Blank Tractor Bill of Sale Document for Michigan

Misconceptions

Many people have misunderstandings about the Michigan Tractor Bill of Sale form. Here are some common misconceptions:

- It's only for new tractors. The form can be used for both new and used tractors. It serves as proof of ownership regardless of the tractor's age.

- Only dealerships can provide a Bill of Sale. Individuals can also create and sign a Bill of Sale. It’s not limited to commercial transactions.

- A Bill of Sale is not necessary. While it may not be legally required in every situation, having a Bill of Sale is highly recommended for clarity and protection.

- The form needs to be notarized. Notarization is not mandatory for a Bill of Sale in Michigan, but it can add an extra layer of security.

- It must be filled out by a lawyer. You don’t need a lawyer to complete the form. It’s straightforward and can be done by anyone involved in the sale.

- Only the seller needs to sign it. Both the buyer and the seller should sign the Bill of Sale to confirm the transaction.

- The form is only for tractors. While it’s designed for tractors, it can also be adapted for other types of equipment.

- Once signed, it cannot be changed. If both parties agree, the Bill of Sale can be amended. Just ensure that both parties sign any changes.

Form Properties

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Tractor Bill of Sale form is used to document the sale of a tractor between a buyer and a seller. |

| Governing Law | This form is governed by Michigan state law, specifically under the Michigan Vehicle Code. |

| Required Information | Essential details include the names and addresses of both parties, the tractor's make, model, year, and Vehicle Identification Number (VIN). |

| Signatures | Both the buyer and seller must sign the form to validate the sale. |

| Notarization | While notarization is not mandatory, it is recommended for added legal protection. |

| Record Keeping | Both parties should keep a copy of the completed bill of sale for their records. |

| Transfer of Ownership | The bill of sale serves as proof of ownership transfer, which may be required for registration purposes. |

Key takeaways

When filling out and using the Michigan Tractor Bill of Sale form, there are several important points to consider. These key takeaways will help ensure a smooth transaction and proper documentation.

- Purpose of the Bill of Sale: This document serves as proof of the sale and transfer of ownership for a tractor. It is essential for both the buyer and seller.

- Accurate Information: Ensure that all details, including the names of the buyer and seller, are correct. Any errors can lead to complications in the future.

- Tractor Details: Include specific information about the tractor, such as the make, model, year, and Vehicle Identification Number (VIN). This helps to clearly identify the item being sold.

- Sale Price: Clearly state the agreed-upon sale price. This figure should reflect the amount the buyer will pay to the seller.

- Signatures: Both the buyer and seller must sign the document. Their signatures validate the transaction and confirm agreement on the sale terms.

- Date of Sale: Record the date when the sale takes place. This is important for legal and tax purposes.

- Notarization: While not always required, having the bill of sale notarized can provide an additional layer of security and legitimacy to the transaction.

- Keep Copies: Both parties should retain a copy of the signed bill of sale. This serves as a reference in case any disputes arise later.

- Local Regulations: Be aware of any specific local regulations regarding tractor sales in Michigan. Different counties may have varying requirements.

By keeping these takeaways in mind, individuals can navigate the process of filling out and using the Michigan Tractor Bill of Sale form with confidence.

Dos and Don'ts

When filling out the Michigan Tractor Bill of Sale form, it is essential to follow certain guidelines to ensure accuracy and legality. Here are six important do's and don'ts to consider:

- Do provide complete and accurate information about the tractor, including the make, model, year, and Vehicle Identification Number (VIN).

- Do include the names and addresses of both the buyer and seller to establish clear ownership transfer.

- Do sign and date the form to validate the transaction and confirm that both parties agree to the sale.

- Do keep a copy of the completed bill of sale for your records, as it serves as proof of the transaction.

- Don't leave any sections of the form blank; incomplete forms may lead to disputes or complications later.

- Don't use vague language when describing the tractor; specificity helps prevent misunderstandings.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all necessary details. Ensure that both the buyer's and seller's names, addresses, and contact information are fully completed. Missing information can lead to delays or complications in the transfer process.

-

Incorrect Vehicle Identification Number (VIN): The VIN is crucial for identifying the tractor. Double-check that the VIN listed on the form matches the one on the tractor itself. An incorrect VIN can create issues with registration and ownership verification.

-

Omitting Sale Price: It is essential to clearly state the sale price of the tractor. Leaving this blank or writing an unclear amount can lead to misunderstandings or disputes between the buyer and seller.

