Download P 45 It Template

Misconceptions

- Misconception 1: The P45 form is only for employees who are leaving a job voluntarily.

- Misconception 2: The P45 form is not necessary if the employee finds a new job immediately.

- Misconception 3: Employees can get multiple copies of the P45 if they lose one.

- Misconception 4: The P45 form is only relevant for tax purposes.

- Misconception 5: Only employers need to worry about completing the P45 correctly.

- Misconception 6: The P45 form is the same for all employees.

This is not true. The P45 form is also required when an employee is terminated, laid off, or even in the unfortunate event of their passing. It serves as an official record of employment regardless of the circumstances of departure.

In reality, the P45 is essential for any employee transitioning to a new job. It provides their new employer with important tax information, ensuring that tax is calculated correctly and preventing overpayment.

This is incorrect. The P45 is issued in three parts, and once they are distributed, additional copies are not available. Employees must keep their parts safe, especially Part 1A, as it may be needed for tax returns or other purposes.

While it is primarily a tax document, the P45 also plays a role in various benefits and entitlements. For instance, it can be used when claiming Jobseeker's Allowance or Employment and Support Allowance.

Both employers and employees share responsibility for ensuring the P45 is filled out accurately. Errors can lead to tax complications for the employee, so both parties should review the information carefully.

This is misleading. While the basic structure of the P45 is consistent, the details vary based on individual circumstances, such as tax codes and student loan deductions. Each form is unique to the employee's situation.

File Details

| Fact Name | Details |

|---|---|

| Purpose | The P45 form is used to provide details of an employee's tax and income when they leave a job. |

| Parts of the Form | The P45 consists of three parts: Part 1 for HM Revenue & Customs, Part 1A for the employee, and Parts 2 and 3 for the new employer. |

| Filing Requirement | Employers must send Part 1 to HMRC immediately after an employee leaves. Parts 1A, 2, and 3 should be given to the employee. |

| Student Loan Deductions | The form includes sections for indicating if student loan deductions apply, ensuring proper tax treatment. |

| Governing Law | The P45 form is governed by UK tax law, specifically under the Income Tax (Earnings and Pensions) Act 2003. |

Key takeaways

The P45 form is essential when an employee leaves a job. It provides important information about their earnings and tax deductions.

Employers must complete all sections of the form accurately, ensuring that details such as the employee's National Insurance number and leaving date are correct.

Part 1A of the P45 is for the employee's records. It's crucial for them to keep this part safe, as they may need it for future tax returns.

If an employee is going to a new job, they should give Parts 2 and 3 of the P45 to their new employer to avoid being taxed at the emergency rate.

In the unfortunate event of an employee's death, the employer must indicate this on the form and send all parts to HMRC immediately.

Dos and Don'ts

When filling out the P45 form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are six things you should and shouldn't do:

- Do use capital letters when completing the form to ensure clarity.

- Do include the employee's National Insurance number to help with tax records.

- Do ensure that the leaving date is accurately recorded in the format DD MM YYYY.

- Do double-check all entries for correctness before submitting the form.

- Don't leave any required fields blank; this could lead to processing delays.

- Don't alter any parts of the form once it has been completed; this could invalidate the document.

Common mistakes

-

Incorrectly Filling Out Personal Information: Many individuals fail to accurately enter their name, National Insurance number, or date of birth. These details are crucial for proper identification and tax processing.

-

Neglecting to Use Capital Letters: The form specifically requests that capital letters be used. Failing to do so can lead to misinterpretation of the information provided.

-

Forgetting to Indicate Week 1/Month 1 Status: If applicable, individuals must mark 'X' in the designated box. This status affects how tax is calculated and reported.

-

Omitting the Leaving Date: The leaving date must be clearly stated. Omitting this information can delay processing and create confusion regarding tax obligations.

-

Not Certifying the Information: The form requires a certification that the details entered are correct. Failing to sign or certify can render the form invalid.

-

Leaving Out Tax and Pay Information: Individuals often overlook the requirement to fill in total pay and tax amounts. This information is essential for accurate tax reporting.

-

Ignoring the Instructions for Student Loan Deductions: If a student loan deduction applies, it is important to indicate this correctly. Misreporting can lead to incorrect deductions in the future.

What You Should Know About This Form

-

What is the purpose of the P45 form?

The P45 form is used to provide details about an employee who is leaving a job. It includes information such as the employee's total pay and tax deducted during their employment. This form is essential for both the employee and their new employer, as it helps ensure the correct tax code is applied in future employment.

