Blank Transfer-on-Death Deed Document for North Carolina

Misconceptions

Many people have misunderstandings about the North Carolina Transfer-on-Death Deed form. Here are nine common misconceptions:

- It only applies to real estate. Some think the Transfer-on-Death Deed can be used for any type of asset. However, it is specifically designed for real property, such as land and homes.

- It requires probate. A common belief is that using this deed means the property must go through probate. In fact, properties transferred via this deed do not go through probate, simplifying the process for heirs.

- It can be revoked easily. Many assume that once a Transfer-on-Death Deed is signed, it cannot be changed. In reality, the grantor can revoke or change the deed at any time before their death.

- It’s only for married couples. Some people think only married couples can use this deed. However, anyone can use it to transfer property to any individual or group, regardless of marital status.

- It’s automatically effective upon signing. There’s a misconception that the deed takes effect immediately after signing. The deed only becomes effective when the grantor passes away.

- All heirs must agree to the transfer. Some believe that all heirs must consent to the transfer before it can happen. However, the transfer occurs automatically upon the grantor's death, regardless of other heirs’ opinions.

- It can be used for multiple properties at once. People often think they can include several properties in one Transfer-on-Death Deed. Each property must have its own deed to ensure proper transfer.

- It’s the same as a will. Many confuse the Transfer-on-Death Deed with a will. While both deal with property transfer, a will goes through probate, whereas this deed does not.

- It eliminates all taxes. Some believe that using a Transfer-on-Death Deed means there will be no taxes on the property transfer. Taxes may still apply based on the property's value and local laws.

Understanding these misconceptions can help individuals make informed decisions about their estate planning in North Carolina.

Form Properties

| Fact Name | Details |

|---|---|

| Definition | The North Carolina Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by North Carolina General Statutes, specifically N.C.G.S. § 32A-15. |

| Requirements | The deed must be signed by the property owner and witnessed by two individuals or notarized to be valid. |

| Revocation | Property owners can revoke the Transfer-on-Death Deed at any time before their death by executing a new deed or a written revocation. |

Key takeaways

Filling out and using the North Carolina Transfer-on-Death Deed form is an important step in estate planning. Here are some key takeaways to keep in mind:

- Understand the Purpose: The Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries without going through probate.

- Eligibility: Only real property can be transferred using this deed. It does not apply to personal property or bank accounts.

- Complete the Form Accurately: Ensure that all required information is filled out correctly, including the names of the grantor(s) and grantee(s).

- Signatures Matter: The deed must be signed by the property owner in the presence of a notary public to be valid.

- Recording the Deed: After signing, the deed must be recorded at the county register of deeds office where the property is located.

- Revocation is Possible: The Transfer-on-Death Deed can be revoked at any time by filing a revocation form or executing a new deed.

- Beneficiary Designations: You can designate multiple beneficiaries, but be clear about how the property will be divided among them.

- Tax Implications: Consult with a tax professional to understand any potential tax consequences for your beneficiaries.

- State-Specific Rules: Familiarize yourself with North Carolina laws regarding Transfer-on-Death Deeds, as they may differ from other states.

- Seek Legal Advice: If you have questions or concerns, consider consulting an attorney who specializes in estate planning to ensure your wishes are honored.

Being informed and prepared can make a significant difference in your estate planning process. Take the time to understand the implications of the Transfer-on-Death Deed to secure your property for your loved ones.

Dos and Don'ts

Filling out the North Carolina Transfer-on-Death Deed form can be straightforward if you keep a few key points in mind. Here’s a list of what to do and what to avoid.

- Do ensure that you are eligible to use the Transfer-on-Death Deed.

- Do clearly identify the property you wish to transfer.

- Do include the full names of the beneficiaries.

- Do sign the form in front of a notary public.

- Do record the deed with the appropriate county office.

- Don't forget to double-check all information for accuracy.

- Don't leave out any required signatures or dates.

- Don't assume that verbal agreements are enough; everything must be in writing.

- Don't delay in recording the deed, as it may affect its validity.

By following these guidelines, you can help ensure that your Transfer-on-Death Deed is completed correctly and effectively. This can provide peace of mind for you and your beneficiaries.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to complications. Each section of the form must be filled out completely to ensure the deed is valid.

-

Incorrect Property Description: Mistakes in describing the property can result in legal issues. It's crucial to accurately identify the property using its legal description, not just the address.

-

Not Signing the Deed: A common oversight is neglecting to sign the deed. The deed must be signed by the property owner to be legally binding.

