Blank Last Will and Testament Document for Michigan

Misconceptions

When it comes to creating a Last Will and Testament in Michigan, there are several misconceptions that can lead to confusion. Here are eight common misunderstandings:

- Only wealthy individuals need a will. Many people believe that wills are only for those with significant assets. In reality, anyone can benefit from having a will to ensure their wishes are followed after their passing.

- Wills are only necessary if you have children. While having children often prompts the need for a will, anyone with assets or specific wishes should consider creating one, regardless of parental status.

- A will can be verbal. Some may think that simply stating their wishes out loud is enough. In Michigan, a will must be in writing and signed to be legally valid.

- Once a will is created, it never needs to be updated. Life changes, such as marriage, divorce, or the birth of children, may necessitate updates to a will. Regular reviews ensure it reflects current wishes.

- All assets automatically go to the spouse. While many people assume their spouse will inherit everything, this is not always the case. A will can specify different distributions that might not align with default state laws.

- Handwritten wills are not valid. In Michigan, handwritten wills, also known as holographic wills, can be valid if they meet certain criteria, including being signed by the testator.

- Wills avoid probate. Many think that having a will means their estate will bypass probate. In reality, a will must go through the probate process, although it can simplify the process compared to not having one.

- Only lawyers can create a will. While legal assistance can be beneficial, individuals can create their own wills using templates or online resources, provided they follow Michigan's legal requirements.

Understanding these misconceptions can help individuals make informed decisions about their estate planning. Having a clear and valid will can provide peace of mind for both the individual and their loved ones.

Form Properties

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Last Will and Testament form allows individuals to specify how their assets should be distributed after their death. |

| Governing Law | This form is governed by the Michigan Estates and Protected Individuals Code (EPIC), specifically MCL 700.2501. |

| Age Requirement | Individuals must be at least 18 years old to create a valid will in Michigan. |

| Witnesses | The will must be signed by at least two witnesses who are not beneficiaries of the will. |

| Signature Requirement | The testator (the person making the will) must sign the document for it to be valid. |

| Revocation | A will can be revoked at any time by creating a new will or by physically destroying the original document. |

| Self-Proving Will | Michigan allows for a self-proving will, which simplifies the probate process by including a notarized affidavit from the witnesses. |

| Holographic Wills | Holographic wills, which are handwritten and signed by the testator, are recognized in Michigan if they meet certain criteria. |

| Executor Appointment | The will allows the testator to appoint an executor to manage the estate and ensure the will is executed as intended. |

| Minor Children | If the testator has minor children, the will can specify guardianship arrangements for their care. |

Key takeaways

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. Here are ten key takeaways to consider when filling out and using the Michigan Last Will and Testament form:

- Understand the Purpose: A will outlines how your assets will be distributed and who will care for your minor children, if applicable.

- Eligibility: You must be at least 18 years old and of sound mind to create a valid will in Michigan.

- Choose an Executor: Select a trustworthy person to manage your estate and ensure your wishes are carried out. This individual is known as the executor.

- Be Clear and Specific: Clearly list your assets and specify who will receive each item. Ambiguities can lead to disputes among heirs.

- Witness Requirements: In Michigan, your will must be signed in the presence of at least two witnesses who are not beneficiaries of the will.

- Revocation of Previous Wills: If you create a new will, it automatically revokes any previous wills. Make sure to destroy old copies to avoid confusion.

- Consider a Self-Proving Affidavit: This document can simplify the probate process by confirming the validity of your will without needing witness testimony.

- Keep It Accessible: Store your will in a safe place and inform your executor and family members of its location.

- Review and Update Regularly: Life changes, such as marriage, divorce, or the birth of a child, may require updates to your will.

- Consult a Professional: While many people fill out their wills on their own, seeking legal advice can ensure that your will meets all legal requirements and accurately reflects your wishes.

Taking the time to properly fill out and use the Michigan Last Will and Testament form can provide peace of mind for you and your loved ones. Make sure to address these key points to create a clear and effective document.

Dos and Don'ts

When filling out the Michigan Last Will and Testament form, it's essential to approach the task with care. Here are six key things to keep in mind:

- Do ensure that you are of sound mind and at least 18 years old when creating your will.

- Do clearly identify yourself and your beneficiaries in the document to avoid confusion.

