Blank Promissory Note Document for North Carolina

Misconceptions

Understanding the North Carolina Promissory Note form is essential for both lenders and borrowers. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

- 1. A Promissory Note is the same as a loan agreement. While both documents relate to borrowing money, a promissory note is a promise to pay back a loan, whereas a loan agreement outlines the terms of the loan, including interest rates and repayment schedules.

- 2. Only banks can issue Promissory Notes. This is not true. Any individual or business can create a promissory note as long as it includes the necessary elements, such as the amount borrowed and repayment terms.

- 3. A verbal agreement is sufficient. A verbal agreement is not legally binding in the same way a written promissory note is. Having a written document provides clear evidence of the terms agreed upon.

- 4. Promissory Notes do not need to be notarized. While notarization is not always required, having a note notarized can add an extra layer of security and help in case of disputes.

- 5. The borrower can change the terms without consent. Changes to the terms of a promissory note require mutual agreement from both parties. One party cannot unilaterally change the terms.

- 6. A Promissory Note is only for large loans. Promissory notes can be used for any amount of money. They are flexible and can be tailored to suit both small and large loans.

- 7. If the borrower defaults, the lender has no recourse. This is a misconception. If a borrower defaults, the lender can take legal action to recover the owed amount, depending on the terms outlined in the note.

Being aware of these misconceptions can help both lenders and borrowers navigate the process more effectively. Always consider seeking professional advice if you have questions about a promissory note.

Form Properties

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The North Carolina Promissory Note is governed by the North Carolina General Statutes, specifically Chapter 25 (Uniform Commercial Code). |

| Requirements | The note must include the principal amount, interest rate, payment terms, and the signatures of the parties involved. |

| Enforceability | For a promissory note to be enforceable, it must be clear and unambiguous in its terms. |

| Types | North Carolina recognizes various types of promissory notes, including secured and unsecured notes. |

Key takeaways

Here are key takeaways about filling out and using the North Carolina Promissory Note form:

- The form establishes a legal agreement between a borrower and a lender.

- Ensure all parties' names and addresses are clearly stated at the beginning of the document.

- Specify the loan amount in both numerical and written form to avoid confusion.

- Clearly outline the interest rate, if applicable, and how it will be calculated.

- Include the repayment schedule, detailing when payments are due and the amount of each payment.

- State any late fees or penalties for missed payments to ensure both parties understand the consequences.

- Both parties should sign and date the document to make it legally binding.

- Consider having the document notarized to add an extra layer of security and authenticity.

- Keep a copy of the signed note for personal records and future reference.

- Review the terms of the note regularly to ensure compliance and to address any changes in circumstances.

Dos and Don'ts

When filling out the North Carolina Promissory Note form, it’s important to be thorough and accurate. Here are some key do’s and don’ts to keep in mind:

- Do read the entire form carefully before starting. Understanding what is required can prevent mistakes.

- Do provide accurate information. Double-check names, addresses, and amounts to ensure everything is correct.

- Do sign and date the form. An unsigned note may not be legally binding.

- Do keep a copy for your records. This can be helpful for future reference or in case of disputes.

- Don’t leave any required fields blank. Missing information can lead to delays or rejection.

- Don’t use white-out or erase mistakes. Instead, cross out the error and write the correct information nearby.

- Don’t rush through the process. Taking your time can help you avoid costly errors.

- Don’t forget to check the interest rate and repayment terms. These details are crucial to the agreement.

Common mistakes

-

Failing to include all required parties. It's essential that all borrowers and lenders are clearly identified. Missing a signature can lead to disputes later.

-

Not specifying the loan amount. The total amount borrowed must be clearly stated to avoid confusion.

-

Omitting the interest rate. If applicable, the interest rate should be clearly defined to ensure both parties understand the cost of borrowing.

-

Neglecting to state the repayment schedule. Clearly outline when payments are due to prevent misunderstandings.

-

Using vague language. Be specific about terms and conditions. Ambiguities can lead to different interpretations.

-

Forgetting to include a default clause. This clause is crucial as it defines what happens if the borrower fails to make payments.

-

Not signing the document. Both parties must sign the promissory note for it to be legally binding.

-

Failing to date the document. The date of signing is important for establishing timelines related to the loan.

-

Leaving out the governing law clause. This clause indicates which state’s laws will apply in case of disputes.

-

Not keeping copies. Both parties should retain a signed copy of the promissory note for their records.

What You Should Know About This Form

-

What is a North Carolina Promissory Note?

A North Carolina Promissory Note is a legal document in which one party (the borrower) promises to pay a specific amount of money to another party (the lender) under agreed-upon terms. This document outlines the amount borrowed, the interest rate, repayment schedule, and any penalties for late payment. It serves as a formal acknowledgment of the debt and is enforceable in a court of law.

-

What information is typically included in a Promissory Note?

Typically, a North Carolina Promissory Note includes:

- The names and addresses of both the borrower and the lender.

- The principal amount being borrowed.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Any penalties for late payments or default.

- Signatures of both parties, indicating agreement to the terms.

-

Is a Promissory Note legally binding in North Carolina?

Yes, a Promissory Note is legally binding in North Carolina, provided it meets certain requirements. For it to be enforceable, it must contain clear terms regarding the loan amount, interest rate, repayment schedule, and signatures from both parties. If these elements are present, the note can be enforced in court if the borrower fails to repay the loan as agreed.

-

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended note. This ensures clarity and helps prevent disputes regarding the terms of the agreement.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults on the Promissory Note, the lender has several options. The lender may choose to pursue legal action to recover the owed amount. This could involve filing a lawsuit to obtain a judgment against the borrower. Additionally, the lender may seek to negotiate a repayment plan or settlement. Understanding the options available can help both parties navigate the situation effectively.

