Printable Release of Promissory Note Template

Misconceptions

When it comes to the Release of Promissory Note form, several misconceptions often arise. Understanding these misconceptions can help individuals navigate their financial obligations more effectively. Here are four common misunderstandings:

- Misconception 1: The Release of Promissory Note is unnecessary if the debt is paid off.

- Misconception 2: A verbal agreement suffices in place of the Release of Promissory Note.

- Misconception 3: The Release of Promissory Note is only needed for large loans.

- Misconception 4: Once a Release of Promissory Note is signed, it cannot be revoked.

Many believe that simply paying off a debt means they no longer need a Release of Promissory Note. However, obtaining this release is crucial as it formally documents that the obligation has been satisfied. Without it, the lender may still have claims against the borrower.

Some individuals think that a verbal confirmation of debt repayment is enough. In reality, a written release provides legal protection and clarity for both parties. Verbal agreements can lead to misunderstandings and disputes down the line.

It is a common belief that only significant loans require a formal release. In truth, any promissory note, regardless of the amount, benefits from a release. This ensures that all parties have a clear understanding of their financial relationships.

Some may think that signing a release is the end of the road. However, if there are issues or disputes regarding the release, it can be challenged in court. Understanding the conditions under which a release may be contested is essential for all parties involved.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Release of Promissory Note form is a legal document that signifies the cancellation of a promissory note. |

| Purpose | This form is used to formally acknowledge that a borrower has fulfilled their obligation to repay a loan. |

| Governing Law (California) | In California, the release is governed by the California Civil Code, particularly Sections 1541-1543. |

| Governing Law (Texas) | In Texas, the Texas Business and Commerce Code regulates the release of promissory notes. |

| Required Information | The form typically requires the names of the parties involved, the date of the note, and the amount paid. |

| Signatures | Both the lender and the borrower must sign the document to validate the release. |

| Notarization | In some states, notarization may be required to enhance the form's legal standing. |

| Record Keeping | It is advisable to keep a copy of the release for personal records and future reference. |

| Impact on Credit | Obtaining a release can positively impact the borrower’s credit report by showing that the debt has been settled. |

Key takeaways

When filling out and utilizing the Release of Promissory Note form, several important points should be considered to ensure clarity and effectiveness. Here are key takeaways:

- Understand the Purpose: The form serves to officially release a borrower from the obligation of repaying a promissory note.

- Accurate Information: Ensure all details, such as names, dates, and amounts, are filled out correctly to avoid any misunderstandings.

- Signature Requirement: The release must be signed by the lender to be valid. Without this signature, the release is not enforceable.

- Keep Copies: After the form is completed and signed, retain copies for both parties. This documentation can be important for future reference.

- Consult Legal Advice: If there are any uncertainties regarding the terms or implications of the release, consider seeking legal counsel.

- Notarization: While not always required, having the document notarized can add an extra layer of authenticity.

- Review State Laws: Different states may have specific requirements regarding the release of promissory notes. Familiarize yourself with local regulations.

- Timing Matters: Complete the release promptly after the note has been satisfied to avoid any confusion regarding the borrower’s obligations.

Dos and Don'ts

When filling out a Release of Promissory Note form, it is important to proceed with care. This document serves as a formal acknowledgment that a debt has been paid or that the obligations under the promissory note have been fulfilled. Below are some guidelines to help ensure the process goes smoothly.

- Do ensure all parties are identified clearly. Include the names and addresses of both the lender and the borrower.

- Do provide accurate details of the promissory note. Include the date, amount, and any relevant identifiers associated with the note.

- Do sign and date the form. Both parties should provide their signatures to validate the release.

- Do keep a copy of the completed form. Retain a copy for your records, as it serves as proof of the release.

- Don't leave any sections blank. Ensure all required fields are filled out completely to avoid confusion.

- Don't forget to check for errors. Review the document for any mistakes before finalizing it.

- Don't rush the process. Take your time to ensure everything is accurate and complete.

