Download Louisiana act of donation Template

Misconceptions

Understanding the Louisiana act of donation form is essential for anyone considering this legal document. Unfortunately, several misconceptions can lead to confusion. Here are nine common misunderstandings:

-

The act of donation is only for wealthy individuals.

This is not true. The act of donation can be utilized by anyone wishing to transfer property or assets to another person, regardless of their financial status.

-

Once an act of donation is signed, it cannot be changed.

While it is true that an act of donation is a legal commitment, it can be amended or revoked under certain circumstances, such as mutual agreement or specific legal reasons.

-

The act of donation requires a lawyer.

Although having legal guidance can be beneficial, it is not mandatory. Individuals can complete the form on their own if they understand the requirements.

-

The act of donation is the same as a will.

These two documents serve different purposes. A will outlines how assets are distributed after death, while an act of donation transfers ownership during a person's lifetime.

-

All donations are tax-free.

While many donations may not incur taxes, it is important to consult with a tax professional. Certain thresholds and conditions may apply, leading to potential tax implications.

-

The recipient of a donation has no responsibilities.

In some cases, recipients may have obligations, such as maintaining the property or fulfilling conditions outlined in the donation agreement.

-

The act of donation can only involve real estate.

This is a misconception. The act of donation can involve various types of property, including personal belongings, vehicles, and financial assets.

-

Once the act of donation is filed, it is public information.

While certain aspects of the act may be recorded, specific details may remain private, depending on local laws and regulations.

-

All acts of donation are irrevocable.

This is not entirely accurate. Certain conditions may allow a donor to revoke a donation, especially if it was made under duress or with a misunderstanding.

Clarifying these misconceptions can help individuals make informed decisions regarding the Louisiana act of donation form. Understanding the nuances of this legal document is crucial for effective planning and execution.

File Details

| Fact Name | Details |

|---|---|

| Definition | The Louisiana Act of Donation form is a legal document used to transfer ownership of property as a gift. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1469-1474. |

| Types of Donations | Donations can be either inter vivos (between living persons) or mortis causa (effective upon death). |

| Requirements | The form must be signed by both the donor and the donee for it to be valid. |

| Notarization | While notarization is not always required, it is recommended for clarity and legal strength. |

| Revocation | Donors can revoke the act of donation under certain conditions, such as ingratitude or non-fulfillment of obligations. |

| Tax Implications | Donations may have gift tax implications; consult a tax professional for guidance. |

| Property Types | The form can be used for various types of property, including real estate and personal property. |

| Record Keeping | It is advisable to keep a copy of the signed form for personal records and future reference. |

| Legal Advice | Seeking legal advice before completing the form can help avoid potential disputes or issues. |

Key takeaways

Filling out the Louisiana Act of Donation form is an important process for anyone looking to legally transfer ownership of property without compensation. Here are some key takeaways to consider:

- Understand the Purpose: The Act of Donation allows individuals to gift property to another person while ensuring the transfer is legally recognized.

- Eligibility: Both the donor (the person giving the gift) and the donee (the person receiving the gift) must be legally capable of entering into a contract.

- Property Types: The form can be used for various types of property, including real estate, personal belongings, and financial assets.

- Written Form: The donation must be documented in writing. Verbal agreements are not sufficient for legal recognition.

- Notarization: While notarization is not always required, having the document notarized can help prevent disputes in the future.

- Tax Implications: Donors should be aware of potential tax consequences. Consulting with a tax professional can provide clarity.

- Clear Description: The form must include a clear and detailed description of the property being donated to avoid confusion.

- Consideration of Future Needs: Think about the long-term implications of the donation. Ensure it aligns with your future financial and personal plans.

- Revocation: Understand that donations can be revoked under certain circumstances, particularly if the donor becomes incapacitated.

- Legal Advice: Seeking legal advice before completing the form can help ensure that all aspects of the donation are handled correctly.

Taking the time to understand these key points can help ensure that the donation process goes smoothly and that all parties involved are protected.

Dos and Don'ts

When filling out the Louisiana Act of Donation form, it's important to follow certain guidelines to ensure that the process goes smoothly. Here are seven key do's and don'ts to keep in mind:

- Do provide accurate information. Double-check names, addresses, and any other details.

- Do sign the form in the presence of a notary public to ensure its validity.

