Download Netspend Dispute Template

Misconceptions

Misconception 1: The Netspend Dispute form can be submitted at any time.

In reality, the form must be submitted within 60 days of the transaction in question. Delaying beyond this period may result in the inability to dispute the transaction.

Misconception 2: You can submit a dispute without any supporting documentation.

While it is possible to submit the form, providing supporting documentation can significantly assist in the resolution process. Documentation strengthens your case and may expedite the decision.

Misconception 3: You will automatically receive a refund after submitting the dispute form.

A decision regarding the refund will be made within 10 business days after the completed form is received. Refunds are not guaranteed and depend on the investigation's outcome.

Misconception 4: You are liable for all unauthorized transactions.

If your card is lost or stolen, you may not be liable for unauthorized transactions that occur after you report the loss and request to block activity on your card.

Misconception 5: You do not need to inform the merchant before submitting a dispute.

It is advisable to contact the merchant first. If the merchant agrees to provide a refund, this information can be included in your dispute, potentially simplifying the process.

Misconception 6: The dispute form is only for lost or stolen cards.

The form can be used for any unauthorized credit or debit transactions, not just for cases involving lost or stolen cards. All unauthorized transactions are eligible for dispute.

Misconception 7: You can submit multiple disputes on one form without limits.

You can submit up to five transactions on one form. If you have more than five disputes, additional forms will be necessary.

Misconception 8: The dispute process is instant.

The process takes time. After submitting the form, expect a response within 10 business days, but the resolution may take longer depending on the complexity of the case.

File Details

| Fact Name | Details |

|---|---|

| Purpose of the Form | This form is designed to initiate disputes for unauthorized credit or debit transactions on your Netspend card. |

| Submission Deadline | You must complete and submit the form within 60 days of the disputed transaction date. |

| Response Time | Netspend will make a decision about your dispute within 10 business days after receiving your completed form. |

| Supporting Documentation | Providing supporting documents, such as receipts or emails, can help in resolving your dispute more effectively. |

| Liability for Unauthorized Use | If your card is lost or stolen, you might be liable for unauthorized transactions unless you reported it and requested to block the card. |

| Blocking Card Activity | You can instruct Netspend to block activity on your card if it has been lost, stolen, or compromised. |

| Contacting the Merchant | The form asks whether you have contacted the merchant regarding the disputed transaction, which can be crucial for resolution. |

| Police Report | Filing a police report is recommended if your card was lost or stolen; include this report with your dispute form. |

| Access to PIN | You must disclose if anyone else has access to your PIN, as this information is relevant to the dispute. |

Key takeaways

When filling out the Netspend Dispute form, keep these key points in mind:

- Act Quickly: Submit the form as soon as possible, but no later than 60 days after the disputed transaction.

- Complete Information: Fill in all required fields, including your name, contact information, and card details.

- Document Everything: Provide supporting documents like receipts or emails to strengthen your case.

- Transaction Details: Clearly list each disputed transaction, including the amount, date, time, and merchant's name.

- Merchant Contact: Indicate whether you have contacted the merchant and if a refund is expected.

- Lost or Stolen Card: If your card was lost or stolen, mention it on the form to block further activity.

- Police Report: Attach a copy of the police report if applicable, as it can help your dispute.

- Sign and Send: Don’t forget to sign the form and fax it to the provided number for processing.

By following these steps, you can ensure that your dispute is handled efficiently and effectively.

Dos and Don'ts

When filling out the Netspend Dispute form, follow these guidelines to ensure your submission is complete and effective:

- Do complete the form as soon as possible, ideally within 60 days of the transaction.

- Do provide accurate and detailed information about the disputed transactions.

- Do include supporting documentation, such as receipts or emails, to strengthen your case.

- Do indicate if your card was lost or stolen to block further activity.

- Do sign and date the form before submission.

- Don't leave any required fields blank; ensure all sections are filled out completely.

- Don't submit the form without a full copy of the police report if applicable.

- Don't forget to mention if anyone else has access to your PIN.

- Don't delay in submitting the form; time is crucial for dispute resolution.

Common mistakes

-

Missing Information: Failing to fill out all required fields can lead to delays. Ensure that your name, contact information, and card number are complete and accurate.

-

Incorrect Transaction Details: Double-check the transaction amounts, dates, and merchant names. Providing incorrect information can result in the rejection of your dispute.

-

Not Submitting Supporting Documents: Neglecting to include relevant documents, such as receipts or police reports, may weaken your case. Always attach any evidence that supports your claim.

-

Ignoring the Deadline: Submitting the form more than 60 days after the transaction can disqualify your dispute. Make sure to act promptly.

