Printable Quitclaim Deed Template

Quitclaim Deed - Customized for State

Misconceptions

Many people have misunderstandings about the quitclaim deed form. Here are nine common misconceptions, along with clarifications for each.

-

A quitclaim deed transfers ownership without warranties.

This is true, but it is often misconstrued to mean that it is a risky option. While it does not provide guarantees about the title, it can be a useful tool in specific situations, such as transferring property between family members.

-

Quitclaim deeds are only used in divorce settlements.

While they are commonly utilized in divorce proceedings, quitclaim deeds can also facilitate transfers for various reasons, including estate planning or gifting property.

-

Using a quitclaim deed means the property has no value.

This is a misconception. A quitclaim deed can transfer valuable property. The absence of warranties does not imply a lack of value.

-

All states treat quitclaim deeds the same.

This is incorrect. Each state has its own laws and regulations regarding quitclaim deeds, including how they must be executed and recorded.

-

A quitclaim deed eliminates all claims to the property.

This is misleading. A quitclaim deed transfers whatever interest the grantor has, but it does not eliminate existing claims or liens against the property.

-

Quitclaim deeds are only for individuals.

In reality, businesses and organizations can also use quitclaim deeds to transfer property interests.

-

Quitclaim deeds are complicated legal documents.

While legal documents can be complex, quitclaim deeds are relatively straightforward. They typically require only basic information about the parties and the property.

-

You do not need to record a quitclaim deed.

This is not advisable. Recording the deed is important to establish public notice of the transfer and protect the interests of the new owner.

-

Once a quitclaim deed is signed, it cannot be revoked.

This is inaccurate. A quitclaim deed can be revoked under certain circumstances, such as mutual agreement or specific legal grounds.

Understanding these misconceptions can help individuals make informed decisions regarding property transfers and the use of quitclaim deeds.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership interest in real property from one party to another without any warranties. |

| Primary Use | Commonly used to transfer property between family members or in divorce settlements. |

| Governing Law | Each state has its own laws governing quitclaim deeds. For example, in California, it is governed by the California Civil Code Section 1092. |

| Warranties | Unlike warranty deeds, quitclaim deeds do not guarantee that the grantor has a valid title to the property. |

| Consideration | While consideration (payment) is often required, it can be nominal, such as $1, especially in family transfers. |

| Recording | To ensure public notice of the transfer, the quitclaim deed should be recorded with the local county recorder's office. |

| Revocation | Once executed and delivered, a quitclaim deed generally cannot be revoked without the consent of the grantee. |

| Tax Implications | Property transfers via quitclaim deed may have tax implications, so consulting a tax professional is advisable. |

Key takeaways

When dealing with a Quitclaim Deed form, it is important to understand its purpose and the process involved. Here are some key takeaways to keep in mind:

- Definition: A Quitclaim Deed is a legal document used to transfer ownership of property from one person to another without guaranteeing that the title is clear.

- Parties Involved: The form requires the names of the grantor (the person giving up the interest) and the grantee (the person receiving the interest).

- Property Description: A clear description of the property must be included. This often includes the address and legal description to avoid confusion.

- No Guarantees: Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor has a valid title to the property.

- Use Cases: Common scenarios for using a Quitclaim Deed include transferring property between family members or clearing up title issues.

- Consideration: While not always necessary, it’s common to include a nominal amount of money (like $1) to signify consideration for the transfer.

- Signing Requirements: The document must be signed by the grantor, and some states may require notarization for it to be valid.

- Filing: After completion, the Quitclaim Deed should be filed with the appropriate county office to make the transfer official.

- Consultation: It may be beneficial to consult with a legal professional to ensure that the Quitclaim Deed meets all local requirements and is used appropriately.

Understanding these key points can help ensure a smoother property transfer process when using a Quitclaim Deed.

Dos and Don'ts

When filling out a Quitclaim Deed form, it’s important to approach the task carefully. Here are ten things to keep in mind, including both what to do and what to avoid.

- Do clearly identify the property being transferred. Include the full legal description.

- Don't leave any fields blank. Incomplete forms can lead to complications.

- Do include the names of all parties involved in the transaction. This ensures clarity in ownership.

- Don't forget to sign the form in front of a notary. A notarized signature is often required for validity.

- Do check local requirements. Some states have specific rules for Quitclaim Deeds.

