Blank Lady Bird Deed Document for North Carolina

Misconceptions

The Lady Bird Deed, also known as an enhanced life estate deed, is a popular estate planning tool in North Carolina. However, several misconceptions surround this form. Understanding these misconceptions can help individuals make informed decisions about their estate planning. Below is a list of six common misconceptions.

- 1. The Lady Bird Deed is only for wealthy individuals. Many people believe that only those with significant assets can benefit from a Lady Bird Deed. In reality, it can be useful for anyone who owns property and wants to simplify the transfer of that property upon death.

- 2. A Lady Bird Deed avoids probate completely. While a Lady Bird Deed can help avoid probate for the property it covers, it does not eliminate the need for probate for other assets that are not included in the deed.

- 3. The property is immediately transferred to beneficiaries. Some think that once the Lady Bird Deed is executed, the property is instantly transferred to the beneficiaries. However, the transfer occurs only after the original owner passes away.

- 4. A Lady Bird Deed can be revoked at any time. Although it is true that the grantor can revoke or change the deed, some people mistakenly believe that this can be done without any formal process. In reality, revoking a Lady Bird Deed typically requires creating a new deed.

- 5. The Lady Bird Deed protects the property from creditors. There is a misconception that a Lady Bird Deed provides complete protection from creditors. However, if the grantor has outstanding debts, creditors may still have claims against the property before it passes to the beneficiaries.

- 6. All states recognize the Lady Bird Deed. Many assume that the Lady Bird Deed is a universally accepted form across all states. In fact, while it is recognized in North Carolina and some other states, not all states have similar provisions, and the rules can vary significantly.

Understanding these misconceptions can help individuals better navigate their estate planning options and make informed choices regarding their property and assets.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed allows property owners in North Carolina to transfer their property to beneficiaries while retaining control during their lifetime. |

| Governing Law | The Lady Bird Deed is governed by North Carolina General Statutes, specifically under the laws pertaining to real property transfers. |

| Benefits | This deed helps avoid probate, ensuring a smoother transition of property to heirs upon the owner's death. |

| Retained Rights | Property owners retain the right to sell, mortgage, or change the property without needing consent from beneficiaries. |

| Tax Implications | Using a Lady Bird Deed may help in minimizing estate taxes, as the property value is not included in the owner's estate. |

| Revocation | The deed can be revoked or modified at any time before the owner's death, providing flexibility to the property owner. |

Key takeaways

When considering the North Carolina Lady Bird Deed, there are several important aspects to keep in mind. Here are some key takeaways:

- Property Transfer: The Lady Bird Deed allows property owners to transfer real estate to beneficiaries while retaining control during their lifetime.

- Avoiding Probate: This deed helps avoid the probate process, allowing for a smoother transition of property upon the owner's death.

- Retained Rights: The original property owner retains the right to live in the property and can sell or change the deed at any time.

- Tax Implications: It's important to understand the potential tax implications, as the transfer may affect property taxes and capital gains taxes.

Using the Lady Bird Deed can simplify estate planning and provide peace of mind for property owners. Always consider consulting with a legal professional to ensure proper completion and understanding of the form.

Dos and Don'ts

When filling out the North Carolina Lady Bird Deed form, it’s essential to approach the process with care. This deed allows property owners to transfer their real estate to beneficiaries while retaining certain rights. Here’s a list of what you should and shouldn’t do:

- Do ensure you understand the purpose of a Lady Bird Deed.

- Do verify that you are the sole owner or have the authority to act on behalf of co-owners.

- Do provide accurate property descriptions to avoid confusion later.

- Do list the beneficiaries clearly, including their full names and relationship to you.

- Do consult with a legal expert if you have questions about the form.

- Don’t rush through the form; take your time to ensure accuracy.

- Don’t leave any required fields blank; incomplete forms may be rejected.

- Don’t forget to sign the deed in front of a notary public.

- Don’t assume that verbal agreements are enough; everything must be documented.

By following these guidelines, you can help ensure that your Lady Bird Deed is filled out correctly and serves its intended purpose.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to accurately describe the property being transferred. This includes omitting important details such as the property address or legal description. A clear and precise description is essential to avoid confusion and potential legal issues.

