Printable Owner Financing Contract Template

Misconceptions

Owner financing can be a great option for both buyers and sellers, but there are several misconceptions that can lead to confusion. Here’s a look at some common misunderstandings about the Owner Financing Contract form.

- Owner financing is only for buyers with bad credit. Many people believe that owner financing is a last resort for those who can't secure traditional loans. In reality, it can be a flexible option for buyers with varying financial situations.

- It's a complicated process. Some think that owner financing involves a lot of red tape and legal hurdles. While there are important details to consider, the process can be straightforward with clear communication between parties.

- All owner financing agreements are the same. Each contract can be tailored to fit the specific needs of the buyer and seller. Terms such as interest rates, payment schedules, and down payments can vary widely.

- Only sellers can initiate owner financing. Buyers can also propose owner financing arrangements. If a buyer is interested, they can approach a seller and discuss the possibility.

- Owner financing eliminates the need for a real estate agent. While some may choose to handle the transaction independently, many still benefit from the expertise of a real estate agent, especially in negotiating terms.

- There’s no need for a written contract. Some people assume that a verbal agreement is enough. However, having a written contract is essential to protect both parties and clarify the terms of the agreement.

- Owner financing is only for residential properties. This option is not limited to homes; it can also apply to commercial properties, land, and other types of real estate.

- Once the contract is signed, it can't be changed. While changes to the contract should be agreed upon by both parties, modifications can be made if both the buyer and seller are in agreement.

Understanding these misconceptions can help buyers and sellers navigate the owner financing landscape more effectively. It’s always wise to do thorough research and consider seeking professional advice when necessary.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract is an agreement where the seller finances the purchase of the property for the buyer. |

| Down Payment | Typically, the buyer makes a down payment, which is a percentage of the purchase price, agreed upon by both parties. |

| Interest Rate | The contract specifies an interest rate, which may be fixed or variable, affecting the total cost of the loan. |

| Payment Schedule | Payments can be structured monthly, quarterly, or annually, depending on what the seller and buyer agree upon. |

| Governing Law | In California, for example, the contract is governed by the California Civil Code, while in Texas, it falls under the Texas Property Code. |

| Title Transfer | Ownership of the property may transfer to the buyer upon signing the contract, but the seller retains a lien until the loan is paid off. |

| Default Consequences | If the buyer defaults on payments, the seller has the right to foreclose on the property, similar to traditional mortgages. |

| Legal Requirements | Each state has specific legal requirements for owner financing contracts, including disclosure obligations and recording the contract. |

| Negotiability | Terms of the contract, including interest rates and payment schedules, are often negotiable between the buyer and seller. |

| Advantages | Owner financing can benefit buyers with limited access to traditional financing and sellers looking to attract more potential buyers. |

Key takeaways

When dealing with an Owner Financing Contract form, it's essential to understand several key aspects to ensure a smooth transaction. Here are important takeaways:

- Understand the Basics: An Owner Financing Contract allows the buyer to purchase a property directly from the seller without traditional bank financing.

- Clearly Define Terms: Specify the purchase price, down payment, interest rate, and repayment schedule in the contract.

- Include Legal Descriptions: Make sure to provide a detailed legal description of the property to avoid any confusion.

- Outline Responsibilities: Clearly state the responsibilities of both the buyer and seller regarding property maintenance and taxes.

- Consult Local Laws: Owner financing laws can vary by state, so it’s important to be aware of local regulations that may apply.

- Consider a Title Search: Conducting a title search can help uncover any liens or issues with the property before finalizing the contract.

- Document Everything: Ensure that all agreements, modifications, and communications are documented to protect both parties.

- Seek Professional Help: Consulting with a real estate attorney or a knowledgeable professional can provide valuable guidance throughout the process.

Dos and Don'ts

When filling out the Owner Financing Contract form, it’s essential to approach the task carefully. Here are some key things to keep in mind:

- Do read the entire contract thoroughly before filling it out.

- Do ensure all names and addresses are accurate and up to date.

- Do clearly outline the terms of financing, including interest rates and payment schedules.

- Do consult with a legal professional if you have any questions.

- Don't leave any blank spaces; every section should be completed.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to sign and date the document where required.

- Don't ignore the importance of keeping a copy for your records.

Taking these steps will help ensure that your Owner Financing Contract is filled out correctly and effectively protects your interests.