North Carolina Promissory Note Example

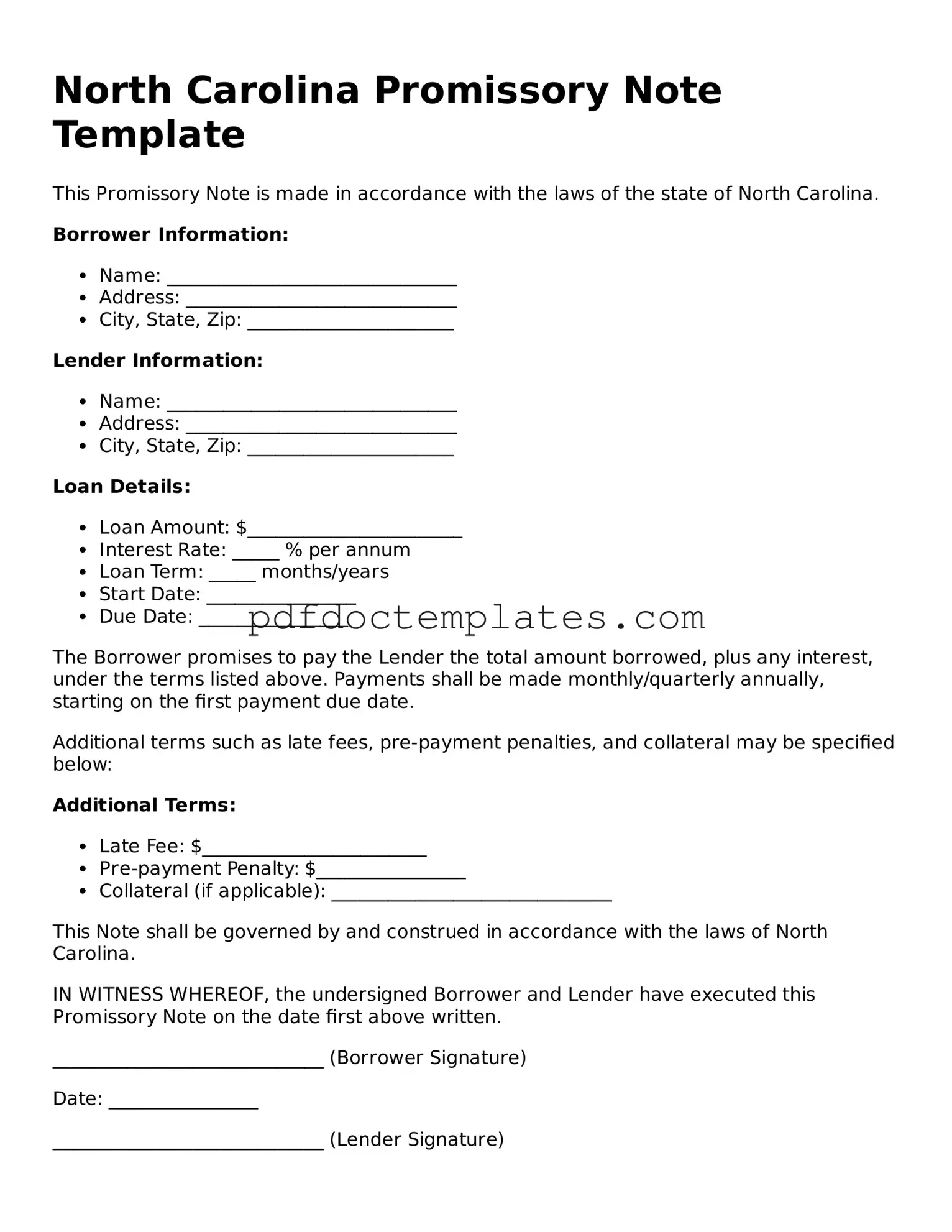

North Carolina Promissory Note Template

This Promissory Note is made in accordance with the laws of the state of North Carolina.

Borrower Information:

- Name: _______________________________

- Address: _____________________________

- City, State, Zip: ______________________

Lender Information:

- Name: _______________________________

- Address: _____________________________

- City, State, Zip: ______________________

Loan Details:

- Loan Amount: $_______________________

- Interest Rate: _____ % per annum

- Loan Term: _____ months/years

- Start Date: ________________

- Due Date: ________________

The Borrower promises to pay the Lender the total amount borrowed, plus any interest, under the terms listed above. Payments shall be made monthly/quarterly annually, starting on the first payment due date.

Additional terms such as late fees, pre-payment penalties, and collateral may be specified below:

Additional Terms:

- Late Fee: $________________________

- Pre-payment Penalty: $________________

- Collateral (if applicable): ______________________________

This Note shall be governed by and construed in accordance with the laws of North Carolina.

IN WITNESS WHEREOF, the undersigned Borrower and Lender have executed this Promissory Note on the date first above written.

_____________________________ (Borrower Signature)

Date: ________________

_____________________________ (Lender Signature)

Date: ________________

Check out Other Common Promissory Note Templates for US States

Tennessee Promissory Note - This document is often used in personal loans and business financing arrangements.

To establish a clear understanding between a landlord and a tenant, utilizing a Lease Agreement form is essential. This document not only outlines essential terms such as rent payment and property maintenance but also serves to protect the interests of both parties throughout the duration of the lease.

Promissory Note Washington State - Defaulting on a promissory note can lead to legal action and credit damage.

Promissory Note Notarized - Having clear terms can help avoid potential conflicts down the line.

Michigan Promissory Note - Some lenders offer concessions, like grace periods, within the terms of the promissory note.