- Do read the entire document before signing to understand your rights and obligations.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank. Fill in all required sections to avoid delays.

- Don't use white-out or erase any mistakes. Instead, cross out errors and initial them.

- Don't rush through the process. Take your time to ensure everything is correct.

Common mistakes

-

Incomplete Information: Individuals often fail to provide all necessary personal details. Missing names, addresses, or dates can lead to delays or complications in the donation process.

-

Incorrect Property Description: It is crucial to accurately describe the property being donated. Vague or incorrect descriptions can create confusion and may invalidate the donation.

-

Not Following Signature Requirements: The form typically requires signatures from both the donor and the recipient. Neglecting to include all required signatures can result in the form being rejected.

-

Failure to Include Witnesses: Some donations may require witnesses to sign the form. Not adhering to this requirement can affect the legality of the donation.

-

Ignoring Notary Requirements: Depending on the type of property, a notary may need to witness the signing of the form. Skipping this step can lead to issues with the validity of the donation.

-

Not Keeping Copies: After submitting the form, individuals often forget to keep copies for their records. Retaining copies is important for future reference and can help resolve any disputes that may arise.

What You Should Know About This Form

-

What is the Louisiana Act of Donation Form?

The Louisiana Act of Donation Form is a legal document used to transfer ownership of property from one person to another without any exchange of money. This form is commonly used for gifts of real estate, personal property, or other assets. It serves to formalize the donation and provide a clear record of the transfer.

-

Who can use the Act of Donation Form?

Any individual or entity can use the Act of Donation Form to donate property. The donor, or the person making the gift, must have legal ownership of the property. The recipient, known as the donee, must also be legally capable of receiving the property, which typically includes individuals and certain organizations.

-

What types of property can be donated using this form?

The Act of Donation Form can be used to donate various types of property, including:

- Real estate, such as land or buildings

- Personal property, including vehicles, jewelry, and art

- Financial assets, like stocks or bonds

-

Is there a specific format for the Act of Donation Form?

While there is no single prescribed format for the Act of Donation Form, it should include essential elements such as the names and addresses of both the donor and donee, a description of the property being donated, and the date of the donation. It is advisable to consult with a legal professional to ensure that the form meets all necessary legal requirements.

-

Does the Act of Donation need to be notarized?

In Louisiana, it is generally recommended that the Act of Donation Form be notarized to ensure its validity. Notarization provides an additional layer of authenticity and helps prevent disputes regarding the legitimacy of the donation.

-

Are there any tax implications for donating property?

Yes, there can be tax implications for both the donor and the donee. The donor may be eligible for a charitable deduction if the donation is made to a qualified organization. The donee may also need to consider potential tax consequences related to the value of the property received. Consulting with a tax professional is advisable to understand these implications fully.

-

Can the donor change their mind after the donation?

Once the Act of Donation Form is executed and the property is transferred, it is generally considered a completed transaction. However, if the donor wishes to revoke the donation, they may be able to do so under certain circumstances, particularly if the donation was made under duress or if there was a lack of capacity. Legal advice should be sought in such cases.

-

Where should the Act of Donation Form be filed?

The Act of Donation Form should be filed with the appropriate local government office, such as the parish clerk of court, especially if the donation involves real estate. Keeping a copy of the completed form for personal records is also recommended.

