Printable Promissory Note Template

Promissory Note - Customized for State

Promissory Note Subtypes

Misconceptions

Understanding promissory notes is essential for anyone dealing with loans or financial agreements. However, several misconceptions can cloud this understanding. Here are five common misconceptions about promissory notes:

- All promissory notes are the same. In reality, promissory notes can vary widely in terms of terms, conditions, and legal requirements. Some may be simple agreements, while others can be complex and detailed.

- Promissory notes are only used for large loans. Many people think that promissory notes are reserved for significant financial transactions. However, they can also be used for smaller loans between friends or family members.

- A promissory note guarantees repayment. While a promissory note is a formal promise to pay, it does not guarantee that the borrower will repay the loan. If the borrower defaults, the lender may need to pursue legal action to recover the funds.

- You don’t need to have a written promissory note. Some believe that verbal agreements are sufficient. However, having a written promissory note is crucial for clarity and legal enforceability.

- Promissory notes are only for personal loans. This is a common belief, but promissory notes are also frequently used in business transactions, such as financing a purchase or securing a loan for business operations.

By addressing these misconceptions, individuals can better navigate the complexities of financial agreements and make informed decisions regarding promissory notes.

Form Properties

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a defined time. |

| Parties Involved | Typically, there are two parties: the borrower (maker) who promises to pay, and the lender (payee) who receives the payment. |

| Governing Law | In the United States, promissory notes are governed by the Uniform Commercial Code (UCC), which varies slightly by state. |

| Interest Rates | The note can specify an interest rate, which may be fixed or variable, affecting the total repayment amount. |

| Enforceability | A promissory note is legally enforceable if it meets certain criteria, including clear terms and signatures of both parties. |

| Default Consequences | If the borrower fails to repay, the lender may take legal action to recover the owed amount, potentially including interest and fees. |

Key takeaways

Here are some key takeaways about filling out and using the Promissory Note form:

- Understand the Purpose: A promissory note is a legal document that outlines a borrower's promise to repay a loan under specific terms.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender.

- Specify the Loan Amount: Indicate the exact amount of money being borrowed, ensuring it is accurate.

- Detail the Interest Rate: Include the interest rate, whether it is fixed or variable, and how it will be calculated.

- Set Repayment Terms: Outline the repayment schedule, including due dates and the total duration of the loan.

- Include Late Fees: Specify any penalties for late payments to encourage timely repayment.

- Consider Collateral: If applicable, mention any collateral that secures the loan, providing additional protection for the lender.

- Signatures Required: Ensure both parties sign and date the document to make it legally binding.

- Keep Copies: Both the borrower and lender should retain copies of the signed promissory note for their records.

Dos and Don'ts

When filling out a Promissory Note form, attention to detail is crucial. Here are some essential dos and don'ts to guide you through the process:

- Do ensure all parties involved are clearly identified, including full names and addresses.

- Do specify the loan amount in both numerical and written form to avoid confusion.

- Do outline the repayment terms, including the interest rate and payment schedule.

- Do include any conditions or contingencies that may affect the loan agreement.

- Don't leave any blank spaces on the form; incomplete information can lead to disputes.

- Don't use vague language; clarity is key in legal documents.

- Don't forget to date the document; an undated note can complicate matters later.

- Don't overlook the need for signatures from all parties; without them, the agreement may not be enforceable.

By following these guidelines, you can create a clear and effective Promissory Note that serves its intended purpose.

Common mistakes

-

Missing Borrower Information: Failing to provide complete details about the borrower, such as their full name, address, and contact information, can lead to confusion later on.

-

Incorrect Loan Amount: Entering the wrong amount for the loan can create disputes. Double-check the figures to ensure accuracy.

-

Not Specifying Interest Rate: Omitting the interest rate or leaving it blank can result in misunderstandings regarding repayment terms.

-

Vague Repayment Terms: Failing to clearly outline the repayment schedule, including due dates and payment amounts, can lead to complications in the future.

-

Neglecting Signatures: Forgetting to sign the document or to obtain the necessary signatures from all parties involved can render the note invalid.

-

Not Including a Default Clause: Leaving out terms that address what happens in the event of default can leave both parties unprotected.

-

Failure to Keep Copies: Not retaining a copy of the signed Promissory Note for personal records can lead to issues if disputes arise later.

What You Should Know About This Form

-

What is a Promissory Note?

A Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a particular time or on demand. It serves as a legal document that outlines the terms of the loan, including the amount borrowed, interest rate, and repayment schedule.

-

Who uses a Promissory Note?

Individuals and businesses commonly use Promissory Notes. They can be used in various situations, such as personal loans between friends or family, business loans, or any situation where one party lends money to another.

-

What information is included in a Promissory Note?

A typical Promissory Note includes:

- The names and addresses of the borrower and lender

- The principal amount of the loan

- The interest rate, if applicable

- The repayment schedule, including due dates

- Any collateral securing the loan

- Signatures of both parties

-

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding document. Once signed by both parties, it creates an obligation for the borrower to repay the loan according to the agreed-upon terms. If the borrower fails to repay, the lender may take legal action to recover the owed amount.

-

Do I need a lawyer to create a Promissory Note?

No, you do not necessarily need a lawyer to create a Promissory Note. Many templates are available online that you can use to draft your own note. However, if the loan amount is significant or if you have specific concerns, consulting with a legal professional may be beneficial.

-

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is important to document any modifications in writing and have both parties sign the updated note to ensure that it remains legally enforceable.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has several options. They may choose to negotiate a new repayment plan, pursue legal action to recover the debt, or, if applicable, seize any collateral specified in the note. It is crucial for lenders to understand their rights and options in such situations.

-

Can a Promissory Note be transferred to another party?

