Printable LLC Share Purchase Agreement Template

Misconceptions

There are several misconceptions surrounding the LLC Share Purchase Agreement form. Understanding these can help clarify its purpose and use.

- Misconception 1: An LLC Share Purchase Agreement is only necessary for large transactions.

- Misconception 2: The agreement is not legally binding.

- Misconception 3: Only the seller needs to sign the agreement.

- Misconception 4: The agreement is a standard template that requires no customization.

- Misconception 5: The LLC Share Purchase Agreement does not need to include payment terms.

- Misconception 6: The agreement can be verbal.

- Misconception 7: Once signed, the agreement cannot be amended.

This is not true. Any transfer of ownership interests in an LLC should be documented to protect both parties, regardless of the transaction size.

In fact, a properly executed LLC Share Purchase Agreement is legally binding. It outlines the terms of the sale and provides legal recourse if either party fails to comply.

Both the buyer and the seller must sign the agreement to ensure that both parties are in agreement with the terms outlined.

While templates exist, each agreement should be tailored to fit the specific circumstances of the transaction and the parties involved.

Payment terms are crucial. The agreement should clearly outline how and when payment will be made to avoid disputes later.

Verbal agreements can lead to misunderstandings and are difficult to enforce. A written agreement is essential for clarity and legal protection.

Agreements can be amended if both parties agree to the changes. It is important to document any amendments in writing to maintain clarity.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | An LLC Share Purchase Agreement is a legal document that outlines the terms under which shares of a limited liability company are bought and sold. |

| Governing Law | The agreement is typically governed by the laws of the state in which the LLC is formed, such as Delaware or California. |

| Key Components | Essential elements include purchase price, payment terms, and representations and warranties of the seller. |

| Parties Involved | The agreement involves at least two parties: the seller, who owns the shares, and the buyer, who intends to purchase them. |

| Importance | This document is crucial for protecting the interests of both parties and ensuring a smooth transfer of ownership. |

Key takeaways

When filling out and using the LLC Share Purchase Agreement form, several important considerations should be kept in mind. The following key takeaways can help ensure the process is smooth and effective.

- Understand the Purpose: The LLC Share Purchase Agreement outlines the terms of the sale of ownership interests in a limited liability company. It serves as a binding contract between the buyer and the seller.

- Identify the Parties: Clearly identify all parties involved in the transaction. This includes the seller(s) and buyer(s), as well as the LLC itself.

- Detail the Purchase Price: Specify the purchase price for the shares being sold. This should include any payment terms and conditions, such as deposits or financing arrangements.

- Include Representations and Warranties: Both parties should include representations and warranties regarding the shares being sold. This may cover the ownership of the shares and the authority to sell them.

- Consult Legal Expertise: It is advisable to consult with a legal professional when drafting or reviewing the agreement. This can help ensure that all legal requirements are met and that the agreement is enforceable.

Dos and Don'ts

When completing the LLC Share Purchase Agreement form, it's essential to approach the task with care and attention to detail. Here are five important do's and don'ts to keep in mind:

- Do: Read the entire agreement thoroughly before filling it out. Understanding the terms will help you make informed decisions.

- Do: Provide accurate and complete information. Double-check names, addresses, and other details to avoid any discrepancies.

- Do: Seek clarification if you come across any terms or sections that are unclear. It's better to ask questions than to make assumptions.

- Do: Keep a copy of the completed agreement for your records. This will be useful for future reference.

- Do: Consult with a legal professional if you have any doubts about the implications of the agreement.

- Don't: Rush through the form. Taking your time can prevent mistakes that could lead to complications later.

- Don't: Leave any sections blank unless instructed. Incomplete forms may be rejected or cause delays.

- Don't: Ignore deadlines. Ensure you submit the agreement on time to avoid any legal issues.

- Don't: Use unclear or ambiguous language. Be as precise as possible to prevent misunderstandings.

- Don't: Forget to sign and date the agreement. An unsigned document may not hold up in legal situations.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all necessary information. This includes names, addresses, and the number of shares being purchased. Omitting even a small detail can lead to significant issues later.

-

Incorrect Share Valuation: Miscalculating the value of shares can result in disputes. It is essential to accurately assess the fair market value of the shares being sold to avoid complications.