-

Improper Execution: The Lady Bird Deed must be signed by the grantor in the presence of a notary public. Some individuals neglect this step, leading to invalidation of the deed. It is crucial to ensure that all signatures are properly witnessed and notarized.

-

Failure to Include All Necessary Parties: Sometimes, individuals do not list all relevant parties involved in the transaction. This can create complications down the line, especially if there are multiple heirs or co-owners. All parties should be clearly identified to prevent disputes.

-

Not Understanding the Implications: Many people do not fully grasp the legal implications of a Lady Bird Deed. It is important to understand how this type of deed affects property rights and estate planning. Lack of knowledge can lead to unintended consequences for the grantor and beneficiaries.

What You Should Know About This Form

-

What is a Lady Bird Deed?

A Lady Bird Deed, also known as an enhanced life estate deed, is a legal document that allows a property owner to transfer their property to their heirs while retaining certain rights during their lifetime. This type of deed is particularly popular in North Carolina because it provides a way to avoid probate, ensuring that the property passes directly to the heirs upon the owner's death.

-

What are the benefits of using a Lady Bird Deed?

There are several advantages to using a Lady Bird Deed. First, it allows the property owner to maintain control over the property while they are alive. They can sell, mortgage, or change their mind about the transfer without needing the consent of the heirs. Additionally, this deed helps avoid the lengthy and often costly probate process. Furthermore, it can provide tax benefits, as the property may receive a step-up in basis, potentially reducing capital gains taxes for heirs.

-

How does a Lady Bird Deed differ from a traditional life estate deed?

Unlike a traditional life estate deed, which restricts the property owner’s ability to sell or modify the property without the consent of the remaindermen (the future owners), a Lady Bird Deed allows the owner to retain full control. This means they can sell or encumber the property without needing permission from anyone else, making it a more flexible option.

-

Who should consider using a Lady Bird Deed?

Individuals who own real estate and want to ensure a smooth transfer of property to their heirs without going through probate may find a Lady Bird Deed beneficial. It is especially useful for older adults who want to retain control over their property while planning for the future. However, it’s essential to consult with a legal professional to determine if this option aligns with one’s specific circumstances.

-

How do you create a Lady Bird Deed in North Carolina?

Creating a Lady Bird Deed involves drafting the document in accordance with North Carolina laws. It must include specific language that indicates the intent to create an enhanced life estate. After drafting, the deed must be signed by the property owner and notarized. Finally, it should be recorded with the county register of deeds to ensure it is legally recognized. Seeking assistance from a legal professional can help ensure the deed is properly executed.

-

Can a Lady Bird Deed be revoked?

Yes, a Lady Bird Deed can be revoked or modified by the property owner at any time during their lifetime. The owner has the right to change their mind about the transfer, sell the property, or even create a new deed. This flexibility is one of the key benefits of a Lady Bird Deed, allowing individuals to adapt their estate plans as their circumstances change.

