Download Payroll Check Template

Misconceptions

Understanding the Payroll Check form is essential for both employers and employees. However, several misconceptions can lead to confusion. Here are eight common misconceptions:

- Payroll checks are only for hourly employees. Many believe payroll checks are exclusive to hourly workers. In reality, salaried employees also receive payroll checks.

- Payroll checks are always issued weekly. Some think payroll checks must be issued weekly. Payroll frequency varies by employer and can be bi-weekly or monthly.

- All deductions are the same for every employee. It is a common belief that all employees have the same deductions. However, deductions can vary based on individual tax situations and benefits selections.

- Payroll checks can only be issued in paper form. Many assume payroll checks are only available as physical checks. Digital options, such as direct deposit, are increasingly common.

- Employers have unlimited time to issue payroll checks. Some think employers can delay payroll checks indefinitely. However, most states have laws requiring timely payment to employees.

- Employees cannot dispute payroll check amounts. There is a misconception that employees cannot question their pay. Employees have the right to address any discrepancies with their employer.

- Payroll checks do not need to include a breakdown of earnings. Some believe that payroll checks can be issued without details. In fact, most payroll checks should include information about hours worked and deductions.

- Once a payroll check is issued, it cannot be changed. Many think payroll checks are final and cannot be altered. Corrections can be made if errors are identified before or after issuance.

Addressing these misconceptions can help ensure a smoother payroll process for everyone involved.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Payroll Check form is used to document the payment of wages to employees, ensuring accurate record-keeping for both employers and employees. |

| Components | This form typically includes details such as the employee's name, pay period, hours worked, and the total amount paid. |

| Governing Laws | In the United States, payroll practices are governed by both federal and state laws, including the Fair Labor Standards Act (FLSA) and various state labor laws. |

| State-Specific Forms | Some states require specific payroll check forms that comply with local regulations, such as those related to taxes and deductions. |

| Record Retention | Employers are typically required to keep payroll records, including payroll check forms, for a minimum of three years, although state laws may vary. |

Key takeaways

When filling out and using the Payroll Check form, it’s essential to keep a few key points in mind to ensure accuracy and compliance.

- Double-check employee information: Always verify that the employee's name, address, and Social Security number are correct. Mistakes can lead to delays and complications.

- Accurate pay calculations: Ensure that the hours worked, pay rate, and any deductions are calculated correctly. This prevents issues with underpayment or overpayment.

- Signatures matter: Make sure that the appropriate signatures are obtained before issuing the check. This adds a layer of accountability and formality.

- Keep records: Maintain copies of all Payroll Check forms for your records. This is important for tax purposes and for resolving any disputes that may arise.

By following these guidelines, you can streamline the payroll process and reduce the risk of errors.

Dos and Don'ts

When filling out the Payroll Check form, it is essential to ensure accuracy and completeness. Below are five recommendations on what to do and what to avoid during this process.

Things You Should Do:

- Review all personal information for accuracy, including name, address, and Social Security number.

- Double-check the hours worked and the pay rate to ensure they match your records.

- Use clear and legible handwriting if filling out the form by hand.

- Submit the form by the designated deadline to avoid delays in payment.

- Keep a copy of the completed form for your records.

Things You Shouldn't Do:

- Do not leave any required fields blank, as this can cause processing delays.

- Avoid using correction fluid or tape on the form, as this may lead to confusion.

- Do not provide incorrect or outdated information, as it can result in payment errors.

- Refrain from submitting the form without reviewing it for mistakes.

- Do not ignore any instructions provided on the form or by your employer.

Common mistakes

-

Incorrect Employee Information: One common mistake is entering the wrong name, Social Security number, or address. This can lead to delays in processing and potential tax issues.

-

Wrong Pay Period Dates: Failing to accurately specify the pay period can cause confusion. Ensure that the start and end dates are clearly marked and correct.

-

Inaccurate Hours Worked: Employees sometimes miscalculate their hours or forget to include overtime. Double-checking these figures can prevent underpayment or overpayment.

