Blank Operating Agreement Document for Michigan

Misconceptions

When it comes to the Michigan Operating Agreement form, many people hold misconceptions that can lead to confusion. Understanding these misconceptions can help ensure that you are well-informed and prepared. Here are four common misunderstandings:

- It's only necessary for large businesses. Many believe that an operating agreement is only required for larger companies. In reality, even small businesses and single-member LLCs benefit from having one. It outlines the structure and management of the business, regardless of its size.

- It's a legal requirement in Michigan. While having an operating agreement is highly recommended, it is not legally mandated for LLCs in Michigan. However, without one, you may face challenges in resolving disputes or managing operations effectively.

- It needs to be filed with the state. Some think that the operating agreement must be submitted to the state of Michigan. This is a misconception. The agreement is an internal document meant for the members of the LLC and does not need to be filed.

- Once created, it cannot be changed. Another common belief is that an operating agreement is set in stone. In fact, it can be amended as the business evolves. Regularly reviewing and updating the agreement is crucial for ensuring it reflects current operations and member agreements.

By dispelling these myths, you can better appreciate the importance of the Michigan Operating Agreement form and how it can serve your business effectively.

Form Properties

| Fact Name | Details |

|---|---|

| Purpose | The Michigan Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC). |

| Governing Law | This agreement is governed by the Michigan Limited Liability Company Act, specifically MCL 450.4101 et seq. |

| Members' Rights | The agreement specifies the rights and responsibilities of the members, including voting rights and profit distribution. |

| Amendments | Changes to the Operating Agreement can be made with the consent of the members, as outlined within the document itself. |

| Duration | The agreement can establish a specific duration for the LLC or state that it will exist indefinitely until dissolved. |

| Dispute Resolution | Provisions for resolving disputes among members, including mediation or arbitration, can be included in the agreement. |

Key takeaways

When filling out and using the Michigan Operating Agreement form, it's essential to keep a few key points in mind. These takeaways will help ensure that the document serves its intended purpose effectively.

- Understand the Purpose: The Operating Agreement outlines the management structure and operational procedures for your LLC. It provides clarity on how decisions are made and responsibilities are assigned.

- Customize the Agreement: Each business is unique. Tailor the Operating Agreement to reflect the specific needs and goals of your LLC. This customization can include provisions for profit distribution, member responsibilities, and decision-making processes.

- Include All Members: Ensure that all members of the LLC are included in the agreement. Each member should understand their rights and obligations as outlined in the document.

- Review Regularly: As your business evolves, so may your Operating Agreement. Regularly review and update the document to accommodate changes in membership, business structure, or operational needs.

- Legal Compliance: While the Operating Agreement is not mandatory in Michigan, having one can help protect your limited liability status. Ensure that your agreement complies with state laws and regulations.

Dos and Don'ts

When filling out the Michigan Operating Agreement form, there are several important dos and don'ts to keep in mind. This document is essential for outlining the management structure and operating procedures of your business. Here’s a helpful list to guide you through the process:

- Do ensure that all members of the LLC are included in the agreement.

- Do clearly outline the roles and responsibilities of each member.

- Do specify how profits and losses will be distributed among members.

- Do review the agreement with a legal professional to ensure compliance with state laws.

- Don't leave any sections blank; incomplete forms can lead to misunderstandings.

- Don't use vague language; clarity is key to avoid disputes later.

- Don't ignore the importance of member voting rights; these should be clearly defined.

- Don't forget to include a procedure for amending the agreement in the future.

By following these guidelines, you can create a solid foundation for your LLC's operations and help prevent potential conflicts down the line.

Common mistakes

-

Not including all members: It's essential to list all members of the LLC in the Operating Agreement. Omitting a member can lead to disputes and confusion regarding ownership and responsibilities.

-

Failing to specify ownership percentages: Clearly defining each member's ownership percentage is crucial. Without this, disagreements may arise over profit distribution and decision-making authority.

-

Ignoring management structure: The Operating Agreement should outline whether the LLC is member-managed or manager-managed. This distinction affects how decisions are made and who has the authority to act on behalf of the LLC.

-

Not detailing the decision-making process: Establishing how decisions will be made, including voting rights and procedures, is vital. A lack of clarity can lead to conflicts and inefficiencies.

