Printable Livestock Bill of Sale Template

Misconceptions

The Livestock Bill of Sale form is an important document for anyone involved in buying or selling livestock. However, several misconceptions surround this form. Understanding these misconceptions can help ensure that transactions are conducted smoothly and legally.

- Misconception 1: The Livestock Bill of Sale is only necessary for large transactions.

- Misconception 2: The form is only needed in certain states.

- Misconception 3: A verbal agreement is sufficient.

- Misconception 4: The form does not need to be signed.

- Misconception 5: The form is only for cattle sales.

- Misconception 6: The form is not legally binding.

- Misconception 7: There is no standard format for the form.

Many people believe that this form is only required for significant sales. In reality, regardless of the size of the transaction, having a written record protects both the buyer and the seller.

Some individuals think that the requirement for a Bill of Sale varies by state. While specific regulations may differ, it is generally advisable to use a Bill of Sale in all transactions involving livestock.

Trusting a verbal agreement can lead to misunderstandings. A written Bill of Sale provides clarity and serves as proof of the transaction, which is essential if disputes arise later.

Some believe that a Bill of Sale can be valid without signatures. However, both parties should sign the document to confirm their agreement and intentions.

While it is commonly associated with cattle, the Livestock Bill of Sale can be used for various types of livestock, including pigs, sheep, goats, and horses.

Many assume that a Bill of Sale holds no legal weight. In fact, when properly executed, it can be enforced in court, making it a crucial document for both parties involved.

Some people think that any written agreement suffices. However, using a standard format helps ensure that all necessary information is included, minimizing the risk of errors or omissions.

By addressing these misconceptions, individuals can better navigate the complexities of livestock transactions and protect their interests.

Form Properties

| Fact Name | Description |

|---|---|

| Purpose | The Livestock Bill of Sale form serves as a legal document to transfer ownership of livestock from one party to another. |

| Essential Elements | This form typically includes details such as the buyer's and seller's names, the description of the livestock, and the sale price. |

| State-Specific Requirements | Each state may have specific requirements regarding the information that must be included in the form. |

| Governing Laws | In many states, the sale of livestock is governed by the Uniform Commercial Code (UCC) and specific agricultural laws. |

| Notarization | Some states require the form to be notarized to ensure authenticity and protect against disputes. |

| Record Keeping | It is advisable for both parties to keep a copy of the signed Bill of Sale for their records. |

| Tax Implications | Sales tax may apply depending on the state, so it’s important to check local regulations. |

| Transfer of Liability | The Bill of Sale often includes a clause that transfers liability for the livestock from the seller to the buyer upon sale. |

| Dispute Resolution | Many forms include provisions for resolving disputes that may arise from the sale, such as mediation or arbitration clauses. |

Key takeaways

When dealing with the Livestock Bill of Sale form, it is essential to keep a few key points in mind to ensure a smooth transaction. Here are some important takeaways:

- Complete Information: Ensure all sections of the form are filled out accurately. This includes details about the buyer, seller, and the livestock being sold. Missing information can lead to disputes later.

- Signatures Required: Both the buyer and seller must sign the document. Without signatures, the bill of sale is not legally binding, which could jeopardize the transaction.

- Keep Copies: After filling out the form, make copies for both parties. This provides each side with a record of the transaction, which is crucial for future reference.

- Consult Local Laws: Different states may have specific regulations regarding livestock sales. Familiarize yourself with local laws to ensure compliance and avoid potential legal issues.

Dos and Don'ts

When filling out the Livestock Bill of Sale form, there are several important considerations to keep in mind. Here’s a list of what you should and shouldn't do:

- Do provide accurate and detailed information about the livestock being sold, including breed, age, and health status.

- Do include both the buyer's and seller's contact information to ensure clear communication.

- Do specify the sale price clearly to avoid any misunderstandings.

- Do sign and date the form to validate the transaction.

- Don't leave any sections of the form blank; incomplete forms can lead to disputes.

- Don't use vague language; be as specific as possible to protect both parties' interests.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all necessary details. Buyers and sellers should ensure that the names, addresses, and contact information are fully filled out. Missing even one piece of information can lead to complications later.

-

Incorrect Animal Descriptions: Describing the livestock accurately is crucial. People often overlook details such as breed, age, and identification numbers. Inaccuracies can cause disputes or issues with ownership verification.

-

Omitting Payment Terms: Clarity around payment terms is vital. Some individuals forget to specify whether the payment will be made in full upfront or if there will be installments. This omission can lead to misunderstandings between parties.

