Blank Promissory Note Document for Michigan

Misconceptions

Understanding the Michigan Promissory Note form is essential for anyone entering into a loan agreement. However, several misconceptions often arise regarding its use and implications. Below is a list of seven common misconceptions.

- It must be notarized. Many believe that a promissory note requires notarization to be valid. In Michigan, notarization is not a legal requirement for the enforceability of a promissory note.

- It is only for large loans. Some people think that promissory notes are only necessary for substantial amounts. In reality, they can be used for any loan amount, regardless of size.

- Oral agreements are sufficient. There is a misconception that verbal agreements can replace a written promissory note. However, having a written document is crucial for clarity and enforceability.

- They are only for personal loans. While often used in personal lending, promissory notes can also be used in business transactions and real estate deals.

- They do not need to specify interest rates. Some believe that a promissory note can lack an interest rate. However, including this information is important for both parties to understand the terms of repayment.

- They are automatically enforceable. Just because a promissory note exists does not mean it will be automatically enforceable in court. If the terms are unclear or if there are issues with the agreement, enforceability may be questioned.

- They cannot be modified. Another common belief is that once a promissory note is signed, it cannot be changed. In fact, parties can agree to modify the terms, but this should be documented in writing.

Clarifying these misconceptions can help individuals navigate the complexities of loan agreements more effectively. Understanding the true nature of a promissory note in Michigan ensures better preparation and informed decision-making.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Michigan Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. |

| Governing Law | This form is governed by the Michigan Uniform Commercial Code (UCC), specifically Article 3, which deals with negotiable instruments. |

| Requirements | The note must include the amount owed, the interest rate (if any), the payment schedule, and signatures of the borrower and lender. |

| Enforceability | A properly executed Michigan Promissory Note is legally enforceable in court, provided it meets all legal requirements. |

Key takeaways

When using the Michigan Promissory Note form, it’s important to keep a few key points in mind to ensure everything is completed correctly and effectively.

- Understand the Purpose: A promissory note is a legal document that outlines a borrower's promise to repay a loan to the lender. It serves as a record of the debt and the terms of repayment.

- Complete All Required Fields: Make sure to fill in all necessary information, including the names of both the borrower and the lender, the loan amount, interest rate, and repayment schedule.

- Specify the Terms Clearly: Clearly outline the terms of the loan, including any penalties for late payments and the consequences of default. This helps avoid misunderstandings later on.

- Sign and Date the Document: Both parties should sign and date the promissory note. This step is crucial as it indicates agreement to the terms outlined in the document.

- Keep Copies for Records: After signing, make sure both the borrower and lender keep copies of the signed promissory note. This provides proof of the agreement and can be useful in case of disputes.

By following these guidelines, you can effectively use the Michigan Promissory Note form and ensure that both parties are protected in the lending process.

Dos and Don'ts

When filling out the Michigan Promissory Note form, there are essential guidelines to follow. Adhering to these can help ensure that the document is valid and enforceable.

- Do read the entire form carefully before filling it out.

- Do provide accurate information, including names, addresses, and loan amounts.

- Do specify the repayment terms clearly, including interest rates and due dates.

- Do sign and date the document in the appropriate sections.

- Don't leave any fields blank; incomplete forms may be deemed invalid.

- Don't use unclear language or vague terms that could lead to misunderstandings.

Common mistakes

-

Not Including the Date: Many people forget to write the date on the promissory note. This is crucial because it establishes when the agreement was made. Without a date, it can lead to confusion about the timeline of payments.

-

Incorrectly Stating the Amount: Some individuals make errors in the amount being borrowed. It’s important to double-check that the written amount matches the numerical amount. Any discrepancies can cause problems later on.

-

Missing Signatures: A common mistake is not having all necessary parties sign the document. If the borrower or lender does not sign, the note may not be legally binding. Ensure everyone involved has signed the form.

-

Failing to Specify Payment Terms: Some people overlook detailing the payment schedule. It’s essential to clearly outline when payments are due and how much each payment will be. Vague terms can lead to misunderstandings.

What You Should Know About This Form

-

What is a Michigan Promissory Note?

A Michigan Promissory Note is a legal document in which one party (the borrower) promises to pay a specific amount of money to another party (the lender) at a defined time or on demand. This document outlines the terms of the loan, including interest rates and repayment schedules.

-

Who can use a Promissory Note in Michigan?

Anyone can use a Promissory Note in Michigan, including individuals, businesses, and organizations. It is commonly used for personal loans, business financing, and real estate transactions.

-

What information is required in a Michigan Promissory Note?

A valid Promissory Note should include the following information:

- The names and addresses of the borrower and lender

- The loan amount

- The interest rate (if applicable)

- The repayment schedule

- The due date for repayment

- Any penalties for late payment

- Signatures of both parties

-

Is a Michigan Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding in Michigan. Both parties must adhere to the terms outlined in the document. If either party fails to comply, the other party may seek legal remedies.

-

Do I need a lawyer to create a Promissory Note?

While it is not required to have a lawyer, consulting one can be beneficial, especially for complex agreements. A lawyer can ensure that the document meets legal standards and protects your interests.

-

Can I modify a Promissory Note after it has been signed?

Yes, modifications can be made, but both parties must agree to the changes. It is advisable to document any amendments in writing and have both parties sign the revised agreement.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender may take legal action to recover the owed amount. This could include filing a lawsuit or seeking a judgment against the borrower. The specific consequences should be outlined in the Promissory Note.

-

Is there a statute of limitations on enforcing a Promissory Note in Michigan?

Yes, in Michigan, the statute of limitations for enforcing a Promissory Note is generally six years from the date of default. After this period, the lender may lose the right to take legal action for recovery.

-

Where can I find a Michigan Promissory Note template?

