Blank Transfer-on-Death Deed Document for Michigan

Misconceptions

Understanding the Michigan Transfer-on-Death Deed form is crucial for effective estate planning. Here are ten common misconceptions about this form:

- It only applies to real estate. Many people think the Transfer-on-Death Deed is limited to real estate. However, it applies specifically to transferring ownership of real property, not personal property or financial assets.

- It requires probate. Some believe that a Transfer-on-Death Deed must go through probate. In fact, property transferred via this deed avoids probate altogether, simplifying the process for heirs.

- It is irrevocable. There is a misconception that once a Transfer-on-Death Deed is executed, it cannot be changed. In reality, the grantor can revoke or modify the deed at any time before their death.

- Only married couples can use it. Many think this deed is only available to married couples. In truth, any individual can use the Transfer-on-Death Deed to designate beneficiaries.

- It automatically transfers all assets. Some assume that a Transfer-on-Death Deed transfers all assets of the deceased. However, it only transfers the specific property listed in the deed.

- It is a substitute for a will. People often believe that using a Transfer-on-Death Deed eliminates the need for a will. While it can simplify property transfer, a comprehensive estate plan should still include a will.

- Beneficiaries have immediate access to the property. There is a misconception that beneficiaries can access the property immediately after the grantor’s death. They must still go through the necessary legal steps to take ownership.

- It is only for individuals over 65. Some think that only seniors can utilize the Transfer-on-Death Deed. However, anyone of legal age can create one, regardless of their age.

- It is a complex legal document. Many believe that the Transfer-on-Death Deed is difficult to understand. In reality, the form is straightforward and designed for ease of use.

- It can be used in all states. Some assume that the Transfer-on-Death Deed is a nationwide option. However, laws regarding this deed vary by state, and it is only recognized in certain states, including Michigan.

Form Properties

| Fact Name | Details |

|---|---|

| Purpose | The Michigan Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by the Michigan Compiled Laws, specifically MCL 565.25a to 565.25d. |

| Eligibility | Any individual who owns real property in Michigan can create a Transfer-on-Death Deed. |

| Revocation | The deed can be revoked at any time by the property owner, provided a new deed is executed and recorded. |

| Recording Requirement | To be effective, the Transfer-on-Death Deed must be recorded with the county register of deeds before the property owner's death. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries, and they can also specify alternate beneficiaries if the primary ones do not survive. |

Key takeaways

Filling out and using the Michigan Transfer-on-Death Deed form requires careful attention to detail. Here are key takeaways to consider:

- The Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive the property upon the owner's death.

- It is crucial to complete the form accurately to ensure that the intended beneficiaries receive the property without complications.

- Property owners must sign the deed in the presence of a notary public to validate it.

- Beneficiaries should be clearly identified, including their full names and addresses, to avoid any confusion.

- The deed must be recorded with the local register of deeds in the county where the property is located.

- Filing the deed does not affect the owner's ability to sell or mortgage the property during their lifetime.

- Property owners can revoke or change the beneficiaries at any time before their death by filing a new deed.

- Consulting with a legal professional can help ensure that the deed meets all legal requirements and accurately reflects the owner's wishes.

- Heirs should be informed about the existence of the deed to prevent disputes after the owner's passing.

- Understanding state laws regarding Transfer-on-Death Deeds is essential, as they may vary from one state to another.

Dos and Don'ts

When filling out the Michigan Transfer-on-Death Deed form, it's important to follow specific guidelines to ensure the process goes smoothly. Here are some dos and don'ts to consider:

- Do provide accurate information about the property, including the legal description.

- Do include the names and addresses of all beneficiaries clearly.

- Do sign the form in the presence of a notary public.

- Do file the completed deed with the appropriate county register of deeds office.

- Don't leave any sections of the form blank; incomplete forms may be rejected.

- Don't forget to check for any local requirements that may apply.

- Don't use outdated forms; always obtain the latest version.