-

How many parts does the P45 form have, and what should be done with each part?

The P45 form consists of three parts: Part 1, Part 1A, and Part 2. Part 1 is sent to HM Revenue & Customs (HMRC) by the employer. Part 1A is given to the employee, who should keep it safe for their records. Part 2 is provided to the new employer when the employee starts a new job. Each part serves a specific purpose in managing tax records and ensuring accurate tax deductions.

-

What should an employee do if they lose their P45?

If an employee loses their P45, they should contact their previous employer to request a replacement. It's important to have this document for tax purposes. If the previous employer cannot provide a replacement, the employee can still file their tax return using their pay and tax information from their final payslip.

-

What happens if an employee does not provide their P45 to their new employer?

If an employee fails to provide their P45 to their new employer, the employer may apply an emergency tax code. This could result in the employee paying more tax than necessary. To avoid this situation, employees should ensure they give Parts 2 and 3 of the P45 to their new employer as soon as possible.

P 45 It Example

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

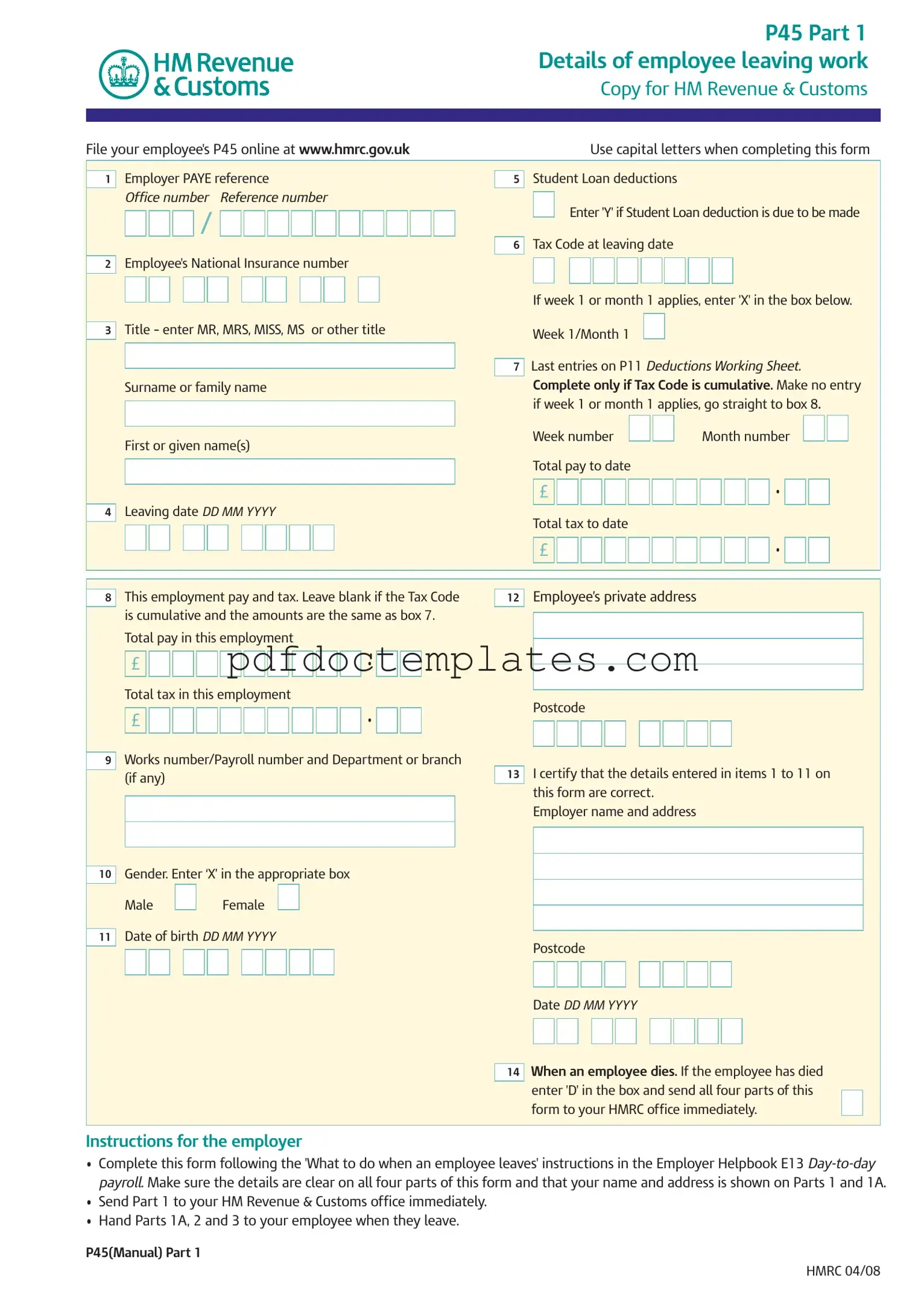

P45 Part 1 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Details of employee leaving work |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Copy for HM Revenue & Customs |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

File your employee's P45 online at www.hmrc.gov.uk |

|

|

|

|

|

|

Use capital letters when completing this form |

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer PAYE reference |

|

|

|

|

|

|

|

|

|

|

|

|

Student Loan deductions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

1 |

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

Office number |

Reference number |

|

|

|

|

Enter 'Y' if Student Loan deduction is due to be made |

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Code at leaving date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

2 |

|

Employee's National Insurance number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If week 1 or month 1 applies, enter 'X' in the box below. |

|

||||||||||||||||||||||||

|

|

|

Title – enter MR, MRS, MISS, MS |

or other title |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

3 |

|

|

|

Week 1/Month 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last entries on P11 Deductions Working Sheet. |

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

||||||||||||||||||||||||||

|

|

|

Surname or family name |

|

|

|

|

|

|

|

|

|

|

|

|

Complete only if Tax Code is cumulative. Make no entry |

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if week 1 or month 1 applies, go straight to box 8. |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Week number |

|

|

|

Month number |

|

|

|

|

|

|

