Printable Promissory Note for a Car Template

Misconceptions

Understanding the Promissory Note for a Car is essential for anyone involved in vehicle financing. However, several misconceptions can lead to confusion. Here are ten common misconceptions explained:

- It is the same as a car loan agreement. A promissory note is a standalone document that outlines the borrower's promise to repay a loan. In contrast, a car loan agreement includes additional terms and conditions related to the financing arrangement.

- It only benefits the lender. While the lender has protections, the borrower also benefits. The note clearly outlines repayment terms, which can help the borrower understand their obligations.

- Signing a promissory note means you own the car. Signing this note does not transfer ownership. Ownership is determined by the title of the vehicle, which may remain with the lender until the loan is paid off.

- It cannot be modified. Promissory notes can be modified if both parties agree. Changes should be documented in writing to ensure clarity and enforceability.

- It is not legally binding. A properly executed promissory note is a legally binding document. Failure to adhere to its terms can result in legal consequences for the borrower.

- Only banks issue promissory notes. Any lender, including individuals or credit unions, can issue a promissory note for a car loan. It is not limited to traditional banking institutions.

- It does not require a witness or notary. While not always necessary, having a witness or notary can add an extra layer of legitimacy and protection to the document.

- It is a simple document with no legal implications. The promissory note contains specific terms that can have significant legal implications, including interest rates and repayment schedules.

- All promissory notes are the same. Promissory notes can vary widely in terms, conditions, and legal language. Each one should be tailored to the specific agreement between the parties involved.

- Once signed, you cannot back out. While it is challenging to back out of a signed promissory note, options may exist. Legal advice can help explore potential remedies or renegotiation possibilities.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specific amount of money for the purchase of a vehicle. |

| Parties Involved | The note typically involves two parties: the borrower (buyer) and the lender (seller or financial institution). |

| Payment Terms | It outlines the payment schedule, including the amount, frequency, and due dates for payments. |

| Interest Rate | The document specifies the interest rate applied to the loan, which can be fixed or variable. |

| Governing Law | The laws governing the promissory note vary by state. For example, in California, it falls under the California Commercial Code. |

| Default Clause | The note includes terms for what happens if the borrower fails to make payments on time. |

| Collateral | The car itself often serves as collateral, meaning the lender can repossess it if payments are not made. |

| Signatures | Both parties must sign the note for it to be legally binding, indicating their agreement to the terms. |

Key takeaways

Filling out a Promissory Note for a Car can seem daunting, but it’s essential for both the buyer and seller. Here are some key takeaways to keep in mind:

- Understand the Purpose: A promissory note is a legal document that outlines the agreement between the buyer and seller regarding the car loan.

- Identify the Parties: Clearly state the names and addresses of both the buyer and seller. This helps avoid confusion later on.

- Detail the Loan Amount: Specify the total amount being borrowed. This should match the agreed-upon price of the car.

- Set the Interest Rate: If applicable, include the interest rate. This affects how much the buyer will ultimately pay back.

- Establish Payment Terms: Outline how and when payments will be made. Include details like the due date and payment frequency.

- Include Late Fees: Specify any penalties for late payments. This encourages timely payments and protects the seller.

- Signatures Matter: Both parties must sign the document for it to be legally binding. Ensure that all signatures are dated.

- Keep Copies: After signing, both parties should keep a copy of the promissory note for their records. This is crucial for future reference.

By following these guidelines, you can ensure that the promissory note serves its purpose effectively and protects the interests of both the buyer and the seller.

Dos and Don'ts

When filling out the Promissory Note for a Car form, it's important to be thorough and accurate. Here are some key dos and don'ts to keep in mind:

- Do read the entire form carefully before starting. Understanding each section will help you avoid mistakes.

- Do provide accurate information about the loan amount and interest rate. This ensures clarity and prevents future disputes.

- Do sign and date the form in the appropriate sections. Your signature is essential for the document to be legally binding.

- Do keep a copy of the completed form for your records. Having a reference can be helpful if questions arise later.

- Don't rush through the form. Taking your time can help you catch errors before they become an issue.

- Don't leave any required fields blank. Missing information can invalidate the note.

- Don't use white-out or make significant changes. This can raise questions about the document's authenticity.

- Don't forget to review the terms of the loan before signing. Ensure you fully understand your obligations.