North Carolina Lady Bird Deed Example

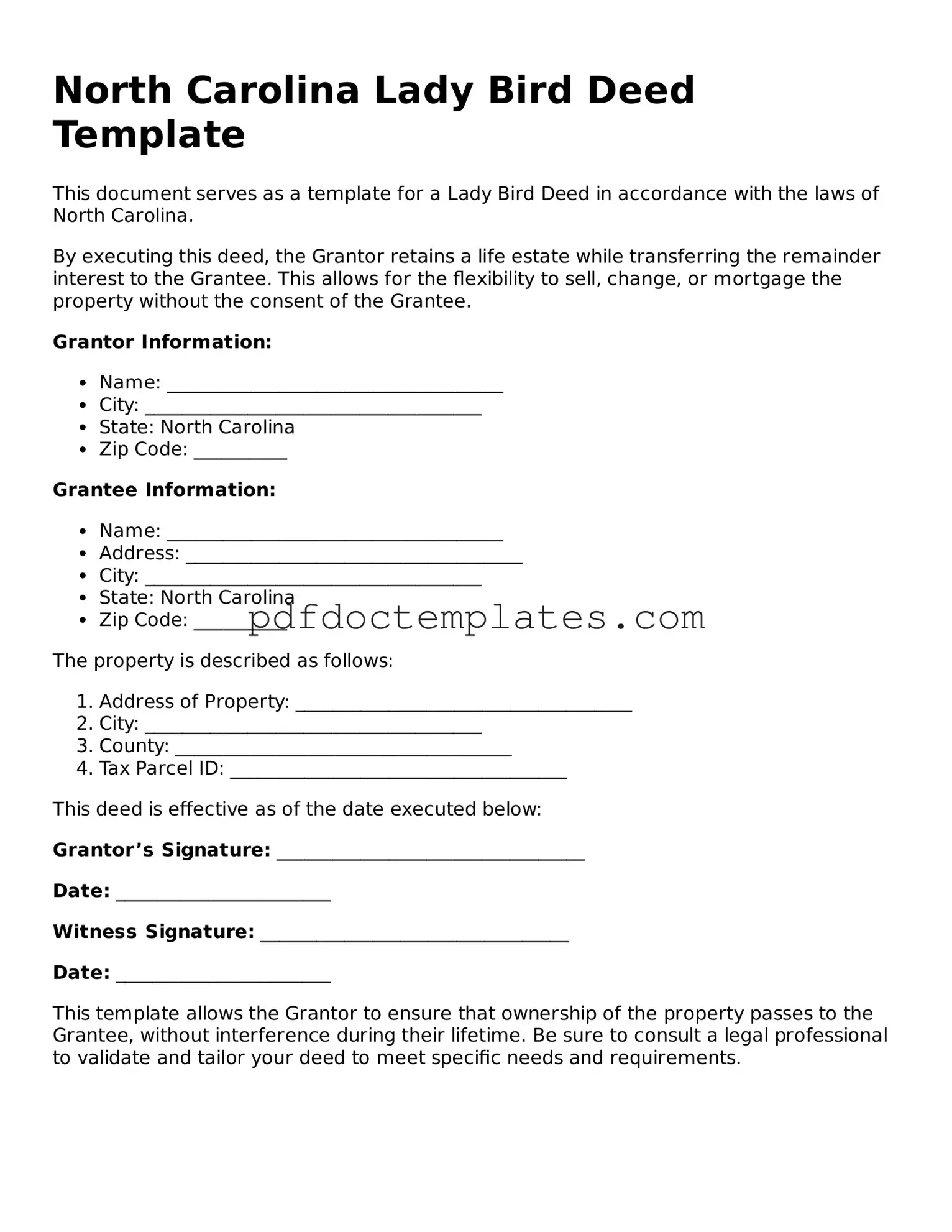

North Carolina Lady Bird Deed Template

This document serves as a template for a Lady Bird Deed in accordance with the laws of North Carolina.

By executing this deed, the Grantor retains a life estate while transferring the remainder interest to the Grantee. This allows for the flexibility to sell, change, or mortgage the property without the consent of the Grantee.

Grantor Information:

- Name: ____________________________________

- City: ____________________________________

- State: North Carolina

- Zip Code: __________

Grantee Information:

- Name: ____________________________________

- Address: ____________________________________

- City: ____________________________________

- State: North Carolina

- Zip Code: __________

The property is described as follows:

- Address of Property: ____________________________________

- City: ____________________________________

- County: ____________________________________

- Tax Parcel ID: ____________________________________

This deed is effective as of the date executed below:

Grantor’s Signature: _________________________________

Date: _______________________

Witness Signature: _________________________________

Date: _______________________

This template allows the Grantor to ensure that ownership of the property passes to the Grantee, without interference during their lifetime. Be sure to consult a legal professional to validate and tailor your deed to meet specific needs and requirements.

Check out Other Common Lady Bird Deed Templates for US States

Michigan Lady Bird Deed - A Lady Bird Deed is sometimes referred to as an enhanced life estate deed.

Having a well-structured lease can significantly impact the rental experience, and acquiring the appropriate documentation is essential; thus, utilizing resources like All Florida Forms can help streamline the process by providing access to standardized forms that ensure all necessary terms are covered.