|

||||||||||||||

|

|

|

First or given name(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total pay to date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

4 |

|

Leaving date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

Total tax to date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee’s private address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

8 |

|

This employment pay and tax. Leave blank if the Tax Code |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

is cumulative and the amounts are the same as box 7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

Total pay in this employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Total tax in this employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Works number/Payroll number and Department or branch |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

(if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

I certify that the details entered in items 1 to 11 on |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

this form are correct. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer name and address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gender. Enter ‘X’ in the appropriate box |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

Male |

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Date of birth DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

When an employee dies. If the employee has died |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

enter 'D' in the box and send all four parts of this |

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

form to your HMRC office immediately. |

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions for the employer

•Complete this form following the 'What to do when an employee leaves' instructions in the Employer Helpbook E13

•Send Part 1 to your HM Revenue & Customs office immediately.

•Hand Parts 1A, 2 and 3 to your employee when they leave.

P45(Manual) Part 1

HMRC 04/08

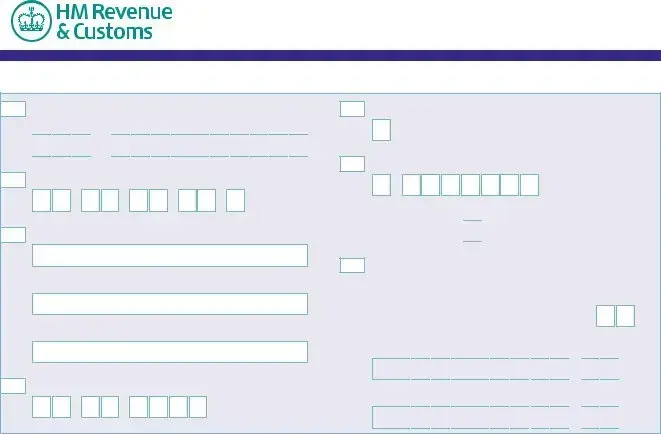

P45 Part 1A

Details of employee leaving work

Copy for employee

|

|

Employer PAYE reference |

|

|

|

|

|

|

|

|

|

|

|

|

Student Loan deductions |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

1 |

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

Office number |

Reference number |

|

|

|

|

Student Loan deductions to continue |

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Code at leaving date |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

2 |

|

Employee's National Insurance number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If week 1 or month 1 applies, enter 'X' in the box below. |

|||||||||||||||||||||||

|

|

Title – enter MR, MRS, MISS, MS |

or other title |

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

3 |

|

|

|

Week 1/Month 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last entries on P11 Deductions Working Sheet. |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