- Don't assume that verbal instructions are sufficient; written documentation is necessary.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to the deed being invalid. Ensure that names, addresses, and property descriptions are fully filled out.

-

Incorrect Signatures: All necessary parties must sign the form. Missing a signature can invalidate the deed, so double-check who needs to sign.

-

Not Notarizing the Document: A Transfer-on-Death Deed must be notarized to be legally binding. Skipping this step can result in complications later.

-

Failing to Record the Deed: After completing the form, it must be recorded with the county register of deeds. Not doing so means the transfer won't be recognized.

-

Using Outdated Forms: Ensure you are using the most current version of the Transfer-on-Death Deed form. Older versions may have different requirements or may no longer be accepted.

-

Ignoring State-Specific Rules: Each state has its own laws regarding Transfer-on-Death Deeds. Familiarize yourself with Michigan's specific requirements to avoid mistakes.

What You Should Know About This Form

-

What is a Transfer-on-Death Deed in Michigan?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in Michigan to designate a beneficiary who will receive their property upon their death. This deed does not take effect until the owner passes away, meaning the owner retains full control over the property during their lifetime. This can simplify the transfer process and help avoid probate.

-

How do I create a Transfer-on-Death Deed?

To create a TODD, you must fill out the appropriate form provided by the Michigan government. You need to include details such as the property description, the name of the beneficiary, and your signature. It is essential to have the deed notarized and recorded with the county register of deeds where the property is located. This ensures that the deed is legally recognized and enforceable.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a TODD at any time while you are still alive. To do this, you must create a new deed that explicitly revokes the previous one or simply fill out a revocation form. Make sure to record the new or revocation deed with the county register of deeds to ensure that your wishes are clear and legally binding.

-

What happens if the beneficiary dies before me?

If the designated beneficiary passes away before you, the TODD becomes void. In this case, you can either designate a new beneficiary or revoke the deed entirely. It’s crucial to keep your beneficiary information updated to ensure your property goes to the intended person.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger taxes at the time of transfer. However, the beneficiary may be responsible for property taxes and any potential estate taxes upon your death. It's advisable to consult a tax professional to understand any specific implications based on your situation.