-

Failure to Contact the Merchant: Not reaching out to the merchant before filing a dispute can be a missed opportunity. Document any communication with the merchant regarding the transaction.

-

Inadequate Explanation: Providing a vague or unclear explanation of the dispute can hinder the review process. Be as detailed as possible when describing what occurred.

-

Overlooking PIN Access: Not disclosing whether anyone else has access to your PIN can be a critical mistake. Be honest about who might have had access to your card information.

-

Not Following Submission Guidelines: Failing to send the form to the correct fax number or not signing the form can result in processing delays. Always review submission instructions carefully.

What You Should Know About This Form

-

What is the purpose of the Netspend Dispute Notification Form?

The Netspend Dispute Notification Form is used to report unauthorized credit or debit transactions on your card. Completing this form allows you to initiate a dispute regarding these transactions.

-

How soon should I submit the Dispute Notification Form?

You must complete and submit the form as soon as possible, but no later than 60 days after the date of the transaction you are disputing. Timely submission is crucial for processing your dispute.

-

How long will it take to resolve my dispute?

Netspend will make a decision regarding your dispute within 10 business days after receiving your completed form. You will be notified of the outcome and any actions taken.

-

What information do I need to provide on the form?

You will need to provide your personal information, card or account number, and details about each transaction you are disputing. This includes the disputed amount, date and time of the transaction, merchant's name, and whether you have contacted the merchant.

-

What if my card was lost or stolen?

If your card was lost or stolen, indicate this on the form. It is important to report this immediately to minimize your liability for unauthorized transactions. You should also consider resetting your PIN and filing a police report.

-

Can I dispute multiple transactions at once?

Yes, you can submit up to five disputed transactions on one form. Provide the necessary details for each transaction clearly to facilitate processing.

-

What supporting documentation should I include?

Include any relevant supporting documents such as a full copy of the police report, receipts, emails, shipping or tracking information, and cancellation information. These documents will help in the determination of your dispute.

-

What happens if I do not submit the form within 60 days?

If you do not submit the form within the 60-day period, you may lose your right to dispute the transaction. It is essential to adhere to this timeline for your claim to be considered.

-

How do I submit the completed form?

After completing the form and gathering your supporting documents, fax everything to 512-531-8770. Ensure that all information is accurate and complete to avoid delays in processing.

-

What if someone else has access to my PIN?

If someone else has access to your PIN, you must explain how this occurred on the form. This information is important for assessing the situation and determining liability for unauthorized transactions.

