Blank Articles of Incorporation Document for New Jersey

Misconceptions

When dealing with the New Jersey Articles of Incorporation form, several misconceptions can lead to confusion. Here are eight common misunderstandings about this important document:

- Incorporation is only for large businesses. Many believe that only large companies need to incorporate. In reality, incorporation is beneficial for small businesses as well, providing liability protection and potential tax advantages.

- Filing the Articles of Incorporation guarantees business success. While filing the form is a crucial step in establishing a business, it does not ensure profitability or success. A solid business plan and effective management are also essential.

- Once filed, the Articles of Incorporation cannot be changed. This is not true. Amendments can be made to the Articles of Incorporation if necessary, allowing for changes in structure or purpose as the business evolves.

- All businesses must file Articles of Incorporation. Not every business needs to incorporate. Sole proprietorships and partnerships, for example, do not require this form. Understanding the business structure is key.

- The Articles of Incorporation are the only document needed to start a business. Incorporation is just one step. Other documents, such as bylaws and operating agreements, may also be necessary to properly establish and run a business.

- Incorporating in New Jersey is the same as incorporating in any other state. Each state has its own rules and requirements. New Jersey has specific guidelines that must be followed, which may differ from those in other states.

- There are no costs associated with filing the Articles of Incorporation. There are fees involved in filing the form, and these can vary based on the type of corporation being established. It's important to budget for these expenses.

- Once incorporated, the business has no further obligations. Incorporation does not eliminate the need for ongoing compliance. Businesses must adhere to state regulations, including annual reports and tax filings.

Understanding these misconceptions can help individuals navigate the incorporation process more effectively. Awareness of the requirements and responsibilities is crucial for long-term success.

Form Properties

| Fact Name | Details |

|---|---|

| Purpose | The New Jersey Articles of Incorporation form is used to legally establish a corporation in the state of New Jersey. |

| Governing Law | The form is governed by the New Jersey Business Corporation Act, specifically N.J.S.A. 14A:1-1 et seq. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for all corporations wishing to operate in New Jersey. |

| Information Required | The form requires basic information, including the corporation's name, purpose, registered agent, and the number of shares authorized. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the corporation's structure. |

Key takeaways

When filling out and using the New Jersey Articles of Incorporation form, there are several important points to keep in mind. These takeaways can help ensure that the process goes smoothly and that your business is properly established.

- The form must be completed accurately. Any errors or omissions can lead to delays in processing.

- Provide all required information, including the name of the corporation, the purpose of the business, and the registered agent's details.

- Filing fees are applicable. Ensure you check the current fee schedule and include payment with your submission.

- Once filed, the Articles of Incorporation become a public record. This means that anyone can access this information, so choose your business name wisely.

- After approval, keep a copy of the filed Articles for your records. This document is essential for various business activities, including opening bank accounts and applying for licenses.

By adhering to these key points, you can navigate the incorporation process with greater confidence. Proper preparation and understanding of the requirements will help set a solid foundation for your new business venture.

Dos and Don'ts

When filling out the New Jersey Articles of Incorporation form, it is important to follow certain guidelines to ensure that the process goes smoothly. Below is a list of things you should and shouldn't do.

- Do provide accurate information. Ensure that all details, such as the name of the corporation and the registered agent, are correct.

- Do include the purpose of the corporation. Clearly state what your business will do.

- Do check for any specific requirements. Some businesses may have additional regulations or forms to complete.

- Do sign the form. The form must be signed by the incorporator to be valid.

- Don't leave any required fields blank. Each section of the form needs to be filled out completely.

- Don't use a name that is already taken. Before submitting, verify that your desired corporation name is available.

- Don't submit without reviewing. Double-check your entries for any errors or omissions.

- Don't forget to include the filing fee. Ensure that the correct payment is submitted with the form.

Common mistakes

-

Inaccurate Business Name: One common mistake is failing to check the availability of the desired business name. Each name must be unique and not already in use by another corporation in New Jersey. Before submitting the form, it’s essential to verify that the name complies with state regulations.