-

Not Signing the Document: Both parties must sign the bill of sale for it to be valid. Forgetting to sign can invalidate the transaction, causing unnecessary complications down the line.

-

Failure to Keep Copies: After completing the form, it is important to make copies for both the buyer and seller. Keeping a record of the transaction protects both parties in case of future disputes or questions regarding ownership.

What You Should Know About This Form

-

What is a Michigan Tractor Bill of Sale?

A Michigan Tractor Bill of Sale is a legal document that records the sale and transfer of ownership of a tractor from one party to another. This form includes essential details about the transaction, such as the buyer and seller's information, the tractor's description, and the sale price. It serves as proof of the transaction and can be useful for registration and tax purposes.

-

Why do I need a Bill of Sale for my tractor?

A Bill of Sale is important for several reasons. First, it provides a clear record of the transaction, which can help protect both the buyer and seller in case of disputes. Second, it may be required for registering the tractor with the state or for obtaining insurance. Lastly, it can assist in documenting the sale for tax purposes, ensuring that both parties fulfill their obligations.

-

What information is included in a Michigan Tractor Bill of Sale?

The form typically includes the following information:

- Names and addresses of both the buyer and seller

- Description of the tractor, including make, model, year, and Vehicle Identification Number (VIN)

- Sale price of the tractor

- Date of the transaction

- Signatures of both parties

-

Is the Bill of Sale required to register my tractor in Michigan?

While a Bill of Sale is not always mandatory for registration, it is highly recommended. The Michigan Secretary of State may require proof of ownership, and a Bill of Sale can serve as that proof. It's wise to check with your local office for specific requirements.

-

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale as long as it includes all necessary information and is signed by both parties. However, using a standard form can help ensure that you don’t miss any important details. There are many templates available online that can guide you in creating a comprehensive document.

-

Do I need to have the Bill of Sale notarized?

Notarization is not required for a Michigan Tractor Bill of Sale, but it can add an extra layer of security. Having the document notarized can help verify the identities of both parties and confirm that they willingly entered into the agreement.

-

What if the tractor has a lien on it?

If there is a lien on the tractor, it is essential to address it before completing the sale. The seller should provide proof that the lien has been satisfied or that arrangements have been made to pay off the lien at the time of sale. Failing to do so can lead to complications for the buyer.

-

How long should I keep the Bill of Sale?

It is advisable to keep the Bill of Sale for as long as you own the tractor. This document serves as proof of ownership and can be important for future transactions, insurance claims, or legal matters. Once you sell the tractor again, you should provide the new buyer with a copy of the Bill of Sale.

-

What should I do if I lose my Bill of Sale?

If you lose your Bill of Sale, you can create a new one. Include all the original details and have both parties sign it again. If you are unable to recreate it, consider reaching out to the other party to see if they have a copy. It’s always a good idea to keep multiple copies of important documents in a safe place.

