Download Stock Transfer Ledger Template

Misconceptions

Here are four common misconceptions about the Stock Transfer Ledger form:

- It is only for large corporations. Many believe that only large corporations need to maintain a Stock Transfer Ledger. In reality, any corporation, regardless of size, should keep accurate records of stock issuance and transfers to comply with legal requirements.

- It is optional. Some individuals think that maintaining a Stock Transfer Ledger is optional. However, it is a crucial document for tracking ownership and ensuring transparency in stock transactions.

- Only the original stockholders need to be recorded. There is a misconception that only original stockholders must be listed. In fact, the ledger should document all stockholders, including those who acquire shares through transfers.

- It does not require regular updates. Some assume that once the ledger is created, it does not need to be updated frequently. This is incorrect; the ledger must be updated promptly after any stock transfer to maintain accurate records.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Stock Transfer Ledger form is used to document the issuance and transfer of shares in a corporation. |

| Information Required | The form requires details such as the corporation's name, stockholder's name and residence, certificates issued, and transfer dates. |

| Governing Law | In many states, the governing laws include the Uniform Commercial Code (UCC) and specific state corporation laws. |

| Record Keeping | Maintaining an accurate Stock Transfer Ledger is essential for legal compliance and to track ownership of shares. |

Key takeaways

Filling out the Stock Transfer Ledger form accurately is crucial for maintaining clear records of stock ownership and transfers. Here are key takeaways to consider:

- Corporation Name: Clearly enter the name of the corporation at the top of the form. This identifies the entity related to the stock transactions.

- Stockholder Information: Provide the name and place of residence of each stockholder. This ensures that ownership details are easily traceable.

- Certificates Issued: Record the certificate numbers and dates of issuance. This information is essential for tracking the history of stock ownership.

- Shares Transferred: Indicate the number of shares being transferred. This helps in maintaining accurate counts of shares held by each stockholder.

- Transfer Details: Note the date of transfer and the name of the person to whom shares are being transferred. This establishes a clear timeline and accountability.

- Original Issues: If shares are being issued for the first time, state this clearly. This distinction is important for record-keeping.

- Payment Information: Document the amount paid for the shares. This can affect the valuation of the stock and the financial records of the corporation.

- Certificates Surrendered: When shares are transferred, include details about any certificates that are surrendered. This prevents duplication of ownership.

- Balance of Shares: Always update the number of shares held after each transaction. Keeping an accurate balance is vital for both the corporation and the stockholders.

By following these guidelines, the Stock Transfer Ledger can serve as an effective tool for managing stock ownership and ensuring compliance with legal requirements.

Dos and Don'ts

When filling out the Stock Transfer Ledger form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are some do's and don'ts to keep in mind:

- Do enter the corporation's name clearly at the top of the form.

- Do provide complete information for each stockholder, including their place of residence.

- Do accurately record the certificate numbers and the number of shares issued.

- Do ensure that the date of transfer is correctly noted.

- Don't leave any fields blank; incomplete information can lead to issues later.

- Don't forget to indicate if the shares are part of an original issue.

By following these guidelines, you can help ensure that your Stock Transfer Ledger is filled out correctly and efficiently.

Common mistakes

-

Failing to enter the corporation's name accurately at the top of the form.

-

Omitting the name of the stockholder in the designated section.

-

Not providing the place of residence for the stockholder, which is essential for identification.

-

Leaving the certificates issued section blank or incorrectly filled out.

-

Incorrectly entering the certificate number, leading to confusion in tracking shares.

-

Failing to include the date of issuance for the shares, which is important for record-keeping.

-

Not specifying the number of shares issued, which can lead to discrepancies in ownership.

-

Neglecting to indicate from whom the shares were transferred, especially if it is an original issue.

-

Forgetting to fill in the amount paid for the shares, which is crucial for financial records.

-

Leaving out the date of transfer of shares, which can complicate tracking ownership changes.

-

Not specifying to whom the shares were transferred, making it difficult to establish new ownership.

-

Failing to indicate the certificates surrendered and their corresponding certificate numbers.

-

Not providing the number of shares held (balance), which is necessary for accurate record-keeping.

What You Should Know About This Form

-

What is a Stock Transfer Ledger?

A Stock Transfer Ledger is a record-keeping document used by corporations to track the issuance and transfer of stock shares. It provides essential details about each transaction, including the stockholder's name, the number of shares issued, and the dates of transfer.

-

Why is a Stock Transfer Ledger important?

This ledger is crucial for maintaining accurate ownership records. It helps prevent disputes over share ownership and ensures compliance with state and federal regulations. Additionally, it aids in the proper management of stockholder information.

-

What information is required to complete the form?

The form requires the following information:

- Corporation’s name

- Name of the stockholder

- Place of residence of the stockholder

- Certificates issued

- Certificate numbers and dates

- Number of shares issued

- Details of the transfer (from whom and to whom shares were transferred)

- Amount paid for shares

- Dates of transfer

- Certificates surrendered

- Balance of shares held

-

Who should maintain the Stock Transfer Ledger?

The corporation's secretary or designated officer typically maintains the Stock Transfer Ledger. This individual is responsible for ensuring that the ledger is updated accurately and promptly after each stock transaction.