-

Neglecting Deductions: It's essential to account for all applicable deductions, such as taxes, health insurance, and retirement contributions. Missing these can lead to incorrect net pay.

-

Signature Issues: Failing to sign the form or having an unauthorized person sign it can invalidate the check. Always ensure that the appropriate signatures are in place before submission.

What You Should Know About This Form

-

What is the Payroll Check form?

The Payroll Check form is a document used by employers to process employee payments. This form typically includes essential information such as the employee's name, identification number, pay period, and the amount to be paid. It serves as a record of the payment made and is crucial for both accounting and tax purposes.

-

How do I fill out the Payroll Check form?

Filling out the Payroll Check form requires attention to detail. Start by entering the employee’s full name and identification number accurately. Next, specify the pay period for which the payment is being made. Finally, indicate the gross pay, deductions, and net pay. Make sure to double-check all figures to avoid any discrepancies.

-

Who is responsible for submitting the Payroll Check form?

The responsibility for submitting the Payroll Check form typically falls on the payroll department or the designated payroll administrator. This individual ensures that all forms are completed accurately and submitted on time to facilitate timely payments to employees.

-

What should I do if I notice an error on the Payroll Check form?

If an error is discovered on the Payroll Check form, it’s important to address it immediately. Contact your payroll department or administrator as soon as possible. They can guide you through the process of correcting the mistake, which may involve issuing a new check or making adjustments in the payroll system.

-

Can the Payroll Check form be submitted electronically?

Many organizations now allow for electronic submission of the Payroll Check form. Check with your employer's policies to see if this option is available. If it is, ensure that you follow the specified procedures for electronic submission, which may include using secure platforms or software designated for payroll processing.