-

Failing to Have Witnesses: In North Carolina, the deed requires two witnesses. Without these signatures, the deed may not be valid.

-

Not Notarizing the Document: The deed must be notarized to ensure its authenticity. Skipping this step can invalidate the transfer.

-

Improper Execution: The deed must be executed in accordance with state laws. Ignoring the specific requirements can lead to challenges later.

-

Failure to Record the Deed: After completing the deed, it must be recorded with the local register of deeds. Not doing so can result in disputes over ownership.

-

Not Informing Beneficiaries: It’s important to communicate with the beneficiaries about the transfer. Lack of communication can lead to confusion and potential conflicts.

What You Should Know About This Form

-

What is a Transfer-on-Death Deed in North Carolina?

A Transfer-on-Death Deed (TODD) is a legal document that allows a property owner to designate one or more beneficiaries to receive their property upon their death. This deed does not transfer ownership during the owner's lifetime, and the owner retains full control over the property until their passing.

-

How does a Transfer-on-Death Deed work?

The property owner fills out the TODD form, specifying the beneficiaries. Once the form is signed and recorded with the county register of deeds, the designated beneficiaries will automatically inherit the property when the owner dies. This process avoids probate, making it simpler and often faster for beneficiaries to gain ownership.

-

Who can be named as a beneficiary in a Transfer-on-Death Deed?

Beneficiaries can include individuals, such as family members or friends, as well as entities like trusts or organizations. There is no limit to the number of beneficiaries that can be named in the deed.

-

Can a Transfer-on-Death Deed be revoked or changed?

Yes, the property owner can revoke or change the TODD at any time while they are alive. To do so, the owner must execute a new deed that explicitly revokes the previous one or file a revocation document with the county register of deeds.

-

What are the benefits of using a Transfer-on-Death Deed?

The primary benefits include avoiding probate, maintaining control of the property during the owner’s lifetime, and simplifying the transfer process for beneficiaries. Additionally, it can provide clarity regarding the owner’s wishes for property distribution after death.

-

Are there any drawbacks to a Transfer-on-Death Deed?

While there are many benefits, potential drawbacks include the inability to use the deed for joint ownership or to transfer property with existing liens. Additionally, if the beneficiaries are not properly designated or if the deed is not correctly executed, it may lead to disputes or complications.

-

Is legal assistance required to complete a Transfer-on-Death Deed?

While it is not legally required to have an attorney assist with completing a TODD, it is often advisable. Legal professionals can ensure that the deed is filled out correctly and complies with state laws, helping to avoid potential issues in the future.

-

How do I record a Transfer-on-Death Deed?

To record a TODD, the completed and signed deed must be submitted to the county register of deeds in the county where the property is located. There may be a small fee for recording the deed, and it is essential to keep a copy for personal records.

-

What happens if a beneficiary predeceases the property owner?

If a beneficiary named in the Transfer-on-Death Deed dies before the property owner, that beneficiary's share typically passes to their heirs, unless the deed specifies otherwise. It is advisable to review and update the deed regularly to reflect any changes in circumstances.