Common mistakes

-

Inaccurate Personal Information: Many individuals forget to double-check their name, address, and contact details. This information must be accurate to avoid complications later on.

-

Missing Loan Amount: Some people neglect to specify the exact amount they are borrowing. Clearly stating this amount is crucial for both parties involved.

-

Not Including Interest Rate: Failing to indicate the interest rate can lead to misunderstandings. It's important to agree on this figure upfront.

-

Omitting Payment Schedule: A common mistake is not outlining when payments are due. This schedule helps both the borrower and lender keep track of obligations.

-

Ignoring Late Fees: Some individuals overlook including terms for late payments. Specifying these fees can encourage timely payments and protect the lender's interests.

-

Not Signing the Document: It may seem obvious, but forgetting to sign the promissory note is a frequent error. Without signatures, the agreement holds no legal weight.

-

Failing to Date the Note: Not including the date can create confusion about when the agreement was made. Always ensure the date is clearly stated.

-

Overlooking Collateral Details: If the car is being used as collateral, this must be explicitly mentioned. Clarity on collateral protects both parties in case of default.

-

Not Keeping Copies: After filling out the form, some forget to make copies for their records. Retaining a copy is essential for future reference and accountability.

What You Should Know About This Form

-

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document in which one party (the borrower) agrees to pay a specific amount of money to another party (the lender) for the purchase of a vehicle. This note outlines the terms of the loan, including the interest rate, repayment schedule, and any penalties for late payments.

-

Why do I need a Promissory Note?

This document serves as a written record of the loan agreement. It protects both the borrower and the lender by clearly defining the terms and conditions. In case of a dispute, having a Promissory Note can provide evidence of the agreement and the obligations of each party.

-

What information should be included in the Promissory Note?

A comprehensive Promissory Note should include:

- The names and addresses of both the borrower and lender

- The amount being borrowed

- The interest rate and how it is calculated

- The repayment schedule, including due dates

- Any late fees or penalties for missed payments

- Consequences of defaulting on the loan

- Signatures of both parties

-

Can I customize the Promissory Note?

Yes, you can customize the Promissory Note to fit your specific needs. However, it is essential to ensure that all necessary legal elements are included and that the terms are clear and enforceable. Consulting with a legal professional may be beneficial to ensure compliance with local laws.

-

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding. Both parties must sign the document, and it should reflect a mutual agreement. If one party fails to uphold their end of the agreement, the other party may have legal recourse to recover the owed amount.

-

What happens if I miss a payment?

If a payment is missed, the lender may impose penalties as outlined in the Promissory Note. This could include late fees or increased interest rates. Additionally, the lender may have the right to take further action, such as initiating a collection process or pursuing legal action, depending on the terms of the agreement.

-

Can the terms of the Promissory Note be changed?

Yes, the terms can be changed if both parties agree to the modifications. It is crucial to document any changes in writing and have both parties sign the amended agreement to ensure clarity and enforceability.

-

Do I need a witness or notarization for the Promissory Note?

While it is not always required, having a witness or notarizing the Promissory Note can add an extra layer of protection. This can help verify the identities of the parties involved and confirm that both parties willingly entered into the agreement.

-

Where can I obtain a Promissory Note template?

Promissory Note templates can be found online through various legal websites, or you may consult with a legal professional to create a customized document. Ensure that any template you choose complies with your state’s laws and meets your specific needs.