Surname or family name |

|

|

|

|

|

|

|

|

|

|

|

|

Complete only if Tax Code is cumulative. If there is an ‘X’ |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

at box 6 there will be no entries here. |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Week number |

|

|

|

Month number |

|

|

|

|

|

||||||||||||||

|

|

First or given name(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total pay to date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4 |

|

Leaving date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total tax to date |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee’s private address |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

8 |

|

This employment pay and tax. If no entry here, the amounts |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

are those shown at box 7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

Total pay in this employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Total tax in this employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Works number/Payroll number and Department or branch |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

(if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

I certify that the details entered in items 1 to 11 on |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

this form are correct. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer name and address |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gender. Enter ‘X’ in the appropriate box |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

Male |

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Date of birth DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To the employee

The P45 is in three parts. Please keep this part (Part 1A) safe. Copies are not available. You might need the information in Part 1A to fill in a Tax Return if you are sent one.

Please read the notes in Part 2 that accompany Part 1A. The notes give some important information about what you should do next and what you should do with Parts 2 and 3 of this form.

Tax credits

Tax credits are flexible. They adapt to changes in your life, such as leaving a job. If you need to let us know about a change in your income, phone 0845 300 3900.

To the new employer

If your new employee gives you this Part 1A, please return it to them. Deal with Parts 2 and 3 as normal.

P45(Manual) Part 1A |

HMRC 04/08 |

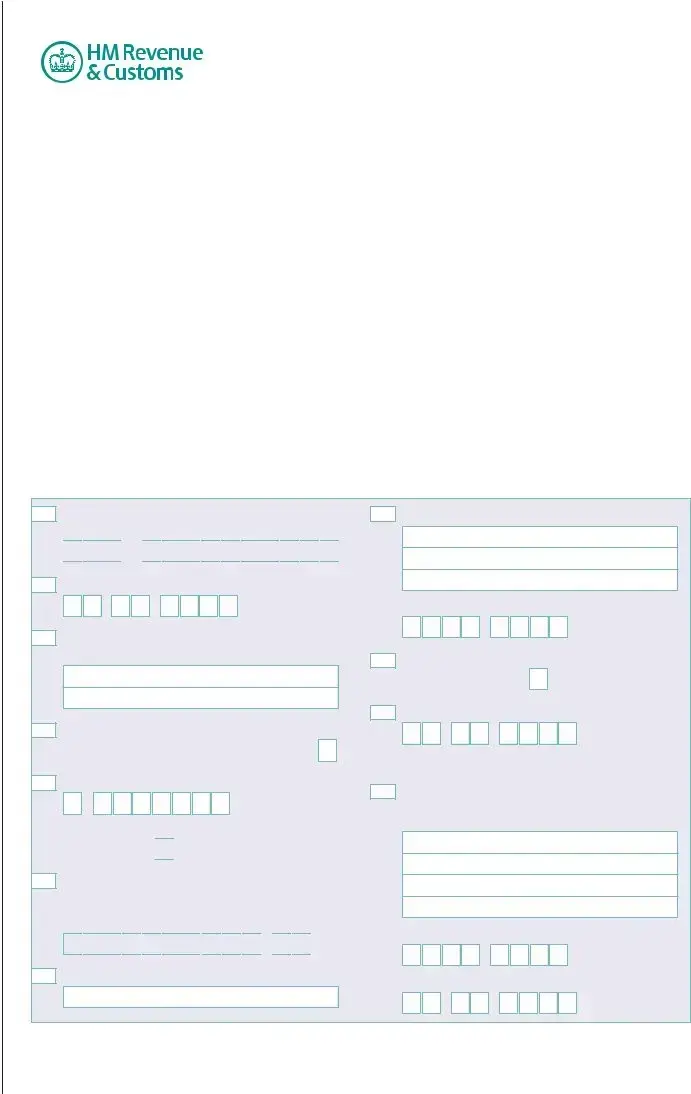

P45 Part 2 Details of employee leaving work

Copy for new employer

1

2

3

4

Employer PAYE reference

Office number Reference number

/

/

Employee's National Insurance number

Title - enter MR, MRS, MISS, MS or other title

Surname or family name

First or given name(s)

Leaving date DD MM YYYY

5Student Loan deductions

Student Loan deductions to continue

6Tax Code at leaving date

If week 1 or month 1 applies, enter 'X' in the box below. Week 1/Month 1

7Last entries on P11 Deductions Working Sheet. Complete only if Tax Code is cumulative. If there is an ‘X’ at box 6, there will be no entries here.