- Do sign the will in the presence of at least two witnesses, who should also sign it.

- Do keep the will in a safe place and inform your executor of its location.

- Don't use ambiguous language that could lead to misinterpretation of your wishes.

- Don't forget to review and update your will periodically, especially after major life events.

Common mistakes

-

Not being clear about their wishes: Many people fail to specify exactly how they want their assets distributed. Ambiguity can lead to confusion and disputes among heirs.

-

Forgetting to name an executor: An executor is crucial for managing the estate. Without one, the probate court may appoint someone unfamiliar with the deceased's wishes.

-

Neglecting to update the will: Life changes such as marriage, divorce, or the birth of a child should prompt a review of the will. Failing to update it can lead to outdated instructions.

-

Not signing the will properly: In Michigan, a will must be signed by the testator (the person making the will) and witnessed by at least two individuals. Skipping this step can invalidate the will.

-

Overlooking state-specific requirements: Each state has its own laws regarding wills. Not adhering to Michigan's specific regulations can render the document ineffective.

-

Failing to keep the will in a safe place: A will should be stored securely but also be accessible when needed. Hiding it or placing it in a location that is hard to find can complicate matters for loved ones.

-

Ignoring tax implications: Some individuals overlook how taxes may affect their estate. Consulting a professional can help clarify these issues and ensure the estate is managed efficiently.

-

Not discussing the will with family: Open conversations about the will can prevent misunderstandings and conflict after death. Many people shy away from these discussions, but they are essential.

-

Using outdated templates: Relying on old or generic templates may lead to mistakes. It's important to ensure that the form used is current and reflects the individual's unique situation.

What You Should Know About This Form

-

What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how an individual's assets and properties will be distributed upon their death. It can also specify guardianship for minor children and appoint an executor to manage the estate. This document is essential for ensuring that a person's wishes are honored after their passing.

-

Who can create a Last Will and Testament in Michigan?

In Michigan, any individual who is at least 18 years old and of sound mind can create a Last Will and Testament. It is important that the individual understands the nature of their assets and the implications of their decisions regarding the distribution of those assets.

-

What are the requirements for a valid Last Will and Testament in Michigan?

To be valid in Michigan, a Last Will and Testament must be written, signed by the testator (the person making the will), and witnessed by at least two individuals. These witnesses must be at least 18 years old and cannot be beneficiaries of the will. The document should clearly express the testator's intentions regarding the distribution of their estate.

-

Can a Last Will and Testament be changed or revoked?

Yes, a Last Will and Testament can be changed or revoked at any time while the testator is alive and competent. Changes can be made by creating a new will or by drafting a codicil, which is an amendment to the existing will. It is advisable to consult with a legal professional to ensure that any changes comply with state laws.

-

What happens if someone dies without a Last Will and Testament in Michigan?

If an individual dies without a Last Will and Testament, they are considered to have died intestate. In this case, Michigan's intestacy laws will determine how the deceased's assets are distributed. Generally, this means that assets will be distributed to relatives according to a specific hierarchy, which may not align with the deceased's wishes.

