Blank Bill of Sale Document for North Carolina

Misconceptions

Understanding the North Carolina Bill of Sale form is crucial for anyone involved in buying or selling personal property. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

-

A Bill of Sale is the same as a title. Many people believe that a Bill of Sale transfers ownership just like a title does. In reality, a Bill of Sale serves as a receipt that documents the transaction but does not replace the need for a title transfer for vehicles or certain other items.

-

You don’t need a Bill of Sale for small transactions. Some individuals think that a Bill of Sale is only necessary for large purchases. However, even small transactions can benefit from a Bill of Sale, as it provides a record of the agreement between the buyer and seller.

-

All Bill of Sale forms are the same. People often assume that any Bill of Sale form can be used interchangeably. Each state, including North Carolina, has specific requirements and formats for Bill of Sale forms, making it important to use the correct version for the state in which the transaction occurs.

-

A Bill of Sale protects you from all legal issues. While a Bill of Sale is a useful document, it does not provide absolute protection against future disputes or legal issues. It is essential to ensure that all terms are clear and agreed upon to minimize potential conflicts.

-

You must have a notary witness a Bill of Sale. Some believe that a notary public must witness the signing of a Bill of Sale. In North Carolina, notarization is not required for most personal property sales, although it can add an extra layer of credibility.

-

Bill of Sale forms are only for vehicles. Many people think that Bill of Sale forms are exclusively for vehicle transactions. In fact, they can be used for a wide range of personal property sales, including furniture, electronics, and collectibles.

-

Once signed, a Bill of Sale cannot be altered. Some individuals believe that a Bill of Sale is set in stone once signed. However, if both parties agree, they can amend the document, but it’s best to create a new Bill of Sale to avoid confusion.

By addressing these misconceptions, individuals can better navigate the process of buying and selling personal property in North Carolina. A clear understanding of the Bill of Sale can lead to smoother transactions and fewer disputes down the line.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Bill of Sale is a legal document that transfers ownership of personal property from one party to another. |

| Governing Law | The Bill of Sale in North Carolina is governed by the North Carolina General Statutes, specifically Article 2 of Chapter 25. |

| Types of Property | This form is commonly used for vehicles, boats, and other personal property. |

| Requirements | Both the seller and buyer must sign the Bill of Sale for it to be valid. |

| Notarization | Notarization is not required in North Carolina, but it can add an extra layer of authenticity. |

| Use for Registration | A Bill of Sale can be used to register vehicles with the North Carolina Division of Motor Vehicles. |

| Tax Implications | Sales tax may apply to the transaction, and it is the buyer's responsibility to pay it when registering the property. |

| Record Keeping | It is advisable for both parties to keep a copy of the Bill of Sale for their records. |

| Dispute Resolution | If disputes arise, the Bill of Sale can serve as evidence in legal proceedings. |

Key takeaways

When completing and utilizing the North Carolina Bill of Sale form, several important considerations can guide individuals through the process. Below are key takeaways that highlight essential aspects of this document.

- The Bill of Sale serves as a legal document that records the transfer of ownership of personal property, often used for vehicles, boats, and other tangible items.

- It is crucial to include the full names and addresses of both the seller and the buyer to ensure clarity and accountability.

- Detailed descriptions of the item being sold should be provided. This includes make, model, year, and any identifying numbers, such as VIN for vehicles.

- The sale price must be clearly stated, as this reflects the agreed-upon amount for the transaction.

- Both parties should sign and date the document to validate the agreement. This step is essential for legal recognition.

- It is advisable to retain copies of the completed Bill of Sale for personal records, as this can be useful for future reference or disputes.

- In North Carolina, a Bill of Sale is not always required for all transactions, but it is highly recommended for clarity and proof of ownership transfer.

- Consulting with a legal professional may provide additional insights, especially for complex transactions or when dealing with high-value items.

Dos and Don'ts

When filling out the North Carolina Bill of Sale form, it's essential to approach the task with care. This document serves as a record of the transaction between a buyer and a seller, and accuracy is key. Here’s a list of ten things you should and shouldn’t do:

- Do ensure all information is accurate, including names, addresses, and vehicle details.

- Do sign the form in the presence of a notary public, if required.

- Do keep a copy of the completed Bill of Sale for your records.

- Do include the purchase price and any relevant terms of sale.