- Don't use vague language. Be precise in your wording to avoid misunderstandings.

- Do provide the date of the transfer. This is essential for record-keeping.

- Don't forget to file the deed with the appropriate county office. This step is crucial for public record.

- Do consult with a legal professional if you have questions. Getting expert advice can prevent errors.

- Don't rush the process. Take your time to ensure everything is filled out correctly.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a complete and accurate description of the property. This includes not including the correct address, legal description, or parcel number. Such errors can lead to confusion or disputes over property ownership.

-

Missing Signatures: All parties involved in the transfer must sign the Quitclaim Deed. Sometimes, individuals overlook the need for all necessary signatures, which can invalidate the document.

-

Not Notarizing the Document: A Quitclaim Deed typically requires notarization to be legally binding. Failing to have the document notarized can result in issues with acceptance during the recording process.

-

Improper Execution: The deed must be executed correctly according to state laws. Mistakes in the execution process, such as not following the required format or not including the date, can render the deed ineffective.

-

Ignoring State-Specific Requirements: Each state may have specific requirements for Quitclaim Deeds. Not being aware of these can lead to non-compliance, potentially affecting the validity of the deed.

What You Should Know About This Form

-

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. Unlike other types of deeds, it does not guarantee that the person transferring the property has clear title to it. Instead, the grantor (the person giving up their interest) simply relinquishes their rights to the property, if any exist.

-

When should I use a Quitclaim Deed?

Quitclaim Deeds are commonly used in specific situations, such as:

- Transferring property between family members, like in a divorce or inheritance.

- Clearing up title issues when a property owner wants to remove a name from the title.

- Transferring property into a trust.

It is important to note that a Quitclaim Deed is not suitable for sales or transactions where the buyer requires a guarantee of clear title.

-

What information is needed to complete a Quitclaim Deed?

To fill out a Quitclaim Deed, you will need the following information:

- The full names and addresses of the grantor and grantee.

- A description of the property being transferred, including the address and legal description.

- The date of the transfer.

- The signature of the grantor, and in some states, a witness or notary public may be required.

-

Do I need to record a Quitclaim Deed?

While it is not mandatory to record a Quitclaim Deed, doing so is highly recommended. Recording the deed with the local county recorder's office provides public notice of the transfer and helps protect the grantee's rights to the property. It also helps to establish a clear chain of title, which is important for any future transactions involving the property.

-

Are there any tax implications associated with a Quitclaim Deed?

There may be tax implications when using a Quitclaim Deed, depending on the circumstances of the transfer. In some cases, such as transferring property between spouses or as a gift, there may be no tax consequences. However, it is advisable to consult a tax professional to understand any potential capital gains taxes or gift taxes that may apply.

-

Can a Quitclaim Deed be revoked?

A Quitclaim Deed, once executed and recorded, is generally considered final and cannot be revoked unilaterally. If the grantor wishes to regain ownership, they would need to execute another legal document, such as a new deed, to transfer the property back. Legal advice may be necessary to navigate this process, especially in more complex situations.