Michigan Transfer-on-Death Deed Example

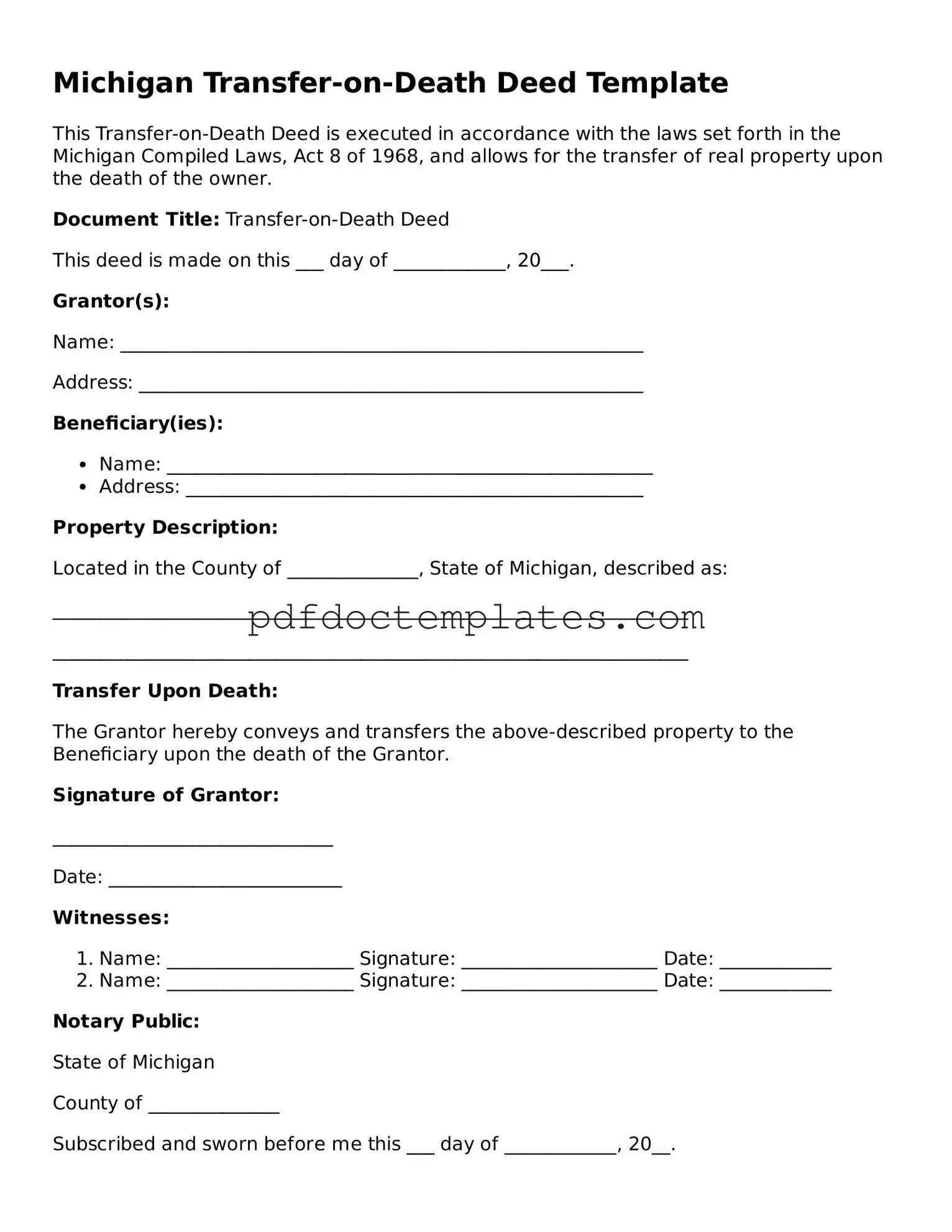

Michigan Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the laws set forth in the Michigan Compiled Laws, Act 8 of 1968, and allows for the transfer of real property upon the death of the owner.

Document Title: Transfer-on-Death Deed

This deed is made on this ___ day of ____________, 20___.

Grantor(s):

Name: ________________________________________________________

Address: ______________________________________________________

Beneficiary(ies):

- Name: ____________________________________________________

- Address: _________________________________________________

Property Description:

Located in the County of ______________, State of Michigan, described as:

____________________________________________________________________

____________________________________________________________________

Transfer Upon Death:

The Grantor hereby conveys and transfers the above-described property to the Beneficiary upon the death of the Grantor.

Signature of Grantor:

______________________________

Date: _________________________

Witnesses:

- Name: ____________________ Signature: _____________________ Date: ____________

- Name: ____________________ Signature: _____________________ Date: ____________

Notary Public:

State of Michigan

County of ______________

Subscribed and sworn before me this ___ day of ____________, 20__.

______________________________

Notary Public

My commission expires: _______________

Instructions for Use:

- Complete all sections of this deed.

- Secure signatures from two witnesses.

- Have a notary public witness the execution of this deed.

- Record the deed with the county register of deeds to ensure the transfer is valid upon the Grantor's death.

Check out Other Common Transfer-on-Death Deed Templates for US States

How to Transfer Land Ownership - It allows for a thoughtful approach to estate planning, considering the needs and dynamics of your family.

A New York Non-disclosure Agreement form, often referred to as an NDA, is a legally binding document aimed at protecting proprietary and confidential information. When signed, it restricts the sharing of sensitive details to unauthorized parties. This tool is vital for individuals and companies looking to safeguard their intellectual property or trade secrets in New York. For more information, you can explore All New York Forms.

Transfer on Death Deed Tennessee Form - Ensure that the beneficiaries are always up to date on the deed.