- Do verify that the seller has the legal right to sell the item.

- Don’t leave any blank spaces on the form; fill in all required fields.

- Don’t use vague language; be specific about the item being sold.

- Don’t forget to date the document.

- Don’t sign the document without reading it thoroughly.

- Don’t assume the form is valid without proper signatures and notarization if necessary.

By following these guidelines, you can ensure that your Bill of Sale is both effective and legally sound. Take your time, double-check your work, and always prioritize clarity and accuracy.

Common mistakes

-

Incomplete Information: Many people forget to fill out all required fields. This includes names, addresses, and the description of the item being sold. Leaving out any detail can lead to confusion later on.

-

Incorrect Dates: Some individuals mistakenly enter the wrong date. The date of the sale is crucial for record-keeping and legal purposes. Double-checking the date can prevent future issues.

-

Not Signing the Document: A common oversight is neglecting to sign the Bill of Sale. Both the buyer and seller must sign to make the document valid. Without signatures, the form may not hold up in disputes.

-

Missing Notarization: In North Carolina, notarization may be required for certain transactions. Failing to have the document notarized can complicate matters, especially if legal issues arise later.

What You Should Know About This Form

-

What is a North Carolina Bill of Sale?

A North Carolina Bill of Sale is a legal document that records the transfer of ownership of personal property from one party to another. It serves as proof of the transaction and outlines the details of the sale, including the item description, purchase price, and the names of the buyer and seller.

-

When do I need a Bill of Sale in North Carolina?

A Bill of Sale is typically needed when selling or purchasing items such as vehicles, boats, or valuable personal property. It is especially important for transactions involving significant amounts of money or when the item requires registration or titling.

-

Is a Bill of Sale required by law in North Carolina?

While a Bill of Sale is not legally required for all transactions, it is highly recommended. For certain items, like motor vehicles, a Bill of Sale can be necessary for registration purposes and to establish proof of ownership.

-

What information should be included in a Bill of Sale?

A comprehensive Bill of Sale should include:

- The names and addresses of both the buyer and seller

- A detailed description of the item being sold

- The purchase price

- The date of the transaction

- Any warranties or guarantees

-

Do I need to have the Bill of Sale notarized?

Notarization is not required for a Bill of Sale in North Carolina. However, having it notarized can add an extra layer of authenticity and may be beneficial in case of disputes.

-

Can I use a generic Bill of Sale template?

Yes, you can use a generic Bill of Sale template, but it is advisable to ensure that it meets North Carolina's specific requirements. Customizing the template to reflect the details of your transaction will help avoid any issues.

-

How do I complete a Bill of Sale?

To complete a Bill of Sale, fill in the necessary information, including the details of the transaction and both parties' signatures. Ensure that all information is accurate and clear. Once completed, provide a copy to both the buyer and seller.

-

What should I do with the Bill of Sale after the transaction?

Both the buyer and seller should keep a copy of the Bill of Sale for their records. This document can be useful for future reference, especially for tax purposes or if any disputes arise regarding the sale.

-

Where can I find a Bill of Sale form for North Carolina?

Bill of Sale forms can be found online through various legal websites or local government offices. It is important to ensure that the form you choose is appropriate for the specific type of transaction you are conducting.

