Blank Tractor Bill of Sale Document for New Jersey

Misconceptions

Understanding the New Jersey Tractor Bill of Sale form can be tricky. Here are some common misconceptions about it:

- 1. A bill of sale is not necessary for tractor transactions. Some people believe that a bill of sale is optional. However, having a bill of sale is important for legal proof of ownership.

- 2. The bill of sale must be notarized. Many think that notarization is required. In New Jersey, notarization is not mandatory for a tractor bill of sale, but it can add an extra layer of protection.

- 3. Only licensed dealers can provide a bill of sale. This is not true. Private sellers can also create and sign a bill of sale for a tractor transaction.

- 4. The bill of sale needs to be filed with the state. Some people assume they must file the bill of sale with state authorities. In New Jersey, you do not need to file it; keeping it for your records is sufficient.

- 5. A verbal agreement is enough. Many believe a simple handshake or verbal agreement suffices. In reality, a written bill of sale is crucial for clarity and legal protection.

- 6. The bill of sale can be generic. Some think any generic form will work. However, it’s best to use a specific New Jersey Tractor Bill of Sale to ensure all necessary details are included.

- 7. The buyer and seller must be present at the same time. People often think both parties must sign the document simultaneously. In fact, they can sign it separately, as long as both signatures are obtained.

- 8. The bill of sale doesn't need to include vehicle details. Some may overlook this. A good bill of sale should include specific details about the tractor, such as make, model, and VIN.

- 9. The bill of sale is only for the buyer's protection. Many assume it only benefits the buyer. In reality, it protects both parties by documenting the transaction clearly.

By clearing up these misconceptions, you can better navigate the process of buying or selling a tractor in New Jersey.

Form Properties

| Fact Name | Description |

|---|---|

| Purpose | The New Jersey Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor from one party to another. |

| Governing Laws | This form is governed by New Jersey state laws regarding the sale and transfer of personal property, specifically under Title 12A of the New Jersey Statutes. |

| Required Information | Essential details include the names and addresses of both the buyer and seller, a description of the tractor, and the sale price. |

| Signature Requirement | Both the buyer and seller must sign the form to validate the transaction and confirm the agreement of terms. |

| Record Keeping | It is advisable for both parties to retain a copy of the completed Bill of Sale for their records, as it serves as proof of the transaction. |

Key takeaways

When filling out and using the New Jersey Tractor Bill of Sale form, there are several important points to keep in mind. Understanding these can help ensure a smooth transaction and protect the interests of both the buyer and the seller.

- Accurate Information: It is essential to provide accurate details about the tractor, including the make, model, year, and Vehicle Identification Number (VIN). This information helps to clearly identify the tractor being sold.

- Seller and Buyer Details: Both parties must include their full names and addresses on the form. This establishes a clear record of who is involved in the transaction.

- Sale Price: Clearly state the sale price of the tractor. This information is important for both parties, especially for tax purposes and future reference.

- Signatures: Both the seller and the buyer must sign the document. Their signatures validate the agreement and signify that both parties accept the terms outlined in the bill of sale.

By following these key takeaways, individuals can facilitate a more organized and legally sound transaction when buying or selling a tractor in New Jersey.

Dos and Don'ts

When filling out the New Jersey Tractor Bill of Sale form, there are several important considerations to keep in mind. Here are some things you should and shouldn't do:

- Do ensure that all information is accurate and complete. Double-check the details of the tractor, including make, model, year, and Vehicle Identification Number (VIN).

- Do include both the buyer's and seller's signatures. This step is crucial for the document to be legally binding.

- Do retain a copy of the completed form for your records. This will help in case any disputes arise in the future.

- Do verify if any additional documentation is required by the state or local authorities before submitting the form.

- Don't leave any sections blank. Incomplete forms can lead to delays or issues with the transaction.

- Don't use incorrect or outdated information. Ensure that all details reflect the current status of the tractor.

- Don't sign the form until all parties are present. Signing prematurely can create misunderstandings.

- Don't forget to check for any specific requirements that may apply to your situation, such as emissions testing or liens on the tractor.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to fill out all required fields. Essential details such as the buyer's and seller's names, addresses, and contact information should always be included.

-

Incorrect Vehicle Identification Number (VIN): The VIN must be accurately recorded. An error in this number can lead to significant complications in the registration process.

