Printable Partial Release of Lien Template

Misconceptions

Understanding the Partial Release of Lien form can be challenging. Here are ten common misconceptions that people often have:

- It only applies to construction projects. Many believe this form is limited to construction. In reality, it can be used in various contexts where a lien is involved.

- It releases the entire lien. A partial release only removes a portion of the lien, not the whole thing. This is crucial for maintaining some level of security for the remaining balance.

- It requires a court order. A Partial Release of Lien can often be executed without court intervention, simplifying the process for all parties involved.

- It is the same as a full lien release. This is a common misunderstanding. A full release clears the entire lien, while a partial release only addresses a specific part.

- It must be notarized. While notarization can add credibility, it is not always a requirement for a partial release to be valid.

- It can be issued at any time. Timing is important. A partial release should be issued only after the agreed-upon work or payment has been completed.

- It eliminates all obligations. A partial release does not absolve the parties of their remaining obligations under the contract.

- Only the property owner can request it. Contractors and subcontractors can also initiate a partial release, depending on the terms of their agreements.

- It has no impact on credit. A partial release can affect credit ratings and future borrowing potential, depending on how it’s handled.

- Once filed, it cannot be reversed. While it can be challenging, there are situations where a partial release can be contested or amended if necessary.

Clarifying these misconceptions can lead to a better understanding of how the Partial Release of Lien form works and its implications for all parties involved.

Form Properties

| Fact Name | Details |

|---|---|

| Definition | A Partial Release of Lien form is used to remove a lien on a specific portion of a property while keeping the lien intact for the remaining part. |

| Purpose | This form allows property owners to free up part of their property from a lien, often to facilitate sales or refinancing. |

| Governing Law | The laws governing Partial Release of Lien forms vary by state. For example, in California, it is governed by California Civil Code Section 8416. |

| Who Uses It | Contractors, subcontractors, and property owners commonly use this form in construction and real estate transactions. |

| Required Information | The form typically requires details such as the property description, lien amount, and parties involved. |

| Filing Process | Once completed, the form must be filed with the appropriate county recorder’s office to be effective. |

| Impact on Lien | A Partial Release does not eliminate the lien; it only applies to the specified part of the property. |

| Time Sensitivity | It is important to file the form promptly to avoid complications in property transactions. |

| Signature Requirement | The form usually requires signatures from all parties involved to validate the release. |

| Legal Advice | Consulting with a legal professional is recommended to ensure compliance with state laws and proper completion of the form. |

Key takeaways

When dealing with a Partial Release of Lien form, understanding its purpose and proper usage is essential. Here are some key takeaways to keep in mind:

- Purpose: A Partial Release of Lien allows a property owner to release a portion of the lien on their property, often after a payment is made for completed work.

- Documentation: Ensure all relevant information is accurately filled out, including the names of the parties involved, property details, and the amount being released.

- Legal Compliance: Check local laws and regulations, as requirements for filing a Partial Release of Lien can vary by state.

- Signatures: Obtain the necessary signatures from all parties involved. This typically includes the lien claimant and the property owner.

- Filing: After completion, file the form with the appropriate local government office to make the release official.

- Record Keeping: Keep a copy of the completed form for your records, as it serves as proof of the partial release.

- Consultation: If unsure about any part of the process, consider consulting with a legal expert to avoid potential issues.

These takeaways will help ensure that the process of filling out and using the Partial Release of Lien form is smooth and compliant with legal requirements.

Dos and Don'ts

When filling out the Partial Release of Lien form, it is important to follow specific guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do: Clearly identify the property involved in the lien.

- Do: Include the correct legal description of the property.

- Do: Provide accurate information about the parties involved.

- Do: Sign and date the form in the appropriate sections.

- Do: Check for any local requirements that may apply to the form.

- Don't: Leave any sections blank unless instructed to do so.

- Don't: Use outdated or incorrect forms.

- Don't: Forget to file the form with the appropriate county office.

