Printable Single-Member Operating Agreement Template

Misconceptions

The Single-Member Operating Agreement is an important document for anyone operating a single-member limited liability company (LLC). However, several misconceptions can lead to confusion. Here are five common misunderstandings:

-

It’s not necessary if you’re the only member.

Many people believe that a Single-Member Operating Agreement is optional. While it’s true that single-member LLCs have fewer formalities than multi-member LLCs, having an operating agreement is still crucial. It provides clarity on how the business operates and helps protect your limited liability status.

-

It’s the same as a partnership agreement.

This is a common misconception. A Single-Member Operating Agreement is specifically tailored for a single-member LLC, whereas a partnership agreement is designed for multiple owners. The terms and provisions differ significantly based on the structure and needs of the business.

-

It can’t be changed once it’s created.

Some believe that once the agreement is drafted and signed, it cannot be modified. In reality, you can amend your operating agreement as your business evolves. It’s essential to keep the document up-to-date to reflect any changes in your business practices or goals.

-

It’s only for legal protection.

While legal protection is a significant benefit, the operating agreement also serves other purposes. It can clarify management roles, outline financial arrangements, and provide guidelines for resolving disputes, making it a versatile tool for business management.

-

It’s a one-size-fits-all document.

Another misconception is that a standard template will suffice for every business. Each LLC has unique needs and circumstances. Therefore, it’s essential to customize your operating agreement to accurately reflect your business operations and goals.

Understanding these misconceptions can help you make informed decisions about your single-member LLC and ensure that your operating agreement serves its intended purpose effectively.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement outlines the management structure and operational procedures for a single-member limited liability company (LLC). |

| Legal Requirement | While not required in all states, having an operating agreement is recommended to clarify ownership and management roles. |

| State-Specific Forms | Some states provide specific forms or templates for Single-Member Operating Agreements, while others allow for more flexibility. |

| Governing Law | The governing law for Single-Member Operating Agreements typically follows the LLC statutes of the state in which the LLC is formed. |

| Personal Liability Protection | This agreement helps maintain the limited liability status of the owner, protecting personal assets from business debts. |

| Management Structure | The agreement specifies whether the LLC is managed by the owner or by appointed managers. |

| Flexibility | Single-Member Operating Agreements can be tailored to meet the specific needs of the business and its owner. |

| Tax Treatment | Single-member LLCs are typically treated as disregarded entities for tax purposes, simplifying tax reporting. |

| Amendments | The agreement can be amended as needed, allowing for changes in business operations or ownership structure. |

| Record Keeping | Maintaining a written operating agreement is crucial for record-keeping and can be beneficial in legal disputes. |

Key takeaways

When filling out and using a Single-Member Operating Agreement form, keep the following key takeaways in mind:

- Define Your Business Structure: Clearly state that your business is a single-member LLC. This establishes your ownership and the nature of your business.

- Outline Management Responsibilities: Specify how you will manage the LLC. This includes decision-making processes and day-to-day operations.

- Establish Financial Guidelines: Detail how profits and losses will be handled. This includes distribution of profits and reinvestment strategies.

- Include a Dissolution Clause: Describe the process for dissolving the LLC if necessary. This helps prevent disputes in the future.

- Identify the Member: Clearly state your name and any relevant personal information. This identifies you as the sole member of the LLC.

- Consider Tax Implications: Understand how the LLC will be taxed. A single-member LLC is typically treated as a disregarded entity for tax purposes.

- Review Legal Requirements: Ensure that the agreement complies with state laws. Each state may have different requirements for LLCs.

- Keep it Updated: Regularly review and update the agreement as your business evolves. Changes in operations or ownership may require adjustments.

- Consult a Professional: If unsure about any aspect, seek advice from a legal or financial professional. Their expertise can help you avoid pitfalls.

Using a Single-Member Operating Agreement is crucial for clarifying the operations and structure of your LLC. It serves as a foundational document that can protect your business interests.

Dos and Don'ts

When filling out the Single-Member Operating Agreement form, it's essential to follow certain guidelines to ensure accuracy and compliance. Here are seven important dos and don'ts to keep in mind:

- Do provide accurate and complete information about your business.

- Do specify the purpose of your business clearly.

- Do include your name and contact information as the sole member.