-

Not Including All Parties: Sometimes, individuals forget to include all relevant parties in the agreement. Ensure that all buyers and sellers are clearly identified to prevent misunderstandings.

-

Failure to Address Payment Terms: Clearly outlining payment terms is crucial. Ambiguities regarding payment methods, timelines, or amounts can lead to disagreements and potential legal issues.

-

Neglecting to Include Conditions Precedent: If there are specific conditions that must be met before the sale can proceed, these should be clearly stated. Failing to do so can create problems down the line.

-

Ignoring State-Specific Requirements: Each state may have unique laws governing LLC transactions. Not adhering to these regulations can invalidate the agreement or lead to legal challenges.

-

Not Seeking Legal Advice: Attempting to navigate the complexities of an LLC Share Purchase Agreement without professional guidance can be a mistake. Consulting with a legal expert can help identify potential pitfalls.

-

Overlooking Signatures: An agreement without proper signatures is not legally binding. Ensure that all parties have signed the document to validate the transaction.

-

Failing to Keep Copies: After the agreement is signed, it's vital to keep copies for all parties involved. Without documentation, proving the terms of the agreement can become challenging.

What You Should Know About This Form

-

What is an LLC Share Purchase Agreement?

An LLC Share Purchase Agreement is a legal document that outlines the terms and conditions under which one party agrees to buy shares in a Limited Liability Company (LLC) from another party. This agreement details the rights and obligations of both the buyer and the seller, ensuring a clear understanding of the transaction.

-

Why is an LLC Share Purchase Agreement important?

This agreement is crucial because it protects the interests of both parties involved in the transaction. It helps prevent misunderstandings by clearly defining the price, payment terms, and any representations or warranties made by the seller. Additionally, it can provide legal recourse if either party fails to fulfill their obligations.

-

What key elements should be included in the agreement?

Essential elements of an LLC Share Purchase Agreement include:

- Identification of the parties involved

- Description of the shares being purchased

- Purchase price and payment terms

- Representations and warranties by the seller

- Conditions for closing the transaction

- Dispute resolution procedures

-

How does the purchase process work?

The purchase process typically begins with negotiations between the buyer and seller regarding the terms of the sale. Once both parties agree, they draft and sign the LLC Share Purchase Agreement. Following this, the buyer usually pays the agreed-upon price, and the seller transfers the shares. Finally, the transaction may need to be recorded in the LLC's official records.

-

Are there any legal requirements for an LLC Share Purchase Agreement?

While specific legal requirements can vary by state, generally, the agreement should be in writing and signed by both parties. It is also advisable to ensure that the agreement complies with the LLC's operating agreement and any applicable state laws governing the sale of LLC shares.

-

Can the agreement be modified after it is signed?

Yes, the LLC Share Purchase Agreement can be modified after it is signed, but both parties must agree to the changes. It is best practice to document any modifications in writing and have both parties sign the amended agreement to avoid future disputes.

