Download Profit And Loss Template

Misconceptions

Understanding the Profit and Loss (P&L) form is essential for anyone managing a business. However, several misconceptions can lead to confusion. Here’s a list of ten common misunderstandings regarding the Profit and Loss form, along with explanations to clarify them.

- The P&L form only shows income. Many believe that the P&L form is solely about income. In reality, it provides a complete picture by detailing both income and expenses, allowing for a better understanding of overall profitability.

- It's the same as a balance sheet. Some people think the P&L form and balance sheet are interchangeable. While both are important financial statements, the P&L focuses on performance over a specific period, whereas the balance sheet provides a snapshot of assets and liabilities at a single point in time.

- Only large businesses need a P&L form. This is a common misconception. Small businesses and even freelancers can benefit from using a P&L form to track their financial performance and make informed decisions.

- All expenses are the same. Not all expenses are treated equally on a P&L form. Expenses can be categorized as fixed or variable, and understanding this distinction is crucial for effective financial planning.

- Profit is the same as cash flow. Many people confuse profit with cash flow. Profit indicates how much money a business makes after expenses, while cash flow reflects the actual cash moving in and out of the business.

- The P&L form is only for accountants. While accountants often prepare these forms, anyone can create and use a P&L. Business owners can gain valuable insights by understanding and analyzing their P&L statement.

- Once completed, the P&L form doesn't need to be revisited. Some think that a P&L form is a one-time task. In fact, it should be regularly updated to reflect ongoing financial activity and to help in decision-making.

- Only revenue matters on the P&L form. Revenue is important, but expenses also play a critical role. High expenses can negate revenue, leading to losses, so both sides of the equation must be analyzed.

- The P&L form is only useful for tax purposes. While it can help during tax season, the P&L form serves broader purposes. It aids in budgeting, forecasting, and assessing overall business health.

- All P&L forms look the same. There is no one-size-fits-all P&L form. Different businesses may have varying formats and categories based on their specific needs and industry standards.

By addressing these misconceptions, business owners can better utilize the Profit and Loss form to enhance their financial understanding and drive their success.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Profit and Loss form summarizes revenues, costs, and expenses over a specific period, providing insight into a business's financial performance. |

| Purpose | This form is used to assess profitability, inform decision-making, and support financial reporting for stakeholders. |

| Components | Key components include total revenue, cost of goods sold, gross profit, operating expenses, and net income. |

| Frequency | Profit and Loss forms can be prepared monthly, quarterly, or annually, depending on the business's needs and reporting requirements. |

| State-Specific Forms | Some states may require specific formats or additional disclosures. For example, California businesses must comply with the California Corporations Code. |

| Tax Implications | The information on the Profit and Loss form is critical for tax reporting and may impact a business's tax obligations. |

| Analysis Tool | It serves as a vital tool for financial analysis, helping identify trends and areas for improvement within the business. |

Key takeaways

Understanding the Profit and Loss (P&L) form is essential for managing your business finances effectively. Here are some key takeaways to consider when filling out and using this important financial document:

- Purpose of the P&L: The Profit and Loss form provides a summary of your business's revenues and expenses over a specific period, allowing you to assess profitability.

- Revenue Recognition: Accurately record all sources of income. This includes sales, services, and any other revenue-generating activities.

- Expense Tracking: Categorize expenses into fixed and variable costs. This helps in understanding where your money is going and managing costs effectively.

- Time Frame: Choose a consistent time frame for your P&L statements, such as monthly, quarterly, or annually. Consistency is key for accurate comparisons.

- Net Profit Calculation: Subtract total expenses from total revenues to determine your net profit. This figure is crucial for evaluating your business's financial health.

- Comparative Analysis: Regularly compare your P&L statements over different periods. This helps identify trends and areas for improvement.

- Use for Decision Making: Leverage the insights gained from your P&L to make informed decisions about budgeting, investments, and operational adjustments.

- Tax Preparation: Keep your P&L organized and accurate, as it is often required for tax filings and can significantly impact your tax liability.

- Seek Professional Help: If you find the P&L form complex, consider consulting with a financial advisor or accountant to ensure accuracy.

- Regular Updates: Update your P&L regularly to reflect the most current financial situation. This practice ensures you have the latest information at your fingertips.

By keeping these takeaways in mind, you can effectively utilize the Profit and Loss form to enhance your business's financial management.

Dos and Don'ts

When filling out the Profit and Loss form, it's essential to follow best practices to ensure accuracy and compliance. Here are some important dos and don’ts:

- Do review your financial records thoroughly before starting.

- Do use consistent terminology and categories for income and expenses.

- Do ensure all figures are accurate and backed by documentation.