-

Overlooking profit and loss distribution: Clearly stating how profits and losses will be distributed among members is necessary. Failing to do so can create misunderstandings and dissatisfaction.

-

Neglecting to include a buy-sell agreement: Planning for the future is important. A buy-sell agreement outlines what happens if a member wants to leave the LLC or if a member passes away. This can prevent disputes and provide a clear path forward.

-

Not updating the agreement: As circumstances change, so should the Operating Agreement. Regularly reviewing and updating the document ensures it reflects the current state of the LLC and its members.

-

Failing to sign and date: An unsigned agreement may not hold up in court. All members should sign and date the document to confirm their acceptance of its terms.

What You Should Know About This Form

-

What is a Michigan Operating Agreement?

A Michigan Operating Agreement is a legal document that outlines the ownership and operating procedures of a Limited Liability Company (LLC) in Michigan. It serves as an internal guideline for the members of the LLC, detailing how the business will be managed, how profits and losses will be distributed, and the roles and responsibilities of each member.

-

Is an Operating Agreement required in Michigan?

While Michigan law does not mandate that LLCs have an Operating Agreement, it is highly recommended. Having this document can help prevent disputes among members and provide clarity on business operations. Additionally, banks and investors often require an Operating Agreement to open business accounts or provide funding.

-

Who should draft the Operating Agreement?

The Operating Agreement can be drafted by any member of the LLC. However, it is advisable to consult with a legal professional to ensure that the document complies with state laws and adequately addresses the needs of the business and its members.

-

What should be included in the Operating Agreement?

The Operating Agreement should include several key components:

- The name and purpose of the LLC

- The names and addresses of the members

- The management structure (member-managed or manager-managed)

- How profits and losses will be allocated

- Procedures for adding or removing members

- Dispute resolution methods

- Amendment procedures for the agreement

-

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. The process for making changes should be clearly outlined in the original document. Typically, amendments require the consent of a certain percentage of the members, which should also be specified in the agreement.

-

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, the default rules set by Michigan law will apply. This may not align with the members' intentions and could lead to conflicts. Without a clear agreement, members may have limited control over how decisions are made and how profits are distributed.

-

How do I file the Operating Agreement?

The Operating Agreement does not need to be filed with the state of Michigan. It should be kept on file with the LLC’s records. Each member should have a copy for their reference. It is important to ensure that all members have access to the most current version of the agreement.

