Printable Loan Agreement Template

Loan Agreement Subtypes

Misconceptions

When it comes to loan agreements, there are several misconceptions that can lead to confusion or misinformed decisions. Here are nine common misunderstandings about loan agreements:

- All loan agreements are the same. Many people believe that all loan agreements follow a standard template. In reality, each agreement can vary significantly based on the lender, the type of loan, and the borrower's circumstances.

- Signing a loan agreement is a simple formality. Some individuals think that signing a loan agreement is just a formality. However, it is a legally binding contract that outlines the terms and conditions of the loan, and failing to understand it can lead to serious consequences.

- Verbal agreements are sufficient. Many assume that a verbal agreement with a lender is enough. In fact, a written loan agreement is essential for protecting both parties and ensuring that all terms are clear and enforceable.

- Loan agreements are only for large amounts. People often think loan agreements are only necessary for significant sums of money. However, even small loans should have a written agreement to avoid misunderstandings.

- Once signed, a loan agreement cannot be changed. Some believe that a loan agreement is set in stone once signed. In truth, many agreements can be amended if both parties agree to the changes.

- Only the borrower needs to read the agreement. It’s a common misconception that only the borrower should read the loan agreement. Lenders also have a responsibility to ensure that both parties fully understand the terms.

- Loan agreements are only for personal loans. Many think loan agreements apply only to personal loans. However, they are also crucial for business loans, mortgages, and other financial transactions.

- Interest rates are fixed and unchangeable. Some individuals believe that once the interest rate is set in a loan agreement, it cannot change. In reality, some loans have variable interest rates that can fluctuate over time.

- All loan agreements are easy to understand. Many assume that loan agreements are straightforward. In fact, they can be complex documents filled with legal terminology that may require careful reading and sometimes professional advice to fully grasp.

Understanding these misconceptions can help you navigate the loan process more effectively. It's essential to approach loan agreements with care and awareness.

Form Properties

| Fact Name | Description |

|---|---|

| Purpose | A Loan Agreement outlines the terms of a loan between a lender and a borrower. It specifies the amount borrowed, the interest rate, and the repayment schedule. |

| Governing Law | Each state may have its own laws governing loan agreements. For example, in California, the governing law is the California Civil Code. |

| Signatures | Both parties must sign the Loan Agreement for it to be legally binding. This ensures that both the lender and borrower agree to the terms outlined in the document. |

| Default Consequences | The agreement typically includes what happens if the borrower defaults on the loan. This may involve late fees, increased interest rates, or legal action. |

Key takeaways

When filling out and using a Loan Agreement form, consider the following key takeaways:

- Ensure all parties involved are clearly identified, including their full names and contact information.

- Specify the loan amount, interest rate, and repayment terms to avoid any misunderstandings.

- Include any collateral that secures the loan, if applicable, to protect the lender's interests.

- Outline the consequences of defaulting on the loan, such as late fees or legal actions.

- Both parties should sign and date the agreement to make it legally binding and enforceable.

Dos and Don'ts

When filling out a Loan Agreement form, attention to detail is crucial. Here are ten important things to keep in mind:

- Do read the entire Loan Agreement carefully before filling it out.

- Do provide accurate and truthful information.

- Do double-check your numbers and calculations.

- Do sign and date the form where required.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any required fields blank.

- Don't use abbreviations or shorthand that could cause confusion.

- Don't ignore any instructions provided with the form.

- Don't sign the form without understanding all terms and conditions.

Common mistakes

-

Incorrect Personal Information: Many individuals fail to provide accurate personal details, such as their full name, address, or Social Security number. This can lead to delays in processing the loan or even denial of the application.

-

Not Reading the Terms: Some applicants skip the fine print. Ignoring the terms and conditions can result in misunderstandings about interest rates, repayment schedules, and potential fees.

-

Inconsistent Financial Information: Providing conflicting financial data, such as income or employment status, raises red flags. It's crucial to ensure that all figures match across the application.

