Blank Durable Power of Attorney Document for New Jersey

Misconceptions

Many individuals have misunderstandings about the New Jersey Durable Power of Attorney (DPOA) form. Clarifying these misconceptions can help ensure that people make informed decisions regarding their legal and financial affairs.

- The DPOA is only for financial matters. This is not entirely accurate. While the DPOA primarily addresses financial decisions, it can also grant authority over health care decisions if specifically stated. It is important to include health care provisions if that is the intent.

- A Durable Power of Attorney is only valid during the principal's lifetime. This misconception overlooks the purpose of the DPOA. It remains effective even if the principal becomes incapacitated, which is a key feature that distinguishes it from a regular power of attorney.

- Once a DPOA is created, it cannot be changed or revoked. This is incorrect. The principal retains the right to modify or revoke the DPOA at any time, as long as they are mentally competent. It is advisable to document any changes formally.

- All DPOA forms are the same across states. This is misleading. Each state has its own requirements and regulations regarding DPOA forms. Therefore, it is crucial to use the specific New Jersey form to ensure compliance with state laws.

Form Properties

| Fact Name | Details |

|---|---|

| Definition | A Durable Power of Attorney (DPOA) allows an individual to appoint someone else to make financial or legal decisions on their behalf, even if they become incapacitated. |

| Governing Law | The New Jersey Durable Power of Attorney is governed by the New Jersey Statutes, specifically N.J.S.A. 46:2B-8. |

| Durability | This form remains effective even if the principal becomes mentally incapacitated, which distinguishes it from a regular power of attorney. |

| Agent Authority | The agent can manage a wide range of financial matters, including banking, real estate transactions, and tax matters. |

| Execution Requirements | The DPOA must be signed by the principal and witnessed by at least one person or notarized to be valid. |

| Revocation | The principal can revoke the DPOA at any time as long as they are mentally competent to do so. |

| Limitations | The DPOA cannot authorize the agent to make healthcare decisions unless specifically stated in a separate healthcare directive. |

| Filing | There is no requirement to file the DPOA with the state, but it is advisable to keep it in a safe place and provide copies to relevant parties. |

| Common Uses | People often use a DPOA for estate planning, to manage finances during travel, or to ensure someone can handle affairs in case of sudden illness. |

Key takeaways

Filling out a Durable Power of Attorney (DPOA) form in New Jersey is a crucial step in planning for the future. Here are some key takeaways to consider:

- Choose Your Agent Wisely: Selecting the right person to act on your behalf is vital. This individual, known as your agent or attorney-in-fact, should be someone you trust implicitly, as they will have significant control over your financial and legal matters.

- Understand the Scope of Authority: The DPOA can grant your agent broad or limited powers. Clearly outline what decisions your agent can make. This can include managing bank accounts, handling real estate transactions, or making healthcare decisions, depending on your preferences.

- Sign in the Presence of Witnesses: New Jersey requires that you sign the DPOA in front of a notary public or two witnesses. This step adds a layer of validity to the document and ensures that it meets state requirements.

- Keep Copies Accessible: Once the DPOA is completed, make several copies. Share these with your agent, healthcare providers, and financial institutions. Having accessible copies ensures that your wishes are honored when the time comes.

By keeping these points in mind, individuals can navigate the process of creating and utilizing a Durable Power of Attorney with confidence and clarity.

Dos and Don'ts

When filling out the New Jersey Durable Power of Attorney form, it's essential to follow specific guidelines to ensure the document is valid and effective. Here are six important do's and don'ts to consider:

- Do choose a trusted agent who will act in your best interest.

- Do clearly specify the powers you are granting to your agent.

- Do sign the document in the presence of a notary public.

- Don't leave any sections of the form blank; complete all required fields.

- Don't use vague language that could lead to misunderstandings.

- Don't forget to keep a copy of the signed document for your records.

Common mistakes

-

Not naming an alternate agent. If the primary agent is unable to act, having a backup is essential.

-

Failing to specify the powers granted. Clearly outline what decisions the agent can make on your behalf.

-

Not signing the document in front of a notary. A notary's signature adds credibility and helps prevent fraud.

-

Leaving out the date. The date helps establish when the document was created and is important for legal purposes.

-

Using outdated forms. Always check to ensure you are using the most current version of the Durable Power of Attorney form.