-

How often should the Stock Transfer Ledger be updated?

The ledger should be updated immediately after any stock issuance or transfer occurs. Timely updates help maintain accurate records and facilitate smooth ownership transitions.

-

Can the Stock Transfer Ledger be kept electronically?

Yes, the Stock Transfer Ledger can be maintained electronically. However, it is important to ensure that the electronic records are secure and backed up regularly to prevent data loss.

-

What happens if there is an error in the Stock Transfer Ledger?

If an error is discovered, it should be corrected promptly. This may involve documenting the correction and ensuring that all parties involved are informed. Maintaining transparency is key to resolving any discrepancies.

-

Is a Stock Transfer Ledger required by law?

While not all states explicitly require a Stock Transfer Ledger, maintaining one is considered best practice for corporations. It helps ensure compliance with corporate governance and provides a clear record of stock ownership.

Stock Transfer Ledger Example

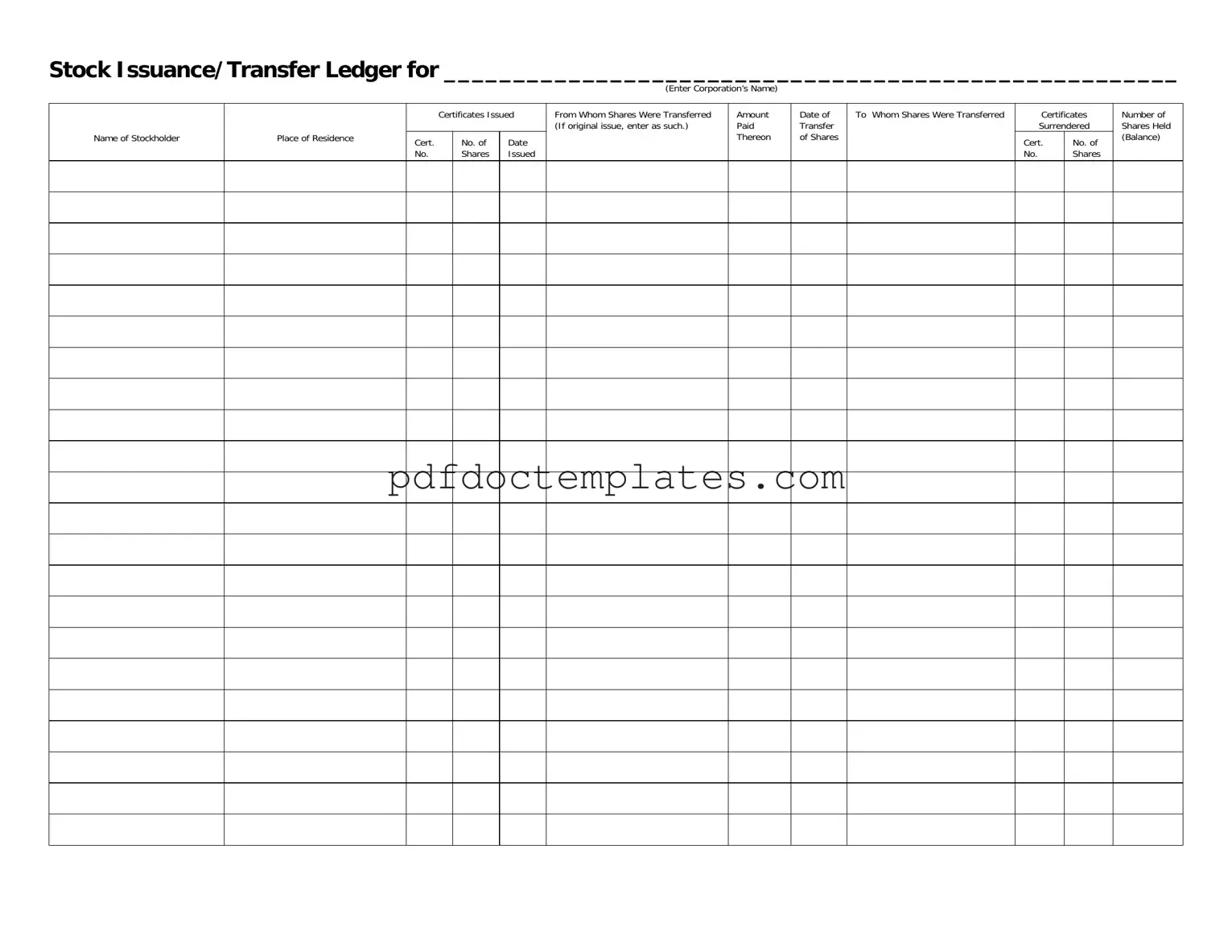

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

Consider More Forms

Form 1099 Nec - Copy B is for the recipient’s records and should be kept for tax reference.

Hiv Test Report Sample - Initial next to the temperature logs for accountability.

When entering into a rental agreement, it's vital for both landlords and tenants to familiarize themselves with the essential components of the contract, which can be thoroughly understood through the use of the Florida Residential Lease Agreement form. This document not only clarifies the responsibilities of each party but also serves as a protective measure against potential disputes. For those looking to access this important resource, visit All Florida Forms.

Form 680 - Understanding the vaccine schedule is vital to completing the form accurately.