Blank Bill of Sale Document for Michigan

Misconceptions

Many people have misunderstandings about the Michigan Bill of Sale form. Here are eight common misconceptions:

- A Bill of Sale is only for vehicles. This form can be used for various types of personal property, including furniture, electronics, and recreational vehicles.

- A Bill of Sale must be notarized. While notarization adds an extra layer of authenticity, it is not a legal requirement in Michigan.

- You do not need a Bill of Sale for gifts. Even if an item is a gift, a Bill of Sale can provide proof of transfer and protect both parties.

- Only the seller needs to sign the Bill of Sale. Both the buyer and seller should sign the document to ensure mutual agreement.

- A Bill of Sale is not legally binding. When properly completed, it serves as a legal document that can be enforced in court.

- There is a specific format that must be followed. While there are recommended elements, the format can vary as long as it includes necessary information.

- Once signed, a Bill of Sale cannot be changed. Amendments can be made if both parties agree and sign the changes.

- You do not need to keep a copy of the Bill of Sale. It is important for both parties to retain a copy for their records in case of future disputes.

Form Properties

| Fact Name | Details |

|---|---|

| Purpose | The Michigan Bill of Sale form serves as a legal document to transfer ownership of personal property from one party to another. |

| Governing Law | This form is governed by Michigan state law, specifically the Michigan Uniform Commercial Code (UCC). |

| Property Types | The Bill of Sale can be used for various types of personal property, including vehicles, boats, and equipment. |

| Notarization | While notarization is not mandatory, having the document notarized can provide additional legal protection. |

| Seller's Information | The form requires the seller's name, address, and signature to validate the transaction. |

| Buyer's Information | Buyer's name and address must also be included to ensure clear identification of both parties. |

| Consideration | The Bill of Sale must state the consideration, or purchase price, agreed upon by both parties. |

Key takeaways

When dealing with the Michigan Bill of Sale form, there are several important points to keep in mind. This document serves as a crucial record of a transaction between a buyer and a seller. Here are key takeaways to ensure you complete and use the form effectively:

- Complete All Required Information: Ensure that all fields are filled out accurately. This includes the names and addresses of both the buyer and seller, a description of the item being sold, and the sale price.

- Signatures Matter: Both parties should sign the Bill of Sale. This signature validates the agreement and can help prevent disputes in the future.

- Keep Copies: After the Bill of Sale is completed and signed, make sure to keep copies for your records. Both the buyer and seller should retain a copy for their files.

- Consider Notarization: While notarization is not always required, having the document notarized can add an extra layer of protection and authenticity to the transaction.

- Understand Local Laws: Familiarize yourself with any specific regulations or requirements in Michigan regarding the sale of certain items, especially vehicles or property, to ensure compliance.

By following these guidelines, you can ensure that your Bill of Sale serves its purpose effectively and protects the interests of both parties involved in the transaction.

Dos and Don'ts

When filling out the Michigan Bill of Sale form, it's important to follow certain guidelines to ensure accuracy and legality. Here are five things you should do and five things you shouldn't do:

- Do: Provide accurate information about the buyer and seller.

- Do: Include a detailed description of the item being sold, including any identifying numbers.

- Do: Sign and date the form to make it legally binding.

- Do: Keep a copy of the completed Bill of Sale for your records.

- Do: Verify that both parties understand the terms of the sale.

- Don't: Leave any sections of the form blank.

- Don't: Use vague language; be specific about the item and the terms.

- Don't: Forget to include the purchase price.

- Don't: Sign the document without reading it thoroughly.

- Don't: Assume verbal agreements are sufficient; always document the sale in writing.

Common mistakes

-

Not including all necessary information: It is crucial to provide complete details about the buyer and seller, including full names, addresses, and contact information. Omitting any of this information can lead to confusion or disputes later on.

-

Failing to accurately describe the item: A thorough description of the item being sold is essential. This includes the make, model, year, VIN (for vehicles), and any other identifying details. Incomplete descriptions can create issues with ownership verification.

-

Not specifying the purchase price: Clearly stating the amount paid for the item is necessary. This establishes the value of the transaction and can be important for tax purposes.

-

Neglecting to include the date of sale: The date when the transaction takes place should be documented. This helps establish a timeline and is important for record-keeping.

