Blank Promissory Note Document for New Jersey

Misconceptions

Misconceptions about the New Jersey Promissory Note form can lead to confusion for both lenders and borrowers. Here are eight common misunderstandings:

- 1. A Promissory Note is the same as a Loan Agreement. While both documents relate to borrowing money, a promissory note is a simple promise to repay, whereas a loan agreement outlines the terms and conditions of the loan.

- 2. All Promissory Notes must be notarized. Notarization is not a requirement for a promissory note to be valid in New Jersey, though it can provide additional legal protection.

- 3. A verbal promise is sufficient. A promissory note should be in writing to ensure enforceability. Verbal agreements can be difficult to prove in court.

- 4. Interest rates must be specified. While it is common to include an interest rate, it is not mandatory. A note can exist without specifying one, but it may affect the lender's return.

- 5. A Promissory Note is only for personal loans. Promissory notes can be used for various types of loans, including business loans and real estate transactions.

- 6. All Promissory Notes are the same. The terms and conditions can vary widely based on the agreement between the parties. Customization is often necessary.

- 7. Defaulting on a Promissory Note has no consequences. Defaulting can lead to legal action, including lawsuits or garnishment of wages, depending on the terms outlined in the note.

- 8. Once signed, a Promissory Note cannot be changed. Modifications are possible if both parties agree to the changes and document them appropriately.

Understanding these misconceptions can help individuals navigate the complexities of borrowing and lending in New Jersey more effectively.

Form Properties

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The New Jersey Uniform Commercial Code (UCC) governs promissory notes in New Jersey. |

| Parties Involved | The note involves two main parties: the maker (borrower) and the payee (lender). |

| Interest Rate | The interest rate can be fixed or variable, depending on the agreement between the parties. |

| Payment Terms | Payment terms specify when and how payments will be made, including due dates and payment methods. |

| Default Clause | A default clause outlines what happens if the maker fails to make payments as agreed. |

| Transferability | Promissory notes can often be transferred to another party, making them negotiable instruments. |

| Signatures Required | The maker must sign the note, and the payee may also sign it for acknowledgment. |

| Legal Enforcement | If the note is not paid, the payee can take legal action to enforce the terms of the note. |

Key takeaways

- Understand the Purpose: A promissory note is a written promise to pay a specified amount of money to a specific person or entity.

- Identify the Parties: Clearly list the borrower and lender's names and addresses. This information is crucial for legal clarity.

- Specify the Amount: State the exact amount of money being borrowed. This should be a clear and precise figure.

- Set the Terms: Outline the repayment terms, including the due date and any interest rates. Be specific to avoid confusion later.

- Include Payment Method: Indicate how the borrower will make payments. Options can include checks, bank transfers, or cash.

- Consider Legal Requirements: Ensure the note complies with New Jersey laws. This may include specific formatting or language.

- Signatures Matter: Both parties must sign the note. Without signatures, the document may not be enforceable.

- Keep Copies: After signing, each party should keep a copy of the promissory note for their records. This is important for future reference.

Dos and Don'ts

When filling out the New Jersey Promissory Note form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don’ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate information, including names, addresses, and amounts.

- Do clearly state the repayment terms, including interest rates and due dates.

- Do sign and date the form in the appropriate sections.

- Don't leave any blank spaces; fill in all required fields.

- Don't use ambiguous language; be clear and specific.

- Don't forget to keep a copy for your records.

- Don't rush through the process; take your time to ensure everything is correct.

Common mistakes

-

Incorrect Borrower Information: Failing to provide the full legal name and address of the borrower can lead to confusion and enforcement issues later on.

-

Missing Lender Details: Not including the lender's complete name and contact information can hinder communication and legal processes.

-

Omitting Loan Amount: Leaving out the specific amount being borrowed can create disputes about the terms of the loan.

-

Vague Payment Terms: Failing to clearly outline the payment schedule, including due dates and amounts, may lead to misunderstandings.

-

Ignoring Interest Rate: Not specifying the interest rate, or neglecting to indicate if it is fixed or variable, can result in legal complications.