- Don't: Submit the form without reviewing it for errors.

Common mistakes

-

Inaccurate Property Description: One of the most common mistakes is failing to provide a complete and accurate description of the property involved. This can lead to confusion or disputes later on. Ensure that the address, legal description, and any relevant identifiers are correct and thorough.

-

Omitting Necessary Signatures: Another frequent error occurs when individuals forget to obtain the required signatures. All parties involved must sign the form to validate the release. Without these signatures, the document may not hold up in legal situations.

-

Incorrect Dates: Filling in the wrong dates can create complications. The date of the release should reflect when the lien is being released. If this date is incorrect, it could lead to misunderstandings about the timeline of the lien’s validity.

-

Neglecting to Notify Relevant Parties: After completing the form, it’s essential to notify all relevant parties, including the property owner and any other lienholders. Failing to do so can result in a lack of clarity and potential disputes down the line.

What You Should Know About This Form

-

What is a Partial Release of Lien?

A Partial Release of Lien is a legal document that allows a property owner to release a portion of a lien placed on their property. This typically occurs when a contractor or subcontractor has been paid for a specific portion of work completed, and the lien is reduced accordingly. The release protects the property owner from future claims on the paid amount.

-

When should I use a Partial Release of Lien?

You should use a Partial Release of Lien when you have made a payment to a contractor or subcontractor, and you want to ensure that the amount paid is no longer subject to any lien claims. This is particularly important in construction projects where payments are made in stages. By filing this form, you document that a portion of the lien has been satisfied.

-

How do I complete a Partial Release of Lien?

To complete a Partial Release of Lien, you will need to fill out the form with the necessary information. This includes the details of the property, the amount being released, and the names of the parties involved. Ensure all information is accurate. Once completed, the form must be signed and dated by the lien claimant and may need to be notarized, depending on state requirements.

-

Do I need to file the Partial Release of Lien with a government office?

Yes, in most cases, you must file the Partial Release of Lien with the appropriate county office where the original lien was recorded. This filing is crucial to make the release official and to protect your rights as a property owner. Check your local regulations for specific filing requirements and any associated fees.

-

What happens if I do not file a Partial Release of Lien?

If you do not file a Partial Release of Lien after making a payment, the contractor or subcontractor may still have the right to claim the unpaid portion of the lien. This could lead to legal complications, including potential foreclosure actions on your property. Filing the release is essential to safeguard your interests and clarify the status of the lien.

