Download Membership Ledger Template

Misconceptions

Understanding the Membership Ledger form is essential for accurate record-keeping and compliance. However, several misconceptions can lead to confusion. Here are seven common misunderstandings about this important document:

- Misconception 1: The Membership Ledger form is only for new members.

- Misconception 2: Completing the form is optional.

- Misconception 3: Only the original issuer of the membership interest can fill out the form.

- Misconception 4: The form is only relevant for financial transactions.

- Misconception 5: The Membership Ledger does not need to be updated regularly.

- Misconception 6: Mistakes on the form can be ignored.

- Misconception 7: The Membership Ledger form is the same for all organizations.

This is not true. The form serves as a comprehensive record for all membership interests, including transfers and surrenders, regardless of when a member joined.

In reality, maintaining an accurate Membership Ledger is often required by law or organizational bylaws. It helps ensure transparency and accountability.

While the original issuer typically completes the initial entries, subsequent transfers can be documented by any authorized member or representative involved in the transaction.

Although monetary amounts are recorded, the form also tracks changes in membership status, which is crucial for governance and membership rights.

This is misleading. The ledger should be updated promptly after any transfer or issuance of membership interests to maintain accurate records.

Errors can lead to significant issues down the line. It is important to correct any mistakes immediately and document the changes properly.

This is incorrect. Different organizations may have specific requirements or formats for their Membership Ledger, so it is essential to follow the guidelines relevant to your organization.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Membership Ledger form tracks the issuance and transfer of membership interests or units within a company. |

| Required Information | It requires details such as the company's name, certificates issued, amounts paid, and dates of transfers. |

| Transfer Documentation | Each transfer must include the name of the member, their place of residence, and the certificate number associated with the membership interest. |

| State-Specific Law | In many states, the governing law for membership interest transfers is found in the state's business organization code, such as the Delaware Limited Liability Company Act. |

| Balance Tracking | The form also helps maintain a record of the number of membership interests or units held after each transaction. |

Key takeaways

Filling out and using the Membership Ledger form is essential for tracking ownership interests in a company. Here are some key takeaways to ensure you handle this process smoothly:

- Company Name: Always start by clearly entering the company's name at the top of the form. This identifies the ledger and associates it with the correct entity.

- Certificates Issued: Document the certificates issued, including details about who issued them and the specific membership interests or units involved.

- Amount Paid: Record the amount paid for each membership interest or unit. This information is crucial for financial records and future transactions.

- Date of Transfer: Always include the date when the membership interests were transferred. This helps maintain an accurate timeline of ownership.

- Original Issue: If the membership interest is an original issue, make sure to note that clearly. This distinguishes it from subsequent transfers.

- Member Information: Include the name and place of residence of the member receiving the membership interest. This provides transparency and accountability.

- Certificate Numbers: Keep track of the certificate numbers for both issued and surrendered certificates. This aids in maintaining accurate records.

- Units Held: At the end of the form, summarize the number of membership interests or units held by each member. This gives a clear overview of ownership distribution.

- Regular Updates: Update the ledger regularly to reflect any changes in membership interests. This ensures that the information remains current and reliable.

By keeping these key points in mind, you can effectively manage the Membership Ledger form and support the ongoing operations of the company.

Dos and Don'ts

When filling out the Membership Ledger form, it's important to follow certain guidelines to ensure accuracy and clarity. Here are seven things you should and shouldn't do:

- Do enter the company's name clearly at the top of the form.

- Don't leave any sections blank; every part of the form needs to be completed.

- Do double-check the amount paid for each membership interest or unit.

- Don't use abbreviations or shorthand that might confuse the reader.

- Do specify the date of transfer accurately.

- Don't forget to include the certificate numbers for each transaction.

- Do ensure that the member's place of residence is up to date.

By following these guidelines, you can help maintain a clear and organized Membership Ledger.

Common mistakes

-

Incomplete Company Name: When filling out the form, it is crucial to enter the complete name of the company. Omitting part of the name can lead to confusion and potential issues with record-keeping.

-

Incorrect Dates: Ensure that all dates, especially the date of transfer, are accurate. An incorrect date can create discrepancies in the ledger, which may complicate future transactions.

-

Missing Member Information: All fields related to the member's name and place of residence should be filled out completely. Leaving out this information may hinder the ability to contact the member or verify ownership.

-

Improper Certificate Numbers: Each certificate number must be entered precisely as it appears. Errors in these numbers can lead to the misallocation of membership interests.

-

Omitting Amounts Paid: It is essential to include the amount paid for the membership interest or units. Failing to do so may result in misunderstandings regarding the financial contributions of members.

-

Neglecting to Update Balances: After any transfer, it is important to update the number of membership interests or units held. This ensures that the ledger accurately reflects the current ownership status.

What You Should Know About This Form

-

What is the purpose of the Membership Ledger form?

The Membership Ledger form is used to track the issuance and transfer of membership interests or units within a company. It provides a detailed record of who holds membership interests, how many units they possess, and any transfers that occur. This helps maintain clear ownership records and ensures compliance with company policies and regulations.

-

How do I fill out the Membership Ledger form?

To complete the form, start by entering the company's name at the top. Then, for each entry, provide the following details:

- Certificates Issued: Indicate the certificate number and the amount paid for the membership interest.

- Transfer Details: If applicable, note the name of the member to whom the interest was transferred, along with their place of residence.

- Membership Interest Units: Record the number of units issued and any certificates surrendered during the transfer.

- Balance: Finally, list the total number of membership interests or units held after the transfer.

-

Who needs to use the Membership Ledger form?

This form is essential for companies that issue membership interests or units. It should be used by company officers, administrative staff, or anyone responsible for maintaining accurate records of membership ownership. Keeping this ledger updated is crucial for effective management and transparency.

