Download Mortgage Statement Template

Misconceptions

Understanding mortgage statements is crucial for homeowners. However, several misconceptions can lead to confusion. Here are five common misunderstandings about the Mortgage Statement form:

- All payments are applied immediately. Many believe that any payment made is applied to their mortgage right away. In reality, partial payments are held in a suspense account until the full amount is received.

- Late fees are automatically charged. Some homeowners think that late fees are charged immediately upon missing a payment. In fact, a grace period is often provided, and fees are only assessed after a specific date.

- The statement reflects the current interest rate indefinitely. It is a common assumption that the interest rate listed on the statement remains the same forever. However, interest rates can change, and the statement will indicate the applicable rate until a specified date.

- Escrow is optional for all homeowners. Many people believe that escrow accounts for taxes and insurance are optional. In reality, lenders often require escrow accounts to ensure these payments are made on time.

- Delinquency notices are only sent after multiple missed payments. Some homeowners think they will only receive a delinquency notice after several payments are missed. However, a notice may be issued after just one missed payment, alerting the homeowner to the potential consequences of not addressing the issue.

By clarifying these misconceptions, homeowners can better manage their mortgage obligations and avoid potential pitfalls.

File Details

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for borrower inquiries. |

| Borrower Details | It lists the borrower's name and address, ensuring that the statement is personalized and relevant. |

| Statement Date | The statement date indicates when the mortgage statement was generated, which is crucial for tracking payments. |

| Payment Due Date | This date specifies when the next payment is due, helping borrowers manage their finances effectively. |

| Late Fee Information | If the payment is received after a specified date, a late fee will be charged. This encourages timely payments. |

| Outstanding Principal | The statement shows the remaining balance on the mortgage, which is essential for understanding the overall debt. |

| Interest Rate | The interest rate is provided, along with the date until which it is applicable, informing the borrower of their loan terms. |

| Payment Breakdown | The statement breaks down the total amount due into principal, interest, escrow, and fees, offering clarity on charges. |

| Delinquency Notice | A notice alerts the borrower if they are late on payments, emphasizing the importance of staying current to avoid foreclosure. |

| Financial Assistance | The statement provides information about mortgage counseling or assistance for borrowers experiencing financial difficulty. |

Key takeaways

Here are some key takeaways for filling out and using the Mortgage Statement form:

- Servicer Information: Always verify the servicer name, customer service phone number, and website to ensure you have the correct contact details.

- Account Details: Fill in your name, address, account number, and statement date accurately to avoid confusion.

- Payment Due Date: Note the payment due date. Late fees will apply if payment is not received by this date.

- Outstanding Principal: Check the outstanding principal amount to understand how much you owe on your mortgage.

- Interest Rate: Be aware of your interest rate and when it may change.

- Prepayment Penalty: Know whether your mortgage has a prepayment penalty, as this can affect your payment strategy.

- Transaction Activity: Review the transaction activity section to track any charges and payments made during the specified period.

- Partial Payments: Understand that partial payments are held in a suspense account and do not apply to your mortgage until the full amount is paid.

- Delinquency Notice: Take any delinquency notices seriously. If you are behind on payments, act quickly to avoid further fees or foreclosure.

- Financial Assistance: If you're facing financial difficulties, seek information about mortgage counseling or assistance options available to you.

Dos and Don'ts

When filling out the Mortgage Statement form, there are important steps to follow. Here’s a list of things you should and shouldn’t do:

- Do fill in all required fields accurately, including your account number and payment due date.

- Do double-check the amount due before submitting your payment.

- Do keep a copy of the completed form for your records.

- Do contact customer service if you have questions about any charges or fees.

- Don’t ignore the late fee policy; be aware of the date when fees apply.

- Don’t submit partial payments without understanding how they will be handled.

- Don’t leave any sections blank unless they are marked as optional.

- Don’t hesitate to seek mortgage counseling if you are experiencing financial difficulty.

Common mistakes

-

Missing Information: Failing to fill in key details like the statement date, account number, or payment due date can lead to confusion and delays. Always double-check that all required fields are completed.

-

Incorrect Amounts: Entering the wrong figures for amounts due, outstanding principal, or interest rates can cause significant issues. Ensure that you verify these numbers against your records before submitting.

-

Ignoring Late Fees: Be aware of the late fee policy. If payment is not made by the due date, a fee will apply. Not accounting for this can result in unexpected charges.

-

Partial Payments Misunderstanding: Remember that partial payments are held in a suspense account and do not reduce your mortgage balance. It’s crucial to understand how payments are applied to avoid confusion.

-

Overlooking Counseling Resources: If facing financial difficulties, don’t ignore the resources available for assistance. The form provides information on mortgage counseling that can help you navigate your situation.

What You Should Know About This Form

-

What is a Mortgage Statement?

A mortgage statement is a document provided by your mortgage servicer that outlines the details of your mortgage account. It includes information such as your outstanding principal balance, interest rate, payment due date, and the total amount due for the current billing cycle.

-

What information can I find on my Mortgage Statement?

Your mortgage statement contains several key pieces of information:

- Account Number

- Payment Due Date

- Amount Due

- Outstanding Principal

- Interest Rate

- Escrow for Taxes and Insurance

- Transaction Activity

- Recent Account History

-

What happens if I miss a payment?

If you miss a payment, a late fee will be charged according to the terms outlined in your mortgage statement. It is important to make your payment by the due date to avoid additional fees and potential negative impacts on your credit score.

-

What are partial payments?