-

Not discussing the document with the chosen agent. Communication is key to ensure your agent understands your wishes.

-

Overlooking state-specific requirements. Each state has its own rules, so be sure to follow New Jersey's specific guidelines.

-

Neglecting to keep copies. After filling out the form, make sure to keep copies for your records and provide one to your agent.

-

Not reviewing the document regularly. Life changes, and so should your Durable Power of Attorney. Regular reviews ensure it reflects your current wishes.

What You Should Know About This Form

-

What is a Durable Power of Attorney in New Jersey?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone you trust to make decisions on your behalf. This authority remains effective even if you become incapacitated. In New Jersey, this document can cover financial matters, health care decisions, or both.

-

Why should I consider having a Durable Power of Attorney?

Having a DPOA is crucial for ensuring that your wishes are honored if you become unable to make decisions for yourself. It provides peace of mind, knowing that someone you trust will manage your affairs according to your preferences.

-

Who can be appointed as my agent?

You can choose anyone you trust to act as your agent, such as a family member, friend, or professional advisor. However, it is essential to select someone who understands your values and will act in your best interests.

-

What powers can I grant to my agent?

You can grant your agent broad or limited powers. Common powers include managing bank accounts, paying bills, and making investment decisions. You can also specify whether your agent can make health care decisions on your behalf.

-

Do I need a lawyer to create a Durable Power of Attorney?

While it is not legally required to have a lawyer, consulting one can be beneficial. A legal professional can help ensure that the document meets all legal requirements and accurately reflects your wishes.

-

How do I create a Durable Power of Attorney in New Jersey?

To create a DPOA, you must complete a specific form that includes your information, your agent's information, and the powers you wish to grant. After filling out the form, you must sign it in the presence of a notary public or two witnesses to make it legally valid.

-

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a DPOA at any time as long as you are mentally competent. To do so, you should create a written revocation and notify your agent and any institutions where the DPOA was presented.

-

What happens if I do not have a Durable Power of Attorney?

If you become incapacitated without a DPOA, your loved ones may need to go through a court process to obtain guardianship. This can be time-consuming and emotionally taxing, making it more challenging for your family to manage your affairs.

-

Is a Durable Power of Attorney the same as a Living Will?

No, a DPOA and a Living Will serve different purposes. A DPOA allows someone to make decisions on your behalf, while a Living Will outlines your wishes regarding medical treatment and end-of-life care. Both documents can work together to ensure your preferences are respected.