-

Omitting Sale Price: The sale price of the tractor should be clearly stated. This figure is crucial for tax purposes and may affect the buyer's ability to register the vehicle.

-

Not Including Date of Sale: The date on which the sale occurs is often overlooked. This date is important for both parties and may be necessary for future reference.

-

Failure to Sign: Both the buyer and seller must sign the document. A missing signature can invalidate the bill of sale and complicate the transfer of ownership.

-

Not Notarizing the Document: While not always required, having the bill of sale notarized can provide an additional layer of protection and authenticity, especially in disputes.

-

Neglecting to Keep Copies: After completing the form, both parties should retain copies. This practice ensures that each has a record of the transaction for future reference.

What You Should Know About This Form

-

What is a Tractor Bill of Sale in New Jersey?

A Tractor Bill of Sale is a legal document that records the transfer of ownership of a tractor from one party to another in New Jersey. It serves as proof of the transaction and outlines the details of the sale, including the buyer, seller, and the tractor's specifications.

-

Why do I need a Tractor Bill of Sale?

This document protects both the buyer and seller. For the buyer, it provides proof of ownership, which is crucial for registration and insurance purposes. For the seller, it serves as evidence that the tractor has been sold, which can protect against future liability claims related to the vehicle.

-

What information is required on the Tractor Bill of Sale?

The form should include the following details:

- Names and addresses of both the buyer and seller

- Date of the sale

- Make, model, and year of the tractor

- Vehicle Identification Number (VIN)

- Sale price

- Signatures of both parties

-

Is the Tractor Bill of Sale required to be notarized?

Notarization is not a requirement for a Tractor Bill of Sale in New Jersey. However, having the document notarized can add an extra layer of authenticity and may be beneficial in case of disputes.

-

Can I use a generic Bill of Sale form for my tractor?

While you can use a generic Bill of Sale, it is advisable to use a specific Tractor Bill of Sale form. This ensures that all relevant details specific to tractors are included, minimizing the risk of overlooking important information.

-

What if the tractor has a lien against it?

If there is a lien on the tractor, it is essential to disclose this information in the Bill of Sale. The buyer should be aware of any outstanding debts associated with the tractor, as they may assume responsibility for the lien upon purchase.

-

Do I need to register the Tractor Bill of Sale with any government office?

No, you do not need to register the Tractor Bill of Sale with any government office in New Jersey. However, the buyer should keep a copy of the signed document for their records and for future registration purposes.

-

What happens if I lose my Tractor Bill of Sale?

If you lose your Tractor Bill of Sale, you can create a new one, but both the buyer and seller must agree to the terms again. It is crucial to keep multiple copies of important documents to avoid complications in the future.

-

Can I cancel the sale after signing the Bill of Sale?

Once the Bill of Sale is signed, it generally signifies a binding agreement. Canceling the sale can be complicated and may require mutual consent from both parties. It is advisable to discuss any concerns with the other party as soon as possible.

-

Where can I obtain a Tractor Bill of Sale form?

You can find a Tractor Bill of Sale form online through various legal document websites or local government resources. Ensure that the form you choose complies with New Jersey laws and includes all necessary details.