Partial Release of Lien Example

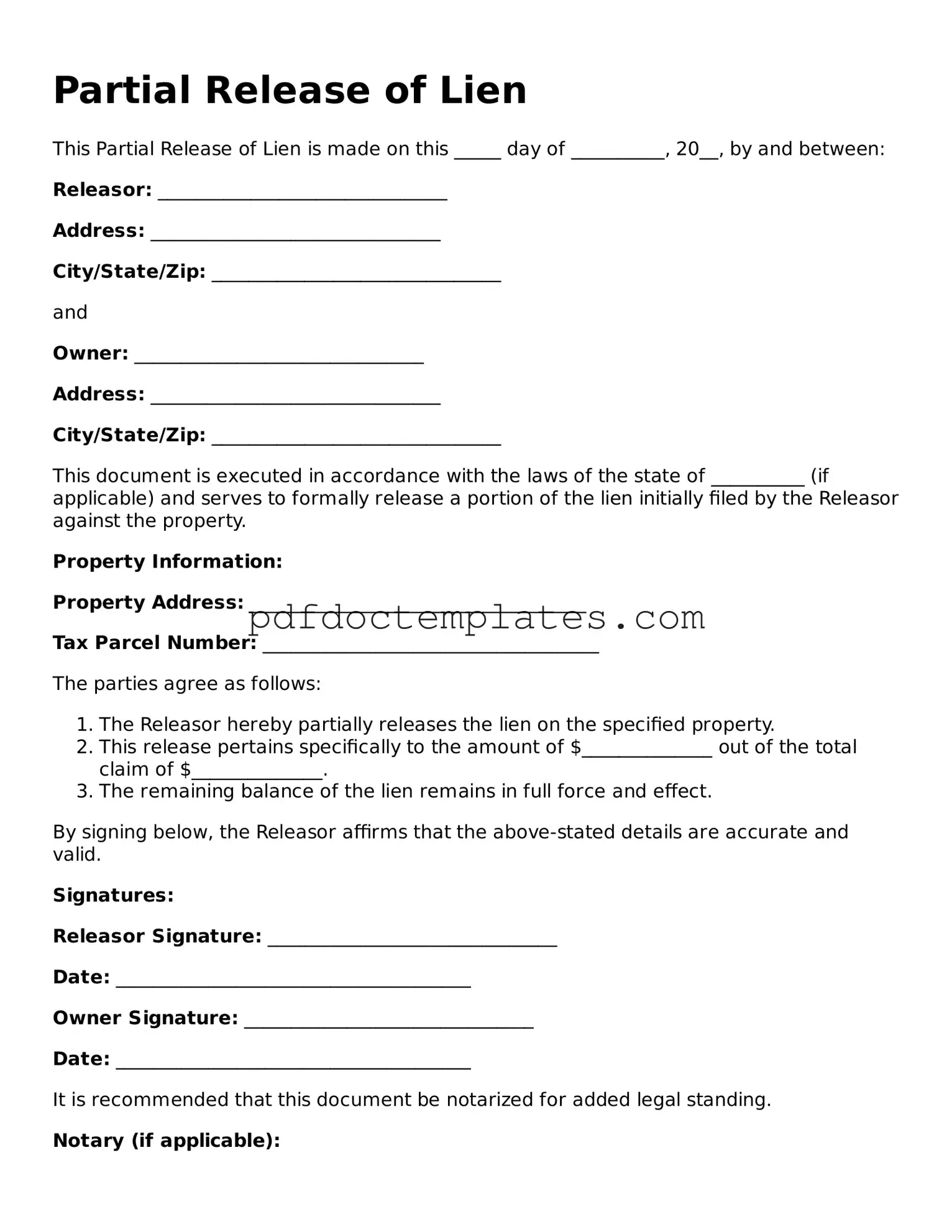

Partial Release of Lien

This Partial Release of Lien is made on this _____ day of __________, 20__, by and between:

Releasor: _______________________________

Address: _______________________________

City/State/Zip: _______________________________

and

Owner: _______________________________

Address: _______________________________

City/State/Zip: _______________________________

This document is executed in accordance with the laws of the state of __________ (if applicable) and serves to formally release a portion of the lien initially filed by the Releasor against the property.

Property Information:

Property Address: ____________________________________

Tax Parcel Number: ____________________________________

The parties agree as follows:

- The Releasor hereby partially releases the lien on the specified property.

- This release pertains specifically to the amount of $______________ out of the total claim of $______________.

- The remaining balance of the lien remains in full force and effect.

By signing below, the Releasor affirms that the above-stated details are accurate and valid.

Signatures:

Releasor Signature: _______________________________

Date: ______________________________________

Owner Signature: _______________________________

Date: ______________________________________

It is recommended that this document be notarized for added legal standing.

Notary (if applicable):

_________________________

_________________________

Different Types of Partial Release of Lien Forms:

Tattoo Release Form App - This document is used to protect the artist legally.

To ensure comprehensive protection for all participants, it's essential to utilize a Release of Liability form, which can be conveniently accessed at smarttemplates.net/fillable-release-of-liability/. By signing this document, individuals acknowledge and accept the inherent risks associated with the activity, thereby safeguarding themselves and the organizing entity from potential legal repercussions.

Media Release Consent Form - Media Releases are common in events, ensuring that attendees are aware of potential media coverage.