North Carolina Bill of Sale Example

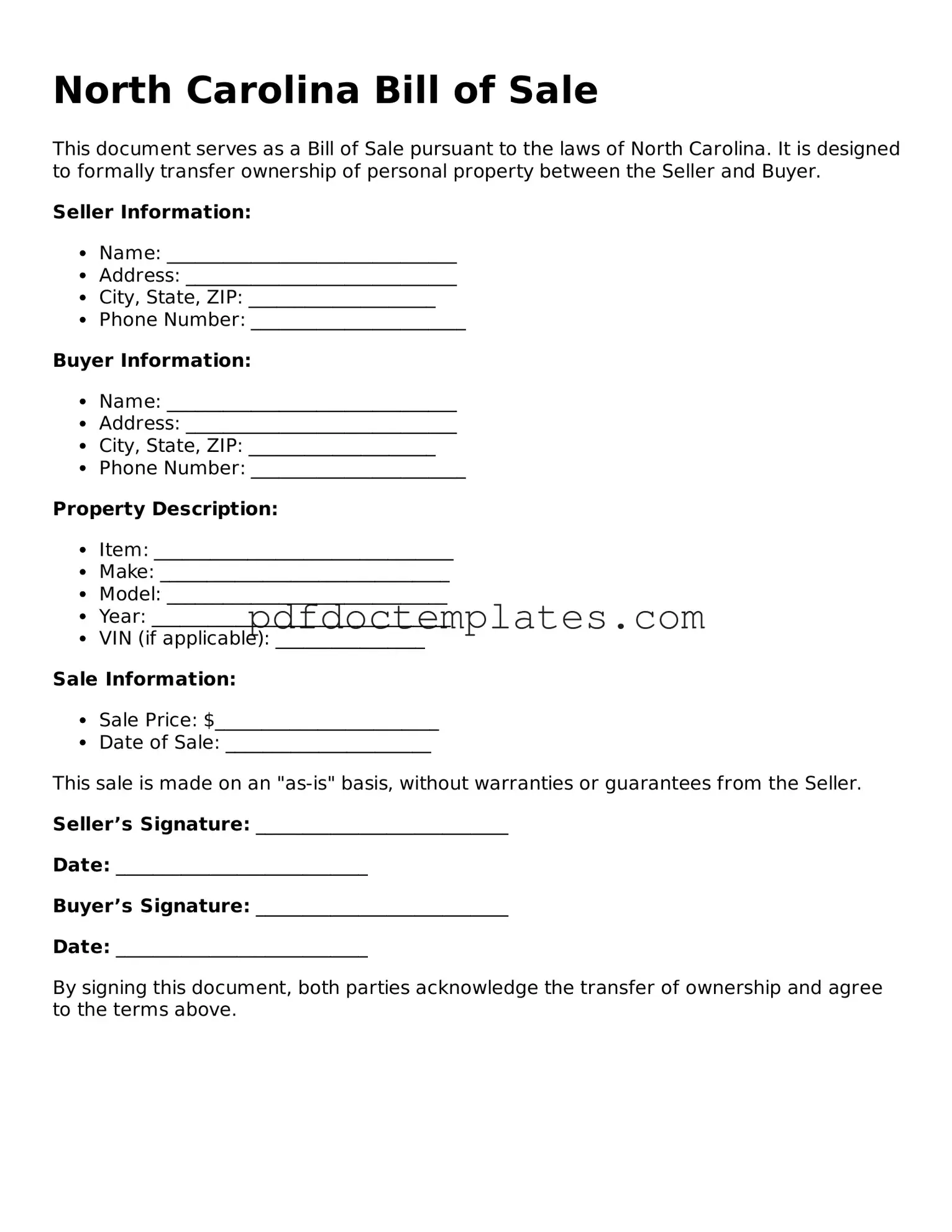

North Carolina Bill of Sale

This document serves as a Bill of Sale pursuant to the laws of North Carolina. It is designed to formally transfer ownership of personal property between the Seller and Buyer.

Seller Information:

- Name: _______________________________

- Address: _____________________________

- City, State, ZIP: ____________________

- Phone Number: _______________________

Buyer Information:

- Name: _______________________________

- Address: _____________________________

- City, State, ZIP: ____________________

- Phone Number: _______________________

Property Description:

- Item: ________________________________

- Make: _______________________________

- Model: ______________________________

- Year: ________________________________

- VIN (if applicable): ________________

Sale Information:

- Sale Price: $________________________

- Date of Sale: ______________________

This sale is made on an "as-is" basis, without warranties or guarantees from the Seller.

Seller’s Signature: ___________________________

Date: ___________________________

Buyer’s Signature: ___________________________

Date: ___________________________

By signing this document, both parties acknowledge the transfer of ownership and agree to the terms above.

Check out Other Common Bill of Sale Templates for US States

Virginia Bill of Sale Template - Utilizing a Bill of Sale ensures transparency and accountability in sales dealings.

To successfully navigate the process of selling your trailer, you may find our comprehensive guide on the Trailer Bill of Sale template valuable. This form is designed to ensure that all necessary details are documented properly, protecting both the seller and buyer during the transaction. For more information, you can access the template here.

Dol Bill of Sale - When selling an item, providing a Bill of Sale can increase buyer confidence and demonstrate transparency in the transaction.

Is a Bill of Sale Required in Arizona - Buyers can utilize the Bill of Sale for registration purposes when acquiring vehicles.