-

Skipping signatures: Both the buyer and seller must sign the Bill of Sale. Without signatures, the document lacks legal validity and may not be recognized in disputes.

-

Not providing a witness or notary: While not always required, having a witness or notary can add an extra layer of protection. This can help verify the identities of the parties involved.

-

Using unclear language: Avoid vague terms or jargon that could lead to misunderstandings. Clear and precise language ensures that all parties are on the same page regarding the transaction.

-

Ignoring local laws: Each state may have specific requirements for a Bill of Sale. It's important to be aware of Michigan's regulations to ensure compliance.

-

Not keeping copies: After completing the Bill of Sale, both parties should retain a copy for their records. This is essential for future reference and proof of the transaction.

-

Overlooking additional terms: If there are specific conditions or warranties associated with the sale, these should be clearly stated in the document. This helps prevent misunderstandings down the line.

What You Should Know About This Form

-

What is a Michigan Bill of Sale?

A Michigan Bill of Sale is a legal document that records the transfer of ownership of personal property from one party to another. This form serves as proof of the transaction and includes essential details such as the buyer's and seller's information, a description of the item being sold, and the sale price.

-

When do I need a Bill of Sale in Michigan?

A Bill of Sale is necessary in various situations, particularly when selling or buying vehicles, boats, firearms, or other valuable items. It is especially important for high-value transactions or when the item requires registration, such as a car. While not always legally required, having one can protect both the buyer and seller.

-

What information should be included in a Michigan Bill of Sale?

The Bill of Sale should include:

- The full names and addresses of both the buyer and seller

- A detailed description of the item, including make, model, year, and VIN for vehicles

- The sale price

- The date of the transaction

- Signatures of both parties

-

Is a Bill of Sale required for vehicle sales in Michigan?

Yes, a Bill of Sale is highly recommended for vehicle sales in Michigan. While it is not mandatory for every transaction, it provides proof of the sale and can be required when registering the vehicle in the new owner's name. It is a good practice to have one for both parties' protection.

-

Can I create my own Bill of Sale in Michigan?

Yes, you can create your own Bill of Sale in Michigan. There are no specific state requirements for the format, but it must contain all relevant information to be effective. Many templates are available online, or you can draft your own document as long as it includes the necessary details.

-

Do I need to have the Bill of Sale notarized?

Notarization is not required for a Bill of Sale in Michigan. However, having it notarized can add an extra layer of authenticity and may be beneficial in disputes. It is advisable to check with local regulations or the specific requirements of the transaction.

-

What should I do with the Bill of Sale after the transaction?

After the transaction, both the buyer and seller should keep a copy of the Bill of Sale for their records. The buyer may need it for registration or proof of ownership, while the seller should retain it as evidence of the sale.

-

What if there are issues after the sale?

If issues arise after the sale, such as disputes over the condition of the item or payment problems, the Bill of Sale serves as a crucial piece of evidence. It can help clarify the terms of the sale and provide a basis for resolving disputes. If necessary, parties may seek legal advice to address any unresolved issues.