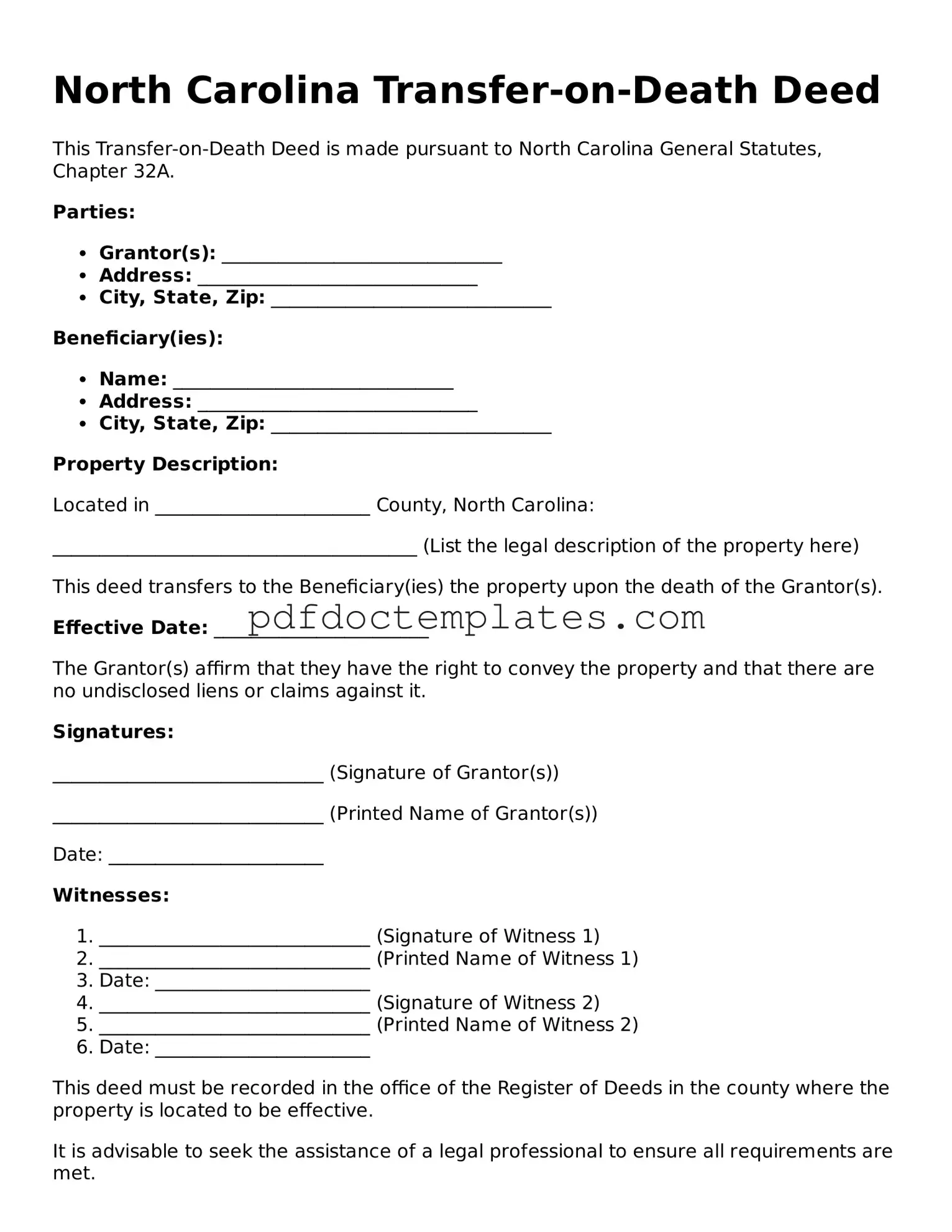

North Carolina Transfer-on-Death Deed Example

North Carolina Transfer-on-Death Deed

This Transfer-on-Death Deed is made pursuant to North Carolina General Statutes, Chapter 32A.

Parties:

- Grantor(s): ______________________________

- Address: ______________________________

- City, State, Zip: ______________________________

Beneficiary(ies):

- Name: ______________________________

- Address: ______________________________

- City, State, Zip: ______________________________

Property Description:

Located in _______________________ County, North Carolina:

_______________________________________ (List the legal description of the property here)

This deed transfers to the Beneficiary(ies) the property upon the death of the Grantor(s).

Effective Date: _______________________

The Grantor(s) affirm that they have the right to convey the property and that there are no undisclosed liens or claims against it.

Signatures:

_____________________________ (Signature of Grantor(s))

_____________________________ (Printed Name of Grantor(s))

Date: _______________________

Witnesses:

- _____________________________ (Signature of Witness 1)

- _____________________________ (Printed Name of Witness 1)

- Date: _______________________

- _____________________________ (Signature of Witness 2)

- _____________________________ (Printed Name of Witness 2)

- Date: _______________________

This deed must be recorded in the office of the Register of Deeds in the county where the property is located to be effective.

It is advisable to seek the assistance of a legal professional to ensure all requirements are met.

Check out Other Common Transfer-on-Death Deed Templates for US States

Virginia Transfer on Death Deed - By executing a Transfer-on-Death Deed, property owners maintain the right to sell or mortgage the property as they see fit.

To ensure proper management of affairs, it's essential to have a Power of Attorney form in place, especially for those who may face situations where they are unable to make decisions for themselves. This document not only empowers a trusted individual to handle financial and medical matters but also provides peace of mind knowing that one's interests will be safeguarded. For those in need of guidance, resources like All New York Forms can be invaluable in navigating the process.

Transfer on Death Deed New Jersey - This form can be appealing to individuals who wish to pass down property without the delays often associated with wills.

Transfer on Death Deed California - A well-prepared Transfer-on-Death Deed can protect your legacy and support your beneficiaries seamlessly.