- Do keep the form organized and easy to read.

- Don’t omit any sources of income or expense.

- Don’t rush through the process; take your time to avoid errors.

Following these guidelines will help you create a clear and accurate Profit and Loss statement.

Common mistakes

-

Neglecting to categorize expenses properly: Many individuals fail to classify expenses accurately. This can lead to confusion and misrepresentation of financial health.

-

Forgetting to include all income sources: Some people overlook additional income streams, which skews the overall profit calculation.

-

Using estimates instead of actual figures: Relying on approximations can result in inaccuracies. It's crucial to use real numbers for a true financial picture.

-

Not updating the form regularly: Failing to keep the Profit and Loss form current can lead to outdated information, affecting decision-making.

-

Overlooking one-time expenses: Some individuals forget to account for non-recurring costs, which can impact profitability assessments.

-

Ignoring tax implications: Taxes play a significant role in net profit. Not considering them can lead to an incomplete understanding of financial performance.

-

Mixing personal and business finances: Combining these can create confusion and make it difficult to assess the true profitability of the business.

-

Failing to review and analyze the results: Simply filling out the form is not enough. Regular analysis helps identify trends and areas for improvement.

What You Should Know About This Form

-

What is a Profit and Loss form?

A Profit and Loss form, often referred to as a P&L statement, is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period. This form helps businesses understand their financial performance and profitability over time.

-

Why is a Profit and Loss form important?

The Profit and Loss form is crucial for several reasons:

- It provides insights into the company's financial health.

- It helps in identifying trends in revenue and expenses.

- It is often required for tax purposes and when applying for loans.

- It aids in making informed business decisions.

-

How often should a Profit and Loss form be prepared?

Typically, businesses prepare Profit and Loss forms on a monthly, quarterly, or annual basis. The frequency depends on the size of the business and its financial needs. Regular updates allow for better tracking of financial performance and timely decision-making.

-

What information is included in a Profit and Loss form?

A standard Profit and Loss form includes the following sections:

- Revenue: Total income generated from sales or services.

- Cost of Goods Sold (COGS): Direct costs associated with producing goods sold.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Costs not directly tied to production, such as rent, utilities, and salaries.

- Net Profit: The final profit after all expenses have been deducted from gross profit.

-

How can I use the Profit and Loss form to improve my business?

You can use the Profit and Loss form to identify areas where costs can be cut or revenues increased. By analyzing trends, you can make strategic decisions about pricing, marketing, and resource allocation. Regularly reviewing this document can lead to better financial planning and growth.

-

What should I do if my Profit and Loss form shows a loss?

If your Profit and Loss form shows a loss, don’t panic. Start by reviewing your expenses and identifying areas where you can reduce costs. Consider strategies to increase revenue, such as expanding your product line or improving marketing efforts. Consulting with a financial advisor can also provide valuable insights and help you develop a recovery plan.