Payroll Check Example

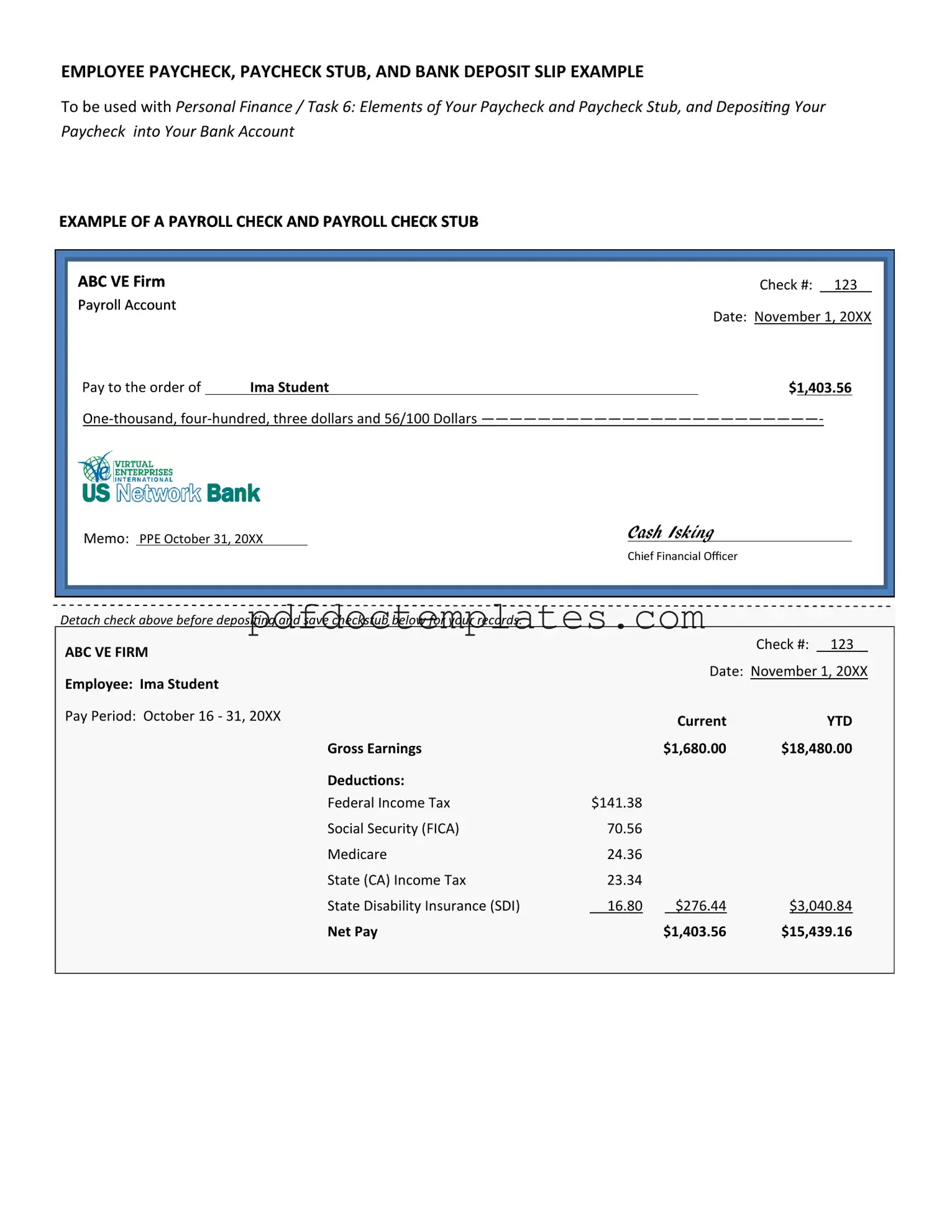

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

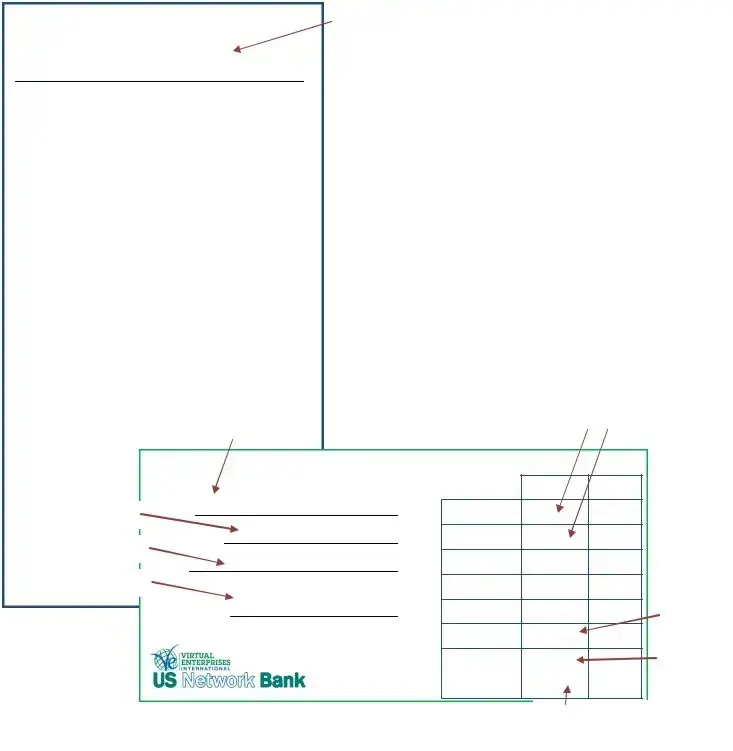

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account

Consider More Forms

Sos Hcp Updates - Healthcare professionals are trained to honor advanced directives like this form.

A Power of Attorney form in New York is a legal document that allows an individual to appoint another person to make important decisions on their behalf. These decisions can span from financial matters to medical care, ensuring that someone is available to manage affairs when the individual cannot do so themselves. For those interested in creating this vital document, it's helpful to reference All New York Forms to find appropriate templates and guidelines. Understanding this form is crucial for anyone considering securing their future decisions and welfare.

Free Printable Shower Sheets for Cna - This form is a critical component in the continuum of care for residents.