Michigan Last Will and Testament Example

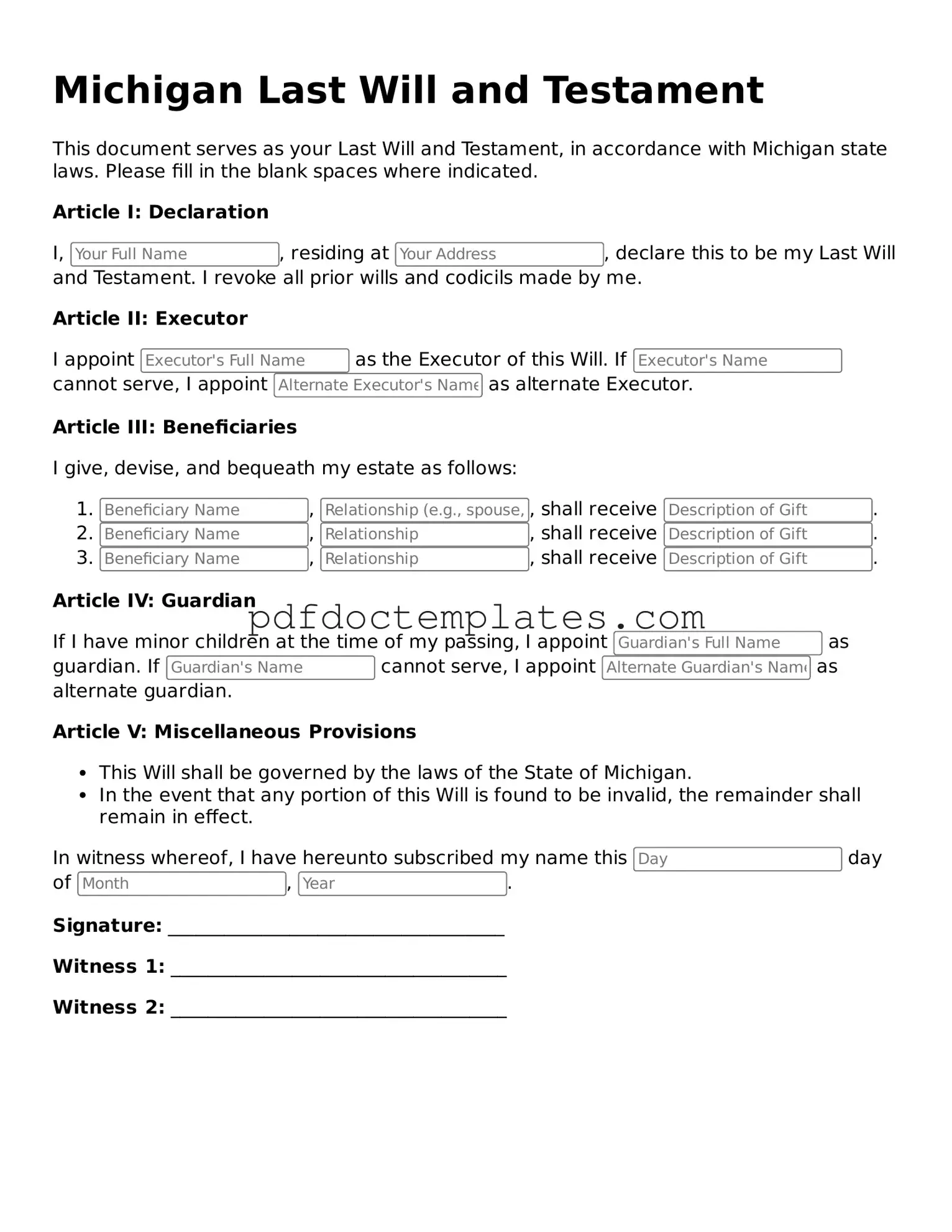

Michigan Last Will and Testament

This document serves as your Last Will and Testament, in accordance with Michigan state laws. Please fill in the blank spaces where indicated.

Article I: Declaration

I, , residing at , declare this to be my Last Will and Testament. I revoke all prior wills and codicils made by me.

Article II: Executor

I appoint as the Executor of this Will. If cannot serve, I appoint as alternate Executor.

Article III: Beneficiaries

I give, devise, and bequeath my estate as follows:

- , , shall receive .

- , , shall receive .

- , , shall receive .

Article IV: Guardian

If I have minor children at the time of my passing, I appoint as guardian. If cannot serve, I appoint as alternate guardian.

Article V: Miscellaneous Provisions

- This Will shall be governed by the laws of the State of Michigan.

- In the event that any portion of this Will is found to be invalid, the remainder shall remain in effect.

In witness whereof, I have hereunto subscribed my name this day of , .

Signature: ____________________________________

Witness 1: ____________________________________

Witness 2: ____________________________________

Check out Other Common Last Will and Testament Templates for US States

Washington State Will Template - Can include specific gifts such as heirlooms or sentimental items.

Where to Get a Will Made - Helps clarify how to handle remaining funds or properties without clear heirs.

Understanding the importance of a Hold Harmless Agreement in New York is crucial for individuals and businesses alike. By utilizing this legal document, parties can ensure that they are protected from potential liabilities that may arise during various activities. This agreement is particularly significant in contexts like construction and event planning, where risks may be present. For those looking to draft such agreements, resources like All New York Forms can provide valuable templates and guidance.

New Jersey Will Template - A will can also include provisions for charitable donations, allowing individuals to support causes they care about after death.

Do I Need an Attorney for a Will - Can be a way to provide for loved ones in a secure, legally binding manner.