-

Missing Signatures: Forgetting to sign the loan agreement is a common oversight. Without a signature, the document is not legally binding, which can halt the loan process.

-

Overestimating Loan Amount: Some borrowers request more money than they actually need. This can lead to higher repayments and unnecessary debt.

-

Neglecting to Review Credit History: Failing to check your credit report before applying can result in surprises. A poor credit score can affect loan approval and terms.

What You Should Know About This Form

-

What is a Loan Agreement form?

A Loan Agreement form is a legal document that outlines the terms and conditions under which a borrower agrees to receive funds from a lender. This form serves as a written record of the agreement between the two parties, detailing important aspects such as the loan amount, interest rate, repayment schedule, and any collateral that may be required.

-

What information is typically included in a Loan Agreement?

Typically, a Loan Agreement includes the following information:

- The names and contact information of both the borrower and the lender.

- The principal amount of the loan.

- The interest rate, which may be fixed or variable.

- The repayment schedule, including the frequency of payments and the due dates.

- Any fees associated with the loan, such as origination fees or late payment penalties.

- Conditions for default and the rights of both parties in such an event.

-

Why is it important to have a Loan Agreement?

Having a Loan Agreement is crucial for several reasons. First, it provides legal protection for both the borrower and the lender. In case of any disputes, this document serves as evidence of the agreed-upon terms. Second, it helps clarify expectations, reducing the likelihood of misunderstandings about repayment and other obligations. Lastly, a well-drafted agreement can foster trust between the parties involved, as it demonstrates a commitment to honoring the terms of the loan.

-

Can a Loan Agreement be modified after it is signed?

Yes, a Loan Agreement can be modified after it has been signed, but both parties must agree to the changes. This typically involves drafting an amendment to the original agreement that outlines the new terms. It is advisable to document any modifications in writing to ensure that both parties have a clear understanding of the updated terms and to avoid potential disputes in the future.

-

What should I do if I cannot repay the loan on time?

If you find yourself unable to repay the loan on time, it is important to communicate with your lender as soon as possible. Many lenders are willing to work with borrowers who are facing financial difficulties. You may be able to negotiate a new repayment plan, request a temporary forbearance, or explore other options. Ignoring the situation can lead to serious consequences, including damage to your credit score and potential legal action.