New Jersey Durable Power of Attorney Example

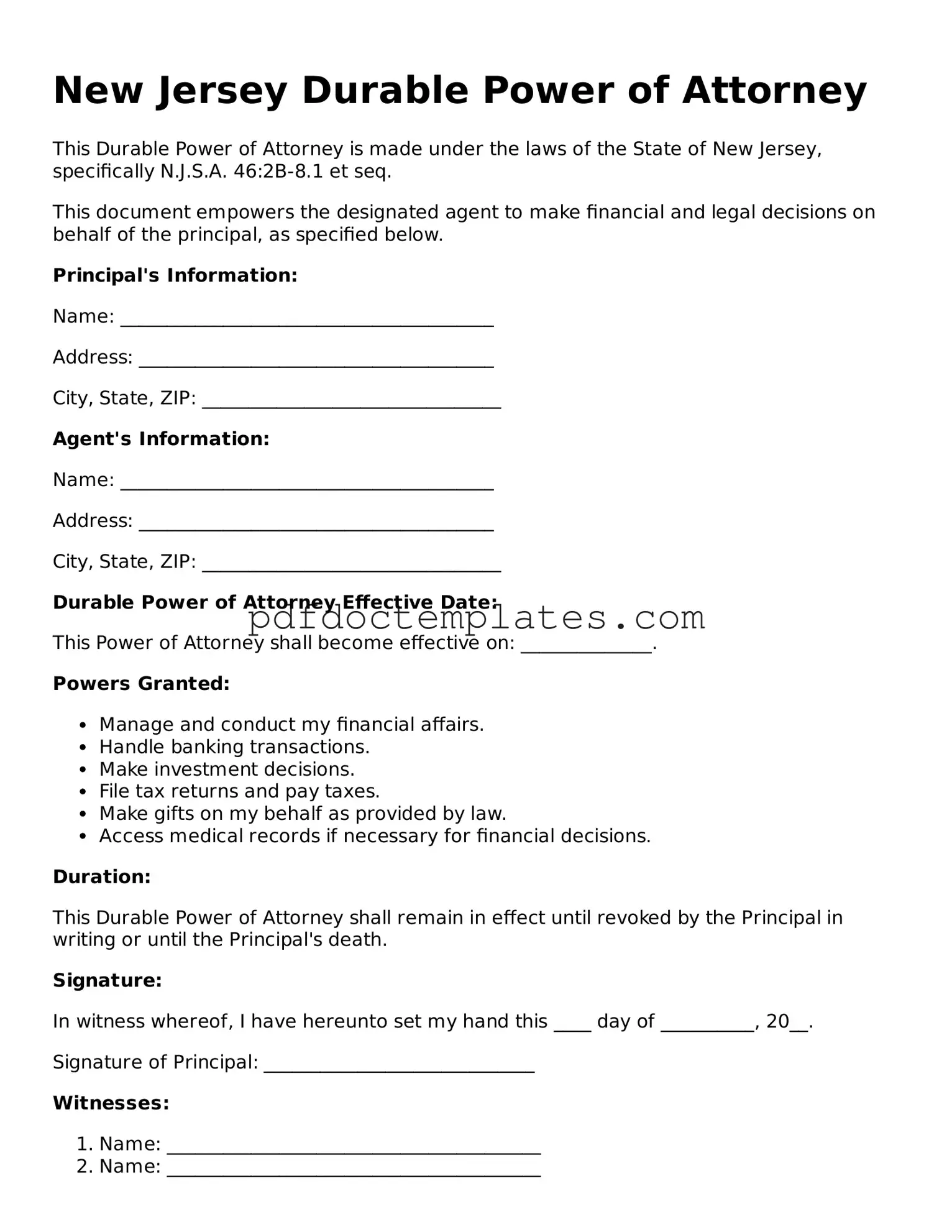

New Jersey Durable Power of Attorney

This Durable Power of Attorney is made under the laws of the State of New Jersey, specifically N.J.S.A. 46:2B-8.1 et seq.

This document empowers the designated agent to make financial and legal decisions on behalf of the principal, as specified below.

Principal's Information:

Name: ________________________________________

Address: ______________________________________

City, State, ZIP: ________________________________

Agent's Information:

Name: ________________________________________

Address: ______________________________________

City, State, ZIP: ________________________________

Durable Power of Attorney Effective Date:

This Power of Attorney shall become effective on: ______________.

Powers Granted:

- Manage and conduct my financial affairs.

- Handle banking transactions.

- Make investment decisions.

- File tax returns and pay taxes.

- Make gifts on my behalf as provided by law.

- Access medical records if necessary for financial decisions.

Duration:

This Durable Power of Attorney shall remain in effect until revoked by the Principal in writing or until the Principal's death.

Signature:

In witness whereof, I have hereunto set my hand this ____ day of __________, 20__.

Signature of Principal: _____________________________

Witnesses:

- Name: ________________________________________

- Name: ________________________________________

Witness Signature: _______________________________

Witness Signature: _______________________________

Notarization:

State of New Jersey

County of _______________________________

Subscribed and sworn to before me this ____ day of __________, 20__.

Notary Public Signature: ____________________________

Check out Other Common Durable Power of Attorney Templates for US States

North Carolina Durable Power of Attorney - This document is a proactive step in estate planning, ensuring that someone you trust is in charge if needed.

How to Get Power of Attorney Washington State - The document varies by state, so it's important to ensure it meets your local legal requirements for validation.

For businesses looking to establish a clear operational structure, the New York Operating Agreement form is crucial, as it helps ensure all members are on the same page regarding their roles and responsibilities. By utilizing resources such as smarttemplates.net/fillable-new-york-operating-agreement, LLCs can effectively draft an agreement that fits their unique needs, further reducing potential conflicts and enhancing organizational clarity.

Power of Attorney Arizona - Having a Durable Power of Attorney may alleviate stress for both the individual and their loved ones during emergencies.

Power of Attorney Form Virginia - Creating a Durable Power of Attorney can facilitate smoother transitions in times of crisis.