomplete Information: Many individuals fail to fill out all required fields on the form. Missing information can lead to delays or rejections.

-

Incorrect Taxpayer Identification Number: Entering the wrong Social Security Number or Employer Identification Number can cause significant issues. Always double-check these numbers.

-

Not Signing the Form: A common oversight is forgetting to sign the form. Without a signature, the form is not valid.

-

Using the Wrong Version of the Form: Sometimes, people use outdated versions of the form. Ensure you have the most current version to avoid complications.

-

Failing to Specify the Scope of Authority: It’s essential to clearly define what powers you are granting to the representative. Vague language can lead to misunderstandings.

-

Ignoring State-Specific Requirements: Some states may have additional requirements. Be aware of any local rules that might apply.

-

Not Providing Contact Information: Omitting your phone number or email address can hinder communication. This information is crucial for any follow-up.

-

Submitting the Form to the Wrong Address: Always verify the correct mailing address for submission. Sending it to the wrong location can delay processing.

What You Should Know About This Form

-

What is the Tax POA DR 835 form?

The Tax POA DR 835 form is a Power of Attorney document used in the context of tax matters. It allows an individual or entity to designate another person to act on their behalf in dealings with tax authorities. This form is particularly relevant for situations involving tax filings, disputes, and other related matters.

-

Who can use the Tax POA DR 835 form?

Any taxpayer, including individuals and businesses, can use the Tax POA DR 835 form. It is essential for those who wish to have someone else manage their tax affairs, such as accountants, tax preparers, or legal representatives.

-

What information is required to complete the form?

The form typically requires the taxpayer's name, address, and identification number. Additionally, it asks for the representative's information, including their name, address, and contact details. The taxpayer must also specify the scope of authority granted to the representative.

-

How do I submit the Tax POA DR 835 form?

After completing the form, the taxpayer should submit it to the appropriate tax authority. This may involve mailing the form or, in some cases, submitting it electronically. It is important to check the specific submission guidelines provided by the tax authority to ensure compliance.

-

Can I revoke the Power of Attorney granted through the Tax POA DR 835 form?

Yes, the Power of Attorney can be revoked at any time. To do this, the taxpayer should submit a written notice of revocation to the tax authority and inform the representative. This ensures that the representative no longer has the authority to act on the taxpayer's behalf.

-

Is there a fee associated with submitting the Tax POA DR 835 form?

Generally, there is no fee for submitting the Tax POA DR 835 form itself. However, taxpayers should verify with their specific tax authority, as some jurisdictions may have different regulations or associated costs.

-

How long is the Tax POA DR 835 form valid?

The validity of the Power of Attorney granted through the Tax POA DR 835 form usually lasts until the taxpayer revokes it or until the specific matter for which it was granted is resolved. It is advisable for taxpayers to keep track of the duration and any relevant deadlines.

-

Can multiple representatives be designated using the Tax POA DR 835 form?

Yes, the form can accommodate multiple representatives. Taxpayers can specify different individuals or entities and outline the scope of authority for each. This flexibility allows for a tailored approach to managing tax matters.

-

What should I do if I have further questions about the Tax POA DR 835 form?

If further questions arise, taxpayers should consider contacting the tax authority directly or consulting with a tax professional. These resources can provide specific guidance and clarification regarding the use and implications of the form.