Common mistakes

-

Incomplete Information: Individuals often fail to provide all necessary details, such as the names of the parties involved, the date of the original promissory note, or the amount owed. This can lead to delays or complications in the release process.

-

Incorrect Signatures: Signatures may be missing or may not match the names listed on the promissory note. This inconsistency can raise questions about the validity of the release.

-

Failure to Date the Form: Not including the date on which the form is signed can create ambiguity. A dated release is essential for establishing a clear timeline of events.

-

Not Including a Notary: Some individuals neglect to have the release notarized when required. A notarized document can provide additional legal protection and verification of the parties' identities.

-

Ignoring State-Specific Requirements: Each state may have unique requirements for the release of a promissory note. Failing to adhere to these specific regulations can render the release ineffective.

What You Should Know About This Form

-

What is a Release of Promissory Note?

A Release of Promissory Note is a document that formally acknowledges that a borrower has repaid their debt under a promissory note. It serves as proof that the lender no longer has any claim to the amount stated in the note.

-

Why do I need a Release of Promissory Note?

This document is important because it protects both the borrower and the lender. For the borrower, it confirms that they have fulfilled their obligation. For the lender, it clears their records and confirms that the debt has been settled.

-

When should I use this form?

You should use the Release of Promissory Note form once the borrower has fully repaid the loan. It’s essential to complete this form immediately to avoid any confusion or disputes in the future.

-

What information do I need to fill out the form?

The form typically requires the following information:

- The names of the borrower and lender

- The date of the original promissory note

- The amount that was borrowed

- The date the loan was repaid

- Any additional terms, if applicable

-

Do I need witnesses or notarization?

While not always required, having the document notarized or signed in the presence of witnesses can add an extra layer of security. This helps verify that both parties agree to the terms and that the document is legitimate.

-

What happens if I don’t get a Release of Promissory Note?

If you don’t obtain this release, the lender may still be able to claim the debt. The borrower might face challenges in proving that the debt has been paid off. It’s best to secure this document to avoid any potential misunderstandings.

-

Can I create my own Release of Promissory Note?

Yes, you can create your own form, but it's important to ensure that it includes all necessary details. Using a template or a legal form designed for this purpose can help ensure that you don’t miss anything important.

-

Is there a fee associated with filing this document?

Typically, there are no fees for simply creating a Release of Promissory Note, but if you choose to have it notarized or filed with a court, there may be associated costs. Always check local regulations for specific requirements.

-

Where should I keep the Release of Promissory Note?

Once completed, both parties should keep a copy of the Release of Promissory Note in a safe place. This ensures that you have proof of the transaction if needed in the future.