-

Not Including Signatures: A completed form without signatures is essentially useless. Both the buyer and seller must sign the document. Failing to do so renders the agreement invalid, which can create significant issues later on.

-

Ignoring Local Laws: Regulations regarding livestock sales can vary by state or locality. Some people neglect to check these laws before completing the form, which may lead to legal complications down the road.

-

Failing to Keep Copies: After filling out the form, it’s important to retain a copy for personal records. Many individuals forget to do this, which can complicate future transactions or disputes.

-

Not Verifying Buyer/Seller Identity: It’s essential to confirm the identities of all parties involved. Rushing through this step can lead to fraud or misrepresentation, which can be costly and time-consuming to resolve.

What You Should Know About This Form

-

What is a Livestock Bill of Sale?

A Livestock Bill of Sale is a legal document that records the transfer of ownership of livestock from one party to another. This form serves as proof of the transaction and includes important details such as the buyer's and seller's information, a description of the livestock, and the sale price.

-

Why is a Livestock Bill of Sale important?

This document is crucial for several reasons. It provides a clear record of the sale, which can be useful for tax purposes and future reference. Additionally, it helps protect both the buyer and seller by outlining the terms of the sale, including any warranties or representations made about the livestock.

-

What information is typically included in a Livestock Bill of Sale?

A standard Livestock Bill of Sale usually includes:

- The names and addresses of the buyer and seller

- A detailed description of the livestock, including breed, age, and identification numbers

- The sale price

- The date of the sale

- Any warranties or guarantees

-

Do I need a witness or notarization for the Bill of Sale?

While not always required, having a witness or notarization can add an extra layer of security to the transaction. This can be particularly helpful if a dispute arises in the future. It is advisable to check local laws to determine if any specific requirements exist in your area.

-

Can I use a Livestock Bill of Sale for different types of livestock?

Yes, a Livestock Bill of Sale can be used for various types of livestock, including cattle, sheep, goats, pigs, and horses. It is essential to provide accurate descriptions for each type to ensure clarity in the transaction.

-

What happens if there are issues with the livestock after the sale?

If issues arise after the sale, the terms outlined in the Bill of Sale will guide the resolution process. If warranties were included, the seller may be responsible for addressing certain problems. Always consult the document for specifics.

-

Is there a standard format for a Livestock Bill of Sale?

While there is no universally mandated format, many templates are available online that can be customized to fit your needs. It is essential to ensure that all necessary information is included and that the form complies with local laws.

-

How can I obtain a Livestock Bill of Sale form?

Livestock Bill of Sale forms can be obtained from various sources, including agricultural associations, legal websites, and local government offices. Many templates are available for free or for purchase online, which can be tailored to your specific transaction.

-

What should I do with the completed Bill of Sale?

Once the Bill of Sale is completed and signed by both parties, it is advisable to keep copies for your records. The buyer should retain their copy as proof of ownership, while the seller may want to keep a copy for their records as well.

-

Can a Livestock Bill of Sale be used in a dispute?

Yes, a Livestock Bill of Sale can be an important document in the event of a dispute. It serves as evidence of the terms agreed upon during the sale and can help resolve misunderstandings between the buyer and seller.