Yes, a Promissory Note can typically be transferred or sold to another party, unless the original note specifically states otherwise. The new holder of the note assumes the rights to collect payments under the terms of the original agreement.

-

Is a Promissory Note the same as a loan agreement?

While both documents serve similar purposes, they are not the same. A Promissory Note focuses on the borrower's promise to repay the loan, while a loan agreement is a more comprehensive document that outlines the terms of the loan, including conditions, covenants, and rights of both parties.

Promissory Note Example

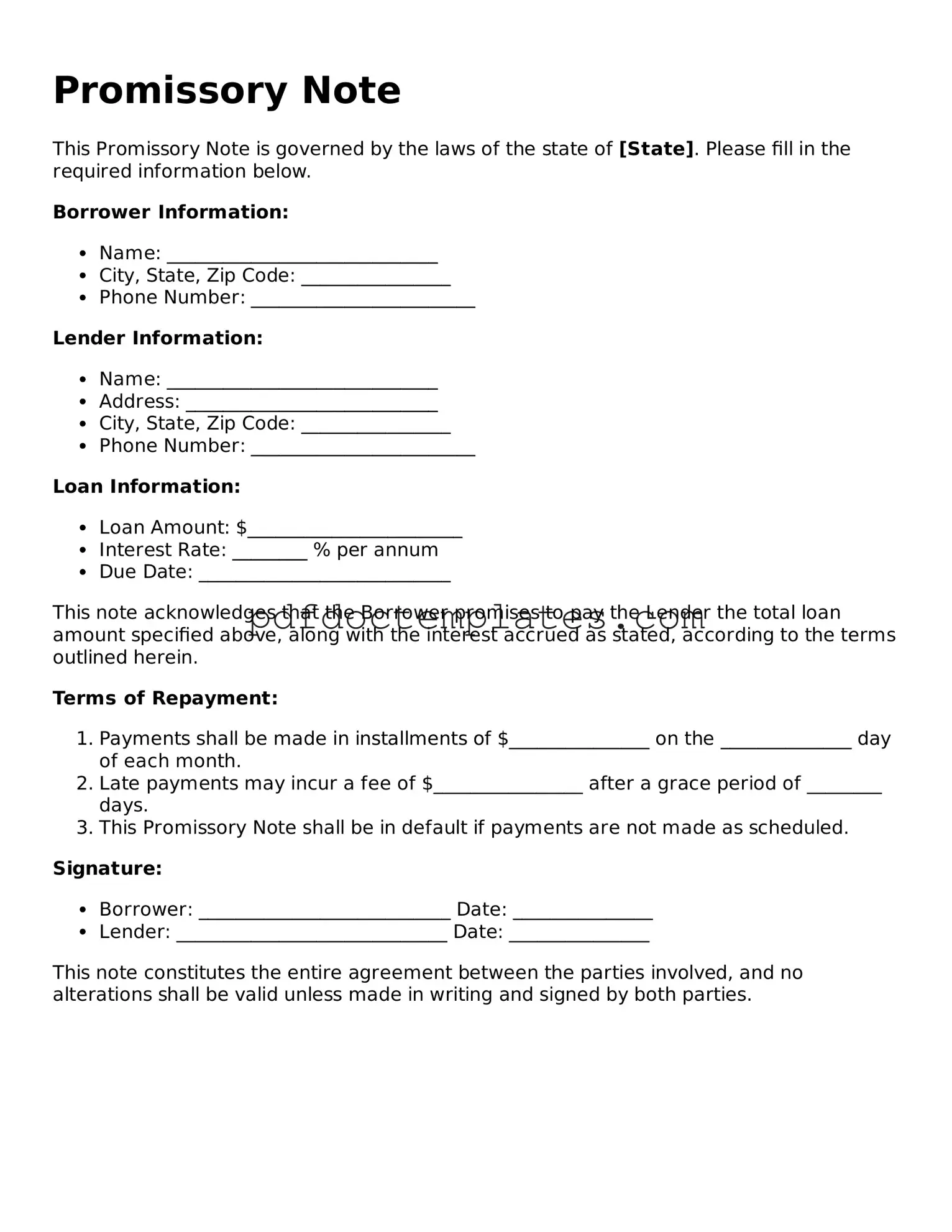

Promissory Note

This Promissory Note is governed by the laws of the state of [State]. Please fill in the required information below.

Borrower Information:

- Name: _____________________________

- City, State, Zip Code: ________________

- Phone Number: ________________________

Lender Information:

- Name: _____________________________

- Address: ___________________________

- City, State, Zip Code: ________________

- Phone Number: ________________________

Loan Information:

- Loan Amount: $_______________________

- Interest Rate: ________ % per annum

- Due Date: ___________________________

This note acknowledges that the Borrower promises to pay the Lender the total loan amount specified above, along with the interest accrued as stated, according to the terms outlined herein.

Terms of Repayment:

- Payments shall be made in installments of $_______________ on the ______________ day of each month.

- Late payments may incur a fee of $________________ after a grace period of ________ days.

- This Promissory Note shall be in default if payments are not made as scheduled.

Signature:

- Borrower: ___________________________ Date: _______________

- Lender: _____________________________ Date: _______________

This note constitutes the entire agreement between the parties involved, and no alterations shall be valid unless made in writing and signed by both parties.

Find Other Forms

Form I-134 - Completing an I-134 is a good way to formally welcome your loved ones into the country.

The New York Articles of Incorporation form serves as a foundational legal document for establishing a corporation in the state of New York. It outlines the basic details required by the state for a company to be officially registered. These details include the corporation's name, its purpose, the office address, and information about its incorporators, which can be found in resources like All New York Forms.

Identity Affidavit - The form's purpose is to simplify identity verification for individuals.