-

What should I do if I make a mistake on the form?

If a mistake is made while filling out the Membership Ledger form, it is important to correct it promptly. Cross out the incorrect information neatly and write the correct details next to it. Make sure to initial the change to indicate that it was made intentionally. If the error is significant, consider using a new form to ensure clarity.

-

How often should the Membership Ledger form be updated?

The Membership Ledger form should be updated every time there is a new issuance or transfer of membership interests. This means that any time a member buys or sells their interests, the ledger must reflect these changes immediately. Regular updates help maintain accurate records and prevent confusion among members.

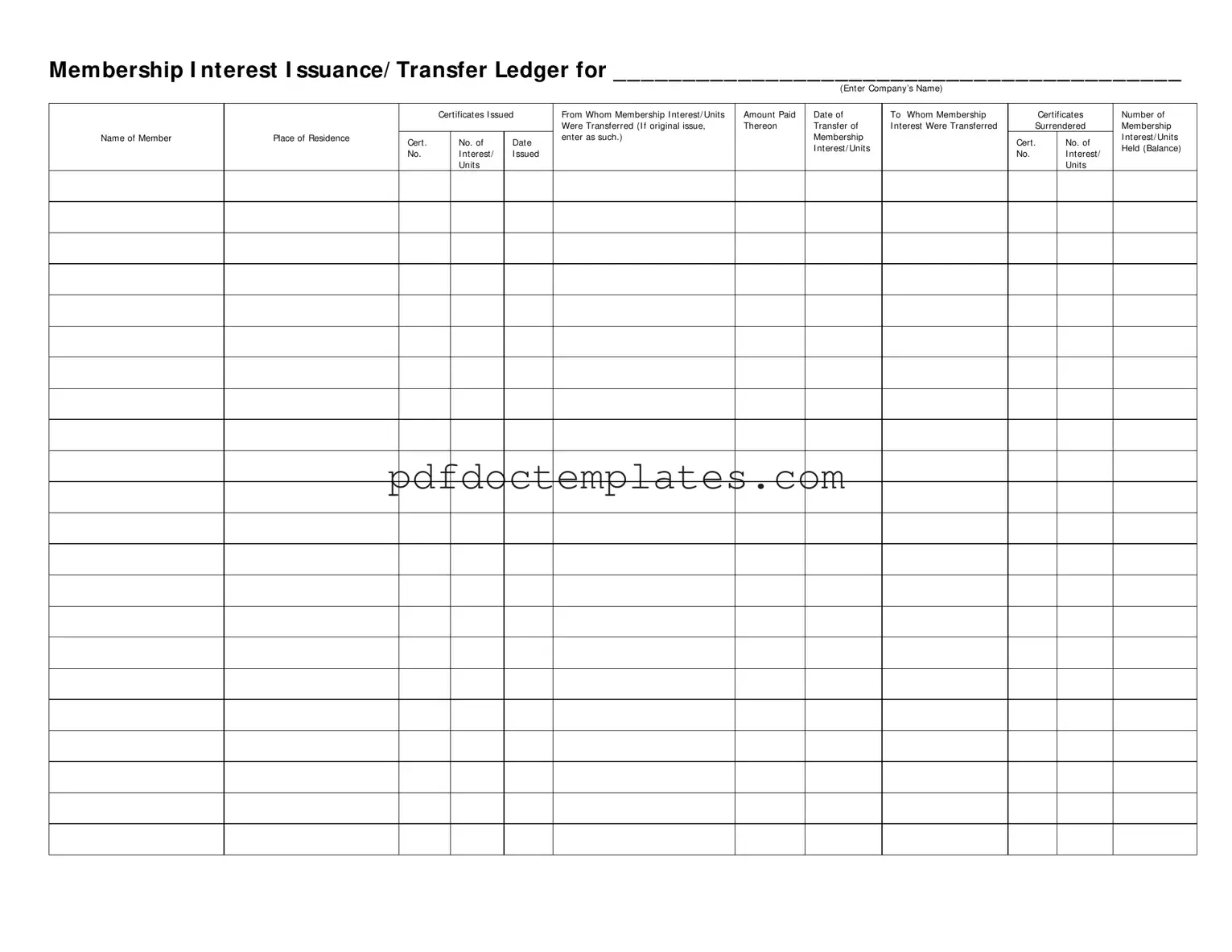

Membership Ledger Example

Membership I nt erest I ssuance/ Transfer Ledger for _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

(Enter Company’s Name)

|

|

|

Certificates I ssued |

From Whom Membership I nterest/ Units |

Amount Paid |

Date of |

To Whom Membership |

||

|

|

|

|

|

|

Were Transferred (I f original issue, |

Thereon |

Transfer of |

I nterest Were Transferred |

Name of Member |

Place of Residence |

Cert . |

|

No. of |

Date |

enter as such.) |

|

Membership |

|

|

|

|

|

|

I nterest/ Units |

|

|||

|

|

No. |

|

I nterest/ |

I ssued |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Units |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certificates

Surrendered

Cert . |

No. of |

No. |

I nterest/ |

|

Units |

|

|

Number of Membership

I nterest/ Units Held (Balance)

Consider More Forms

Prescription Paper for Controlled Substances - The Prescription Pad is instrumental in ensuring timely access to medications for patients.

When engaging in a trailer sale, it is crucial to utilize the correct documentation to prevent misunderstandings, which is why the Florida Trailer Bill of Sale form is highly recommended. This form not only formalizes the transaction but also serves as a vital reference for both the buyer and the seller. To simplify the process, you can find the necessary paperwork at All Florida Forms, making it easier to ensure everything is above board.

Is It Too Late to Vaccinate My Cat - Promote safe interactions among pets with proof of vaccination.