- Do outline the management structure, even if you are the only member.

- Don't leave any sections blank; fill in all required fields.

- Don't use vague language that could lead to misunderstandings.

- Don't forget to review the document for errors before submission.

By adhering to these guidelines, you can create a solid foundation for your business's operating agreement.

Common mistakes

-

Failing to include the member's name: It is crucial to list the full legal name of the single member. Without this, the agreement lacks clarity.

-

Not specifying the business purpose: The agreement should clearly state the purpose of the business. This helps define the scope of operations.

-

Omitting the principal place of business: The address where the business operates must be included. This is important for legal and tax purposes.

-

Neglecting to outline management structure: Even in a single-member LLC, it is beneficial to specify how the business will be managed. This can prevent future confusion.

-

Not detailing financial arrangements: Clearly stating how profits and losses will be handled is essential. This ensures that financial expectations are set from the beginning.

-

Forgetting to include an amendment clause: An amendment clause allows for future changes to the agreement. Without it, making adjustments can become complicated.

-

Ignoring state-specific requirements: Each state may have unique requirements for operating agreements. Failing to comply can lead to legal issues.

-

Not having the agreement signed: The agreement must be signed by the single member. Without a signature, it may not hold legal weight.

-

Overlooking the date of the agreement: Including the date is important for record-keeping and establishing timelines for business activities.

What You Should Know About This Form

-

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a legal document that outlines the management structure and operating procedures of a single-member limited liability company (LLC). This agreement serves as an internal guideline, detailing how the business will be run and how decisions will be made. Although it is not required by law in all states, having one is highly recommended for clarity and protection.

-

Why is it important to have a Single-Member Operating Agreement?

Having a Single-Member Operating Agreement is crucial for several reasons. First, it helps establish the separation between personal and business assets, which is essential for liability protection. Additionally, this document can outline how profits and losses will be handled, ensuring that the member understands their financial obligations. Furthermore, it can provide guidance on what happens in the event of the member's death or incapacity, which is vital for business continuity.

-

What should be included in a Single-Member Operating Agreement?

A well-drafted Single-Member Operating Agreement typically includes the following components:

- The name and address of the LLC.

- The purpose of the business.

- The name of the sole member.

- Details on how profits and losses will be distributed.

- Procedures for adding new members, if applicable.

- Provisions for the dissolution of the LLC.

Including these elements ensures that the agreement is comprehensive and serves its intended purpose.

-

Is a Single-Member Operating Agreement legally binding?

Yes, a Single-Member Operating Agreement is legally binding as long as it is properly executed. This means that both parties must agree to its terms, and it should be signed by the member. While not all states require this document to be filed with the state, it is still enforceable in a court of law, provided it complies with state laws.

-

Can I create my own Single-Member Operating Agreement?

Yes, you can create your own Single-Member Operating Agreement. There are templates available online that can guide you in drafting this document. However, it is advisable to consult with a legal professional to ensure that the agreement meets all legal requirements and adequately protects your interests.

-

How often should I update my Single-Member Operating Agreement?

It is wise to review and update your Single-Member Operating Agreement regularly, especially after significant changes in your business or personal circumstances. Events such as acquiring new assets, changes in business structure, or shifts in financial responsibilities may necessitate revisions. Keeping the agreement current ensures that it continues to reflect your intentions and complies with any applicable laws.