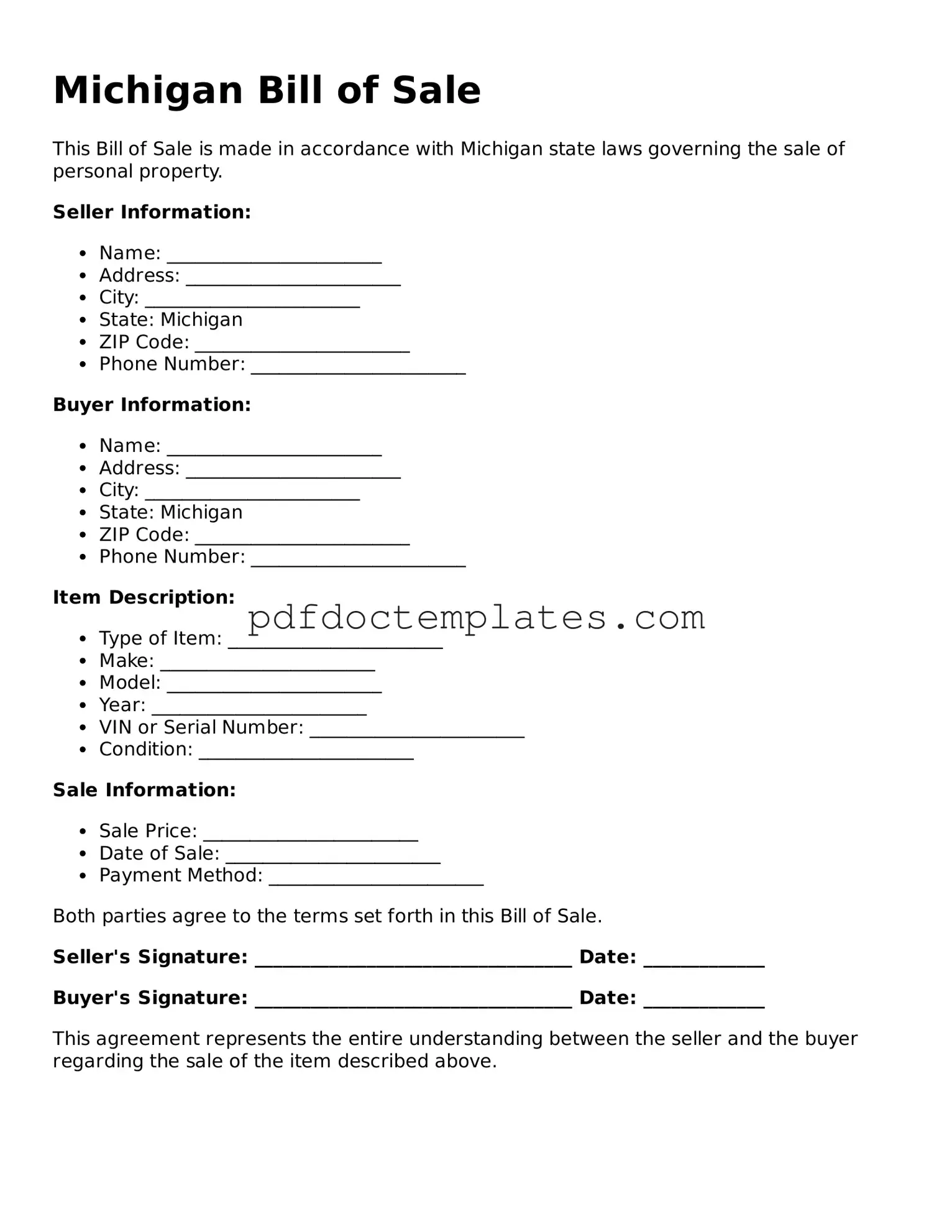

Michigan Bill of Sale Example

Michigan Bill of Sale

This Bill of Sale is made in accordance with Michigan state laws governing the sale of personal property.

Seller Information:

- Name: _______________________

- Address: _______________________

- City: _______________________

- State: Michigan

- ZIP Code: _______________________

- Phone Number: _______________________

Buyer Information:

- Name: _______________________

- Address: _______________________

- City: _______________________

- State: Michigan

- ZIP Code: _______________________

- Phone Number: _______________________

Item Description:

- Type of Item: _______________________

- Make: _______________________

- Model: _______________________

- Year: _______________________

- VIN or Serial Number: _______________________

- Condition: _______________________

Sale Information:

- Sale Price: _______________________

- Date of Sale: _______________________

- Payment Method: _______________________

Both parties agree to the terms set forth in this Bill of Sale.

Seller's Signature: __________________________________ Date: _____________

Buyer's Signature: __________________________________ Date: _____________

This agreement represents the entire understanding between the seller and the buyer regarding the sale of the item described above.

Check out Other Common Bill of Sale Templates for US States

Virginia Bill of Sale Template - For businesses, using a standard Bill of Sale form can standardize sales processes.

In New York, completing a Power of Attorney form is essential for individuals wanting to designate someone they trust to handle various decisions on their behalf, especially in cases where they may be unable to manage these matters themselves. It is vital to understand the implications of this document to ensure your wishes are honored. For those looking for guidance and resources, you can find a comprehensive template at All New York Forms.

Is a Bill of Sale Required in Arizona - The Bill of Sale can include warranties or guarantees about the item, adding a layer of protection.