Promissory Note for a Car Example

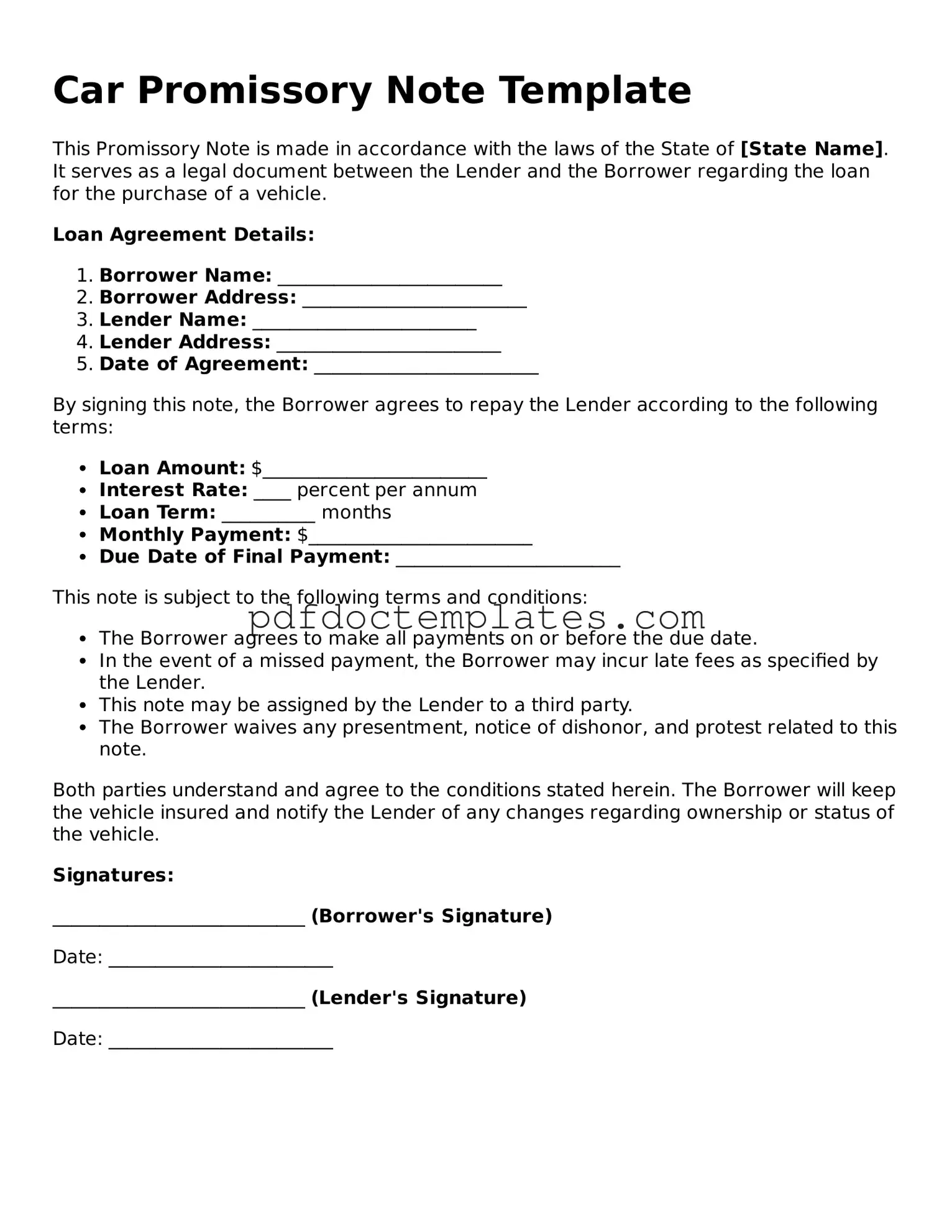

Car Promissory Note Template

This Promissory Note is made in accordance with the laws of the State of [State Name]. It serves as a legal document between the Lender and the Borrower regarding the loan for the purchase of a vehicle.

Loan Agreement Details:

- Borrower Name: ________________________

- Borrower Address: ________________________

- Lender Name: ________________________

- Lender Address: ________________________

- Date of Agreement: ________________________

By signing this note, the Borrower agrees to repay the Lender according to the following terms:

- Loan Amount: $________________________

- Interest Rate: ____ percent per annum

- Loan Term: __________ months

- Monthly Payment: $________________________

- Due Date of Final Payment: ________________________

This note is subject to the following terms and conditions:

- The Borrower agrees to make all payments on or before the due date.

- In the event of a missed payment, the Borrower may incur late fees as specified by the Lender.

- This note may be assigned by the Lender to a third party.

- The Borrower waives any presentment, notice of dishonor, and protest related to this note.

Both parties understand and agree to the conditions stated herein. The Borrower will keep the vehicle insured and notify the Lender of any changes regarding ownership or status of the vehicle.

Signatures:

___________________________ (Borrower's Signature)

Date: ________________________

___________________________ (Lender's Signature)

Date: ________________________

Different Types of Promissory Note for a Car Forms:

Release and Satisfaction of Promissory Note - This document eliminates the need for further financial obligations under the note.

For those seeking to understand the legal requirements, the New York Promissory Note is an indispensable resource that outlines the obligations of borrowers and lenders alike. You can find a useful template for your Promissory Note needs that simplifies the process of drafting this important document.