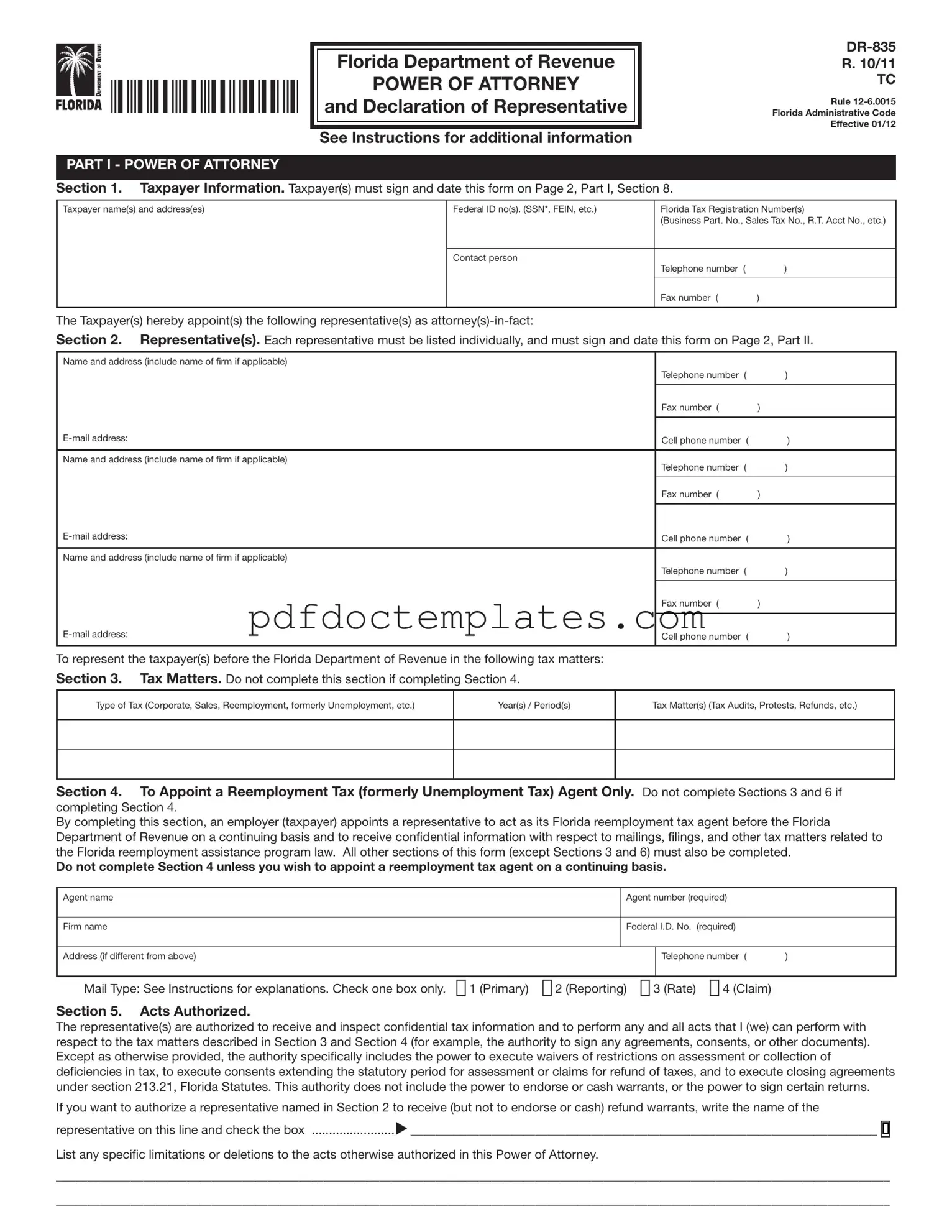

Tax POA dr 835 Example

I |

|

|

|

|

|

|

||

|

|

Florida Department of Revenue |

|

|

|

|||

1111111111111111111111111111111111 |

|

|

|

Florida |

R. 10/11 |

|||

|

I iiiiiiiiiiiiiiiiiiiiiiiiiiiiii~I |

|

|

Effective 01/12 |

||||

|

|

|

|

POWER OF ATTORNEY |

|

|

|

TC |

|

|

|

|

and Declaration of Representative |

|

|

|

Administrative Code |

|

|

|

|

L!;;;;;;;;;;;;;l |

|

|

|

Rule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Instructions for additional information |

|

|

|

|

PART I - POWER OF ATTORNEY

Section 1. Taxpayer Information. Taxpayer(s) must sign and date this form on Page 2, Part I, Section 8.