Partial payments are amounts that do not cover the full mortgage payment due. If you make a partial payment, it will not be applied to your mortgage balance. Instead, it will be held in a separate suspense account until you pay the remaining balance. Only then will the funds be applied to your mortgage.

-

What is a delinquency notice?

A delinquency notice informs you that you are behind on your mortgage payments. If you do not bring your loan current, you may face additional fees and the risk of foreclosure, which could result in the loss of your home. The notice will indicate how many days you are delinquent and the total amount needed to bring your account up to date.

-

How can I make my mortgage payment?

You can make your mortgage payment by sending a check payable to your servicer, as indicated on your statement. Ensure that you include your account number on the check to ensure proper crediting. You may also have options for online payments or automatic withdrawals, which can simplify the payment process.

-

What if I am experiencing financial difficulty?

If you are facing financial challenges, it is important to seek assistance. Your mortgage statement may provide information about mortgage counseling or assistance programs available to help you navigate your situation. Reaching out to your servicer can also provide options tailored to your needs.

-

How often will I receive a Mortgage Statement?

Typically, mortgage statements are sent monthly. However, the frequency may vary depending on your servicer and the terms of your mortgage agreement. If you have questions about your statement schedule, you can contact your servicer’s customer service for clarification.

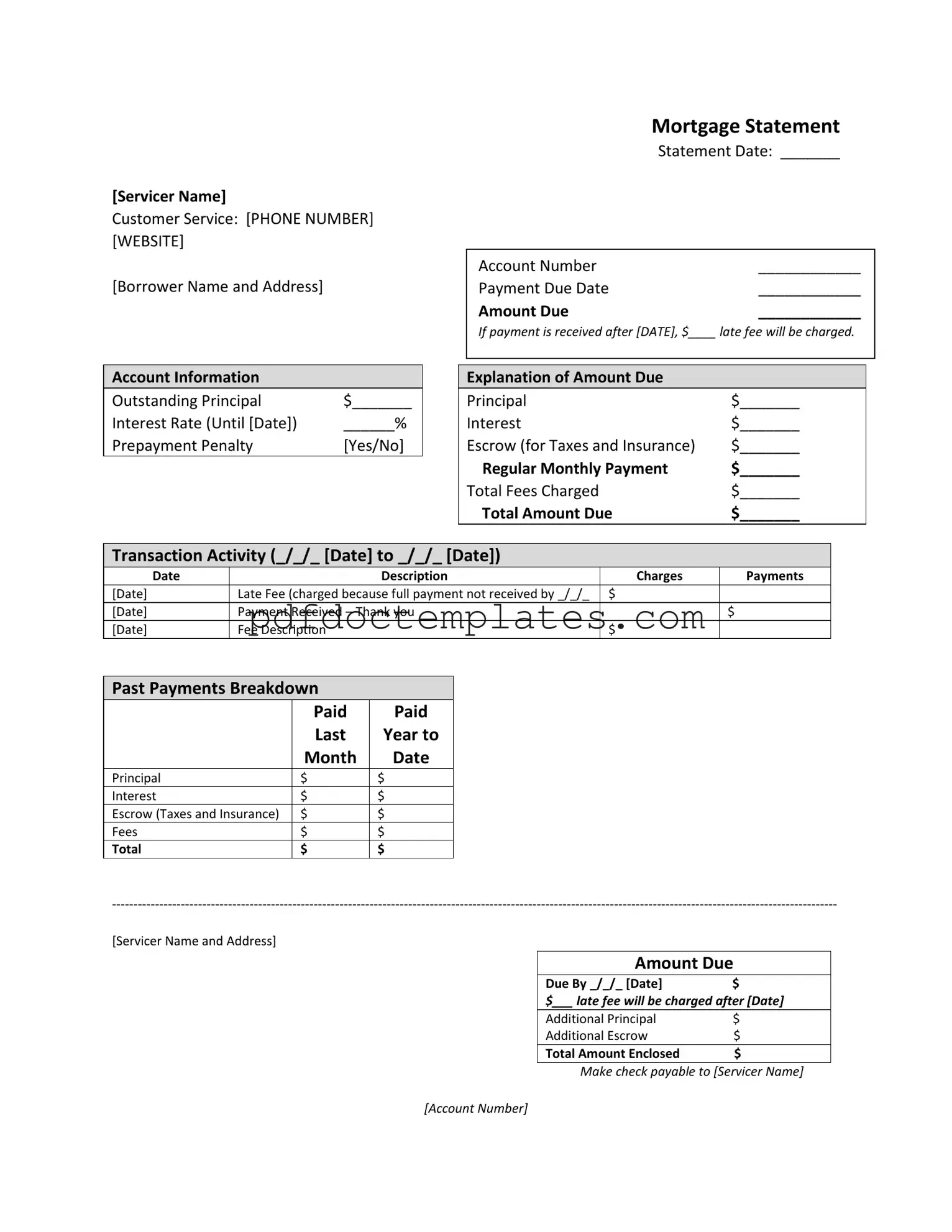

Mortgage Statement Example

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

Consider More Forms

Imm 1294 Form 2023 Pdf Download - The application process may take time, and applicants are encouraged to be patient.

For those looking to ensure a smooth transfer of ownership, the accurate California Boat Bill of Sale form is indispensable. This document not only serves as proof of purchase but also outlines critical details to facilitate legal registration within the state.

Test Drive Agreement - Fill out the Test Drive Agreement to get behind the wheel of a new car.

Printable Lyft Inspection Form - Check the vehicle's age and mileage against requirements.