Common mistakes

-

Not Reading the Entire Contract: Many individuals rush through the document without fully understanding its terms. This can lead to overlooking crucial details that could impact the agreement.

-

Incorrectly Filling in Buyer and Seller Information: It's vital to ensure that names, addresses, and contact information are accurate. Mistakes here can create confusion and legal issues later on.

-

Failing to Specify the Purchase Price: Clearly stating the purchase price is essential. Without this, there can be disputes about the amount owed.

-

Omitting Payment Terms: The contract should detail the payment schedule, including amounts, due dates, and acceptable payment methods. Missing this information can lead to misunderstandings.

-

Neglecting to Include Interest Rates: If financing involves interest, it must be clearly stated. Failing to include this can result in unexpected financial burdens.

-

Not Addressing Default Terms: The contract should outline what happens if a buyer defaults on payments. Without these terms, it may be challenging to enforce rights in the future.

-

Ignoring Legal Compliance: Ensure that the contract complies with local and federal laws. Ignoring legal requirements can invalidate the agreement.

-

Not Having the Contract Reviewed: A legal review by a qualified attorney can help identify potential issues. Skipping this step may lead to costly mistakes.

-

Failing to Sign and Date the Contract: All parties must sign and date the document for it to be legally binding. Forgetting this step can render the agreement unenforceable.

What You Should Know About This Form

-

What is an Owner Financing Contract?

An Owner Financing Contract is a legal agreement between a seller and a buyer where the seller provides financing directly to the buyer for the purchase of a property. Instead of the buyer obtaining a traditional mortgage from a bank or financial institution, the seller allows the buyer to make payments over time. This arrangement can be beneficial for both parties, especially if the buyer may have difficulty securing a loan through conventional means.

-

What are the benefits of using an Owner Financing Contract?

There are several advantages to owner financing:

- Flexibility: Terms can be negotiated directly between the buyer and seller, allowing for tailored payment plans.

- Faster Transactions: Without the need for bank approval, the closing process can often be quicker.

- Access for Buyers: Buyers who may not qualify for traditional loans can still purchase a home.

- Investment Opportunities: Sellers can earn interest on the financed amount, potentially increasing their overall profit.

-

What should be included in an Owner Financing Contract?

It is essential to include several key elements in the contract to protect both parties:

- Purchase Price: Clearly state the agreed-upon price for the property.

- Down Payment: Specify the amount of money the buyer will pay upfront.

- Interest Rate: Outline the interest rate on the financed amount.

- Payment Schedule: Detail how often payments will be made and the duration of the loan.

- Default Terms: Include what happens if the buyer fails to make payments.

-

Are there any risks associated with Owner Financing?

Yes, both buyers and sellers should be aware of potential risks. For buyers, if they fail to make payments, they could lose the property. Sellers face the risk of the buyer defaulting, which may lead to legal complications. Additionally, since the seller is acting as the lender, they must be prepared to manage the loan and any associated issues, such as late payments or foreclosure.

-

How can I ensure the Owner Financing Contract is legally binding?

To make the contract legally binding, it should be in writing and signed by both parties. It’s advisable to have the contract reviewed by a real estate attorney to ensure compliance with state laws and to address any specific concerns. Additionally, recording the contract with the local county recorder's office can provide further protection.

-

Can an Owner Financing Contract be modified after it is signed?

Yes, an Owner Financing Contract can be modified if both parties agree to the changes. Any modifications should be documented in writing and signed by both the buyer and seller to ensure clarity and legality. It’s recommended to consult with a legal professional when making changes to ensure all modifications are enforceable.