Loan Agreement Example

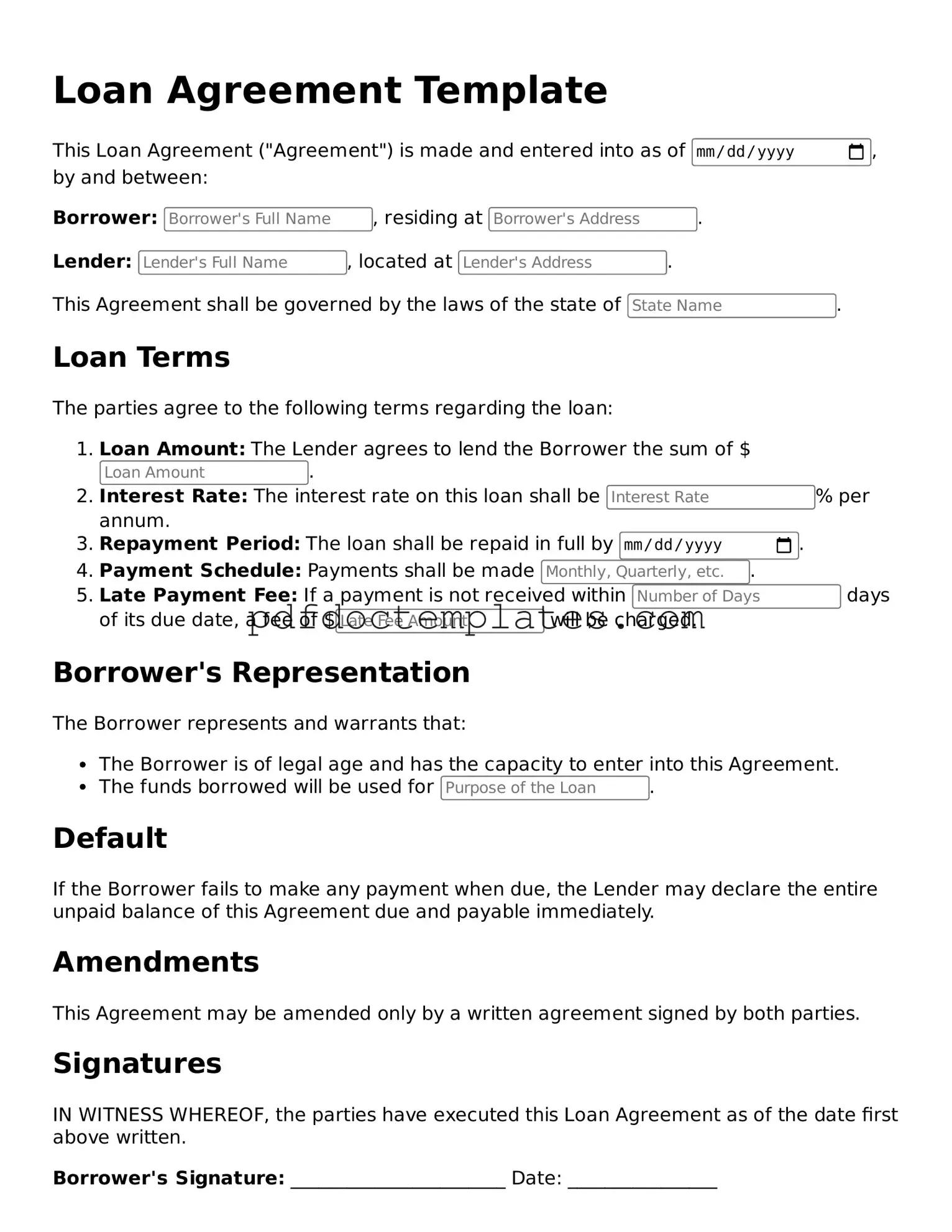

Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into as of , by and between:

Borrower: , residing at .

Lender: , located at .

This Agreement shall be governed by the laws of the state of .

Loan Terms

The parties agree to the following terms regarding the loan:

- Loan Amount: The Lender agrees to lend the Borrower the sum of $.

- Interest Rate: The interest rate on this loan shall be % per annum.

- Repayment Period: The loan shall be repaid in full by .

- Payment Schedule: Payments shall be made .

- Late Payment Fee: If a payment is not received within days of its due date, a fee of $ will be charged.

Borrower's Representation

The Borrower represents and warrants that:

- The Borrower is of legal age and has the capacity to enter into this Agreement.

- The funds borrowed will be used for .

Default

If the Borrower fails to make any payment when due, the Lender may declare the entire unpaid balance of this Agreement due and payable immediately.

Amendments

This Agreement may be amended only by a written agreement signed by both parties.

Signatures

IN WITNESS WHEREOF, the parties have executed this Loan Agreement as of the date first above written.

Borrower's Signature: _______________________ Date: ________________

Lender's Signature: _______________________ Date: ________________

Find Other Forms

Contractor Pay Stub - The Independent Contractor Pay Stub form helps maintain organized financial records for contractors.

In the context of forming a limited liability company (LLC) in New York, having a well-crafted Operating Agreement is essential. This document not only details the roles and responsibilities of the members but also helps in delineating the financial arrangements and operational procedures. For those seeking guidance on structuring this crucial form, resources such as All New York Forms can provide valuable templates and insights to ensure compliance and clarity in the agreement.

Salon Booth Rental Agreement - Defines the responsibilities of both the salon owner and the booth renter.

Simple Boyfriend Application Form - A cultural connoisseur, appreciates art, music, and theater.