Profit And Loss Example

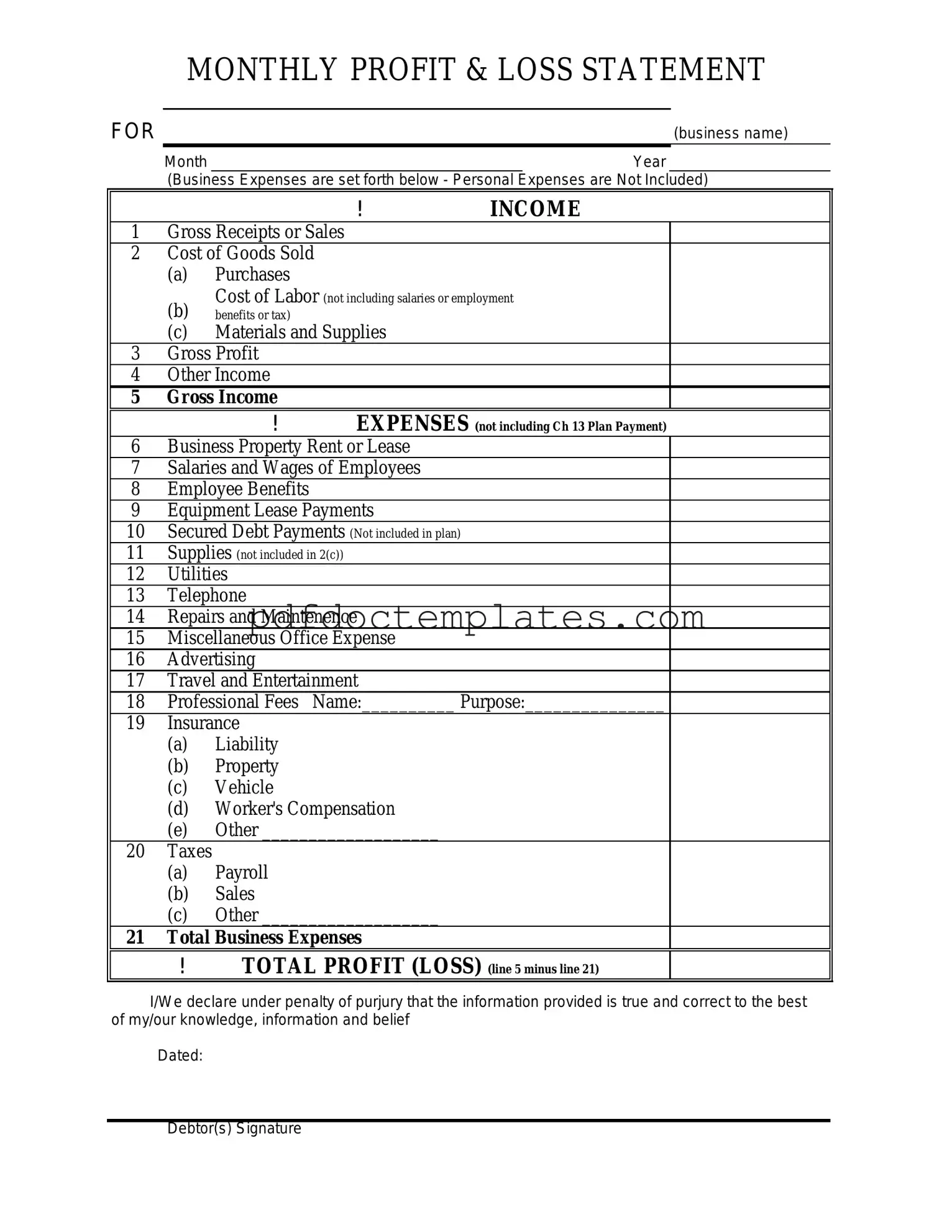

MONTHLY PROFIT & LOSS STATEMENT

FOR |

(business name) |

Month |

Year |

(Business Expenses are set forth below - Personal Expenses are Not Included)

|

|

|

! |

INCOME |

1 |

Gross Receipts or Sales |

|

||

2 |

Cost of Goods Sold |

|

||

|

(a) |

Purchases |

|

|

|

(b) |

Cost of Labor (not including salaries or employment |

||

|

benefits or tax) |

|

|

|

|

(c) |

Materials and Supplies |

|

|

3 |

Gross Profit |

|

|

|

4 |

Other Income |

|

|

|

5 |

Gross Income |

EXPENSES (not including Ch 13 Plan Payment) |

||

|

|

! |

||

6 |

Business Property Rent or Lease |

|

||

7 |

Salaries and Wages of Employees |

|

||

8 |

Employee Benefits |

|

|

|

9 |

Equipment Lease Payments |

|

||

10 |

Secured Debt Payments (Not included in plan) |

|

||

11 |

Supplies (not included in 2(c)) |

|

||

12 |

Utilities |

|

|

|

13 |

Telephone |

|

|

|

14 |

Repairs and Maintenence |

|

||

15 |

Miscellaneous Office Expense |

|

||

16 |

Advertising |

|

|

|

17 |

Travel and Entertainment |

|

||

18 |

Professional Fees |

Name:__________ Purpose:_______________ |

||

19 |

Insurance |

|

|

|

|

(a) |

Liability |

|

|

|

(b) |

Property |

|

|

|

(c) |

Vehicle |

|

|

|

(d) |

Worker's Compensation |

|

|

|

(e) |

Other ___________________ |

|

|

20 |

Taxes |

|

|

|

|

(a) |

Payroll |

|

|

|

(b) |

Sales |

|

|

|

(c) |

Other ___________________ |

|

|

21 |

Total Business Expenses |

|

||

|

! |

TOTAL PROFIT (LOSS) (line 5 minus line 21) |

||

I/We declare under penalty of purjury that the information provided is true and correct to the best of my/our knowledge, information and belief

Dated:

Debtor(s) Signature

Consider More Forms

C Corporation Vs S Corporation - The form requires basic company information and shareholder details.

Basketball Player Evaluation Form - Cultivates relationships between players and coaches through the evaluation process.

In addition to filling out the ADP Pay Stub form, you may find it helpful to consult resources such as Legal PDF Documents, which provide valuable guidance on understanding your pay stub and the implications of various entries, further enhancing your financial literacy.

How to Create a Job Application - Answer truthfully if you’ve ever been convicted of a crime.