Week number |

|

|

Month number |

Total pay to date |

|

|

|

£

•

•

Total tax to date

£

•

•

To the employee

This form is important to you. Take good care of it and keep it safe. Copies are not available. Please keep

Parts 2 and 3 of the form together and do not alter them in any way.

Going to a new job

Claiming Jobseeker's Allowance or

Employment and Support Allowance (ESA)

Take this form to your Jobcentre Plus office. They will pay you any tax refund you may be entitled to when your claim ends, or at 5 April if this is earlier.

Give Parts 2 and 3 of this form to your new employer, or you will have tax deducted using the emergency code and may pay too much tax. If you do not want your new employer to know the details on this form, send it to your HM Revenue & Customs (HMRC) office immediately with a letter saying so and giving the name and address of your new employer. HMRC can make special arrangements, but you may pay too much tax for a while as a result of this.

Going abroad

Not working and not claiming Jobseeker's Allowance or Employment and Support Allowance (ESA)

If you have paid tax and wish to claim a refund ask for form P50 Claiming Tax back when you have stopped working from any HMRC office or Enquiry Centre.

Help

If you need further help you can contact any HMRC office or Enquiry Centre. You can find us in The Phone Book under HM Revenue & Customs or go to www.hmrc.gov.uk

If you are going abroad or returning to a country

outside the UK ask for form P85 Leaving the United Kingdom from any HMRC office or Enquiry Centre.

Becoming

You must register with HMRC within three months of becoming

to get a copy of the booklet SE1 Are you thinking of working for yourself?

To the new employer

Check this form and complete boxes 8 to 18 in Part 3 and prepare a form P11 Deductions Working Sheet. Follow the instructions in the Employer Helpbook E13

P45(Manual) Part 2 |

HMRC 04/08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P45 Part 3 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New employee details |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For completion by new employer |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

File your employee's P45 online at www.hmrc.gov.uk |

|

|

|

|

|

|

|

Use capital letters when completing this form |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer PAYE reference |

|

|

Student Loan deductions |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

1 |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

Office number Reference number |

|

|

|

|

|

Student Loan deductions to continue |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Tax Code at leaving date |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

2 |

Employee's National Insurance number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If week 1 or month 1 applies, enter 'X' in the box below. |

||||||||||||||||||||||

|

|

Title – enter MR, MRS, MISS, MS or other title |

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

3 |

|

|

|

|

Week 1/Month 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last entries on P11 Deductions Working Sheet. |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

Surname or family name |

|

|

|

Complete only if Tax Code is cumulative. If there is an ‘X’ |

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

at box 6, there will be no entries here. |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Week number |

|

|

|

|

|

Month number |

|

|

|

|

||||||||||||

|

|

First or given name(s) |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

Total pay to date |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4 |

|

Leaving date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total tax to date |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To the new employer Complete boxes 8 to 18 and send P45 Part 3 only to your HMRC office immediately.

8

New employer PAYE reference

Office number Reference number

/

/

15

Employee's private address

9Date new employment started DD MM YYYY

10Works number/Payroll number and Department or branch (if any)

11Enter 'P' here if employee will not be paid by you between the date employment began and the next 5 April.

12Enter Tax Code in use if different to the Tax Code at box 6

If week 1 or month 1 applies, enter 'X' in the box below. Week 1/Month 1

13If the tax figure you are entering on P11 Deductions Working Sheet differs from box 7 (see the E13 Employer Helpbook

figure here.

£

•

•

14New employee's job title or job description

Postcode

16Gender. Enter ‘X’ in the appropriate box

Male |

|

Female |

17Date of birth DD MM YYYY

Declaration

18I have prepared a P11 Deductions Working Sheet in accordance with the details above.

Employer name and address

Postcode

Date DD MM YYYY

P45(Manual) Part 3 |

HMRC 04/08 |

Consider More Forms

The Official Girlfriend Application - No complicated steps; just honest responses needed.

In Florida, understanding the Notice to Quit form is essential for both landlords and tenants, as it plays a pivotal role in the eviction process. For landlords seeking to ensure compliance with lease terms, utilizing resources such as All Florida Forms can provide valuable templates and guidance regarding this important legal document, helping to avoid future disputes and maintain clear communication with tenants.

5 Wishes Document - Five Wishes is a straightforward form that helps ensure your health care wishes are honored.

Netspend All-access Login Customer Service - This form requires your signature to validate your request for a dispute.