New Jersey Tractor Bill of Sale Example

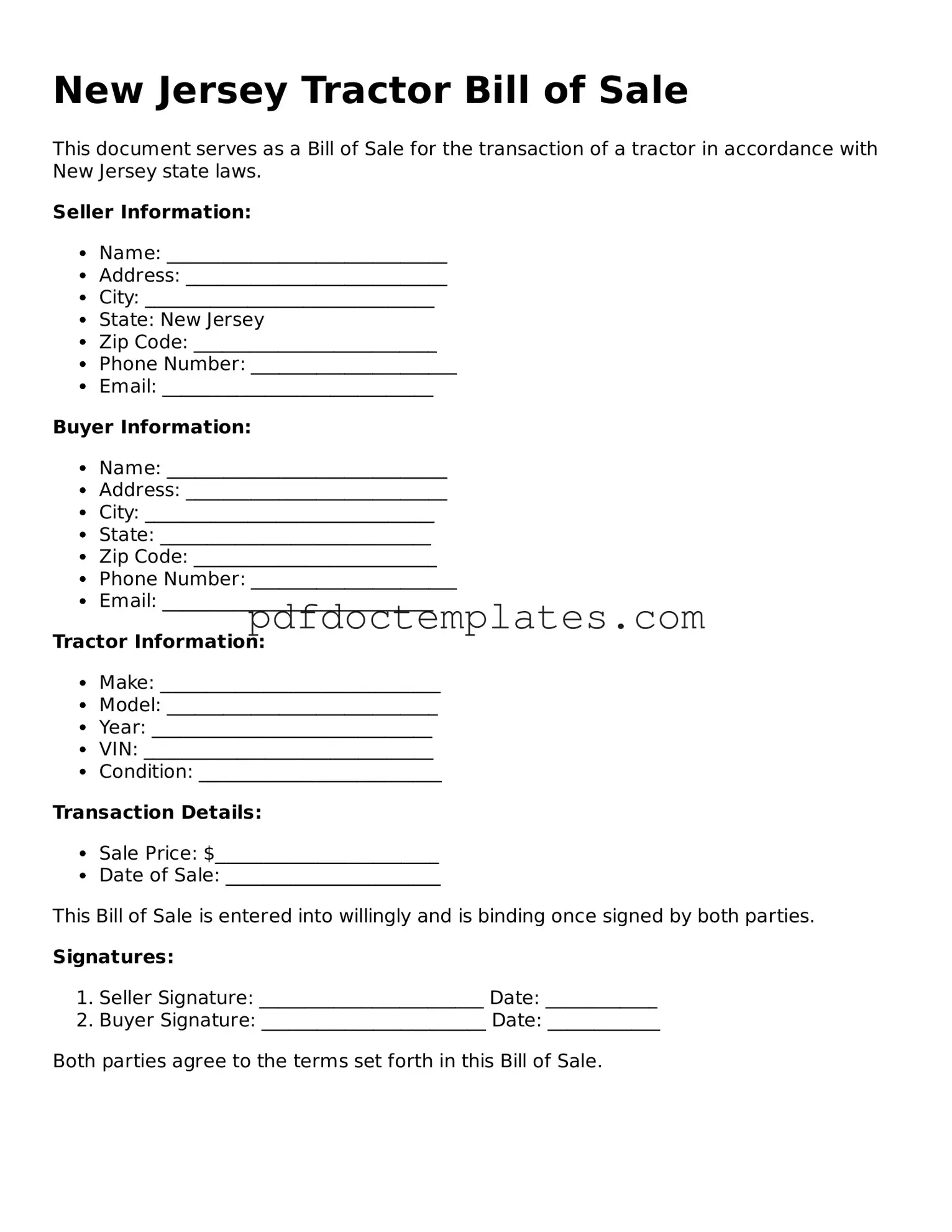

New Jersey Tractor Bill of Sale

This document serves as a Bill of Sale for the transaction of a tractor in accordance with New Jersey state laws.

Seller Information:

- Name: ______________________________

- Address: ____________________________

- City: _______________________________

- State: New Jersey

- Zip Code: __________________________

- Phone Number: ______________________

- Email: _____________________________

Buyer Information:

- Name: ______________________________

- Address: ____________________________

- City: _______________________________

- State: _____________________________

- Zip Code: __________________________

- Phone Number: ______________________

- Email: _____________________________

Tractor Information:

- Make: ______________________________

- Model: _____________________________

- Year: ______________________________

- VIN: _______________________________

- Condition: __________________________

Transaction Details:

- Sale Price: $________________________

- Date of Sale: _______________________

This Bill of Sale is entered into willingly and is binding once signed by both parties.

Signatures:

- Seller Signature: ________________________ Date: ____________

- Buyer Signature: ________________________ Date: ____________

Both parties agree to the terms set forth in this Bill of Sale.

Check out Other Common Tractor Bill of Sale Templates for US States

Bill of Sale for Tractor - Serves as a receipt for the buyer after purchasing a tractor.

A Florida Power of Attorney form is a legal document that grants someone the authority to act on another person's behalf in a variety of matters. This includes financial, legal, and health-related decisions. It plays a crucial role in ensuring that one's affairs are managed according to their wishes should they become unable to do so themselves. For those looking to create or modify such a document, resources like All Florida Forms can be invaluable.

Bill of Sale Truck - A guiding record for future maintenance or warranty claims.