-

Incorrect Registered Agent Information: The form requires the designation of a registered agent. Some people mistakenly provide incorrect or incomplete information. This agent is crucial, as they will receive legal documents on behalf of the corporation. Ensure that the name and address are accurate and up-to-date.

-

Failure to Include Purpose Statement: The Articles of Incorporation must include a statement outlining the purpose of the corporation. Some individuals overlook this requirement or provide vague descriptions. A clear and specific purpose is vital for compliance and future operations.

-

Omitting the Number of Shares: Many applicants forget to specify the number of shares the corporation is authorized to issue. This detail is important for establishing ownership and investment structures. Be sure to indicate the total number of shares and their par value, if applicable.

-

Ignoring Filing Fees: Lastly, individuals sometimes neglect to include the necessary filing fees. Each submission requires payment, and failing to provide the correct amount can delay the incorporation process. Always verify the current fee schedule before submitting your application.

What You Should Know About This Form

-

What is the Articles of Incorporation form in New Jersey?

The Articles of Incorporation form is a legal document that establishes a corporation in New Jersey. It outlines essential information about the corporation, such as its name, purpose, and structure. Filing this document is a crucial step in creating a legal entity that can operate independently of its owners.

-

Who needs to file the Articles of Incorporation?

Any individual or group looking to start a corporation in New Jersey must file the Articles of Incorporation. This includes businesses of all sizes, from small startups to larger enterprises. It is important for anyone planning to conduct business under a corporate structure to complete this form.

-

What information is required on the form?

The form typically requires several key pieces of information, including:

- The name of the corporation

- The purpose of the corporation

- The registered agent's name and address

- The number of shares the corporation is authorized to issue

- The names and addresses of the incorporators

Providing accurate information is vital, as it ensures that your corporation is recognized legally.

-

How do I file the Articles of Incorporation?

You can file the Articles of Incorporation online or by mail. If filing online, visit the New Jersey Division of Revenue and Enterprise Services website. If you choose to file by mail, you will need to send the completed form to the appropriate state office along with the required filing fee.

-

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation varies depending on the type of corporation you are forming. Generally, the fee ranges from $125 to $150. It is advisable to check the New Jersey Division of Revenue and Enterprise Services website for the most current fee schedule.

-

How long does it take to process the Articles of Incorporation?

Processing times can vary. Typically, if you file online, you may receive confirmation within a few business days. If you file by mail, it may take longer, often up to several weeks. To ensure timely processing, consider filing online.

-

What happens after I file the Articles of Incorporation?

Once your Articles of Incorporation are approved, your corporation becomes a legal entity. You will receive a certificate of incorporation, which serves as proof of your corporation's existence. After this, you may need to obtain additional permits or licenses, depending on your business activities.

-

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after filing. If there are changes to your corporation's name, purpose, or structure, you will need to file an amendment with the state. This ensures that your corporation's records remain accurate and up to date.