Michigan Tractor Bill of Sale Example

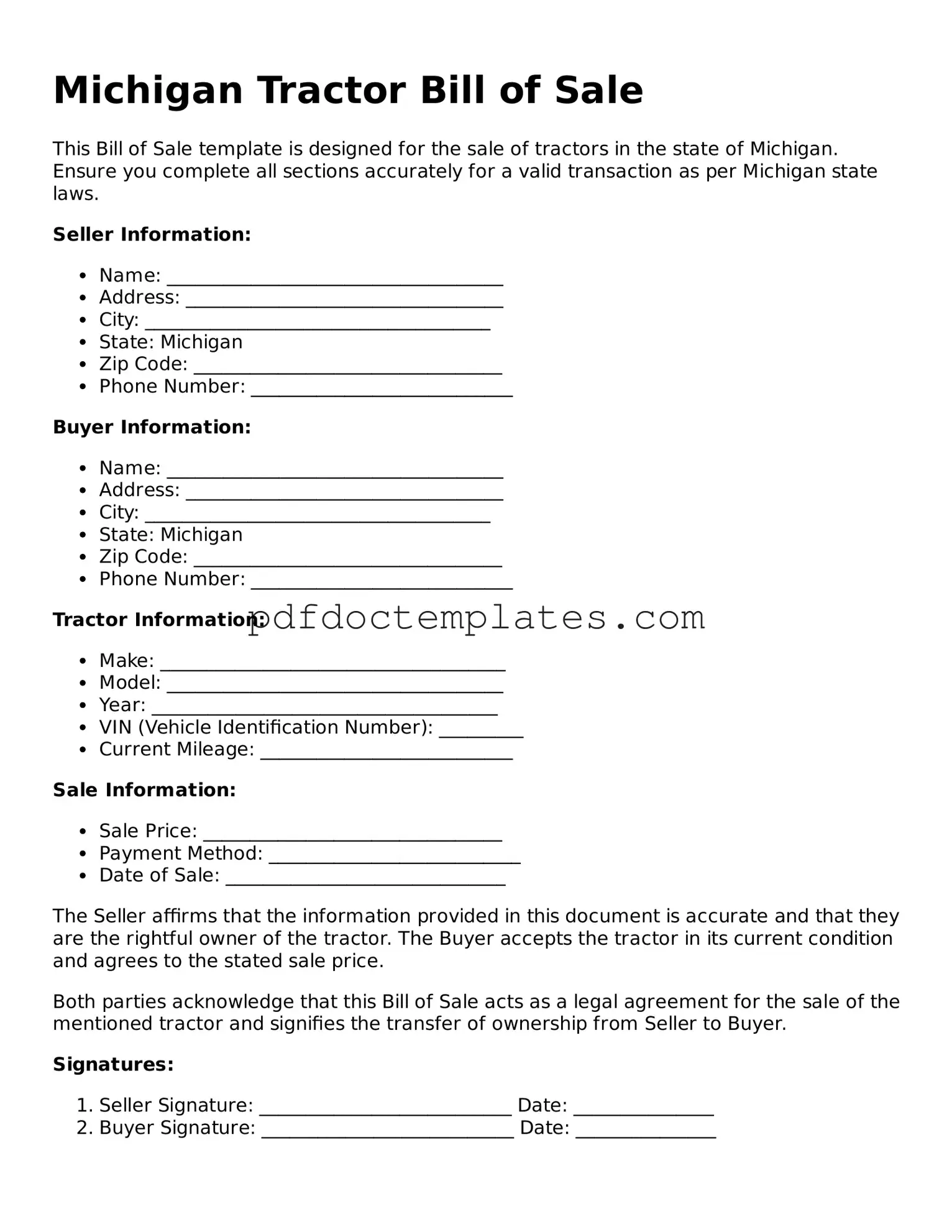

Michigan Tractor Bill of Sale

This Bill of Sale template is designed for the sale of tractors in the state of Michigan. Ensure you complete all sections accurately for a valid transaction as per Michigan state laws.

Seller Information:

- Name: ____________________________________

- Address: __________________________________

- City: _____________________________________

- State: Michigan

- Zip Code: _________________________________

- Phone Number: ____________________________

Buyer Information:

- Name: ____________________________________

- Address: __________________________________

- City: _____________________________________

- State: Michigan

- Zip Code: _________________________________

- Phone Number: ____________________________

Tractor Information:

- Make: _____________________________________

- Model: ____________________________________

- Year: _____________________________________

- VIN (Vehicle Identification Number): _________

- Current Mileage: ___________________________

Sale Information:

- Sale Price: ________________________________

- Payment Method: ___________________________

- Date of Sale: ______________________________

The Seller affirms that the information provided in this document is accurate and that they are the rightful owner of the tractor. The Buyer accepts the tractor in its current condition and agrees to the stated sale price.

Both parties acknowledge that this Bill of Sale acts as a legal agreement for the sale of the mentioned tractor and signifies the transfer of ownership from Seller to Buyer.

Signatures:

- Seller Signature: ___________________________ Date: _______________

- Buyer Signature: ___________________________ Date: _______________

This document serves as an important part of the transaction. Make copies for both parties for their records.

Check out Other Common Tractor Bill of Sale Templates for US States

Farm Tractor Bill of Sale - Recordkeeping for agricultural equipment sales should include a completed bill of sale form.

Farm Equipment Bill of Sale - A Tractor Bill of Sale shows accountability between the buyer and seller.

When dealing with property transfers, it is essential to utilize the correct documentation; for instance, a Florida Quitclaim Deed form serves as a tool to facilitate the transfer of real estate interests without title guarantees. This is particularly useful among family members or friends, where the transaction may not reflect market value. For those seeking the appropriate forms, additional resources can be found at All Florida Forms, ensuring a smooth and efficient transfer process.

Bill of Sale for Tractor - Aids in providing clarity for both parties involved in the transaction.