Taxpayer name(s) and address(es) |

Federal ID no(s). (SSN*, FEIN, etc.) |

Florida Tax Registration Number(s) |

|

|

|

(Business Part. No., Sales Tax No., R.T. Acct No., etc.) |

|

|

|

|

|

|

Contact person |

Telephone number ( |

) |

|

|

||

|

|

|

|

|

|

Fax number ( |

) |

|

|

|

|

The Taxpayer(s) hereby appoint(s) the following representative(s) as

Section 2. Representative(s). Each representative must be listed individually, and must sign and date this form on Page 2, Part II.

Name and address (include name of frm if applicable) |

|

|

|

|

Telephone number |

( |

) |

|

|

|

|

|

Fax number ( |

|

) |

|

|

|

|

Cell phone number |

( |

) |

|

|

|

|

|

Name and address (include name of frm if applicable) |

Telephone number |

( |

) |

|

|||

|

|

|

|

|

Fax number ( |

|

) |

|

|

|

|

Cell phone number |

( |

) |

|

|

|

|

|

Name and address (include name of frm if applicable) |

|

|

|

|

Telephone number |

( |

) |

|

|

|

|

|

Fax number ( |

|

) |

|

|

|

|

Cell phone number |

( |

) |

|

|

|

|

|

To represent the taxpayer(s) before the Florida Department of Revenue in the following tax matters:

Section 3. Tax Matters. Do not complete this section if completing Section 4.

Type of Tax (Corporate, Sales, Reemployment, formerly Unemployment, etc.)

Year(s) / Period(s)

Tax Matter(s) (Tax Audits, Protests, Refunds, etc.)

Section 4. To Appoint a Reemployment Tax (formerly Unemployment Tax) Agent Only. Do not complete Sections 3 and 6 if completing Section 4.

By completing this section, an employer (taxpayer) appoints a representative to act as its Florida reemployment tax agent before the Florida Department of Revenue on a continuing basis and to receive confdential information with respect to mailings, flings, and other tax matters related to the Florida reemployment assistance program law. All other sections of this form (except Sections 3 and 6) must also be completed.

Do not complete Section 4 unless you wish to appoint a reemployment tax agent on a continuing basis.

Agent name |

Agent number (required) |

|

|

|

|

|

|

Firm name |

Federal I.D. No. (required) |

|

|

|

|

|

|

Address (if different from above) |

|

Telephone number ( |

) |

|

|

|

|

Mail Type: See Instructions for explanations. Check one box only. ❑ 1 (Primary) ❑ 2 (Reporting) ❑ 3 (Rate) ❑ 4 (Claim)

Section 5. Acts Authorized.

The representative(s) are authorized to receive and inspect confdential tax information and to perform any and all acts that I (we) can perform with respect to the tax matters described in Section 3 and Section 4 (for example, the authority to sign any agreements, consents, or other documents). Except as otherwise provided, the authority specifcally includes the power to execute waivers of restrictions on assessment or collection of defciencies in tax, to execute consents extending the statutory period for assessment or claims for refund of taxes, and to execute closing agreements under section 213.21, Florida Statutes. This authority does not include the power to endorse or cash warrants, or the power to sign certain returns.

If you want to authorize a representative named in Section 2 to receive (but not to endorse or cash) refund warrants, write the name of the

representative on this line and check the box |

u___________________________________________________________________________ ❑ |

List any specifc limitations or deletions to the acts otherwise authorized in this Power of Attorney.

______________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________

I |

|

|

|

|

111111111111111111111111111111111111111 |

R. 10/11 |

|

|

|||

|

Page 2 |

||

|

|

|

Florida Tax Registration Number: |

Taxpayer Name(s): |

Federal Identifcation Number: |

||

•Taxpayer(s) must complete Page 1 of this Power of Attorney or it will not be processed.

Section 6. Notices and Communication. Do not complete Section 6 if completing Section 4.