New Jersey Articles of Incorporation Example

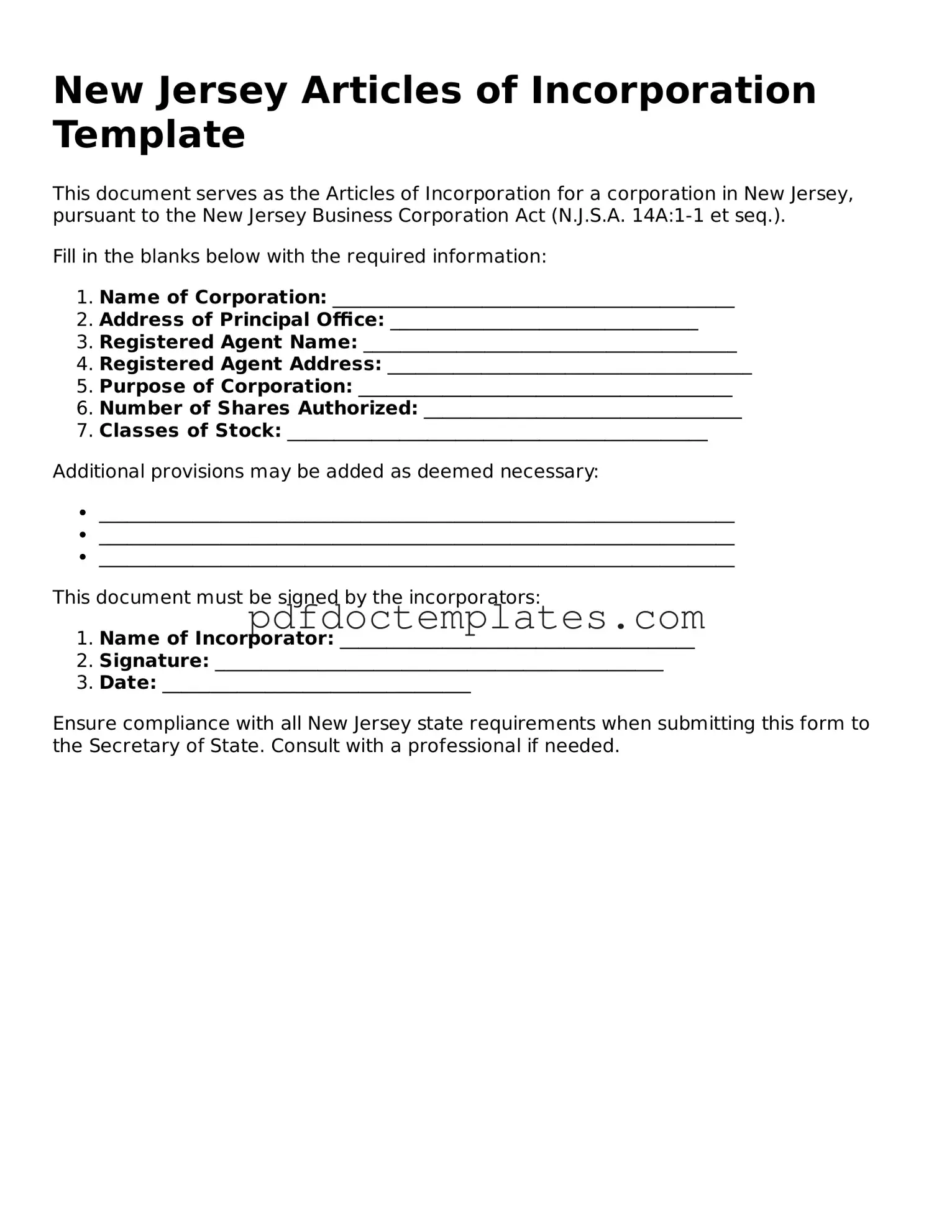

New Jersey Articles of Incorporation Template

This document serves as the Articles of Incorporation for a corporation in New Jersey, pursuant to the New Jersey Business Corporation Act (N.J.S.A. 14A:1-1 et seq.).

Fill in the blanks below with the required information:

- Name of Corporation: ___________________________________________

- Address of Principal Office: _________________________________

- Registered Agent Name: ________________________________________

- Registered Agent Address: _______________________________________

- Purpose of Corporation: ________________________________________

- Number of Shares Authorized: __________________________________

- Classes of Stock: _____________________________________________

Additional provisions may be added as deemed necessary:

- ____________________________________________________________________

- ____________________________________________________________________

- ____________________________________________________________________

This document must be signed by the incorporators:

- Name of Incorporator: ______________________________________

- Signature: ________________________________________________

- Date: _________________________________

Ensure compliance with all New Jersey state requirements when submitting this form to the Secretary of State. Consult with a professional if needed.

Check out Other Common Articles of Incorporation Templates for US States

How Do I Get a Certificate of Good Standing - The incorporation date is usually indicated in the articles once approved.

Having a comprehensive Florida Operating Agreement form is vital for the smooth operation of any LLC, as it clearly defines the roles and responsibilities of its members. To ensure all necessary documentation is in place, you can find templates and additional resources at All Florida Forms, which can help in establishing a solid foundation for your business.

Virginia Business License Cost - It allows the corporation to pursue legal rights, such as litigating or entering contracts.

Wa Secretary of State Business Search - This document officially registers a business with the state.