Michigan Operating Agreement Example

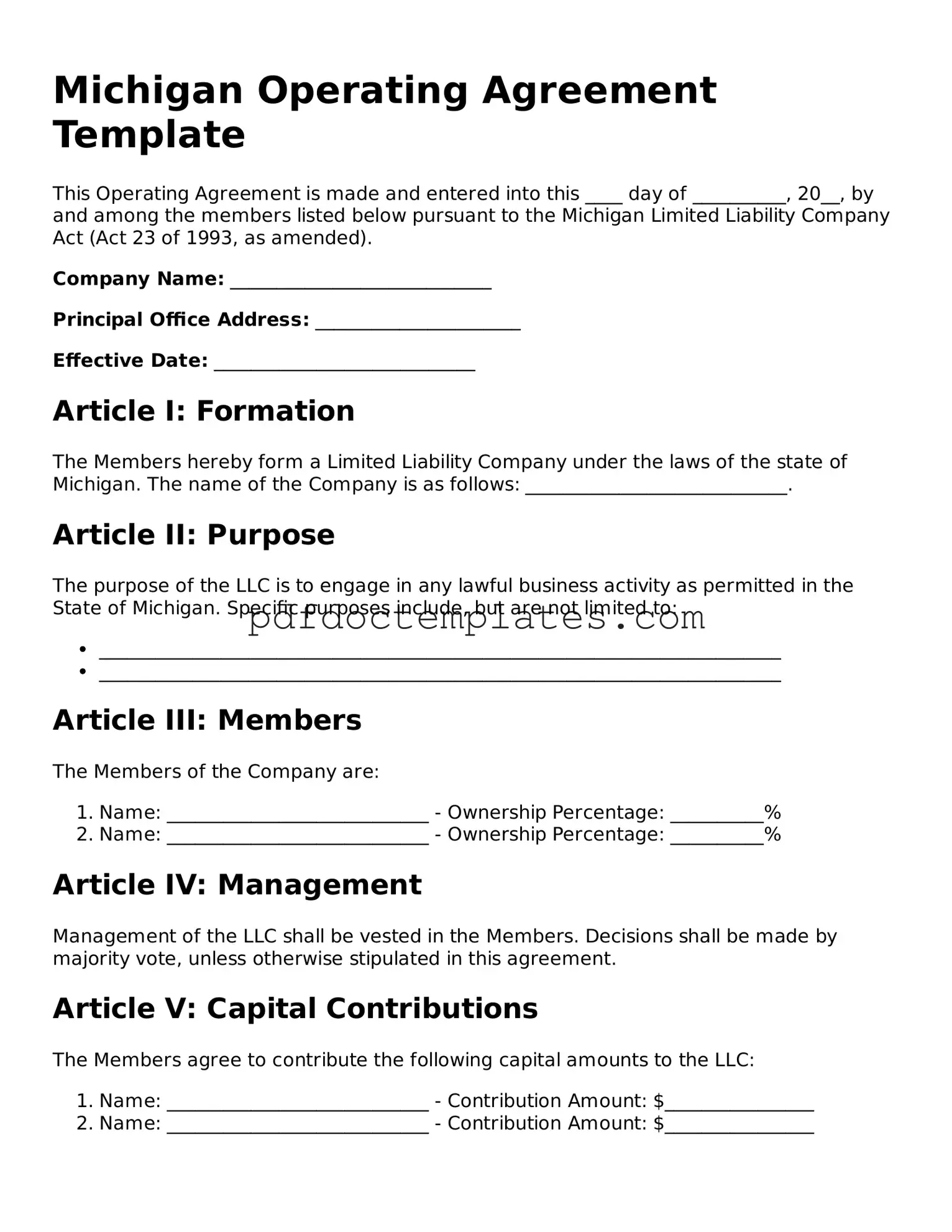

Michigan Operating Agreement Template

This Operating Agreement is made and entered into this ____ day of __________, 20__, by and among the members listed below pursuant to the Michigan Limited Liability Company Act (Act 23 of 1993, as amended).

Company Name: ____________________________

Principal Office Address: ______________________

Effective Date: ____________________________

Article I: Formation

The Members hereby form a Limited Liability Company under the laws of the state of Michigan. The name of the Company is as follows: ____________________________.

Article II: Purpose

The purpose of the LLC is to engage in any lawful business activity as permitted in the State of Michigan. Specific purposes include, but are not limited to:

- _________________________________________________________________________

- _________________________________________________________________________

Article III: Members

The Members of the Company are:

- Name: ____________________________ - Ownership Percentage: __________%

- Name: ____________________________ - Ownership Percentage: __________%

Article IV: Management

Management of the LLC shall be vested in the Members. Decisions shall be made by majority vote, unless otherwise stipulated in this agreement.

Article V: Capital Contributions

The Members agree to contribute the following capital amounts to the LLC:

- Name: ____________________________ - Contribution Amount: $________________

- Name: ____________________________ - Contribution Amount: $________________

Article VI: Distributions

Profits and losses shall be allocated to the Members in proportion to their respective percentage interests in the LLC as outlined in Article III.

Article VII: Dissolution

The LLC may be dissolved upon the unanimous consent of the Members or as otherwise provided by law.

Article VIII: Amendments

This Operating Agreement may only be amended by a written agreement signed by all Members of the LLC.

Signatures

IN WITNESS WHEREOF, the Members have executed this Operating Agreement on the date first above written.

_____________________________ ____________________________

Member Signature Member Name

_____________________________ ____________________________

Member Signature Member Name

Check out Other Common Operating Agreement Templates for US States

Operating Agreement Llc Virginia - It details the process for making important business decisions.

When entering into agreements or engaging in activities that carry inherent risks, it's crucial to have a reliable legal framework in place. A Hold Harmless Agreement serves this purpose by ensuring that parties can operate with reduced concern over potential liabilities. This is particularly important in sectors such as construction or during special events, as it protects participants from unforeseen legal repercussions. For those seeking guidance on creating such agreements, resources like All New York Forms can provide valuable templates and information.

How to Write an Operating Agreement - Establishing an Operating Agreement is essential for compliance and credibility.

How to Set Up an Operating Agreement for Llc - This document helps establish credibility with banks and investors.

How to Write an Operating Agreement - This document aims to maintain harmony among the members over time.