Single-Member Operating Agreement Example

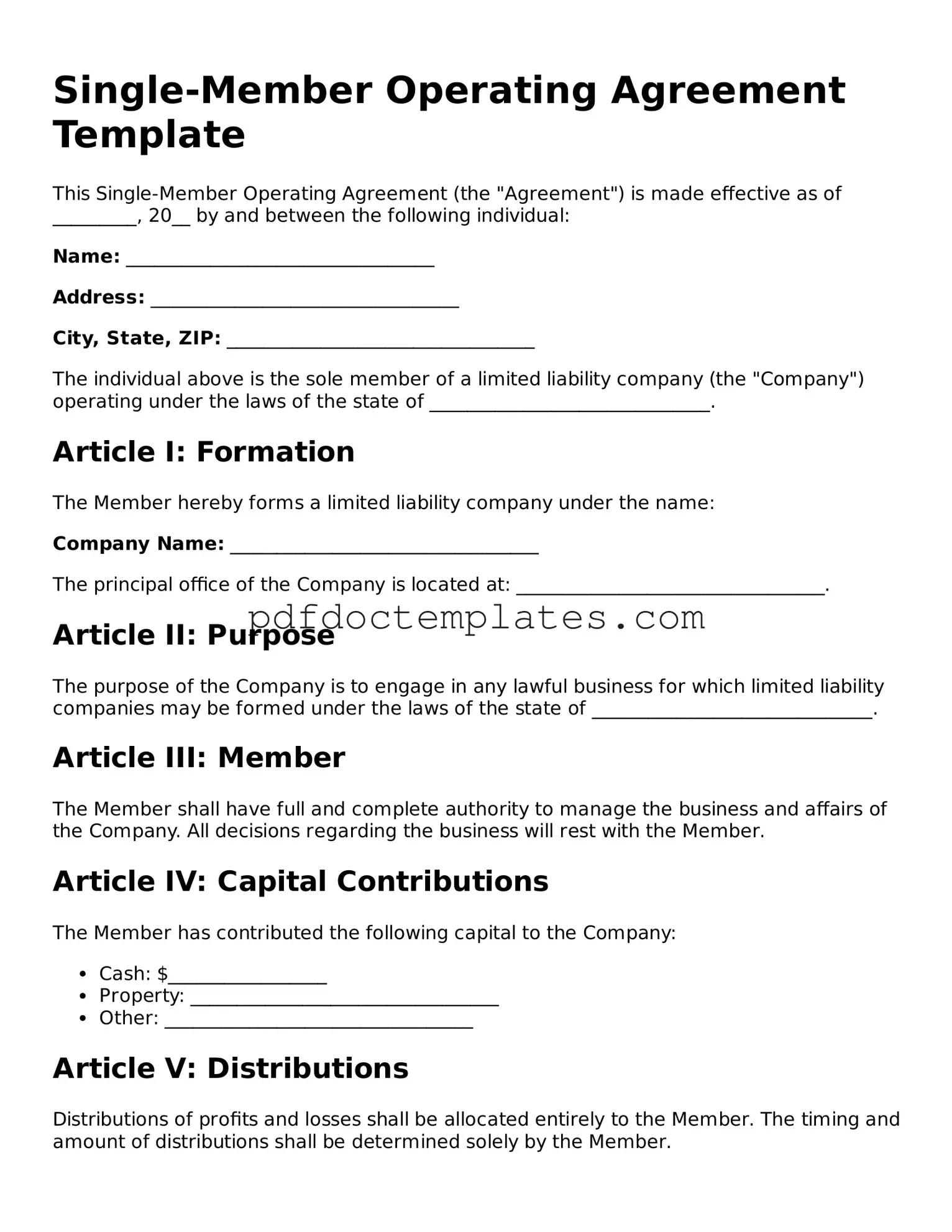

Single-Member Operating Agreement Template

This Single-Member Operating Agreement (the "Agreement") is made effective as of _________, 20__ by and between the following individual:

Name: _________________________________

Address: _________________________________

City, State, ZIP: _________________________________

The individual above is the sole member of a limited liability company (the "Company") operating under the laws of the state of ______________________________.

Article I: Formation

The Member hereby forms a limited liability company under the name:

Company Name: _________________________________

The principal office of the Company is located at: _________________________________.

Article II: Purpose

The purpose of the Company is to engage in any lawful business for which limited liability companies may be formed under the laws of the state of ______________________________.

Article III: Member

The Member shall have full and complete authority to manage the business and affairs of the Company. All decisions regarding the business will rest with the Member.

Article IV: Capital Contributions

The Member has contributed the following capital to the Company:

- Cash: $_________________

- Property: _________________________________

- Other: _________________________________

Article V: Distributions

Distributions of profits and losses shall be allocated entirely to the Member. The timing and amount of distributions shall be determined solely by the Member.

Article VI: Indemnification

The Company shall indemnify the Member to the fullest extent permitted by the laws of the state of ______________________________.

Article VII: Amendments

This Agreement may be amended only in writing and must be signed by the Member.

Article VIII: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the state of ______________________________.

IN WITNESS WHEREOF, the undersigned Member has executed this Agreement as of the date first above written.

Signed: _________________________________

Date: _________________________________