Templates for Michigan Promissory Notes can be found online through legal websites, or you may consult a lawyer for a customized document. Ensure that any template you use complies with Michigan laws.

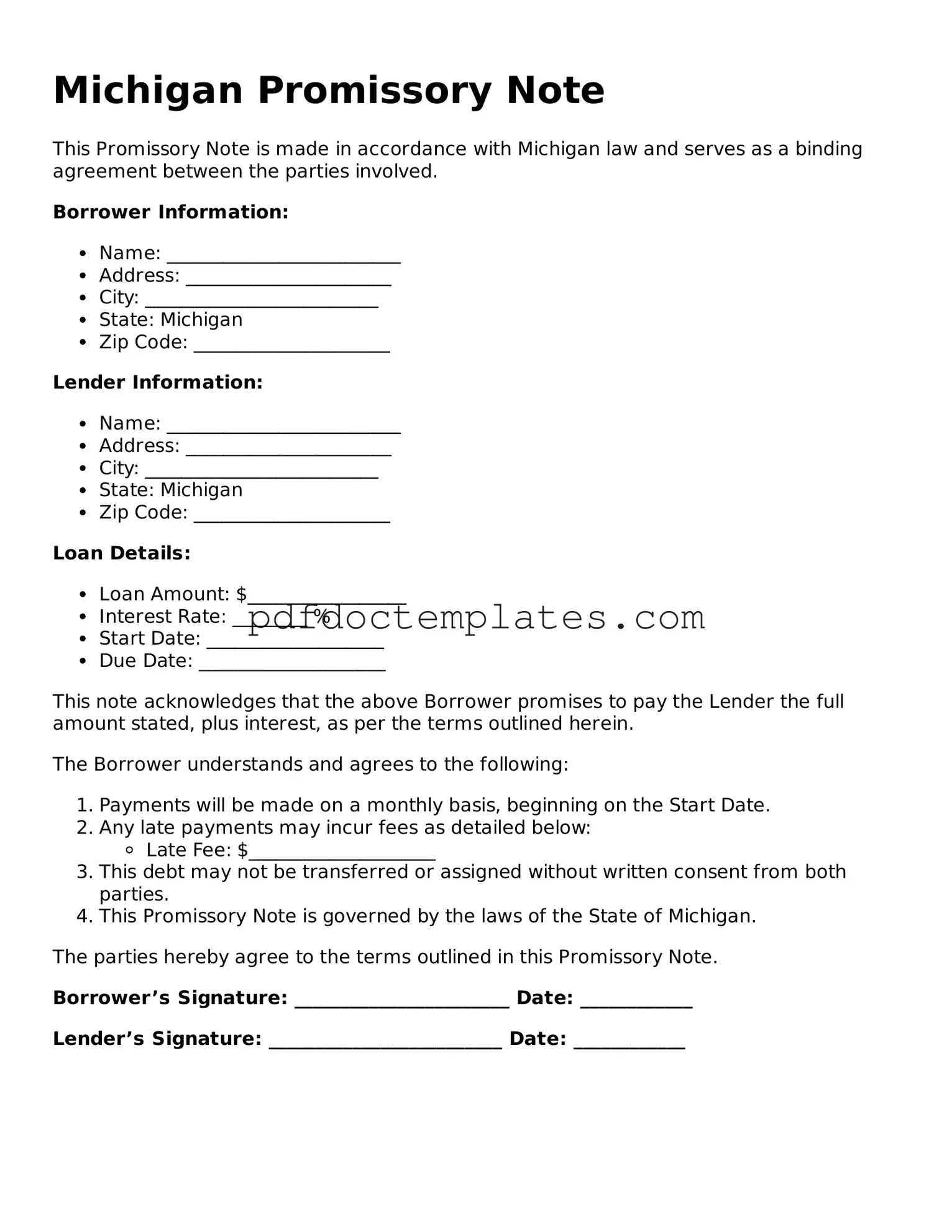

Michigan Promissory Note Example

Michigan Promissory Note

This Promissory Note is made in accordance with Michigan law and serves as a binding agreement between the parties involved.

Borrower Information:

- Name: _________________________

- Address: ______________________

- City: _________________________

- State: Michigan

- Zip Code: _____________________

Lender Information:

- Name: _________________________

- Address: ______________________

- City: _________________________

- State: Michigan

- Zip Code: _____________________

Loan Details:

- Loan Amount: $_________________

- Interest Rate: ________ %

- Start Date: ___________________

- Due Date: ____________________

This note acknowledges that the above Borrower promises to pay the Lender the full amount stated, plus interest, as per the terms outlined herein.

The Borrower understands and agrees to the following:

- Payments will be made on a monthly basis, beginning on the Start Date.

- Any late payments may incur fees as detailed below:

- Late Fee: $____________________

- This debt may not be transferred or assigned without written consent from both parties.

- This Promissory Note is governed by the laws of the State of Michigan.

The parties hereby agree to the terms outlined in this Promissory Note.

Borrower’s Signature: _______________________ Date: ____________

Lender’s Signature: _________________________ Date: ____________

Check out Other Common Promissory Note Templates for US States

Tennessee Promissory Note - Interest rates stated in the note can be fixed or variable, depending on the agreement.

In New York, utilizing a Non-disclosure Agreement form is essential for individuals and organizations who want to protect their confidential information from unwanted exposure. By having parties sign this document, businesses can ensure that their crucial details remain secure and are not disclosed to unauthorized individuals. For those seeking to create such a document, resources like All New York Forms can provide valuable templates and guidance.

Promissory Note Arizona - This form is often used in informal lending situations between friends or family.

Promissory Note Washington State - It serves as a useful reference for both the borrower and lender throughout the loan period.