Owner Financing Contract Example

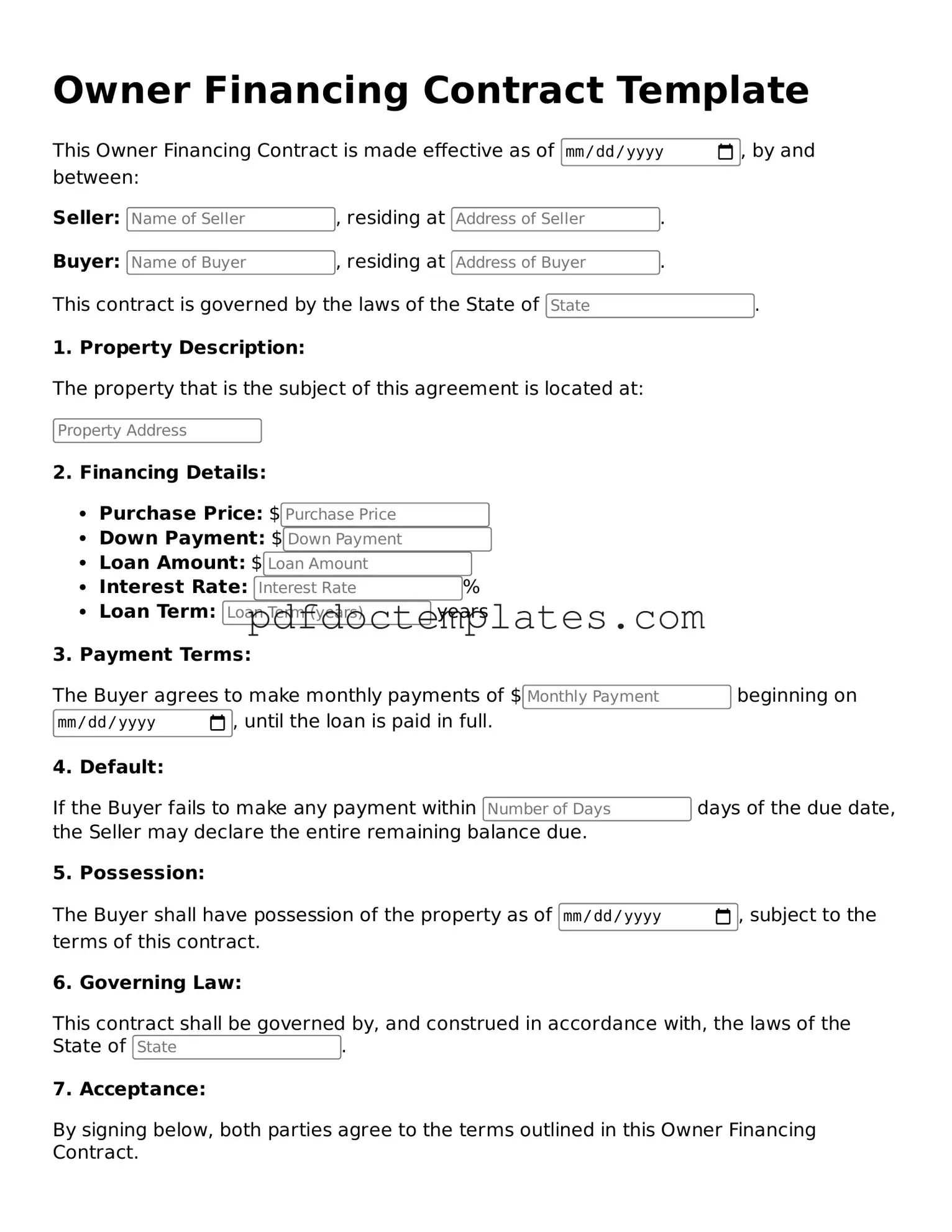

Owner Financing Contract Template

This Owner Financing Contract is made effective as of , by and between:

Seller: , residing at .

Buyer: , residing at .

This contract is governed by the laws of the State of .

1. Property Description:

The property that is the subject of this agreement is located at:

2. Financing Details:

- Purchase Price: $

- Down Payment: $

- Loan Amount: $

- Interest Rate: %

- Loan Term: years

3. Payment Terms:

The Buyer agrees to make monthly payments of $ beginning on , until the loan is paid in full.

4. Default:

If the Buyer fails to make any payment within days of the due date, the Seller may declare the entire remaining balance due.

5. Possession:

The Buyer shall have possession of the property as of , subject to the terms of this contract.

6. Governing Law:

This contract shall be governed by, and construed in accordance with, the laws of the State of .

7. Acceptance:

By signing below, both parties agree to the terms outlined in this Owner Financing Contract.

Seller’s Signature: ___________________________ Date:

Buyer’s Signature: ___________________________ Date:

Different Types of Owner Financing Contract Forms:

Termination of Purchase Agreement - Using this form can aid in avoiding potential legal disputes down the line.

For those engaged in real estate transactions, a professional Real Estate Purchase Agreement is vital to delineate the terms of the sale and safeguard both parties involved in the process.

Purchase Agreement Addendum - Adjustments to the purchase price can be formally recorded in the addendum.