•Notices and other written communications will be sent to the first representative listed in Part I, Section 2, unless the taxpayer selects one of the options below. Receipt by either the representative or the taxpayer will be considered receipt by both.

a. |

If you want notices and communications sent to both you and your representative, check this box |

u |

❑ |

b. |

If you want notices or communications sent to you and not your representative, check this box |

u |

❑ |

Certain

Section 7. Retention / Nonrevocation of Prior Power(s) of Attorney.

The fling of this Power of Attorney will not revoke earlier Power(s) of Attorney on fle with the Florida Department of Revenue, even for the same tax matters and years or periods covered by this document. If you want to revoke a prior Power of

Attorney, check this box |

u ❑ |

You must attach a copy of any Power of Attorney you wish to revoke.

Section 8. Signature of Taxpayer(s).

If a tax matter concerns a joint return, both husband and wife must sign if joint representation is requested. If signed by a corporate offcer, partner, member/managing member, guardian, tax matters partner/person, executor, receiver, administrator, trustee, or fduciary on behalf of the taxpayer, I declare under penalties of perjury that I have the authority to execute this form on behalf of the taxpayer.

Under penalties of perjury, I (we) declare that I (we) have read the foregoing document, and the facts stated in it are true.

If this Power of Attorney is not signed and dated, it will be returned.

_______________________________________________________________________________________ |

________________________________________ |

_________________________________________ |

Signature |

Date |

Title (if applicable) |

_______________________________________________________________________________________ |

|

|

Print name |

|

|

_______________________________________________________________________________________ |

________________________________________ |

_________________________________________ |

Signature |

Date |

Title (if applicable) |

_______________________________________________________________________________________ |

|

|

Print name |

|

|

PART II - DECLARATION OF REPRESENTATIVE

Under penalties of perjury, I declare that:

•I am familiar with the mandatory standards of conduct governing representation before the Department of Revenue, including Rules

•I am familiar with the law and facts related to this matter and am qualified to represent the taxpayer(s) in this matter.

•I am authorized to represent the taxpayer(s) identified in Part I for the tax matter(s) specified therein, and to receive and inspect confidential taxpayer information.

•I am one of the following:

a.Attorney - a member in good standing of the bar of the highest court of the jurisdiction shown below.

b.Certifed Public Accountant - duly qualifed to practice as a certifed public accountant in the jurisdiction shown below.

c.Enrolled Agent – enrolled as an agent pursuant to the requirements of Treasury Department Circular Number 230.

d.Former Department of Revenue Employee. As a representative, I cannot accept representation in a matter upon which I had direct involvement while I was a public employee.

e.Reemployment Tax Agent authorized in Section 4 of this form.

f.Other Qualifed Representative

•I have read the foregoing Declaration of Representative and the facts stated in it are true.

If this Declaration of Representative is not signed and dated, it will not be processed.

Designation – Insert |

Jurisdiction (State) and |

Signature |

Letter from Above (a |

Enrollment Card No. (if any) |

|

|

|

|

Date

Made fillable by FormsPal.

POWER OF ATTORNEY INSTRUCTIONS

R.10/11 Page 3

Purpose of this form

A Power of Attorney (Form

to an attorney, certifed public accountant, enrolled agent, former Department employee, reemployment tax agent, or any other qualifed individual. A Power of Attorney is a legal document authorizing someone other than yourself to act as your representative.

You may use this form for any matters affecting any tax administered by the Department of Revenue. This includes both the audit and collection processes. A Power of Attorney will remain in effect until you revoke it. If you provide more than one Power of Attorney with respect to a tax and tax period, the Department employee handling your case will address notices and correspondence relative to that issue to the frst person listed on the latest Power of Attorney.

A Power of Attorney Form is generally not required, if the representative is, or is accompanied by: a trustee, a receiver, an administrator, an executor of an estate, a corporate offcer, or an authorized employee of the taxpayer.