Release of Promissory Note Example

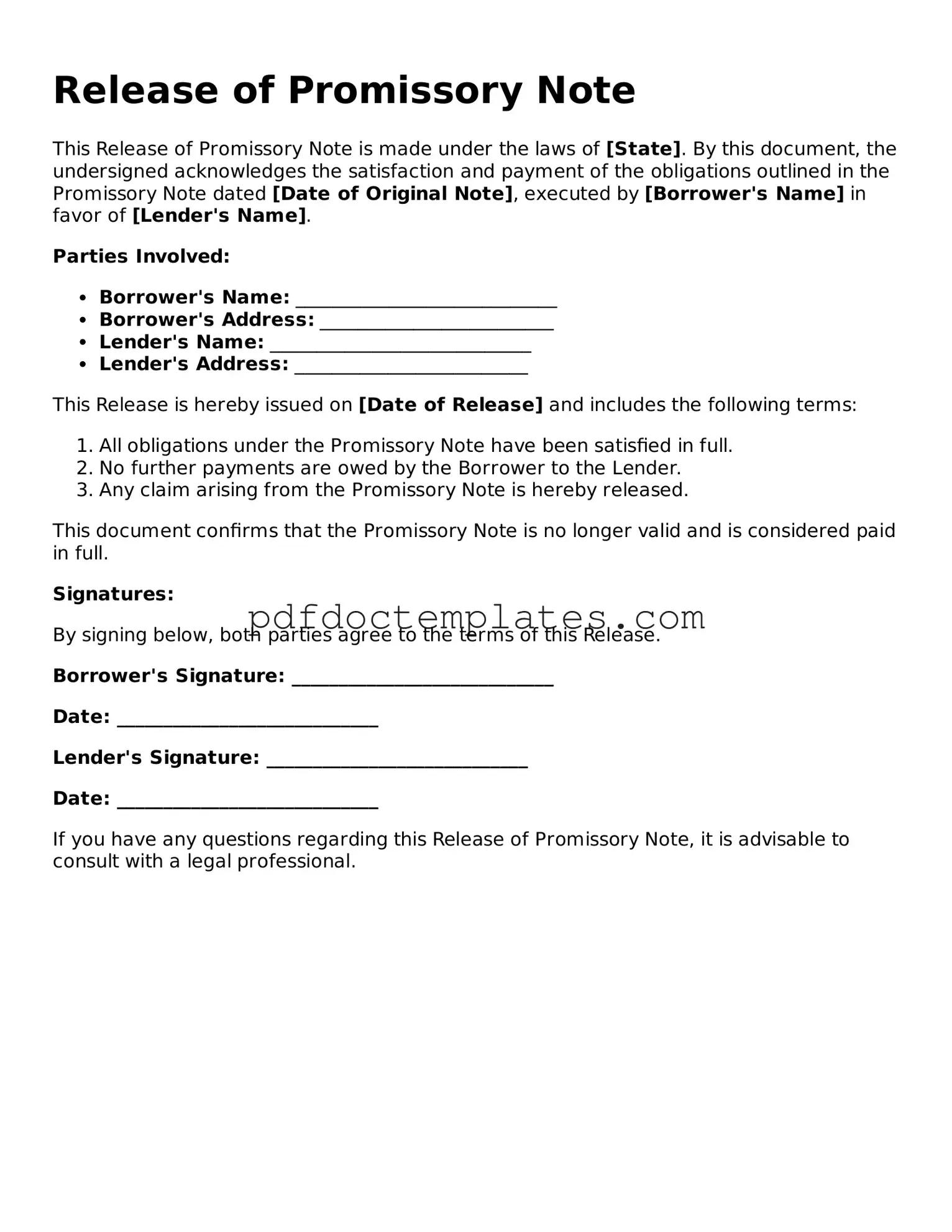

Release of Promissory Note

This Release of Promissory Note is made under the laws of [State]. By this document, the undersigned acknowledges the satisfaction and payment of the obligations outlined in the Promissory Note dated [Date of Original Note], executed by [Borrower's Name] in favor of [Lender's Name].

Parties Involved:

- Borrower's Name: ____________________________

- Borrower's Address: _________________________

- Lender's Name: ____________________________

- Lender's Address: _________________________

This Release is hereby issued on [Date of Release] and includes the following terms:

- All obligations under the Promissory Note have been satisfied in full.

- No further payments are owed by the Borrower to the Lender.

- Any claim arising from the Promissory Note is hereby released.

This document confirms that the Promissory Note is no longer valid and is considered paid in full.

Signatures:

By signing below, both parties agree to the terms of this Release.

Borrower's Signature: ____________________________

Date: ____________________________

Lender's Signature: ____________________________

Date: ____________________________

If you have any questions regarding this Release of Promissory Note, it is advisable to consult with a legal professional.

Different Types of Release of Promissory Note Forms:

Promissory Note Car Loan - Interest rates specified in the note should comply with state regulations.

To create a legally binding document, individuals in New York can utilize the Promissory Note form, which details the obligations of the borrower and lender. It is crucial to include specifics like the repayment terms and interest rates for clarity. For those seeking a reliable template, resources such as NY PDF Forms can be beneficial in ensuring that all necessary components are included to make the agreement enforceable.