LLC Share Purchase Agreement Example

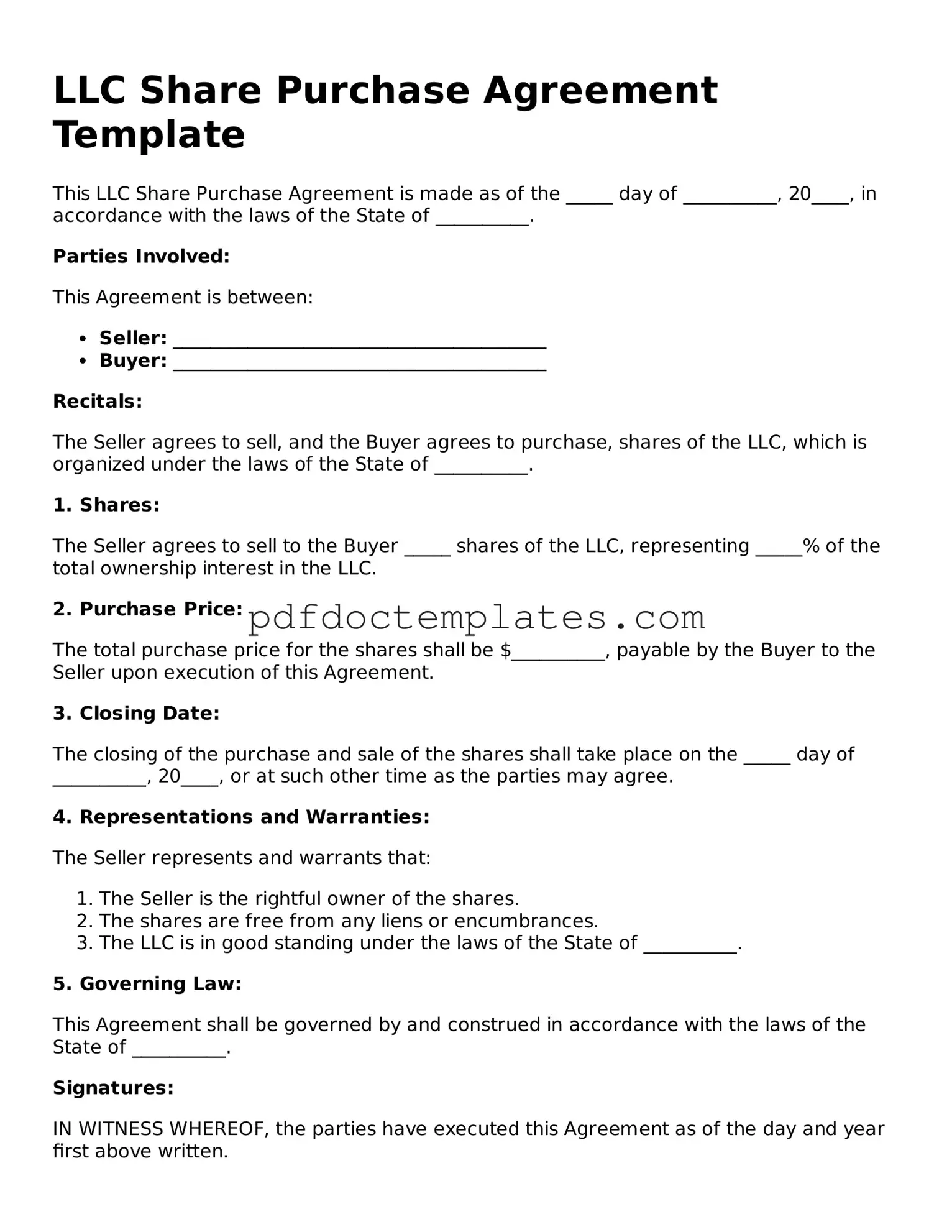

LLC Share Purchase Agreement Template

This LLC Share Purchase Agreement is made as of the _____ day of __________, 20____, in accordance with the laws of the State of __________.

Parties Involved:

This Agreement is between:

- Seller: ________________________________________

- Buyer: ________________________________________

Recitals:

The Seller agrees to sell, and the Buyer agrees to purchase, shares of the LLC, which is organized under the laws of the State of __________.

1. Shares:

The Seller agrees to sell to the Buyer _____ shares of the LLC, representing _____% of the total ownership interest in the LLC.

2. Purchase Price:

The total purchase price for the shares shall be $__________, payable by the Buyer to the Seller upon execution of this Agreement.

3. Closing Date:

The closing of the purchase and sale of the shares shall take place on the _____ day of __________, 20____, or at such other time as the parties may agree.

4. Representations and Warranties:

The Seller represents and warrants that:

- The Seller is the rightful owner of the shares.

- The shares are free from any liens or encumbrances.

- The LLC is in good standing under the laws of the State of __________.

5. Governing Law:

This Agreement shall be governed by and construed in accordance with the laws of the State of __________.

Signatures:

IN WITNESS WHEREOF, the parties have executed this Agreement as of the day and year first above written.

Seller: ________________________________________

Date: ________________________________________

Buyer: ________________________________________

Date: ________________________________________

Find Other Forms

How Do You Know You Had a Miscarriage - References to state procedures enhance understanding of legal options.

To ensure a smooth transaction, understanding the importance of the Vehicle Release of Liability document is essential for buyers and sellers alike. This form effectively releases the seller from future liabilities, reinforcing the need for a thorough procedure that includes the necessary paperwork, such as the proper Vehicle Release of Liability form.

Assurion Insurance - Filling out this form is a step towards resolving issues with coverage.