-

Neglecting Default Clauses: Omitting terms related to default can leave both parties unprotected in case of non-payment.

-

Inadequate Signatures: Not having both parties sign the document, or failing to include the date of signature, can invalidate the note.

-

Not Initialing Changes: If any alterations are made to the form, failing to initial those changes can lead to disputes over the agreed terms.

-

Ignoring State-Specific Requirements: Not adhering to New Jersey's specific laws and requirements for promissory notes can render the document unenforceable.

What You Should Know About This Form

-

What is a Promissory Note?

A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. It serves as a legal document that outlines the terms of the loan or debt agreement.

-

What are the key components of a New Jersey Promissory Note?

A New Jersey Promissory Note typically includes:

- The names and addresses of the borrower and lender.

- The principal amount being borrowed.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Consequences for late payments or default.

- Signatures of both parties.

-

Do I need to notarize a Promissory Note in New Jersey?

While notarization is not required for a promissory note to be legally binding in New Jersey, having it notarized can provide additional legal protection. It can serve as evidence that the parties agreed to the terms outlined in the document.

-

Can a Promissory Note be modified?

Yes, a promissory note can be modified if both parties agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended document to avoid future disputes.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has the right to pursue legal action to recover the owed amount. This may involve filing a lawsuit or seeking a judgment against the borrower. The specific actions depend on the terms outlined in the note.

-

Is interest allowed on a Promissory Note in New Jersey?

Yes, interest can be charged on a promissory note in New Jersey. However, the interest rate must comply with state usury laws, which set limits on how much interest can be charged on loans.

-

Can a Promissory Note be transferred to another party?

A promissory note can be transferred or assigned to another party unless the note specifically states otherwise. The new holder of the note will then have the same rights as the original lender.

-

What should I do if I lose my Promissory Note?

If a promissory note is lost, the borrower should notify the lender immediately. The lender may require the borrower to sign a declaration stating that the note is lost and may issue a replacement note to protect both parties.

-

Are there any specific laws governing Promissory Notes in New Jersey?

Yes, promissory notes in New Jersey are governed by the Uniform Commercial Code (UCC), which outlines the rules for negotiable instruments. It is important to ensure that the note complies with these regulations to be enforceable.

-

Where can I find a New Jersey Promissory Note template?

Templates for New Jersey Promissory Notes can be found online through legal document services or law firms. It is recommended to use a template that complies with New Jersey laws and to consult with a legal professional if there are any questions.