Photocopies and fax copies of Form

How to Complete Form

PART I POWER OF ATTORNEY

Section 1 – Taxpayer Information

•For individuals and sole proprietorships: Enter your name, address, social security number, and telephone number(s) in the spaces provided. Enter your federal employer identifcation number (FEIN), if you have one. If a joint return is involved, and you and your spouse are designating the same

•For a corporation, limited liability company, or partnership: Enter the name, business address, FEIN, a contact person familiar with this matter, and telephone number(s).

•For a trust: Enter the name, title, address, and telephone number(s) of the fduciary, and name and FEIN of the trust.

•For an estate: Enter the name, title, address, and telephone number(s) of the decedent’s personal representative, and the name and identifcation number of the estate. The identifcation number for an estate includes both the FEIN if the estate has one and the decedent’s social security number.

•For any other entity: Enter the name, business address, FEIN, and telephone number(s), as well as the name of a contact person familiar with this matter.

•Identifcation Number: The Department may have assigned you a Florida tax registration number such as a sales tax number, a reemployment tax account number, or a business partner number. These numbers further assist the Department in identifying your particular tax matter, and you should enter them in the appropriate box. If you do not provide this information, the Department may not be able to process the Power of Attorney.

Section 2 – Representative(s)

Enter the individual name, frm name (if applicable), address, telephone number(s), and fax number of each individual appointed as

Section 3 – Tax Matters

Enter the type(s) of tax this Power of Attorney authorization applies to and the years or periods for which the Power of Attorney is granted. The word “All” is not specifc enough. If your tax situation does not ft into a tax type or period (for example, a specifc administrative appeal, audit, or collection matter), describe it in the blank space provided for “Tax Matters.” The Power of Attorney can be limited to specifc reporting period(s) that can be stated in year(s), quarter(s), month(s), etc., or can be granted for an indefnite period. You must indicate the tax types, periods, and/or matters for which you are authorizing representation by your

Examples: |

|

|

Sales and Use Tax |

First and second quarter 2008 |

|

Corporate Income Tax |

|

7/1/07 – 6/30/08 |

Communications Services Tax |

|

2006 thru 2008 |

Insurance Premium Tax |

|

1/1/06 – 12/31/08 |

Technical Assistance Advisement Request |

dated 8/6/08 |

|

Claim for Refund |

|

3/7/07 |

Section 4 – To Appoint a Reemployment Tax Agent Complete this section only if you wish to appoint an agent for reemployment taxes on a continuing basis. You should not complete Section 3 or Section 6, but you must complete the remaining sections of Form

Enter the agent’s name. It must be the same name as found in Section 2. Enter the frm name and address. You do not need to complete the address line if you reported that information in Section 2.

1.Enter the agent number. The agent number is a

2.Enter the federal employer identifcation number. The FEIN is a

3.Select the mail type.

Primary Mail. If you select primary mail, the agent will receive all documents from the Department of Revenue related to this reemployment tax account, and will be authorized to receive confdential information and discuss matters related to the tax and wage report, beneft information, claims, and the employer’s rate.

Reporting Mail. If you select reporting mail, the agent will receive the Employer’s Quarterly Report (Form

Rate Mail. If you select rate mail, the agent will receive tax rate notices and correspondence related to the rate and will be authorized to receive confdential information and discuss the employer’s rate notices and rate with the Department.

Claims Mail. If you select claims mail, the agent will receive the notice of benefts paid, and will be authorized to receive confdential information and discuss matters related to benefts.

Note: Duplicate copies of certain

Note: If you wish to appoint a representative to act on your behalf in a specifc and

Section 5 – Acts Authorized

Your signature on the back of the Power of Attorney authorizes the individual(s) you designate (your representative or

Section 6 – Mailing of Notices and Communications

If you do not check a box, the Department will send notices and other written communications to the frst representative listed in Section 2, unless you select another option. If you wish to have no documents sent to your representative, or documents sent to both you and your representative, you should check the appropriate box in Section 6. Check the second box if you wish to have notices and other written communications sent to you and not to your representative. In certain instances, the Department can only send documents to the taxpayer. Therefore, the taxpayer has the responsibility of keeping the representative informed of tax matters.