Quitclaim Deed Example

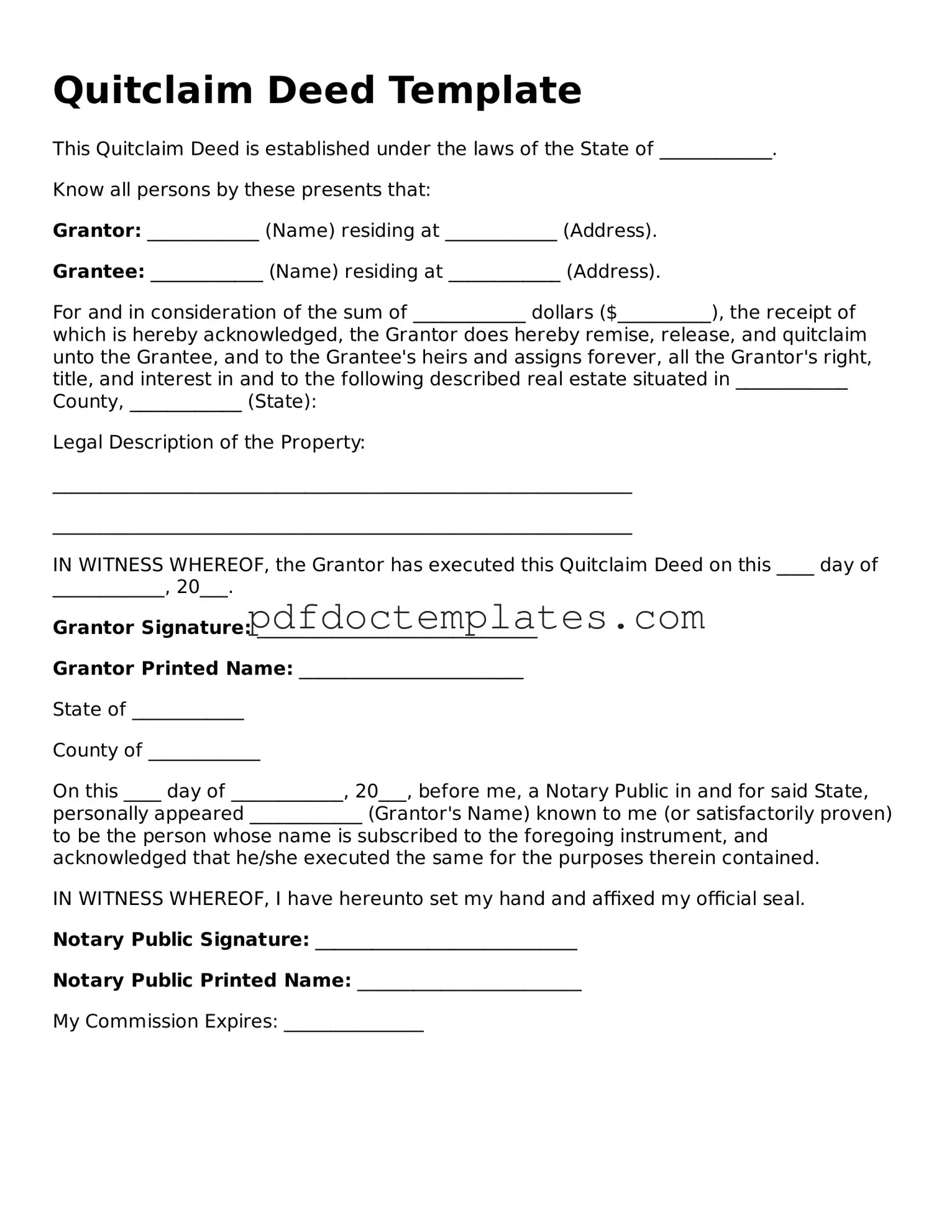

Quitclaim Deed Template

This Quitclaim Deed is established under the laws of the State of ____________.

Know all persons by these presents that:

Grantor: ____________ (Name) residing at ____________ (Address).

Grantee: ____________ (Name) residing at ____________ (Address).

For and in consideration of the sum of ____________ dollars ($__________), the receipt of which is hereby acknowledged, the Grantor does hereby remise, release, and quitclaim unto the Grantee, and to the Grantee's heirs and assigns forever, all the Grantor's right, title, and interest in and to the following described real estate situated in ____________ County, ____________ (State):

Legal Description of the Property:

______________________________________________________________

______________________________________________________________

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed on this ____ day of ____________, 20___.

Grantor Signature: ______________________________

Grantor Printed Name: ________________________

State of ____________

County of ____________

On this ____ day of ____________, 20___, before me, a Notary Public in and for said State, personally appeared ____________ (Grantor's Name) known to me (or satisfactorily proven) to be the person whose name is subscribed to the foregoing instrument, and acknowledged that he/she executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I have hereunto set my hand and affixed my official seal.

Notary Public Signature: ____________________________

Notary Public Printed Name: ________________________

My Commission Expires: _______________

Different Types of Quitclaim Deed Forms:

Deed in Lieu of Foreclosure Sample - The Deed in Lieu can sometimes be part of a larger workout or loan modification plan initiated by the borrower.

The New York Articles of Incorporation form serves as a foundational legal document for establishing a corporation in the state of New York. It outlines the basic details required by the state for a company to be officially registered. These details include the corporation's name, its purpose, the office address, and information about its incorporators. For those looking to simplify this process, resources such as All New York Forms can be invaluable.

California Corrective Deed - The effects of a Corrective Deed can be immediate and impactful on ownership clarity.