Louisiana act of donation Example

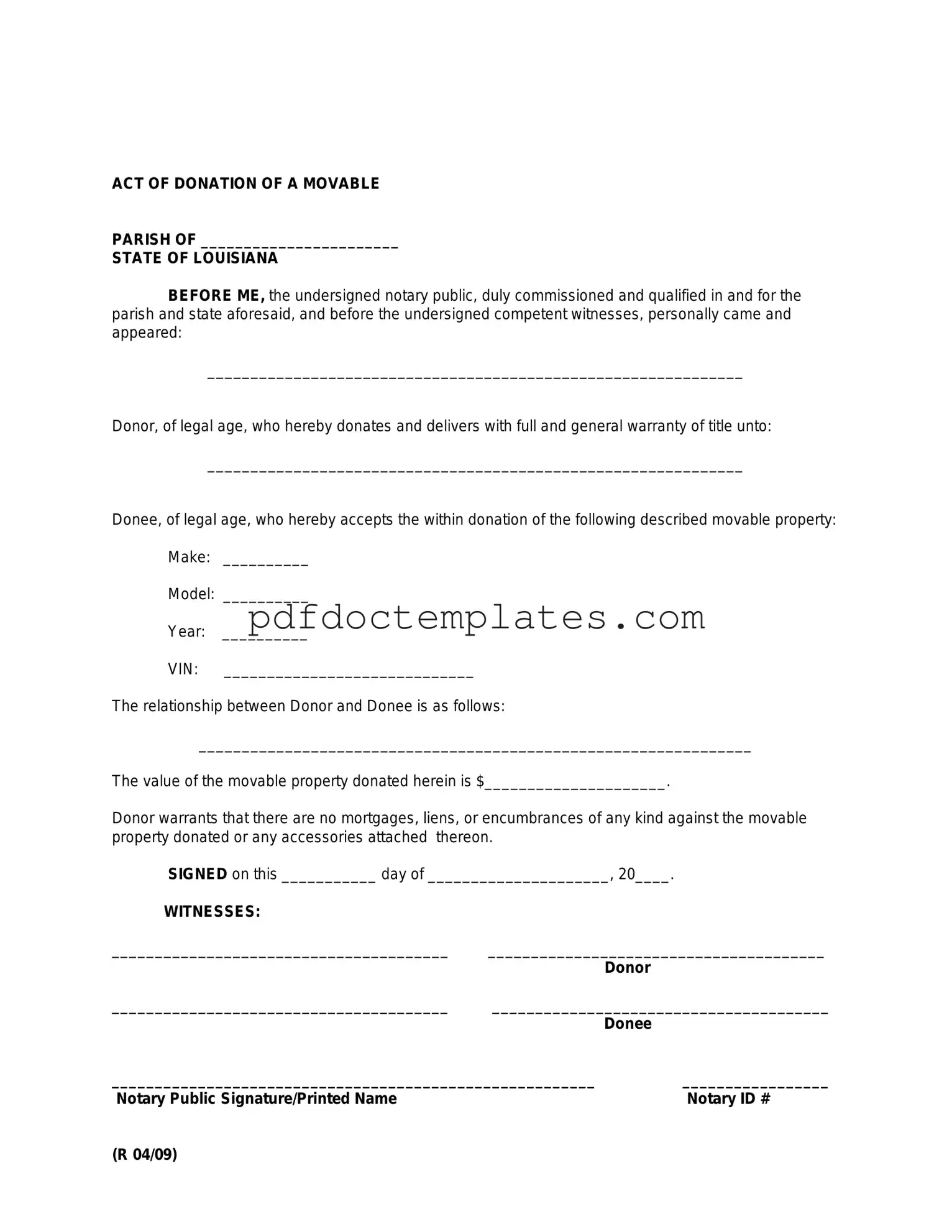

ACT OF DONATION OF A MOVABLE

PARISH OF _______________________

STATE OF LOUISIANA

BEFORE ME, the undersigned notary public, duly commissioned and qualified in and for the parish and state aforesaid, and before the undersigned competent witnesses, personally came and appeared:

______________________________________________________________

Donor, of legal age, who hereby donates and delivers with full and general warranty of title unto:

______________________________________________________________

Donee, of legal age, who hereby accepts the within donation of the following described movable property:

Make: __________

Model: __________

Year: __________

VIN: _____________________________

The relationship between Donor and Donee is as follows:

________________________________________________________________

The value of the movable property donated herein is $_____________________.

Donor warrants that there are no mortgages, liens, or encumbrances of any kind against the movable property donated or any accessories attached thereon.

SIGNED on this ___________ day of _____________________, 20____. |

|

|

WITNESSES: |

|

|

_______________________________________ |

_______________________________________ |

|

|

Donor |

|

_______________________________________ |

_______________________________________ |

|

|

Donee |

|

________________________________________________________ |

_________________ |

|

Notary Public Signature/Printed Name |

|

Notary ID # |

(R 04/09)

Consider More Forms

Puppy Health Record - Note any markings on the puppy for identification.

This document is crucial for anyone looking to transfer ownership, providing a simple means to execute a trailer sale efficiently. You can access the form's requirements through our step-by-step guide for the Trailer Bill of Sale process.

Yugioh Deck List Sheet - Initials from judges indicate they have reviewed the deck list.