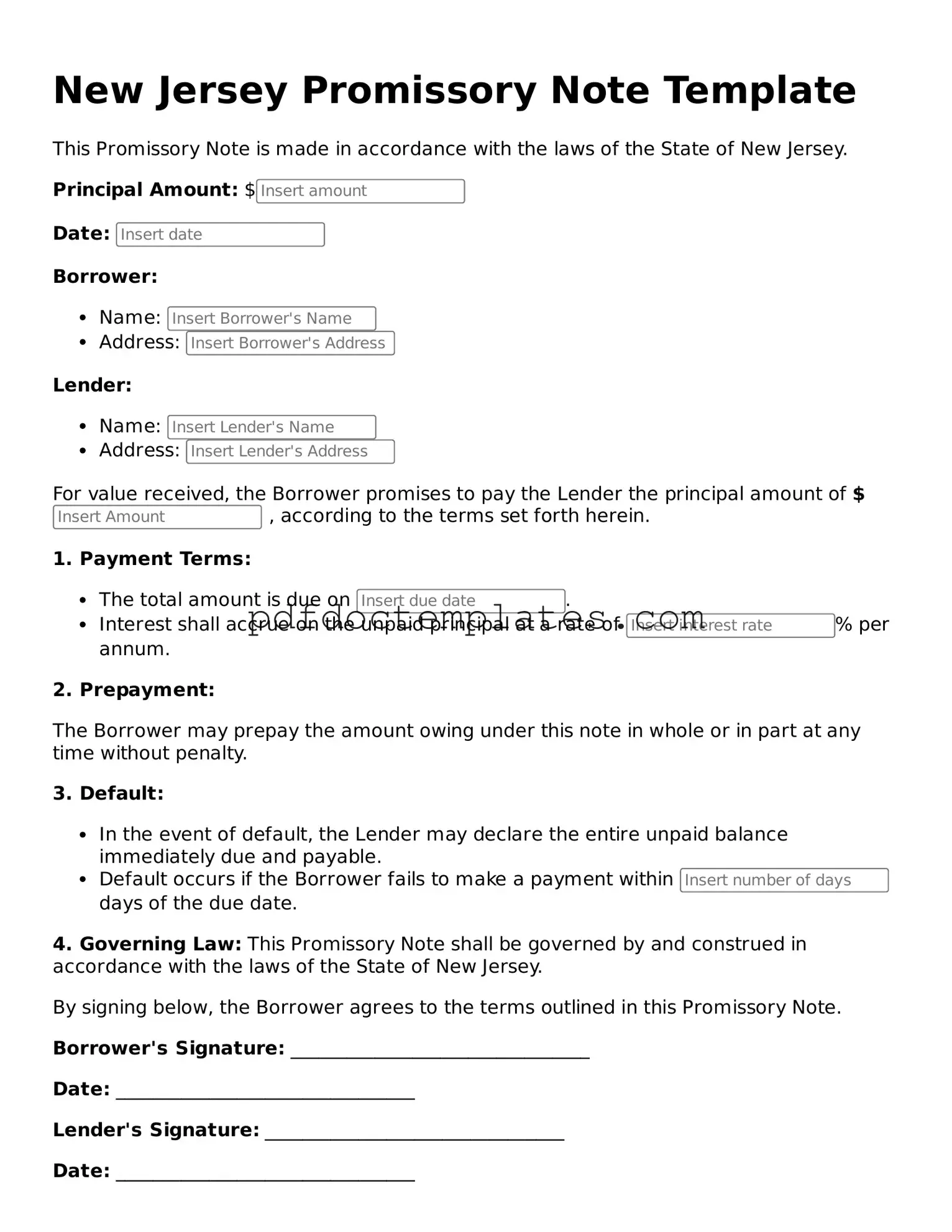

New Jersey Promissory Note Example

New Jersey Promissory Note Template

This Promissory Note is made in accordance with the laws of the State of New Jersey.

Principal Amount: $

Date:

Borrower:

- Name:

- Address:

Lender:

- Name:

- Address:

For value received, the Borrower promises to pay the Lender the principal amount of $ , according to the terms set forth herein.

1. Payment Terms:

- The total amount is due on .

- Interest shall accrue on the unpaid principal at a rate of % per annum.

2. Prepayment:

The Borrower may prepay the amount owing under this note in whole or in part at any time without penalty.

3. Default:

- In the event of default, the Lender may declare the entire unpaid balance immediately due and payable.

- Default occurs if the Borrower fails to make a payment within days of the due date.

4. Governing Law: This Promissory Note shall be governed by and construed in accordance with the laws of the State of New Jersey.

By signing below, the Borrower agrees to the terms outlined in this Promissory Note.

Borrower's Signature: ________________________________

Date: ________________________________

Lender's Signature: ________________________________

Date: ________________________________

Check out Other Common Promissory Note Templates for US States

Promissory Note Virginia - A Promissory Note can be secured with collateral for added protection for the lender.

Promissory Note Arizona - Customizable templates for promissory notes are often available online for convenience.

In New York, having a Power of Attorney is essential for ensuring that your preferences are honored when you are unable to make decisions due to unforeseen circumstances. This document empowers someone you trust to handle crucial financial and medical choices on your behalf. For those looking to establish this legal framework, resources such as All New York Forms can provide the necessary templates and guidance needed to navigate this important process.

Promissory Note Washington State - Terms can be negotiated and should be clearly stated in the note.

Create a Promissory Note - Borrowers may be required to provide personal information, such as their Social Security number.