Note: Taxpayers completing Section 4 (To Appoint a Reemployment Tax Agent Only) should not complete Section 6. See Section 4 of these instructions for information regarding notices and communications sent to a reemployment tax agent.

Section 7 – Retention/Nonrevocation of Prior Power(s) of Attorney The most recent Power of Attorney will take precedence over, but will not revoke, prior Powers of Attorney. If you wish to revoke a prior Power of Attorney, you must check the box on the form and attach a copy of the old Power of Attorney.

Section 8 – Signature of Taxpayer(s)

The Power of Attorney is not valid until signed and dated by the taxpayer. The individual signing the Power of Attorney is representing, under penalties of perjury, that he or she is the taxpayer or authorized to execute the Power of Attorney on behalf of the taxpayer.

•For a corporation, trust, estate, or any other entity: A corporate offcer or person having authority to bind the entity must sign.

•For partnerships: All partners must sign unless one partner is authorized to act in the name of the partnership.

•For a sole proprietorship: The owner of the sole proprietorship must sign.

•For a joint return: Both husband and wife must sign if the representative represents both. If the representative only represents one spouse, then only that spouse should sign.

PART II – DECLARATION OF REPRESENTATIVE

Any party who appears before the Department of Revenue has the right, at his or her own expense, to be represented by counsel or by a qualifed representative. The representative(s) you name must declare, under penalties of perjury, that he or she is qualifed to represent you in this matter and will comply with the mandatory standards of conduct

R. 10/11

Page 4

governing representation before the Department of Revenue. The representative(s) must also declare, under penalties of perjury, that he or she has been authorized to represent the taxpayer(s) in this matter and authorized by the taxpayer(s) to receive confdential taxpayer information.

The representative(s) you name must sign and date this declaration and enter the designation (i.e., items

a.Attorney – Enter the

b.Certifed Public Accountant – Enter the

c.Enrolled Agent – Enter the enrollment card number issued by the Internal Revenue Service.

d.Former Department of Revenue Employee – Former employees may not accept representation in matters in which they were directly involved, and in certain cases, on any matter for a period of two years following termination of employment. If a former Department of Revenue employee is also an attorney or CPA, then the additional designation, jurisdiction, and enrollment card should also be entered.

e.Reemployment Tax Agent – A person(s) appointed under Section 4 of the Power of Attorney to handle reemployment tax matters on a continuing basis. A separate Power of Attorney form must be completed in order for a reemployment tax agent to handle a specifc and

f.Other Qualifed Representative – An individual may represent a taxpayer before the Department of Revenue if training and experience qualifes that person to handle a specifc matter.

Rule

(a)Engage in conduct involving dishonesty, fraud, deceit, or misrepresentation.

(b)Engage in conduct that is prejudicial to the administration of justice.

(c)Handle a matter that the representative knows or should know that he or she is not competent to handle.

(d)Handle a legal or factual matter without adequate preparation.

*Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifers for the administration of Florida’s taxes. SSNs obtained for tax administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is authorized under state and federal law. Visit our Internet site at www.foridarevenue.com and select “Privacy Notice” for more information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

Where to Mail Form

If Form

If Form

Consider More Forms

What Does It Mean If a Company Is Not Bbb Accredited - The business did not comply with my request to opt out of marketing emails.

The Florida Power of Attorney for a Child form is an essential document for parents who may need assistance in ensuring their child's well-being during their absence. This legal tool allows parents to appoint another responsible adult to make critical decisions regarding the child's care, thus providing peace of mind. For further details and to access the necessary documents, you can visit All Florida Forms, which offers a comprehensive guide on this important legal matter.

What Do You Need to Set Up Direct Deposit - Utilize Citibank Direct Deposit for timely payments every pay period.

Patron List for Church Fundraiser - Your dollar is a step towards our mission.