Netspend Dispute Example

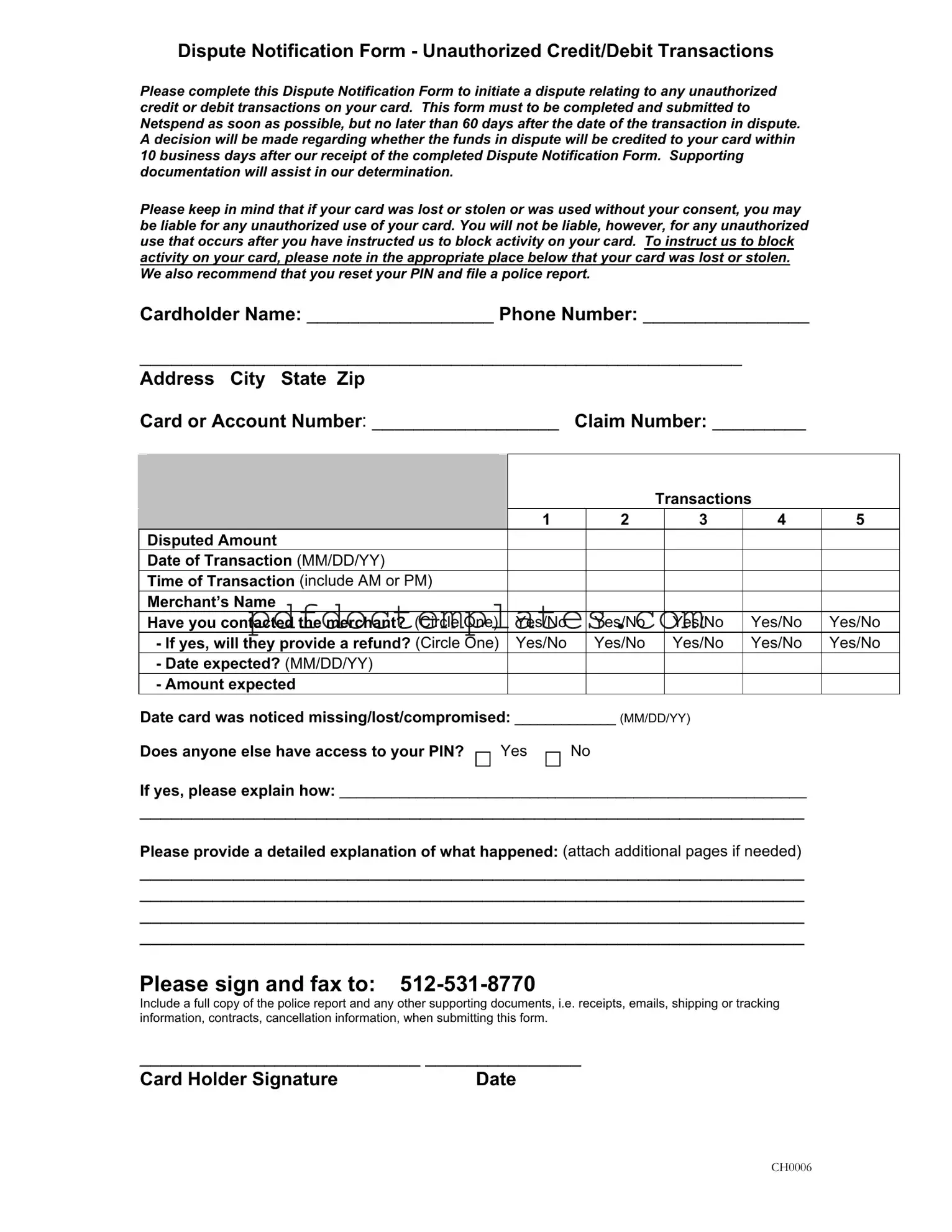

Dispute Notification Form - Unauthorized Credit/Debit Transactions

Please complete this Dispute Notification Form to initiate a dispute relating to any unauthorized credit or debit transactions on your card. This form must to be completed and submitted to Netspend as soon as possible, but no later than 60 days after the date of the transaction in dispute. A decision will be made regarding whether the funds in dispute will be credited to your card within 10 business days after our receipt of the completed Dispute Notification Form. Supporting documentation will assist in our determination.

Please keep in mind that if your card was lost or stolen or was used without your consent, you may be liable for any unauthorized use of your card. You will not be liable, however, for any unauthorized use that occurs after you have instructed us to block activity on your card. To instruct us to block activity on your card, please note in the appropriate place below that your card was lost or stolen. We also recommend that you reset your PIN and file a police report.

Cardholder Name: __________________ Phone Number: ________________ |

|

||||||||

__________________________________________________________ |

|

|

|||||||

Address City State Zip |

|

|

|

|

|

|

|

||

Card or Account Number: __________________ |

Claim Number: _________ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Please provide information for each |

|

|

|

|

|

|

|

|

|

transaction you are disputing (submit up to 5 |

|

|

|

|

|

|

|

|

|

on one form) |

|

|

|

|

Transactions |

|

||

|

|

|

1 |

|

2 |

|

3 |

4 |

5 |

Disputed Amount |

|

|

|

|

|

|

|

||

Date of Transaction (MM/DD/YY) |

|

|

|

|

|

|

|

||

Time of Transaction (include AM or PM) |

|

|

|

|

|

|

|

||

Merchant’s Name |

|

|

|

|

|

|

|

||

Have you contacted the merchant? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

||

|

- If yes, will they provide a refund? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

|

|

- Date expected? (MM/DD/YY) |

|

|

|

|

|

|

|

|

|

- Amount expected |

|

|

|

|

|

|

|

|

Date card was noticed missing/lost/compromised: _____________ (MM/DD/YY)

Does anyone else have access to your PIN?

Yes

No

If yes, please explain how: ______________________________________________________

________________________________________________________________

Please provide a detailed explanation of what happened: (attach additional pages if needed)

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

Please sign and fax to:

Include a full copy of the police report and any other supporting documents, i.e. receipts, emails, shipping or tracking information, contracts, cancellation information, when submitting this form.

___________________________ _______________

Card Holder Signature |

Date |

CH0006

Consider More Forms

Florida 4 Point Inspection Form - Indicate the type of materials used in the plumbing system.

Employer's Quarterly Federal Tax Return - Employers are advised to keep records supporting their Form 941 reports for at least four years.

In New York State, the Operating Agreement form plays a crucial role for limited liability companies (LLCs), as it outlines essential financial and functional decisions while establishing rules and provisions. By detailing member responsibilities and protecting personal assets from business liabilities, this document is indispensable for defining the company's structure. Furthermore, it fosters clarity in governance and conflict resolution, ensuring that all members understand the operational strategies in place. For those looking to create this important document, you can refer to All New York Forms for a helpful template.

Lien Release Requirements by State - By signing this waiver, the party acknowledges receiving a specified amount of money for work completed.