Livestock Bill of Sale Example

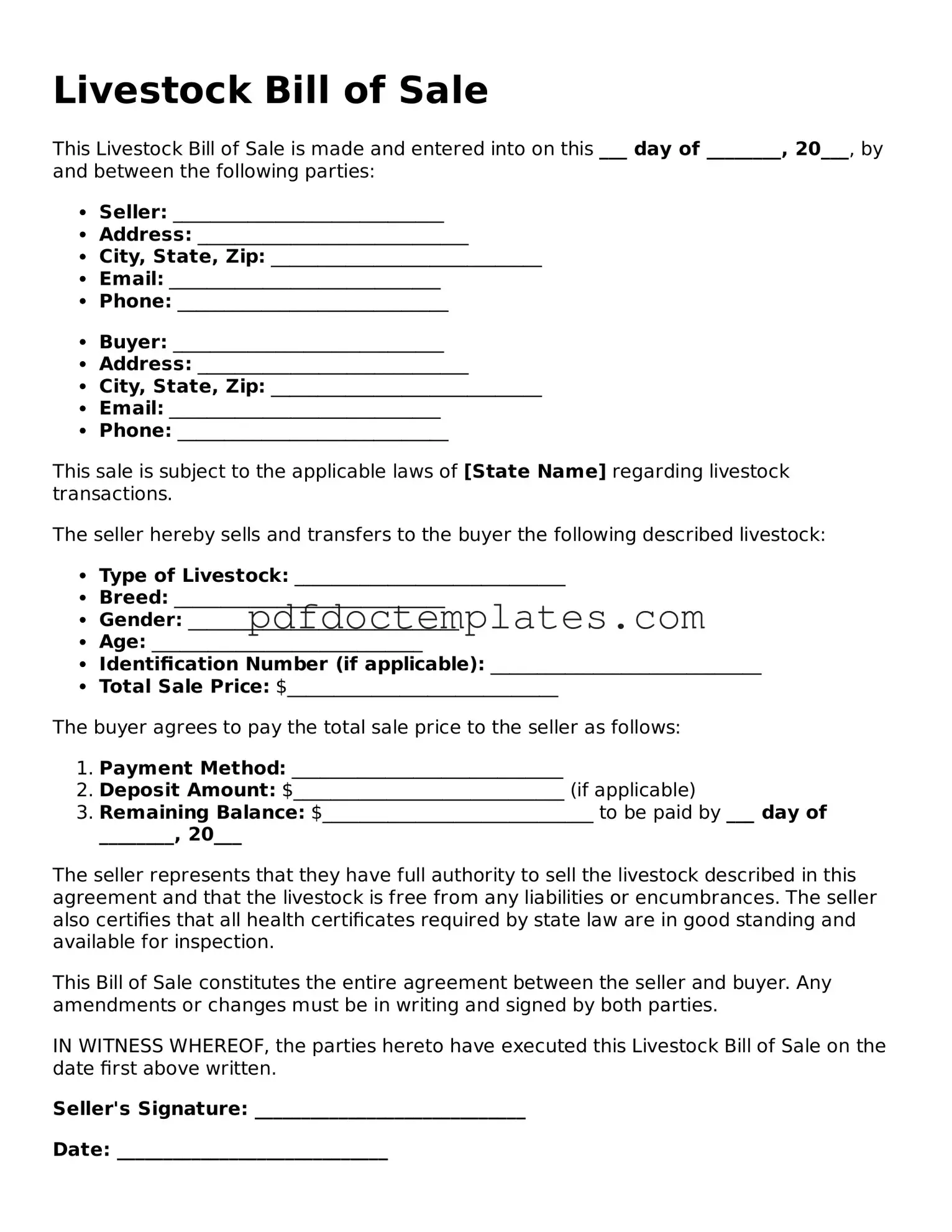

Livestock Bill of Sale

This Livestock Bill of Sale is made and entered into on this ___ day of ________, 20___, by and between the following parties:

- Seller: _____________________________

- Address: _____________________________

- City, State, Zip: _____________________________

- Email: _____________________________

- Phone: _____________________________

- Buyer: _____________________________

- Address: _____________________________

- City, State, Zip: _____________________________

- Email: _____________________________

- Phone: _____________________________

This sale is subject to the applicable laws of [State Name] regarding livestock transactions.

The seller hereby sells and transfers to the buyer the following described livestock:

- Type of Livestock: _____________________________

- Breed: _____________________________

- Gender: _____________________________

- Age: _____________________________

- Identification Number (if applicable): _____________________________

- Total Sale Price: $_____________________________

The buyer agrees to pay the total sale price to the seller as follows:

- Payment Method: _____________________________

- Deposit Amount: $_____________________________ (if applicable)

- Remaining Balance: $_____________________________ to be paid by ___ day of ________, 20___

The seller represents that they have full authority to sell the livestock described in this agreement and that the livestock is free from any liabilities or encumbrances. The seller also certifies that all health certificates required by state law are in good standing and available for inspection.

This Bill of Sale constitutes the entire agreement between the seller and buyer. Any amendments or changes must be in writing and signed by both parties.

IN WITNESS WHEREOF, the parties hereto have executed this Livestock Bill of Sale on the date first above written.

Seller's Signature: _____________________________

Date: _____________________________

Buyer's Signature: _____________________________

Date: _____________________________

Different Types of Livestock Bill of Sale Forms:

Printable Equipment Bill of Sale - An Equipment Bill of Sale is a document that records the transfer of ownership for equipment.

When engaging in a transaction involving personal property, it is essential to utilize a reliable legal instrument such as a General Bill of Sale form. This document not only confirms the sale and transfer but also provides clarity regarding the terms of the transaction. For those seeking guidance or templates for these forms, resources like OnlineLawDocs.com can be invaluable.

Rv Bill of Sale Printable - Facilitates the legal transfer of personal property in the form of an RV.